- United Kingdom

- /

- Professional Services

- /

- LSE:CPI

Capita plc (LON:CPI) Looks Inexpensive After Falling 29% But Perhaps Not Attractive Enough

Capita plc (LON:CPI) shares have retraced a considerable 29% in the last month, reversing a fair amount of their solid recent performance. The recent drop has obliterated the annual return, with the share price now down 7.6% over that longer period.

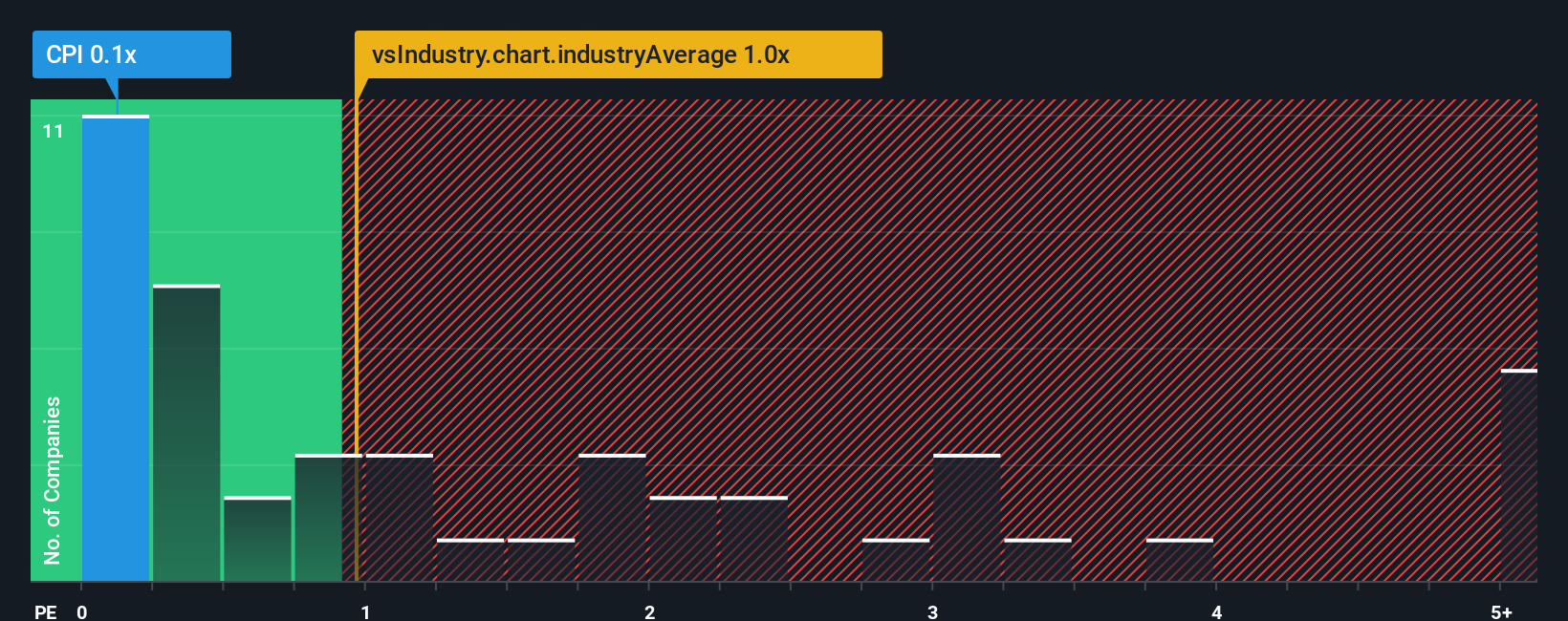

In spite of the heavy fall in price, Capita's price-to-sales (or "P/S") ratio of 0.1x might still make it look like a buy right now compared to the Professional Services industry in the United Kingdom, where around half of the companies have P/S ratios above 1x and even P/S above 3x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Capita

What Does Capita's P/S Mean For Shareholders?

Capita hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Capita.Is There Any Revenue Growth Forecasted For Capita?

The only time you'd be truly comfortable seeing a P/S as low as Capita's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 9.0% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 24% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 1.3% over the next year. With the industry predicted to deliver 6.7% growth, the company is positioned for a weaker revenue result.

With this information, we can see why Capita is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Capita's P/S

Capita's P/S has taken a dip along with its share price. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As expected, our analysis of Capita's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You should always think about risks. Case in point, we've spotted 2 warning signs for Capita you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:CPI

Capita

Operates an outsourcer that supports clients across the public and private sectors in the United Kingdom and rest of Europe.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives