- United Kingdom

- /

- Electrical

- /

- AIM:VLX

Volex And 2 Other UK Penny Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

The UK market has been facing challenges recently, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, which is affecting global economic sentiment. Amid these broader market fluctuations, investors may find opportunities in penny stocks—smaller or newer companies that often offer growth potential at lower price points. Despite being an older term, penny stocks can still be relevant investment options when they are backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Polar Capital Holdings (AIM:POLR) | £4.945 | £465.11M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.70 | £176.46M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.14 | £791.31M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.93 | £146.94M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £4.32 | £84.3M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.625 | £340.64M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.01 | £90.27M | ★★★★★★ |

| Van Elle Holdings (AIM:VANL) | £0.38 | £40.58M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.42 | £181.48M | ★★★★★☆ |

| Helios Underwriting (AIM:HUW) | £2.09 | £149.11M | ★★★★★☆ |

Click here to see the full list of 444 stocks from our UK Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Volex (AIM:VLX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Volex plc manufactures and sells power and data cables across North America, Europe, and Asia with a market cap of £527.89 million.

Operations: The company's revenue is distributed across Asia ($197.3 million), Europe ($421.2 million), and North America ($415 million).

Market Cap: £527.89M

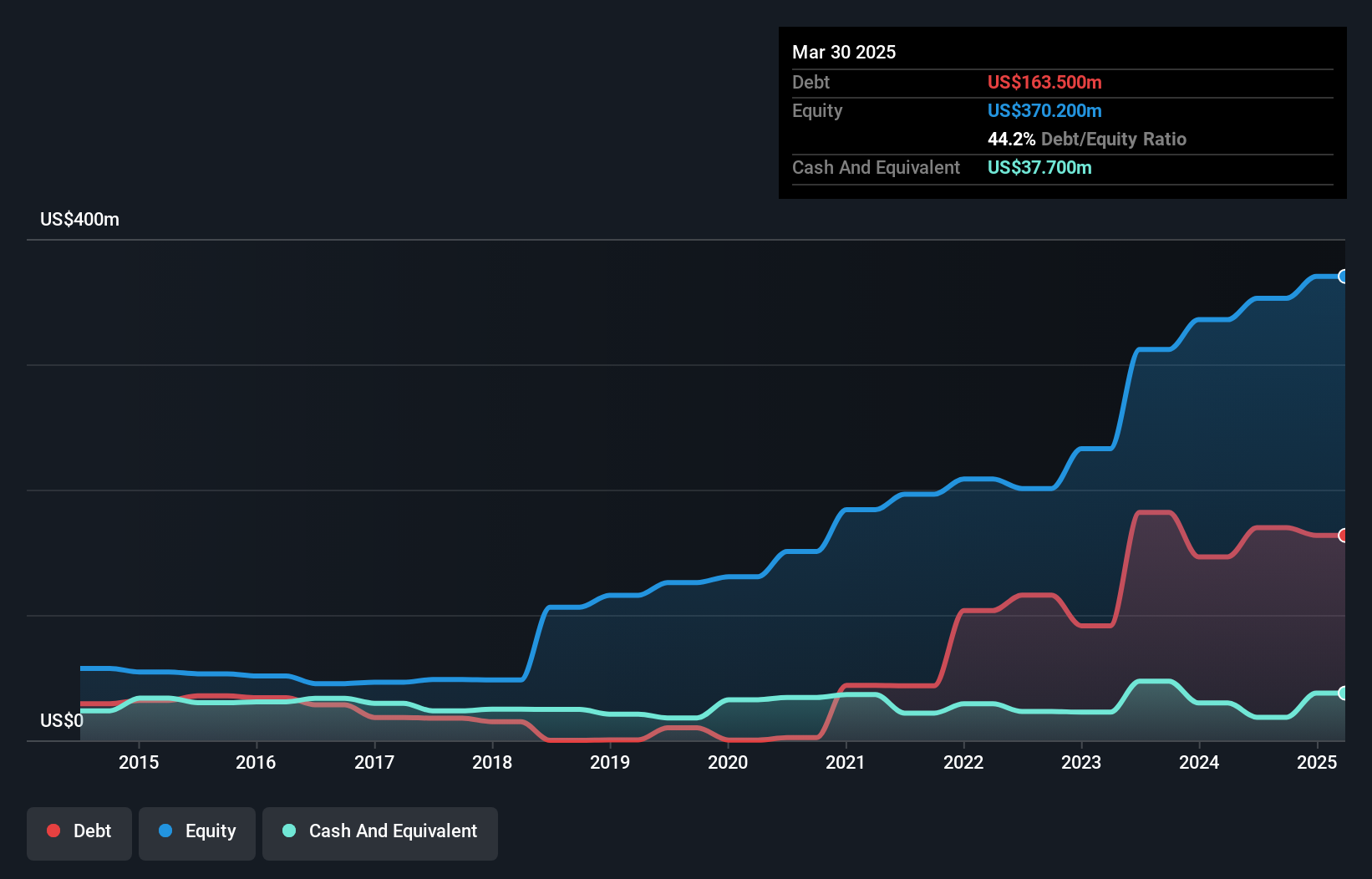

Volex plc, with a market cap of £527.89 million, has demonstrated significant revenue growth, reporting $789.4 million for the 39 weeks ending December 2024—a 21.8% increase from the previous year. Despite a low return on equity at 12.6%, Volex maintains high-quality earnings and covers its debt well with operating cash flow (38.6%). The company is pursuing strategic growth through potential acquisitions, as evidenced by its proposals to acquire TT Electronics plc, although these were rejected. Volex's management and board are experienced, supporting steady profit growth and stable weekly volatility over the past year.

- Jump into the full analysis health report here for a deeper understanding of Volex.

- Explore Volex's analyst forecasts in our growth report.

Cairn Homes (LSE:CRN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cairn Homes plc is a holding company that functions as a home and community builder in Ireland, with a market cap of £1.11 billion.

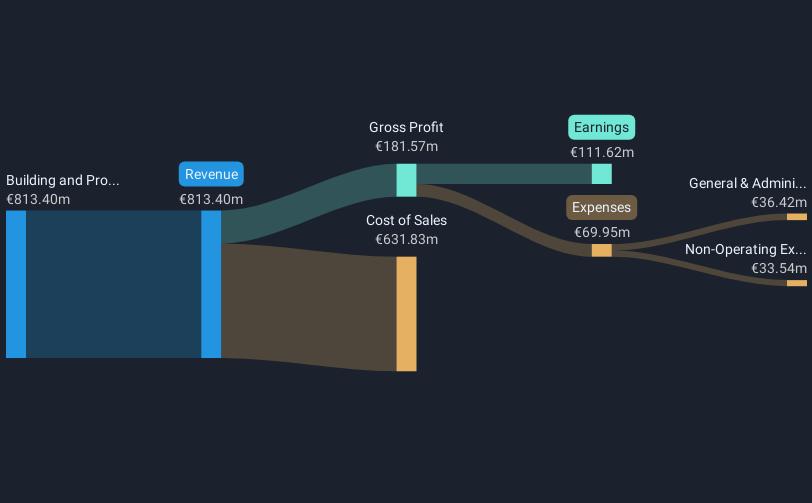

Operations: The company generates revenue primarily from its Building and Property Development segment, amounting to €813.40 million.

Market Cap: £1.11B

Cairn Homes plc, with a market cap of £1.11 billion, has shown robust financial health and growth potential. The company's earnings have grown significantly by 49.5% over the past year, surpassing industry averages and its own five-year growth rate of 26.2% per year. Cairn Homes' debt is well managed, with operating cash flow covering 63.1% of its debt, and it maintains a satisfactory net debt to equity ratio of 20.7%. Recent share buybacks totaling €44.92 million indicate confidence in its valuation, which is supported by a price-to-earnings ratio below the UK market average at 12.2x.

- Get an in-depth perspective on Cairn Homes' performance by reading our balance sheet health report here.

- Evaluate Cairn Homes' prospects by accessing our earnings growth report.

Gulf Keystone Petroleum (LSE:GKP)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Gulf Keystone Petroleum Limited is involved in the exploration, development, and production of oil and gas in the Kurdistan Region of Iraq, with a market cap of £333.88 million.

Operations: The company generates revenue of $115.15 million from its oil and gas exploration and production activities.

Market Cap: £333.88M

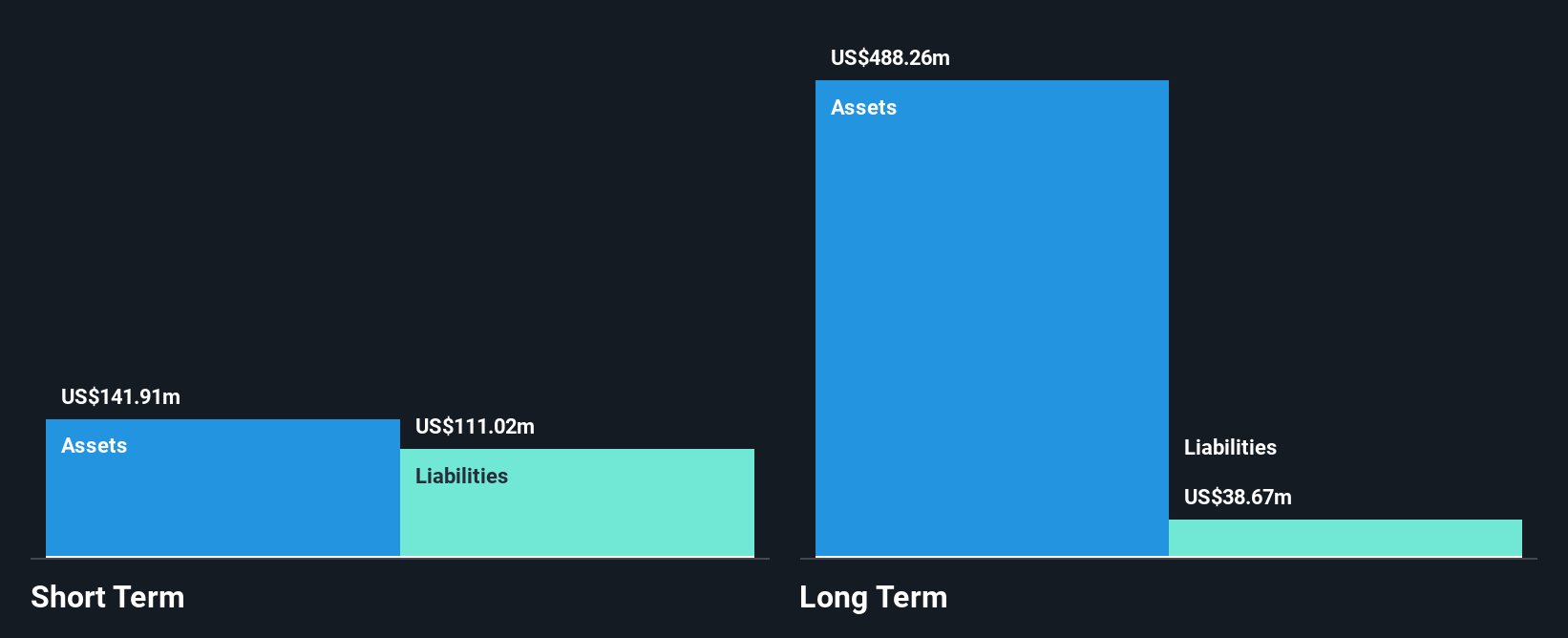

Gulf Keystone Petroleum, with a market cap of £333.88 million, faces challenges as it remains unprofitable despite reducing losses over the past five years by 14.4% annually. The company has no debt and its short-term assets surpass long-term liabilities, but they fall short of covering short-term liabilities. Recent production results show an 86% increase in output to 40,689 bopd in 2024 compared to the previous year, with guidance for up to 45,000 bopd in 2025. Its dividend yield of 8.89% is not well supported by earnings or free cash flows currently.

- Navigate through the intricacies of Gulf Keystone Petroleum with our comprehensive balance sheet health report here.

- Gain insights into Gulf Keystone Petroleum's outlook and expected performance with our report on the company's earnings estimates.

Key Takeaways

- Reveal the 444 hidden gems among our UK Penny Stocks screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Volex, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:VLX

Volex

Manufactures and sells power and data cables in North America, Europe, and Asia.

Undervalued with proven track record.