- United Kingdom

- /

- Consumer Durables

- /

- LSE:BWY

Bellway And 2 Other UK Stocks That May Be Valued Below Their Intrinsic Worth

Reviewed by Simply Wall St

In recent times, the UK market has experienced fluctuations, with the FTSE 100 index closing lower due to weak trade data from China and declining commodity prices affecting major sectors. Amidst these challenges, investors often seek opportunities in stocks that may be undervalued relative to their intrinsic worth, as these can offer potential for growth when broader market conditions stabilize. In this context, Bellway and two other UK stocks present intriguing cases for consideration as potentially undervalued investments.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| On the Beach Group (LSE:OTB) | £2.36 | £4.59 | 48.5% |

| Brickability Group (AIM:BRCK) | £0.592 | £1.05 | 43.5% |

| Gaming Realms (AIM:GMR) | £0.3855 | £0.67 | 42.5% |

| Gateley (Holdings) (AIM:GTLY) | £1.375 | £2.64 | 48% |

| Victrex (LSE:VCT) | £9.53 | £18.15 | 47.5% |

| Duke Capital (AIM:DUKE) | £0.304 | £0.53 | 43% |

| Deliveroo (LSE:ROO) | £1.40 | £2.43 | 42.4% |

| Likewise Group (AIM:LIKE) | £0.185 | £0.37 | 49.8% |

| Optima Health (AIM:OPT) | £1.80 | £3.30 | 45.5% |

| Melrose Industries (LSE:MRO) | £6.338 | £11.83 | 46.4% |

Let's dive into some prime choices out of the screener.

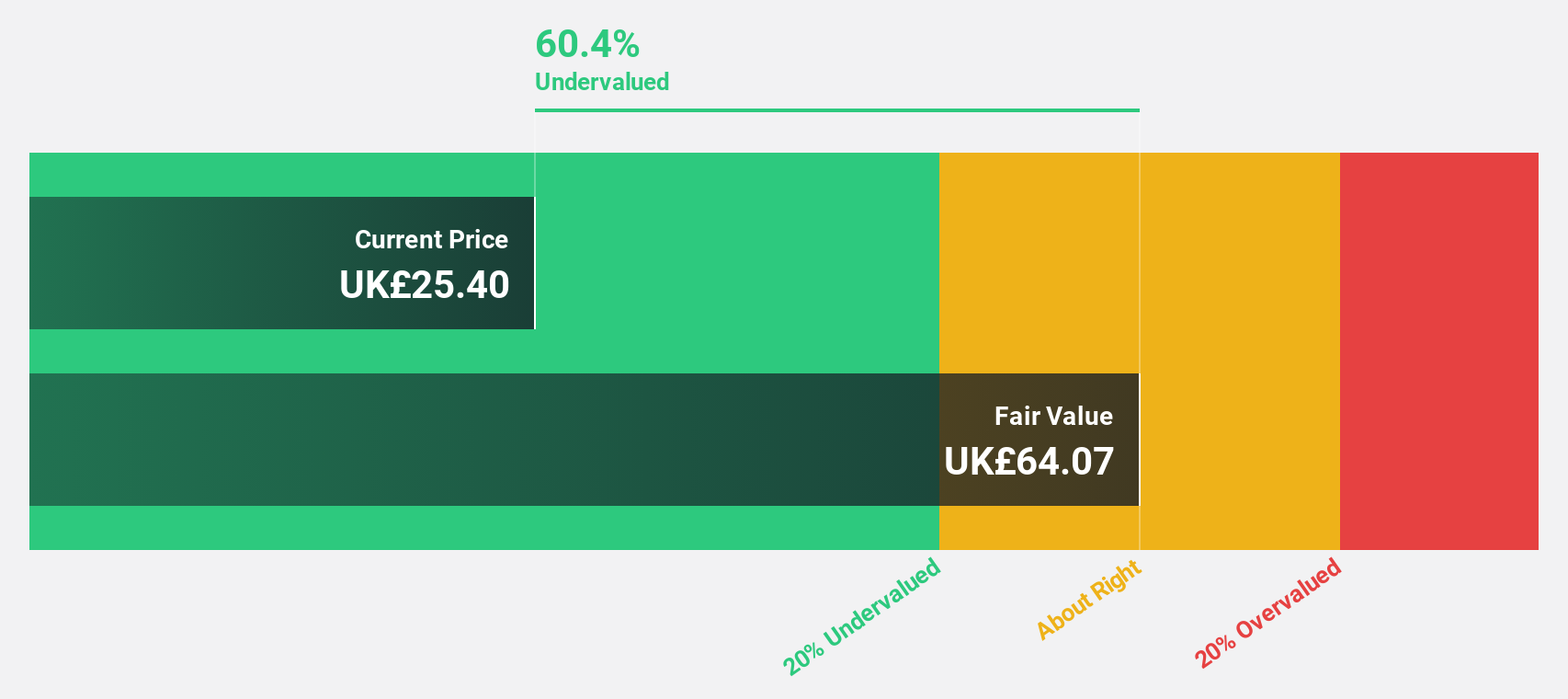

Bellway (LSE:BWY)

Overview: Bellway p.l.c., along with its subsidiaries, operates in the homebuilding industry across the United Kingdom and has a market capitalization of approximately £2.76 billion.

Operations: The company's revenue is primarily derived from its UK House Building segment, which generated £2.38 billion.

Estimated Discount To Fair Value: 19.1%

Bellway is trading at £23.28, below its estimated fair value of £28.78, representing a 19.1% discount. While revenue growth is forecasted at 9.9% annually, outpacing the UK market's 3.6%, profit margins have decreased from last year’s 10.7% to 5.5%. Although earnings are expected to grow significantly by over 20% annually for the next three years, the dividend yield of 2.32% lacks coverage by free cash flows, and ROE remains low at a projected 7.5%.

- Insights from our recent growth report point to a promising forecast for Bellway's business outlook.

- Click here to discover the nuances of Bellway with our detailed financial health report.

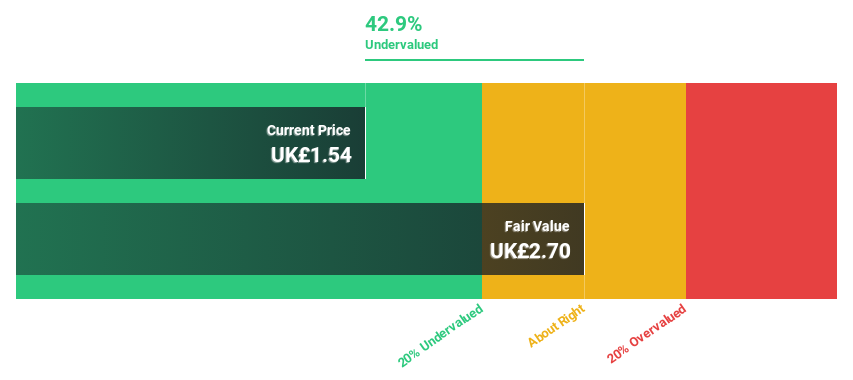

Crest Nicholson Holdings (LSE:CRST)

Overview: Crest Nicholson Holdings plc is a UK-based company specializing in the construction of residential homes, with a market cap of £407.32 million.

Operations: The company's revenue is primarily derived from its home building segment, which includes residential and commercial projects, totaling £618.20 million.

Estimated Discount To Fair Value: 40.6%

Crest Nicholson Holdings is trading at £1.59, significantly below its estimated fair value of £2.67, offering a 40.6% discount. Despite a recent net loss of £103.5 million for the year ending October 2024, the company is forecast to become profitable in three years with earnings expected to grow by nearly 90% annually. However, its Return on Equity remains low at a projected 6.2%, and revenue growth is slower than desired but above market average at 6.4%.

- Our expertly prepared growth report on Crest Nicholson Holdings implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of Crest Nicholson Holdings.

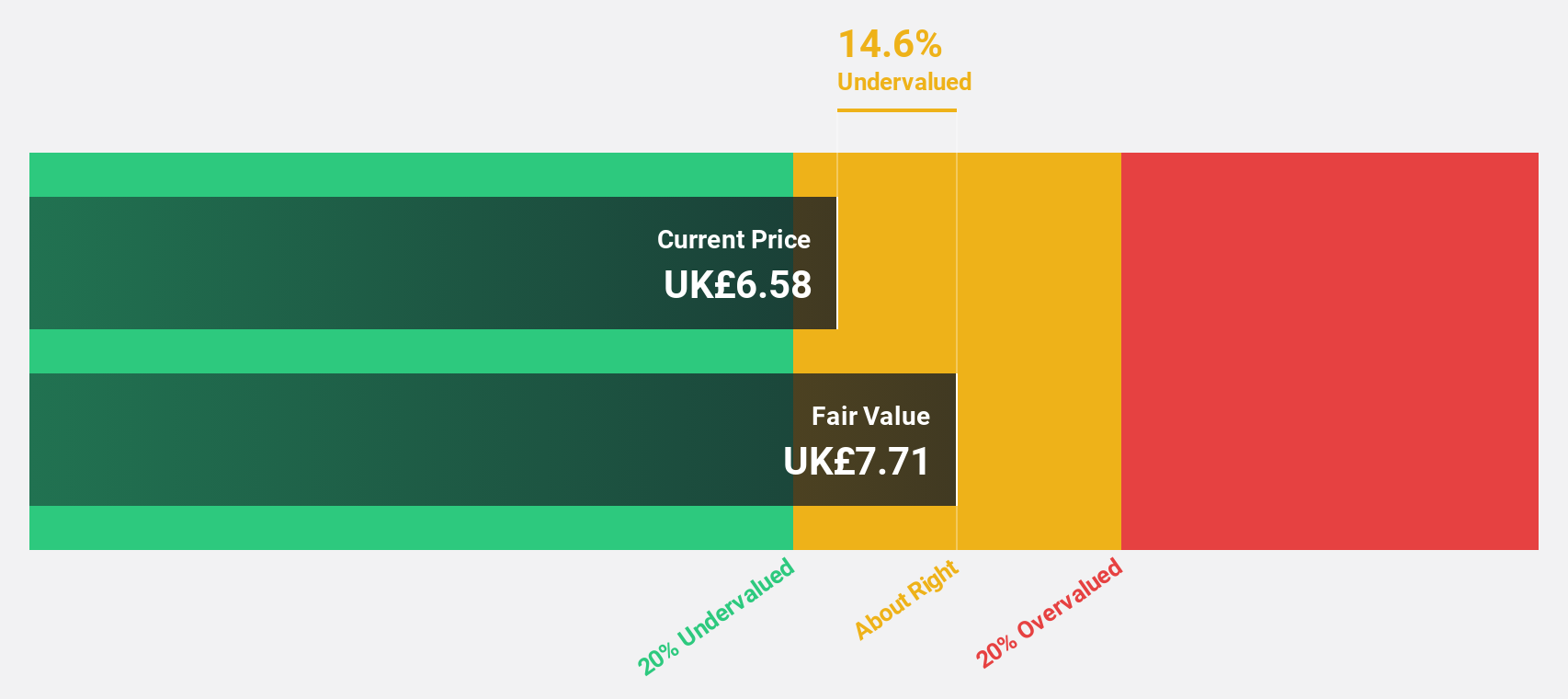

Phoenix Group Holdings (LSE:PHNX)

Overview: Phoenix Group Holdings plc operates in the long-term savings and retirement business in Europe, with a market cap of £4.99 billion.

Operations: The company generates revenue through its Retirement Solutions segment, which reported £2.01 billion, while the With-profits, Europe & Other, and Pensions & Savings segments recorded negative figures of £1.56 billion, £891 million, and £418 million respectively.

Estimated Discount To Fair Value: 17.9%

Phoenix Group Holdings is trading at £4.99, below its estimated fair value of £6.08, indicating it may be undervalued based on cash flows. Although revenue is expected to decline by 20.4% annually over the next three years, the company is forecast to become profitable during this period with a high Return on Equity projected at 45.3%. However, its dividend yield of 10.68% is not well covered by earnings, posing potential risks for investors seeking income stability.

- Our earnings growth report unveils the potential for significant increases in Phoenix Group Holdings' future results.

- Navigate through the intricacies of Phoenix Group Holdings with our comprehensive financial health report here.

Summing It All Up

- Access the full spectrum of 56 Undervalued UK Stocks Based On Cash Flows by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bellway might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:BWY

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives