- United Kingdom

- /

- Consumer Durables

- /

- LSE:BWY

3 UK Stocks Estimated To Be Up To 42% Below Intrinsic Value

Reviewed by Simply Wall St

The UK stock market has recently faced challenges, with the FTSE 100 index slipping in response to weak trade data from China, highlighting concerns over global economic recovery and its impact on commodity prices. In such uncertain times, identifying stocks that are potentially undervalued can be a strategic approach for investors looking to capitalize on discrepancies between market price and intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| ASA International Group (LSE:ASAI) | £0.7625 | £1.50 | 49.2% |

| Zotefoams (LSE:ZTF) | £3.10 | £5.75 | 46.1% |

| Liontrust Asset Management (LSE:LIO) | £4.04 | £6.96 | 42% |

| Duke Capital (AIM:DUKE) | £0.305 | £0.58 | 47.6% |

| Vp (LSE:VP.) | £5.50 | £9.81 | 43.9% |

| Strix Group (AIM:KETL) | £0.475 | £0.83 | 42.5% |

| Victrex (LSE:VCT) | £10.40 | £19.64 | 47% |

| Fintel (AIM:FNTL) | £2.65 | £4.46 | 40.6% |

| Loungers (AIM:LGRS) | £3.22 | £5.41 | 40.5% |

| Watches of Switzerland Group (LSE:WOSG) | £4.838 | £9.08 | 46.7% |

Let's take a closer look at a couple of our picks from the screened companies.

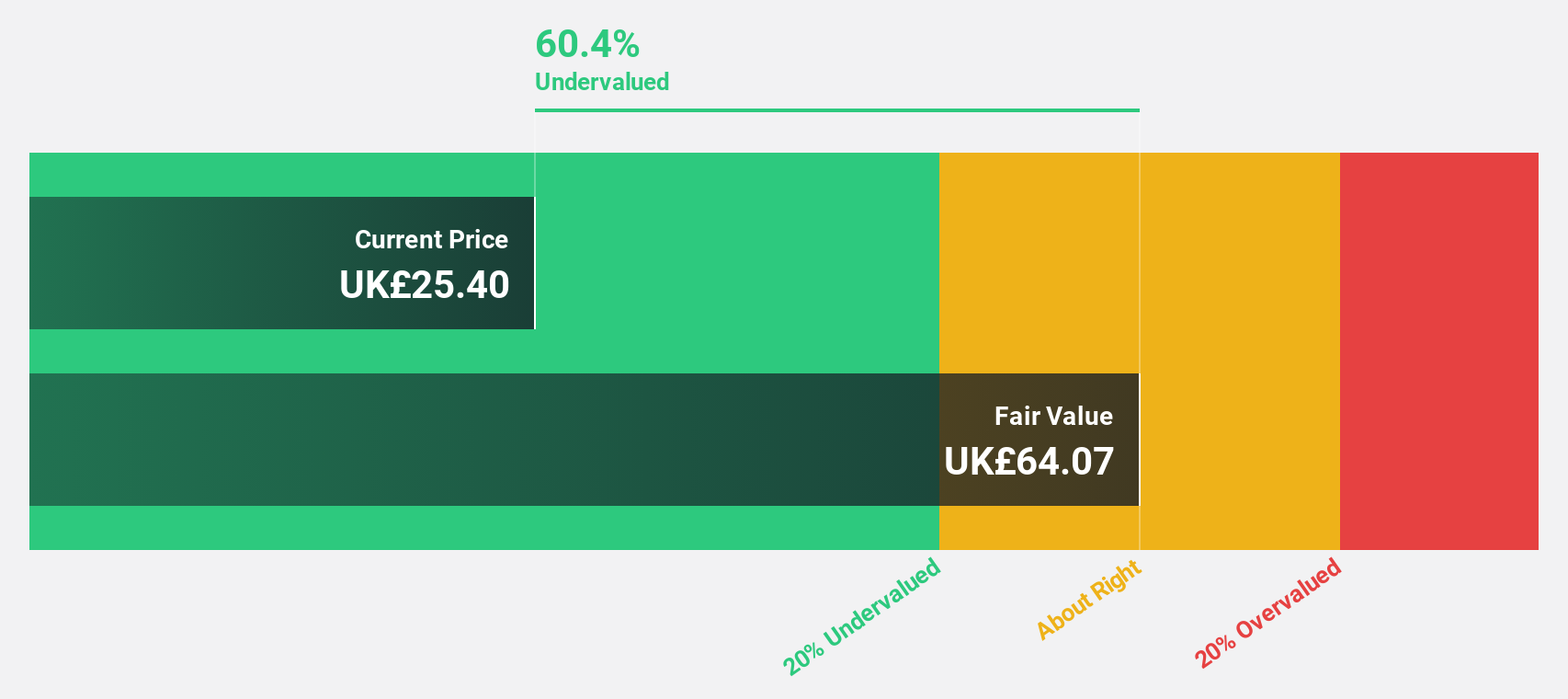

Bellway (LSE:BWY)

Overview: Bellway p.l.c., with a market cap of approximately £2.81 billion, operates in the United Kingdom as a homebuilder through its subsidiaries.

Operations: The company's revenue is primarily derived from its UK House Building segment, generating £2.38 billion.

Estimated Discount To Fair Value: 16%

Bellway is trading at £23.72, below its estimated fair value of £28.24, suggesting it may be undervalued based on discounted cash flows. Analysts project earnings growth of 21.8% annually over the next three years, outpacing the UK market's 14.5%. However, profit margins have decreased from 10.7% to 5.5%, and the dividend yield of 2.28% is not well covered by free cash flows, highlighting potential financial constraints despite revenue growth prospects.

- Our growth report here indicates Bellway may be poised for an improving outlook.

- Click here to discover the nuances of Bellway with our detailed financial health report.

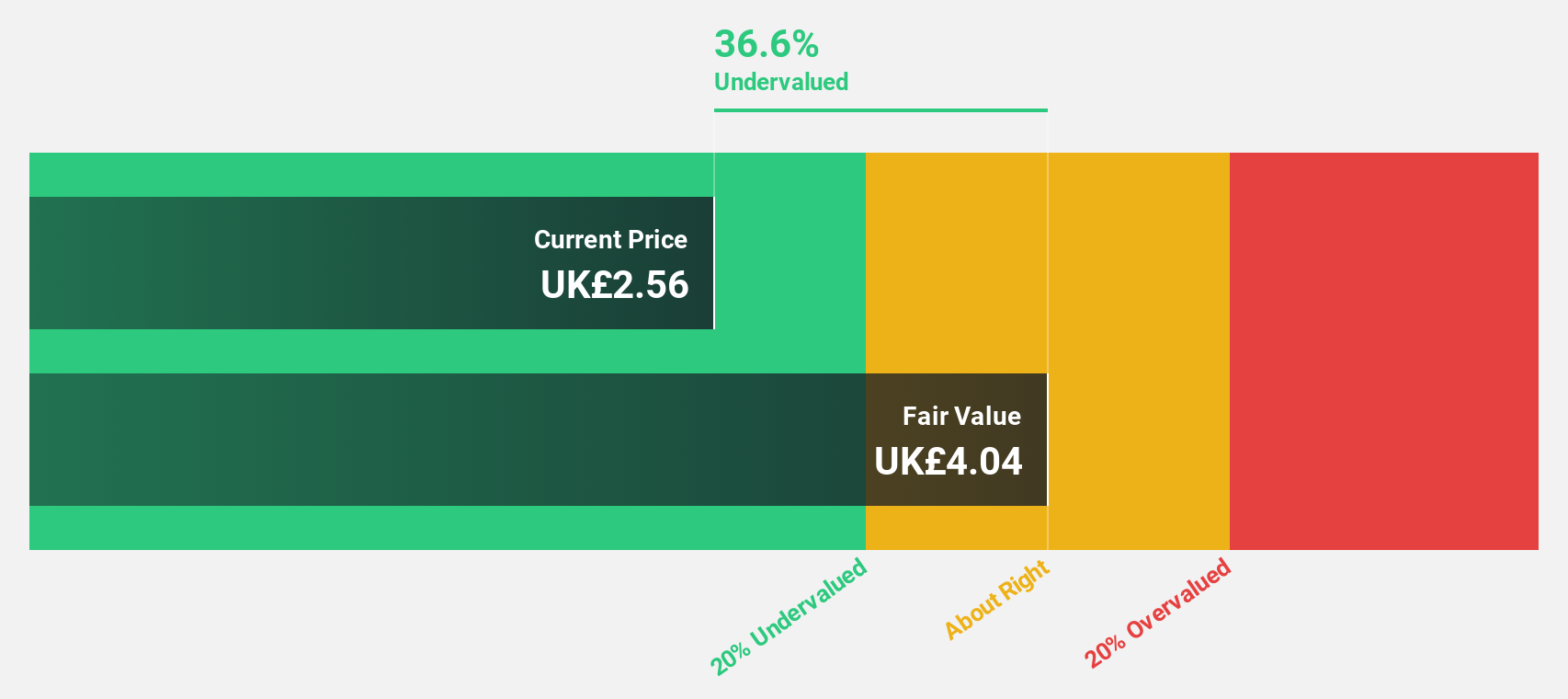

Liontrust Asset Management (LSE:LIO)

Overview: Liontrust Asset Management Plc is a publicly owned investment manager with a market cap of £257.30 million.

Operations: The company generates revenue primarily through its Investment Management segment, amounting to £180.38 million.

Estimated Discount To Fair Value: 42%

Liontrust Asset Management is trading at £4.04, significantly below its estimated fair value of £6.96, reflecting potential undervaluation based on discounted cash flows. Despite a forecasted revenue decline of 2.6% annually over the next three years, earnings are expected to grow by 23.1% per year, surpassing UK market averages. However, the dividend yield of 17.82% is not well-supported by earnings or free cash flow, and recent share buybacks could impact financial flexibility.

- The growth report we've compiled suggests that Liontrust Asset Management's future prospects could be on the up.

- Take a closer look at Liontrust Asset Management's balance sheet health here in our report.

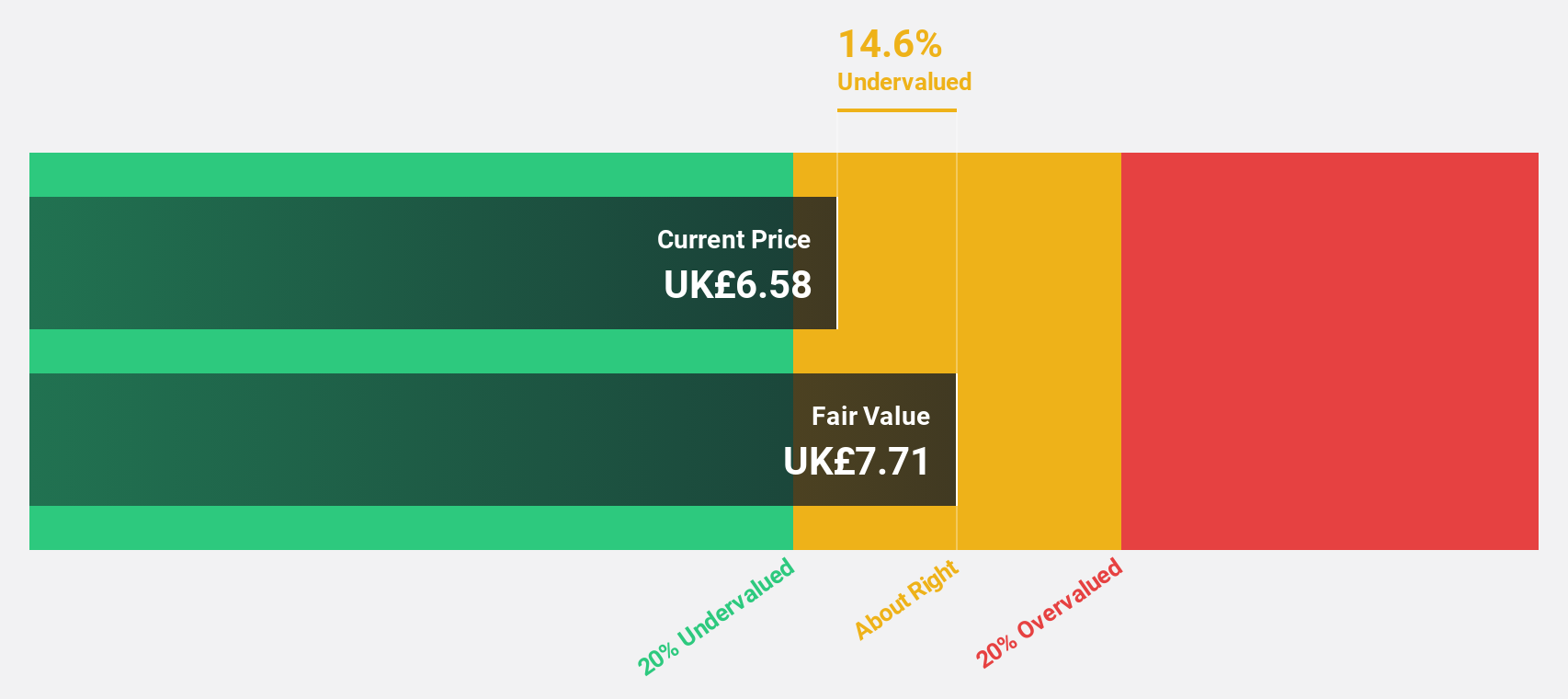

Phoenix Group Holdings (LSE:PHNX)

Overview: Phoenix Group Holdings plc operates in the long-term savings and retirement sector in Europe, with a market cap of £4.98 billion.

Operations: The company's revenue segments include Retirement Solutions at £2.01 billion, while With-profits, Europe & Other, and Pensions & Savings recorded negative revenues of -£1.56 billion, -£891 million, and -£418 million respectively.

Estimated Discount To Fair Value: 18.1%

Phoenix Group Holdings is trading at £4.98, below its estimated fair value of £6.09, indicating potential undervaluation based on cash flows. While earnings are forecast to grow significantly by 60.31% annually over the next three years, revenue is expected to decline by 20.4% per year during the same period. Despite a high projected return on equity of 36.9%, the dividend yield of 10.7% is not well covered by earnings, posing sustainability concerns.

- In light of our recent growth report, it seems possible that Phoenix Group Holdings' financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of Phoenix Group Holdings.

Turning Ideas Into Actions

- Click this link to deep-dive into the 51 companies within our Undervalued UK Stocks Based On Cash Flows screener.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bellway might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:BWY

Good value with reasonable growth potential.