- United Kingdom

- /

- Professional Services

- /

- AIM:MIND

3 UK Penny Stocks With Market Caps Under £100M

Reviewed by Simply Wall St

The London stock market has faced recent challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China impacting global sentiment. Despite these broader market fluctuations, there are still opportunities for investors interested in smaller or newer companies through penny stocks. While the term "penny stocks" might seem outdated, they can still represent valuable investment opportunities when backed by strong financial health and growth potential.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Polar Capital Holdings (AIM:POLR) | £4.965 | £478.61M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.972 | £153.33M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.70 | £422.49M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £1.976 | £744.58M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.405 | £178.93M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.58 | £68.28M | ★★★★☆☆ |

| Luceco (LSE:LUCE) | £1.17 | £180.45M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.48 | £346.11M | ★★★★☆☆ |

| Tristel (AIM:TSTL) | £3.975 | £189.58M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £1.99 | £141.97M | ★★★★★☆ |

Click here to see the full list of 445 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Futura Medical (AIM:FUM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Futura Medical plc researches, develops, and sells pharmaceutical and healthcare products for sexual health, with a market cap of £95.67 million.

Operations: The company generates £8.40 million from the development and commercialisation of MED3000.

Market Cap: £95.67M

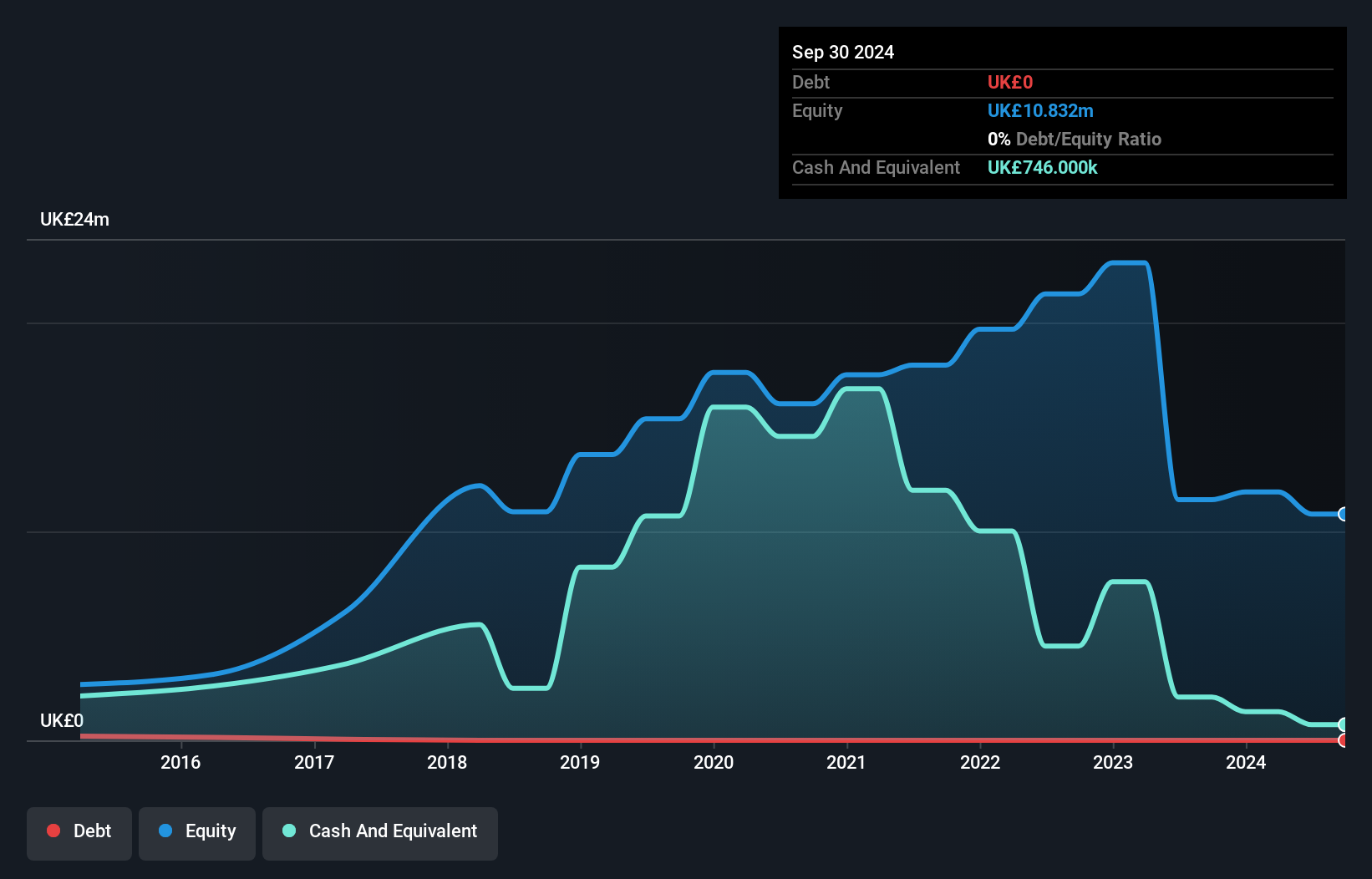

Futura Medical, with a market cap of £95.67 million, is currently unprofitable but has shown promise through its recent successful WSD4000 study for sexual dysfunction treatment in women. The company is debt-free and has no long-term liabilities, which can be advantageous for managing financial stability. Despite being unprofitable, it has reduced losses by 6.8% annually over the past five years and is trading significantly below its estimated fair value. Analysts forecast substantial growth in earnings at 188.27% per year, suggesting potential upside if the company successfully commercializes its products and manages cash constraints effectively.

- Navigate through the intricacies of Futura Medical with our comprehensive balance sheet health report here.

- Assess Futura Medical's future earnings estimates with our detailed growth reports.

Kodal Minerals (AIM:KOD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Kodal Minerals PLC, with a market cap of £88.08 million, is involved in the exploration and evaluation of mineral resources in the United Kingdom and West Africa through its subsidiaries.

Operations: The company has not reported any revenue segments.

Market Cap: £88.08M

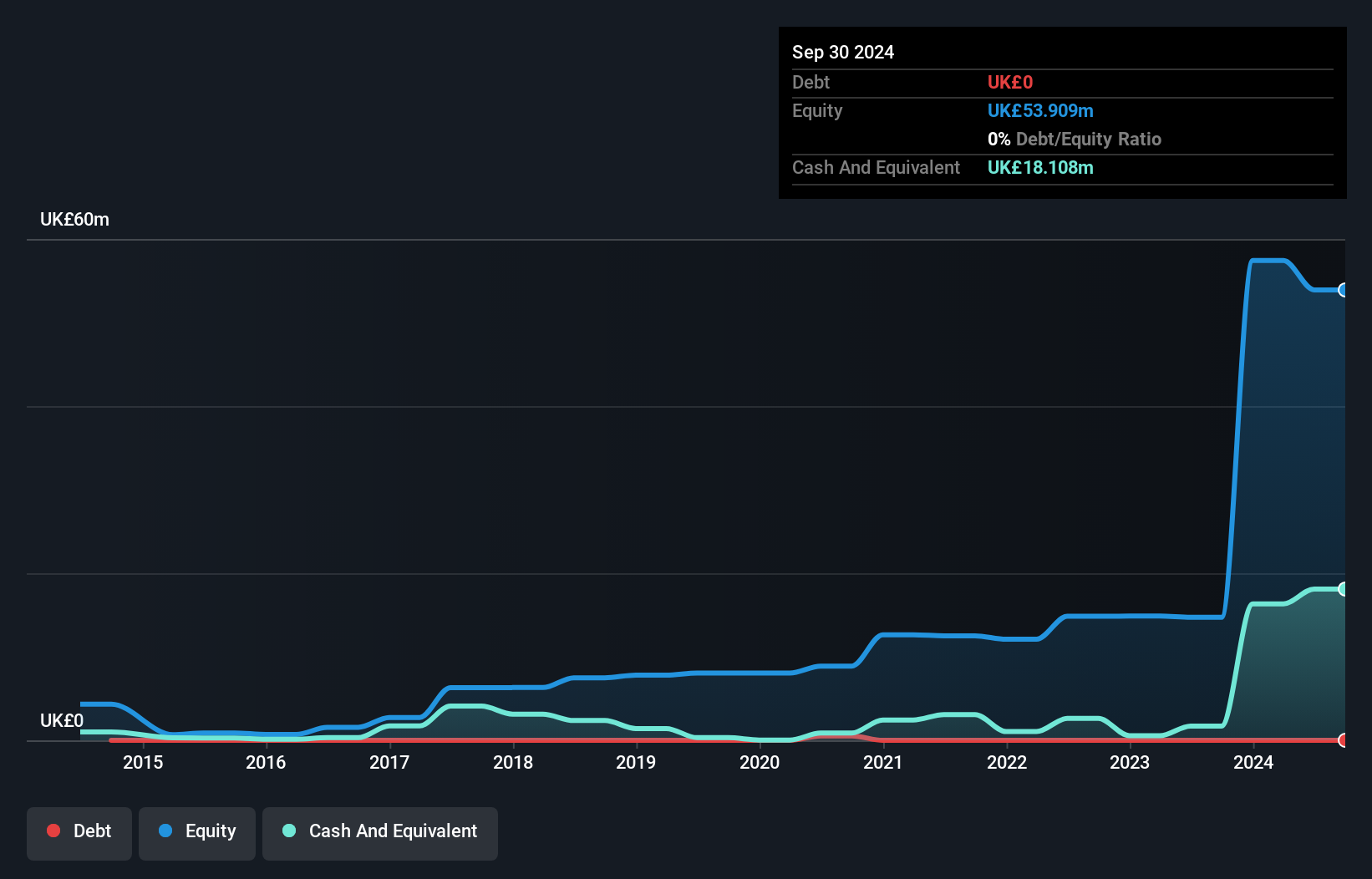

Kodal Minerals, with a market cap of £88.08 million, is pre-revenue and has recently achieved profitability. The company is debt-free and its short-term assets significantly exceed liabilities, offering financial stability. Kodal's Bougouni Lithium Project in Mali is progressing well, with the Dense Media Separation processing plant on track for production in Q1 2025. This project benefits from substantial funding through a US$117.5 million transaction with Hainan Group. Despite recent net losses, Kodal trades at a favorable price-to-earnings ratio of 3.4x compared to the UK market average of 15.7x, indicating potential value relative to peers.

- Take a closer look at Kodal Minerals' potential here in our financial health report.

- Review our growth performance report to gain insights into Kodal Minerals' future.

Mind Gym (AIM:MIND)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Mind Gym plc is a behavioural science company operating in the United Kingdom, Singapore, the United States, and Canada with a market cap of £23.56 million.

Operations: The company generates £44.22 million from offering human capital and business improvement solutions.

Market Cap: £23.56M

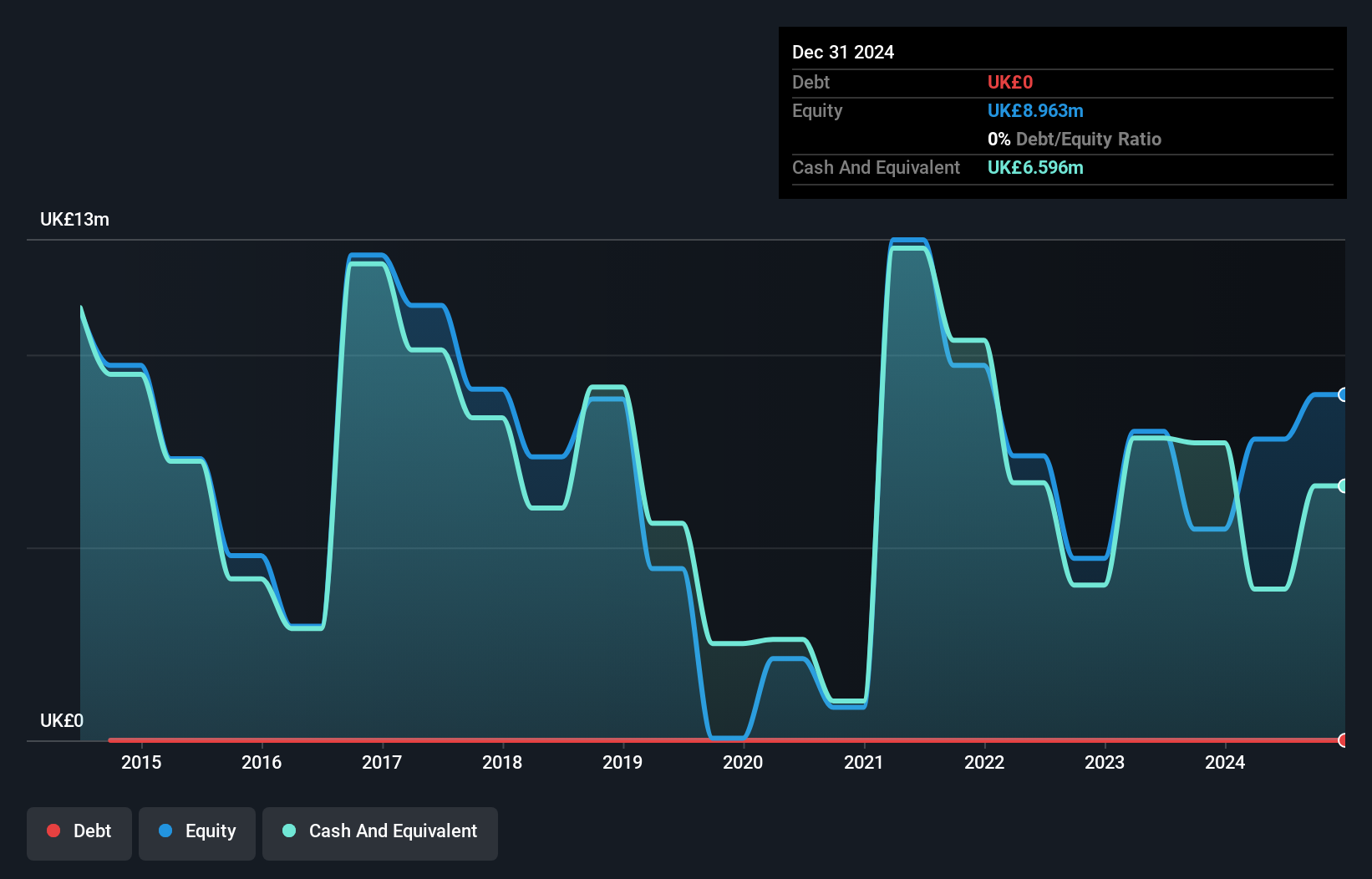

Mind Gym plc, with a market cap of £23.56 million, operates across multiple regions and reported sales of £20.21 million for the recent half-year period. Despite a net loss of £0.787 million, this marks an improvement from the previous year's larger loss. The company's board and management team are experienced, though it remains unprofitable with negative return on equity and increasing losses over five years at 64.3% annually. Mind Gym is debt-free but faces challenges as its short-term assets (£7.5M) do not cover short-term liabilities (£7.9M). Future revenue growth is expected despite anticipated declines in headline revenue due to contract conclusions.

- Unlock comprehensive insights into our analysis of Mind Gym stock in this financial health report.

- Gain insights into Mind Gym's outlook and expected performance with our report on the company's earnings estimates.

Key Takeaways

- Investigate our full lineup of 445 UK Penny Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:MIND

Mind Gym

Operates as a behavioural science company in the United Kingdom, Singapore, the United States, and Canada.

Excellent balance sheet and good value.

Market Insights

Community Narratives