- United Kingdom

- /

- Professional Services

- /

- AIM:STAF

3 UK Penny Stocks With Market Caps Under £200M To Watch

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices closing lower amid concerns about China's economic recovery and its impact on global trade. For investors looking beyond the well-known names, penny stocks can offer intriguing opportunities, especially when backed by robust financials. Though the term "penny stocks" might seem outdated, these smaller or newer companies continue to hold potential for growth and value that larger firms may not always provide.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.855 | £543.55M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.08 | £168.04M | ✅ 3 ⚠️ 2 View Analysis > |

| Helios Underwriting (AIM:HUW) | £2.18 | £155.95M | ✅ 4 ⚠️ 3 View Analysis > |

| Ingenta (AIM:ING) | £0.77 | £11.63M | ✅ 2 ⚠️ 2 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.5325 | $309.56M | ✅ 4 ⚠️ 2 View Analysis > |

| RWS Holdings (AIM:RWS) | £0.94 | £347.59M | ✅ 5 ⚠️ 2 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.425 | £123.16M | ✅ 4 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.19 | £189.45M | ✅ 4 ⚠️ 3 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.73 | £10.05M | ✅ 3 ⚠️ 4 View Analysis > |

| ME Group International (LSE:MEGP) | £1.808 | £682.92M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 292 stocks from our UK Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Begbies Traynor Group (AIM:BEG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Begbies Traynor Group plc offers business recovery, financial advisory, and property services consultancy in the United Kingdom with a market cap of £189.45 million.

Operations: The company generates revenue through two main segments: Property Advisory, contributing £46.4 million, and Business Recovery and Advisory, which brings in £107.3 million.

Market Cap: £189.45M

Begbies Traynor Group plc has shown robust financial performance, with revenues reaching £153.7 million and net income rising to £6.3 million for the year ending April 2025. The company’s strategic leadership changes, including appointing Mark Fry as CEO, aim to further enhance growth and operational efficiency. Despite a large one-off loss impacting recent results, the firm maintains a solid balance sheet with short-term assets exceeding liabilities and debt well covered by cash flow. However, insider selling over the past quarter may warrant caution among investors considering its potential implications on stock sentiment.

- Click to explore a detailed breakdown of our findings in Begbies Traynor Group's financial health report.

- Examine Begbies Traynor Group's earnings growth report to understand how analysts expect it to perform.

INSPECS Group (AIM:SPEC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: INSPECS Group plc is involved in the design, production, sale, marketing, and distribution of fashion eyewear, lenses, and OEM products across multiple regions including the UK, Europe, North America, South America, Asia, Africa, and Australia with a market cap of £44.74 million.

Operations: The company's revenue is primarily generated from two segments: Frames and Optics at £173.22 million and Manufacturing at £21.05 million.

Market Cap: £44.74M

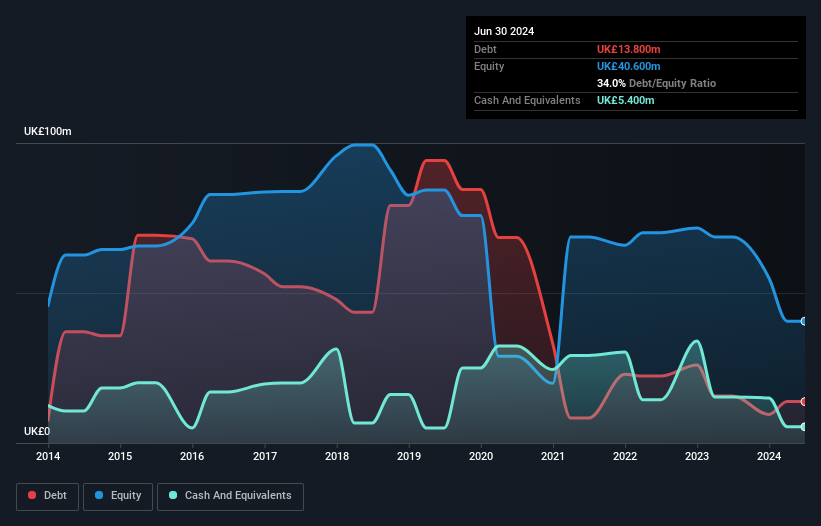

INSPECS Group plc faces challenges with a net loss of £4.61 million for the first half of 2025, compared to a smaller loss last year, despite generating £97.62 million in sales. The company maintains a satisfactory net debt to equity ratio of 26.4% and has sufficient short-term assets (£100.2M) to cover both short and long-term liabilities (£69.2M and £45.6M respectively). While unprofitable, INSPECS benefits from positive free cash flow and an experienced management team with an average tenure of 5.4 years, providing some stability amidst its financial volatility and negative return on equity (-5.2%).

- Jump into the full analysis health report here for a deeper understanding of INSPECS Group.

- Assess INSPECS Group's future earnings estimates with our detailed growth reports.

Staffline Group (AIM:STAF)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Staffline Group PLC, with a market cap of £53.30 million, offers recruitment and outsourced human resource services in the United Kingdom and the Republic of Ireland.

Operations: The company generates revenue through its Recruitment GB segment, contributing £929.3 million, and its Recruitment Ireland segment, adding £102.6 million.

Market Cap: £53.3M

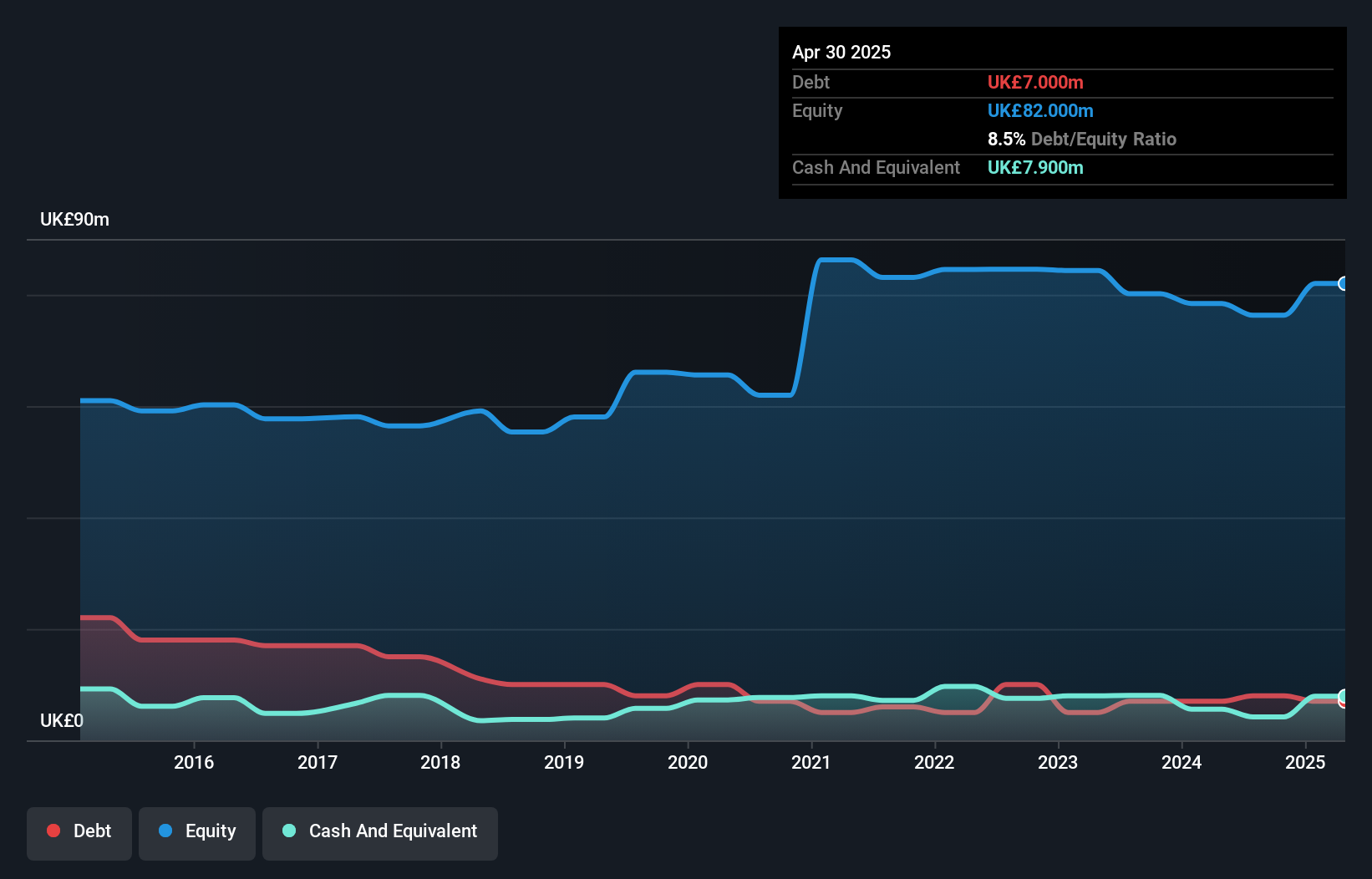

Staffline Group PLC, with a market cap of £53.30 million, has recently turned profitable, reporting a net income of £0.4 million for the first half of 2025 compared to a significant loss last year. The company is trading at 50.5% below its estimated fair value and has reduced its debt significantly over five years, maintaining a satisfactory net debt to equity ratio of 16.5%. Despite high volatility in share price and large one-off gains impacting earnings quality, Staffline's experienced management team and board provide stability as it continues to grow revenues in both UK and Ireland markets.

- Take a closer look at Staffline Group's potential here in our financial health report.

- Learn about Staffline Group's future growth trajectory here.

Make It Happen

- Discover the full array of 292 UK Penny Stocks right here.

- Ready To Venture Into Other Investment Styles? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:STAF

Staffline Group

Provides recruitment and outsourced human resource services in the United Kingdom and the Republic of Ireland.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives