- United Kingdom

- /

- Professional Services

- /

- AIM:FNTL

UK Growth Companies With High Insider Ownership In October 2025

Reviewed by Simply Wall St

In recent months, the UK market has faced challenges as the FTSE 100 index faltered amid weak trade data from China, highlighting concerns over global economic recovery and its impact on London’s bluechip companies. In such a climate, growth companies with high insider ownership can be particularly appealing to investors, as they often indicate strong internal confidence and alignment of interests between company leaders and shareholders.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| SRT Marine Systems (AIM:SRT) | 25.9% | 91.4% |

| Metals Exploration (AIM:MTL) | 10.4% | 85.9% |

| Manolete Partners (AIM:MANO) | 38.1% | 29.5% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.9% | 20.8% |

| Gulf Keystone Petroleum (LSE:GKP) | 12.2% | 86.7% |

| Faron Pharmaceuticals Oy (AIM:FARN) | 21.4% | 62% |

| Energean (LSE:ENOG) | 19% | 48.9% |

| B90 Holdings (AIM:B90) | 22.1% | 157.2% |

| Anglo Asian Mining (AIM:AAZ) | 39.7% | 134.7% |

| ActiveOps (AIM:AOM) | 19.5% | 43.3% |

Let's review some notable picks from our screened stocks.

Fintel (AIM:FNTL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Fintel Plc provides intermediary services and distribution channels to the retail financial services sector in the United Kingdom, with a market capitalization of £231.31 million.

Operations: Fintel Plc generates revenue through its intermediary services and distribution channels within the UK's retail financial services sector.

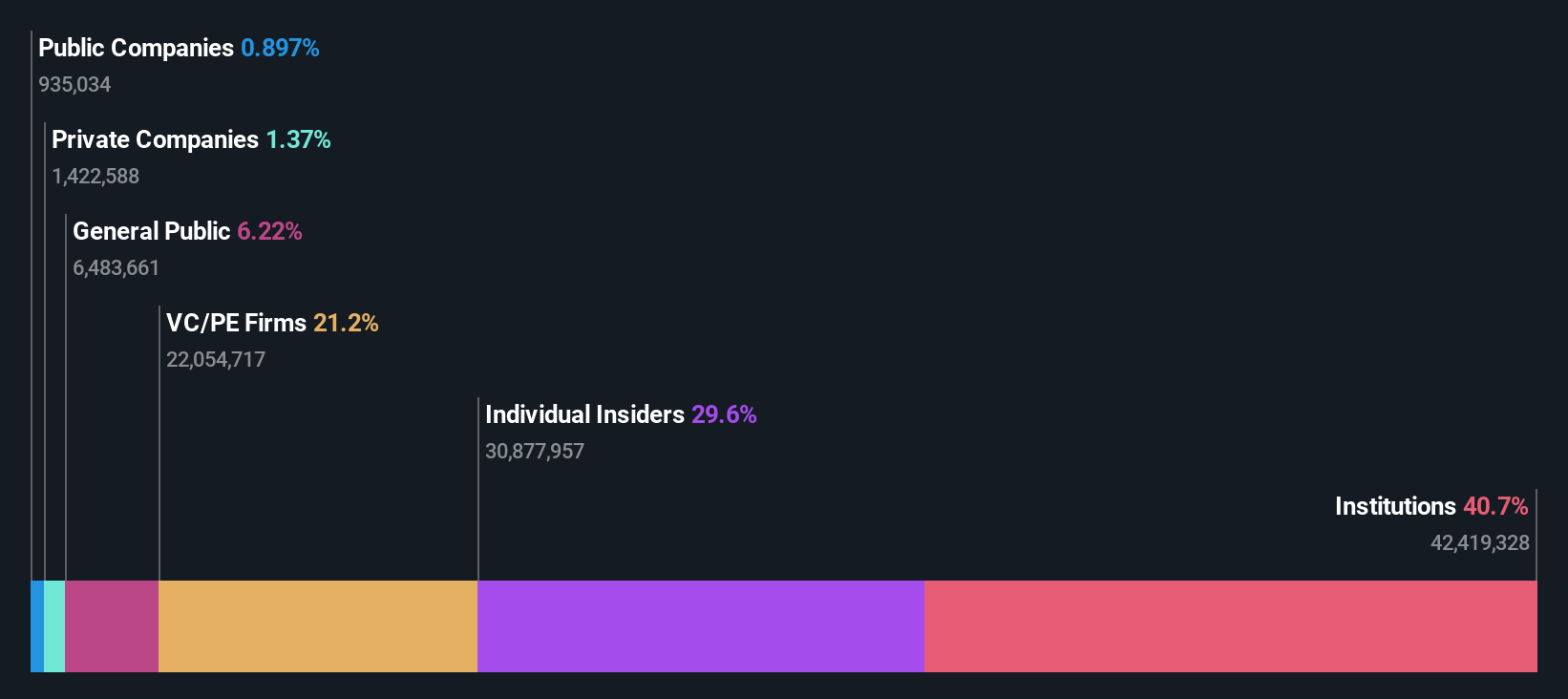

Insider Ownership: 26.8%

Earnings Growth Forecast: 31.2% p.a.

Fintel Plc demonstrates potential as a growth company with high insider ownership in the UK, with earnings forecasted to grow significantly at 31.2% annually, outpacing the broader market. Despite revenue growth being modest at 4.8% per year, it surpasses the UK market average. Recent half-year results show increased sales and net income, reflecting financial strength that supports an interim dividend increase. The stock trades below its estimated fair value and below analyst price targets, indicating possible upside potential.

- Click here to discover the nuances of Fintel with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential undervaluation of Fintel shares in the market.

Nichols (AIM:NICL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nichols plc, along with its subsidiaries, supplies soft drinks to the retail, wholesale, catering, licensed, and leisure industries across the United Kingdom, the Middle East, Africa, and internationally with a market cap of £420.55 million.

Operations: The company's revenue is primarily derived from its Packaged segment, which contributes £133.97 million, and the Out of Home segment, which adds £40.35 million.

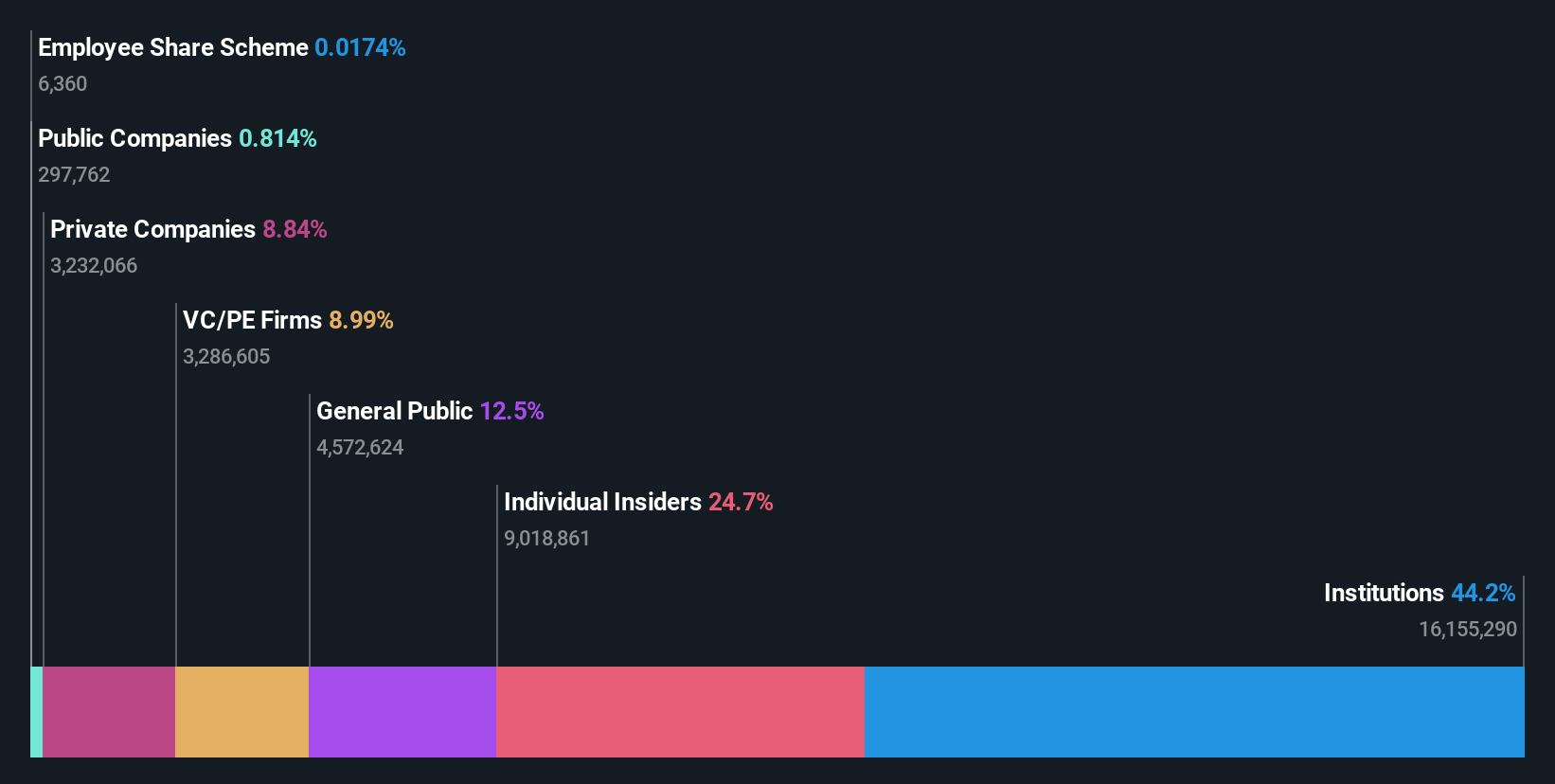

Insider Ownership: 24.7%

Earnings Growth Forecast: 16.4% p.a.

Nichols PLC, with high insider ownership, shows potential for growth despite modest revenue forecasts of 4.4% annually. Earnings are expected to grow at 16.38% per year, outpacing the UK market average of 14.2%. Recent financials show sales of £85.49 million and net income slightly down from last year at £8.53 million. Insiders have been buying shares in recent months, although not substantially, and the stock is trading below its estimated fair value and analyst price targets.

- Get an in-depth perspective on Nichols' performance by reading our analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Nichols is priced lower than what may be justified by its financials.

Alphawave IP Group (LSE:AWE)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Alphawave IP Group plc develops and sells wired connectivity solutions across various global regions, including North America and the Asia Pacific, with a market cap of £1.39 billion.

Operations: The company generates revenue primarily from its Communications Equipment segment, totaling $319.58 million.

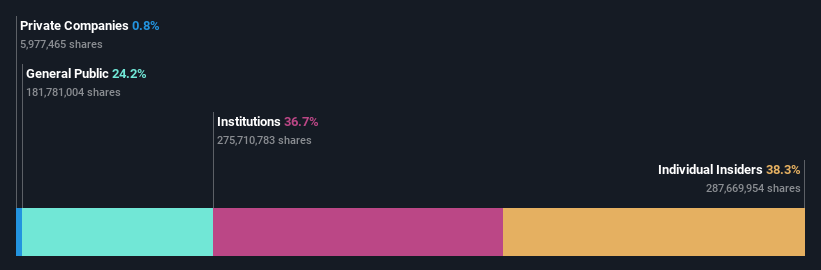

Insider Ownership: 34.1%

Earnings Growth Forecast: 129.1% p.a.

Alphawave IP Group, with significant insider ownership, is poised for growth with its revenue expected to rise 26.1% annually, outpacing the UK market. Recent advancements in their UCIe™ 3D IP on TSMC's SoIC-X technology highlight their leadership in chiplet integration for AI and data centers. Despite reporting a net loss of US$172.08 million for the first half of 2025, Alphawave continues to innovate in high-performance connectivity solutions and expand its product portfolio.

- Unlock comprehensive insights into our analysis of Alphawave IP Group stock in this growth report.

- Our valuation report unveils the possibility Alphawave IP Group's shares may be trading at a premium.

Where To Now?

- Discover the full array of 60 Fast Growing UK Companies With High Insider Ownership right here.

- Interested In Other Possibilities? Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:FNTL

Fintel

Engages in the provision of intermediary services and distribution channels to the retail financial services sector in the United Kingdom.

Good value with reasonable growth potential.

Market Insights

Community Narratives