- United Kingdom

- /

- Metals and Mining

- /

- LSE:FRES

UK Value Stocks Trading At An Estimated Discount In February 2025

Reviewed by Simply Wall St

As the United Kingdom's FTSE 100 index experiences fluctuations due to weak trade data from China and global economic uncertainties, investors are increasingly on the lookout for opportunities within undervalued stocks. In this climate, identifying companies trading at an estimated discount can be particularly appealing, as they may offer potential value despite broader market challenges.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Hercules Site Services (AIM:HERC) | £0.50 | £0.92 | 45.8% |

| Gaming Realms (AIM:GMR) | £0.358 | £0.71 | 49.7% |

| Brickability Group (AIM:BRCK) | £0.572 | £1.10 | 47.9% |

| GlobalData (AIM:DATA) | £1.78 | £3.55 | 49.9% |

| On the Beach Group (LSE:OTB) | £2.575 | £4.94 | 47.9% |

| Fevertree Drinks (AIM:FEVR) | £8.00 | £15.34 | 47.9% |

| Victrex (LSE:VCT) | £9.92 | £19.55 | 49.3% |

| Duke Capital (AIM:DUKE) | £0.291 | £0.57 | 49.1% |

| Deliveroo (LSE:ROO) | £1.313 | £2.60 | 49.5% |

| Informa (LSE:INF) | £8.664 | £16.48 | 47.4% |

Here we highlight a subset of our preferred stocks from the screener.

Fintel (AIM:FNTL)

Overview: Fintel Plc provides intermediary services and distribution channels to the retail financial services sector in the United Kingdom, with a market cap of £291.74 million.

Operations: The company's revenue segments include £24.20 million from Research & Fintech, £21.40 million from Distribution Channels, and £23.30 million from Intermediary Services.

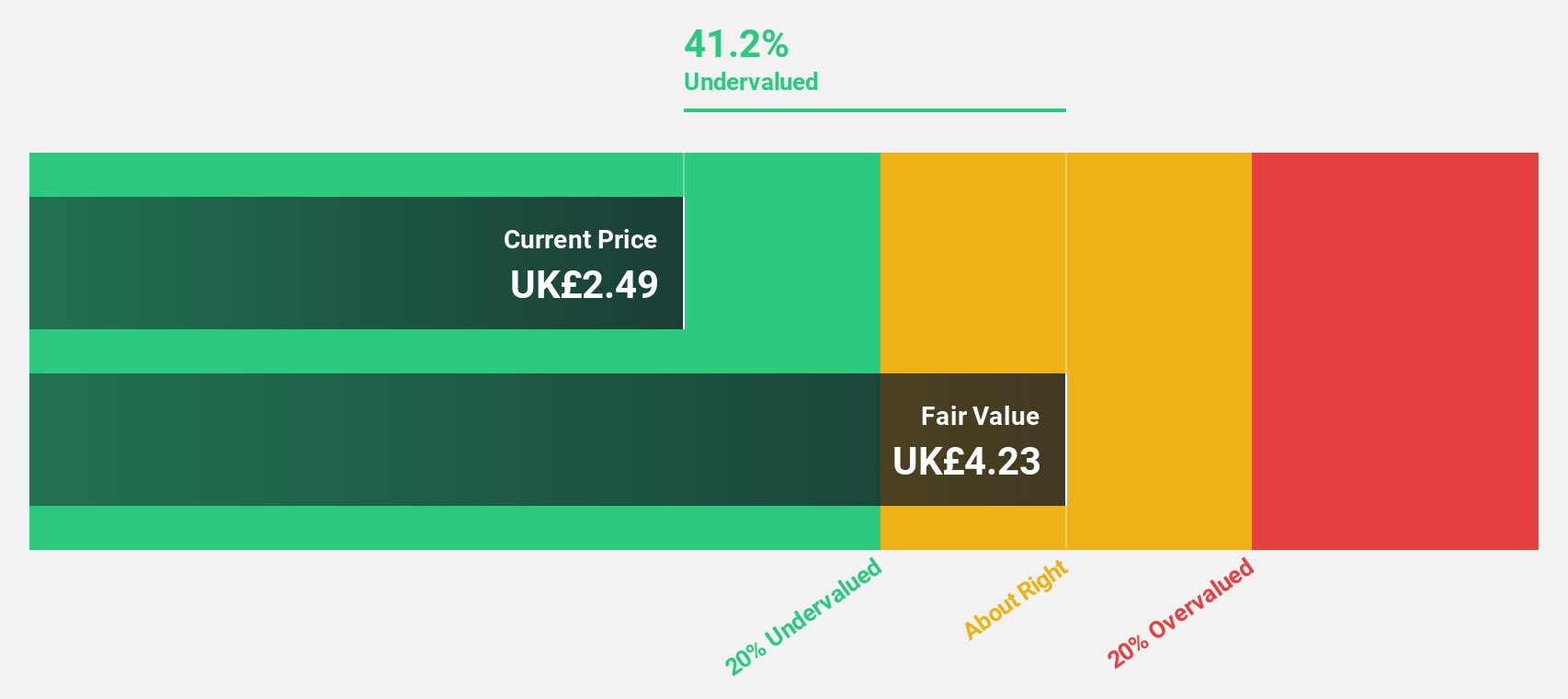

Estimated Discount To Fair Value: 36.7%

Fintel is trading at £2.8, significantly below its estimated fair value of £4.43, suggesting it may be undervalued based on cash flows. Despite a forecasted low return on equity of 12.7% in three years and recent profit margin decline to 8.6%, Fintel's earnings are expected to grow significantly at 34% per year, outpacing the UK market average of 14.8%. A recent follow-on equity offering raised £51 million, potentially impacting future valuations.

- Our expertly prepared growth report on Fintel implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of Fintel with our detailed financial health report.

Fresnillo (LSE:FRES)

Overview: Fresnillo plc is a company engaged in the mining, development, and production of non-ferrous minerals in Mexico with a market cap of £5.13 billion.

Operations: The company's revenue segments include Cienega at $195.82 million, Saucito at $607.29 million, Fresnillo at $439.76 million, Herradura at $633.78 million, Juanicipio at $546.80 million, SAN Julian at $404.32 million, and Noche Buena at $56.24 million.

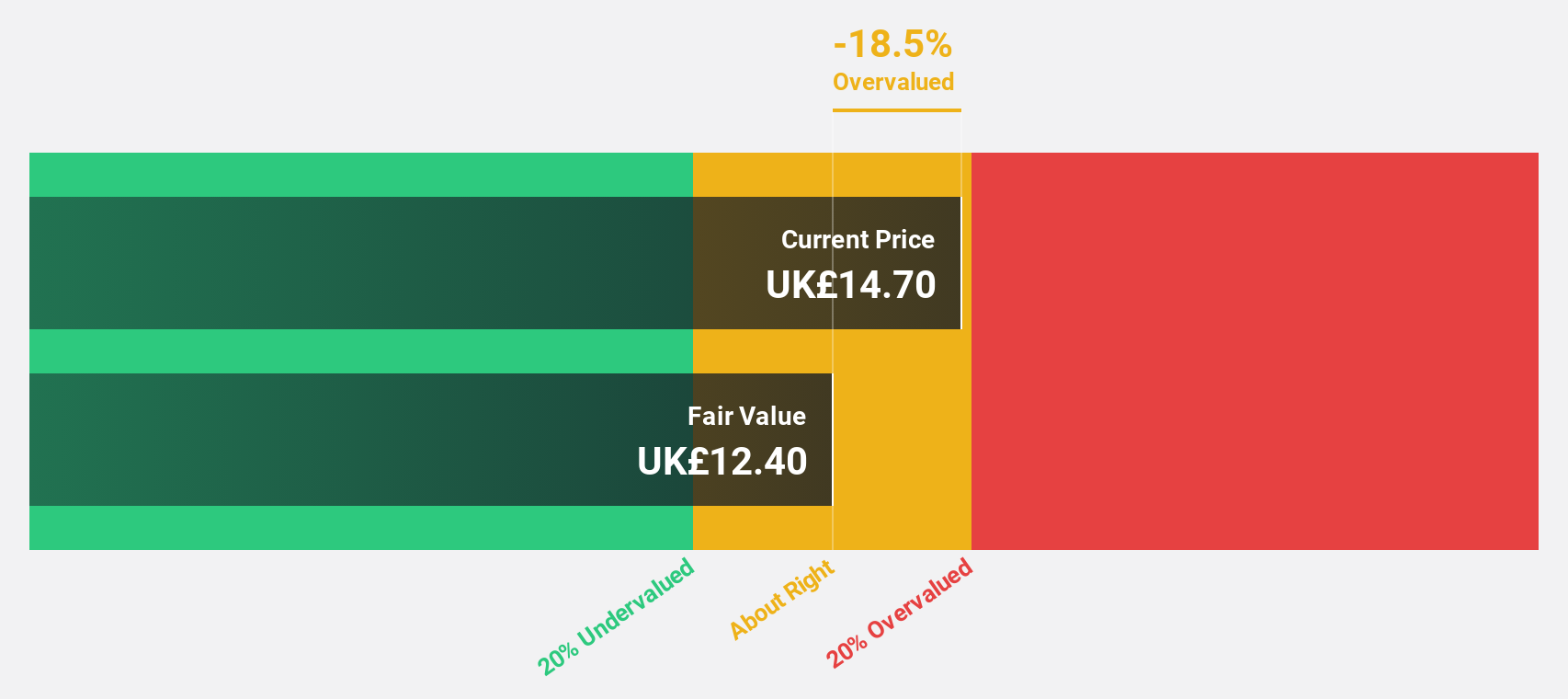

Estimated Discount To Fair Value: 24.9%

Fresnillo is trading at £6.96, below its estimated fair value of £9.27, indicating potential undervaluation based on cash flows. Despite a projected low return on equity of 9.9% in three years and slower revenue growth at 4.2% annually, its earnings are forecasted to grow significantly by 32.1% per year, surpassing the UK market average of 14.8%. Recent production results showed stable silver output but increased gold production year-over-year.

- In light of our recent growth report, it seems possible that Fresnillo's financial performance will exceed current levels.

- Unlock comprehensive insights into our analysis of Fresnillo stock in this financial health report.

Hochschild Mining (LSE:HOC)

Overview: Hochschild Mining plc is a precious metals company involved in the exploration, mining, processing, and sale of gold and silver across Peru, Argentina, the United States, Canada, Brazil, and Chile with a market cap of £905.45 million.

Operations: The company's revenue segments consist of $266.70 million from San Jose and $451.91 million from Inmaculada.

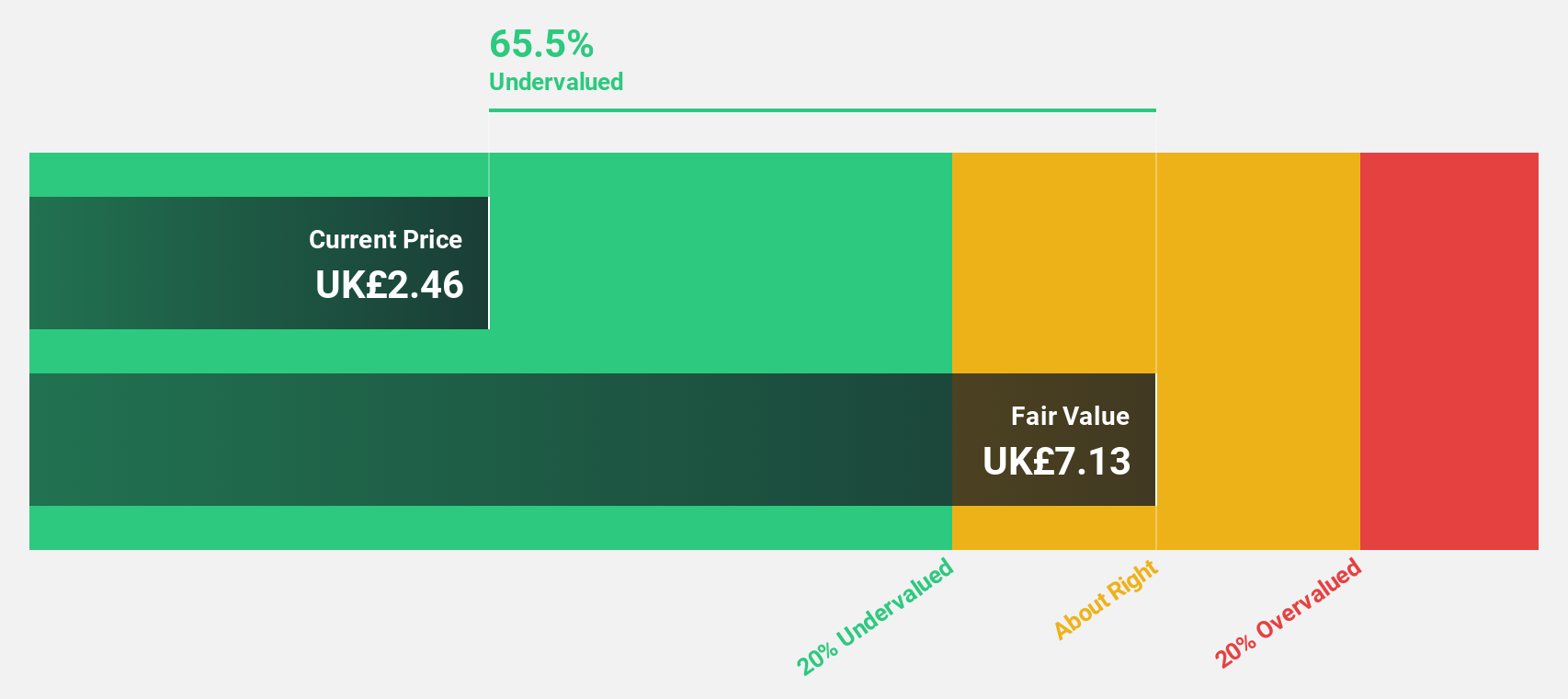

Estimated Discount To Fair Value: 31.6%

Hochschild Mining is trading at £1.76, significantly below its estimated fair value of £2.57, suggesting it may be undervalued based on cash flows. Earnings are projected to grow substantially at 40.3% annually over the next three years, outpacing the UK market average of 14.8%. However, despite becoming profitable this year and forecasting high revenue growth at 9.1%, challenges include high debt levels and volatile share prices recently observed.

- The analysis detailed in our Hochschild Mining growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of Hochschild Mining.

Turning Ideas Into Actions

- Click this link to deep-dive into the 48 companies within our Undervalued UK Stocks Based On Cash Flows screener.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:FRES

Fresnillo

Fresnillo plc mines, develops, and produces non-ferrous minerals in Mexico.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives