- United Kingdom

- /

- Hospitality

- /

- AIM:LGRS

UK's December 2024 Stocks That May Be Priced Below Intrinsic Value

Reviewed by Simply Wall St

The United Kingdom's stock market has been experiencing volatility, with the FTSE 100 and FTSE 250 indices both closing lower amid concerns over weak trade data from China, a significant trading partner. As investors navigate these challenging conditions, identifying stocks that may be priced below their intrinsic value becomes crucial for those looking to capitalize on potential opportunities amidst broader market uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Fevertree Drinks (AIM:FEVR) | £6.75 | £13.12 | 48.6% |

| Brickability Group (AIM:BRCK) | £0.64 | £1.27 | 49.4% |

| Zotefoams (LSE:ZTF) | £3.08 | £5.80 | 46.9% |

| Tracsis (AIM:TRCS) | £5.05 | £9.76 | 48.3% |

| Duke Capital (AIM:DUKE) | £0.30 | £0.58 | 48.1% |

| Vp (LSE:VP.) | £5.50 | £10.04 | 45.2% |

| Victrex (LSE:VCT) | £10.64 | £19.84 | 46.4% |

| BATM Advanced Communications (LSE:BVC) | £0.188 | £0.37 | 49.3% |

| Quartix Technologies (AIM:QTX) | £1.535 | £2.93 | 47.5% |

| St. James's Place (LSE:STJ) | £8.655 | £16.54 | 47.7% |

Let's take a closer look at a couple of our picks from the screened companies.

Fintel (AIM:FNTL)

Overview: Fintel Plc provides intermediary services and distribution channels to the retail financial services sector in the United Kingdom, with a market cap of £278.18 million.

Operations: The company's revenue is generated from three main segments: Research & Fintech (£24.20 million), Distribution Channels (£21.40 million), and Intermediary Services (£23.30 million).

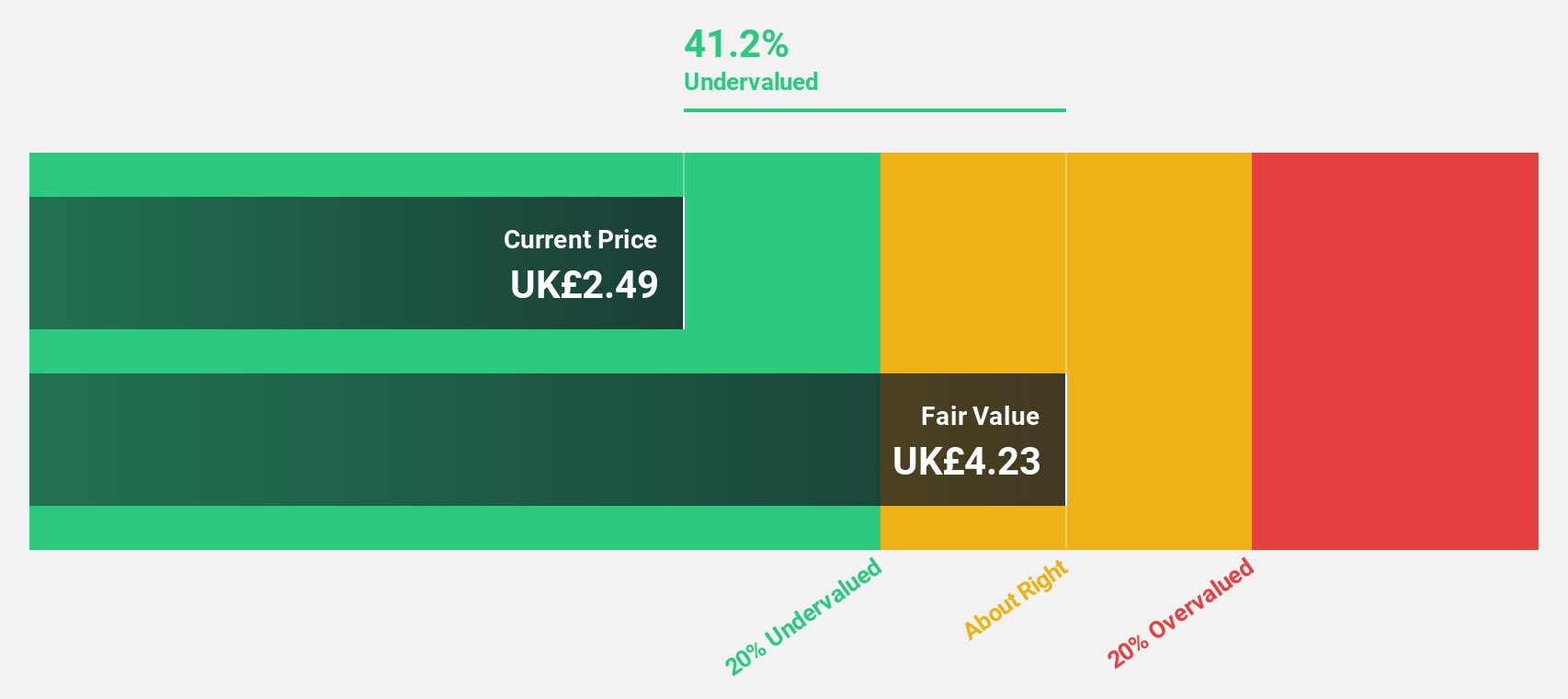

Estimated Discount To Fair Value: 40.3%

Fintel is trading at £2.67, significantly below its estimated fair value of £4.47, indicating it may be undervalued based on cash flows. Despite a decline in profit margins from 12.7% to 8.6%, Fintel's earnings are expected to grow significantly over the next three years, outpacing the UK market's growth rate. A recent follow-on equity offering raised £51 million, potentially bolstering its financial position for future expansion and investment opportunities.

- Our comprehensive growth report raises the possibility that Fintel is poised for substantial financial growth.

- Delve into the full analysis health report here for a deeper understanding of Fintel.

Loungers (AIM:LGRS)

Overview: Loungers plc operates cafés, bars, and restaurants under the Lounge and Cosy Club brand names in England and Wales, with a market cap of £318.10 million.

Operations: The company's revenue primarily comes from operating café bars and café restaurants, generating £353.49 million.

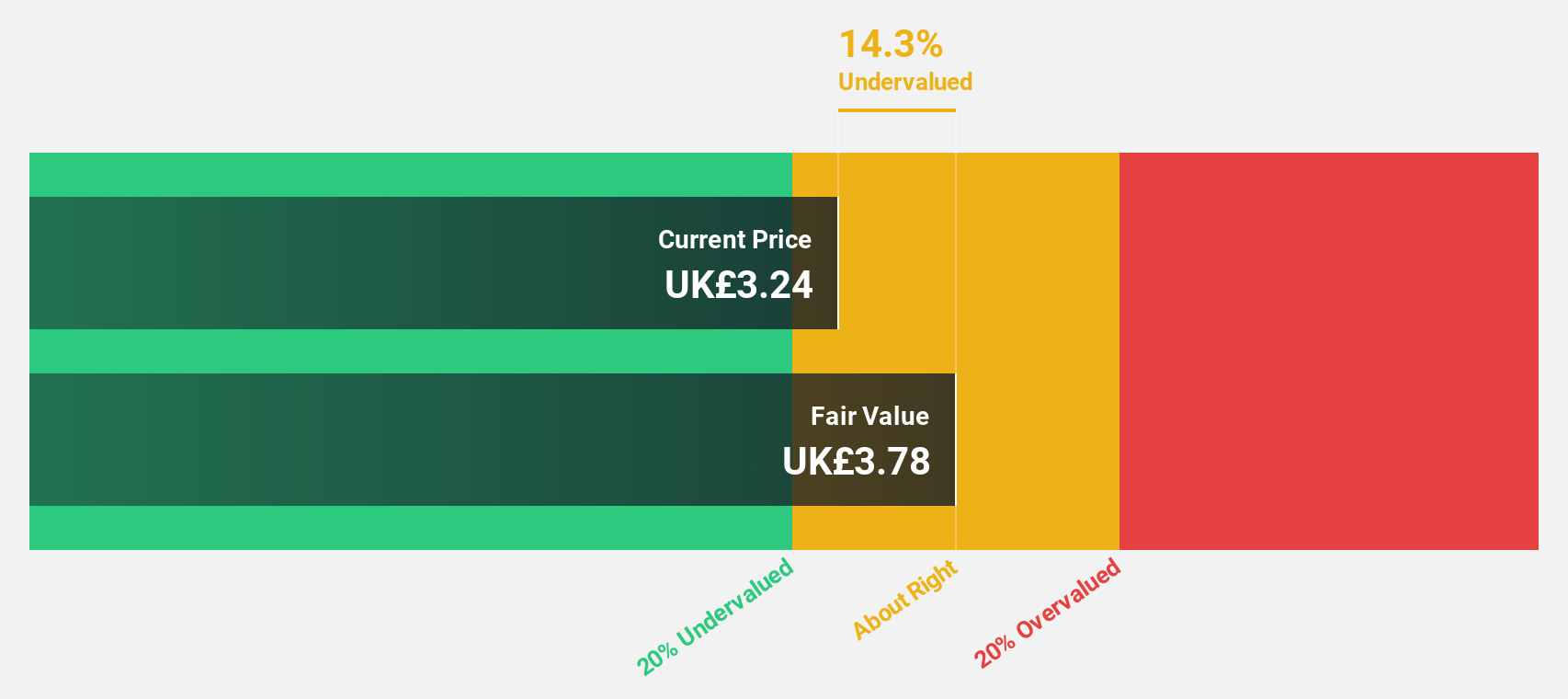

Estimated Discount To Fair Value: 43.2%

Loungers is trading at £3.06, well below its estimated fair value of £5.38, highlighting potential undervaluation based on cash flows. Recent earnings showed growth with sales reaching £178.33 million and net income of £4.28 million for the half year ended October 2024, up from the previous year. Despite shareholder opposition to a proposed £338 million takeover by Fortress Investment Group, Loungers' earnings are forecast to grow significantly faster than the UK market over the next three years.

- Our expertly prepared growth report on Loungers implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in Loungers' balance sheet health report.

Marshalls (LSE:MSLH)

Overview: Marshalls plc, along with its subsidiaries, manufactures and sells landscape, building, and roofing products both in the United Kingdom and internationally with a market cap of £731.69 million.

Operations: The company's revenue segments include £284.40 million from landscape products, £174.70 million from roofing products, and £164.70 million from building products.

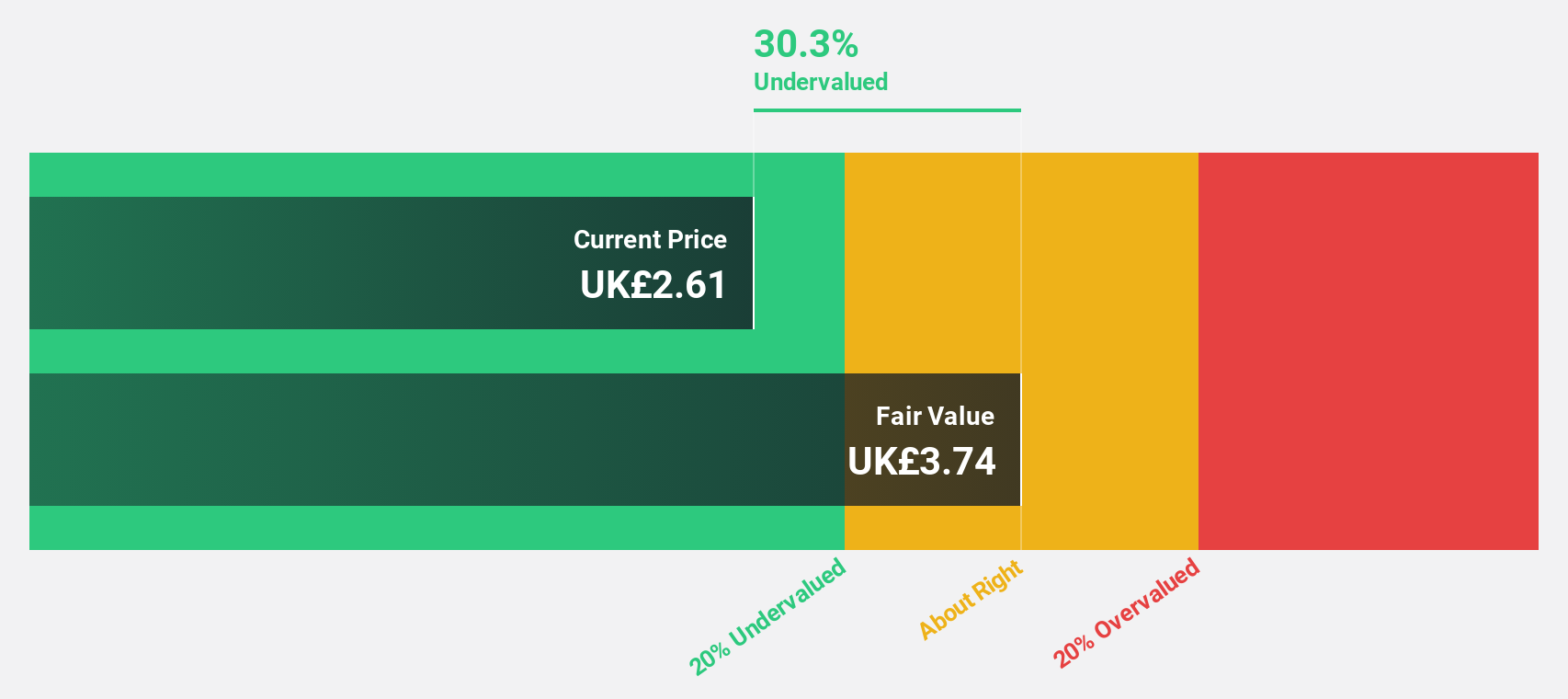

Estimated Discount To Fair Value: 10.1%

Marshalls is trading at £2.9, slightly below its estimated fair value of £3.22, suggesting potential undervaluation based on cash flows. The company forecasts significant earnings growth of 28.1% annually, outpacing the UK market average. However, its dividend yield of 2.86% isn't well covered by earnings and the return on equity is expected to be low at 6.9%. Marshalls plans acquisitions in roofing systems and energy transition to enhance cash flow conversion and reduce debt levels through strategic investments.

- The growth report we've compiled suggests that Marshalls' future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of Marshalls.

Summing It All Up

- Unlock our comprehensive list of 55 Undervalued UK Stocks Based On Cash Flows by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:LGRS

Loungers

Operates cafés, bars, and restaurants under the Lounge, Cosy Club, and Brightside brand names in England and Wales.

Reasonable growth potential with proven track record.

Market Insights

Community Narratives