- United Kingdom

- /

- Healthtech

- /

- AIM:CRW

UK Growth Companies With High Insider Ownership For September 2024

Reviewed by Simply Wall St

The London market has faced recent turbulence, with the FTSE 100 and FTSE 250 indices closing lower amid weak trade data from China, highlighting ongoing global economic challenges. In such a volatile environment, growth companies with high insider ownership can offer a unique appeal as they often signal strong confidence in the company's future prospects by those who know it best.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Filtronic (AIM:FTC) | 28.6% | 34% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.6% | 23.7% |

| Foresight Group Holdings (LSE:FSG) | 31.7% | 27.9% |

| Helios Underwriting (AIM:HUW) | 23.9% | 14.7% |

| LSL Property Services (LSE:LSL) | 10.8% | 33.3% |

| Belluscura (AIM:BELL) | 36.1% | 113.4% |

| B90 Holdings (AIM:B90) | 24.4% | 142.7% |

| Velocity Composites (AIM:VEL) | 27.6% | 188.7% |

| Judges Scientific (AIM:JDG) | 11.9% | 26.9% |

| Gulf Keystone Petroleum (LSE:GKP) | 12.1% | 80.6% |

Let's dive into some prime choices out of the screener.

Craneware (AIM:CRW)

Simply Wall St Growth Rating: ★★★★☆☆

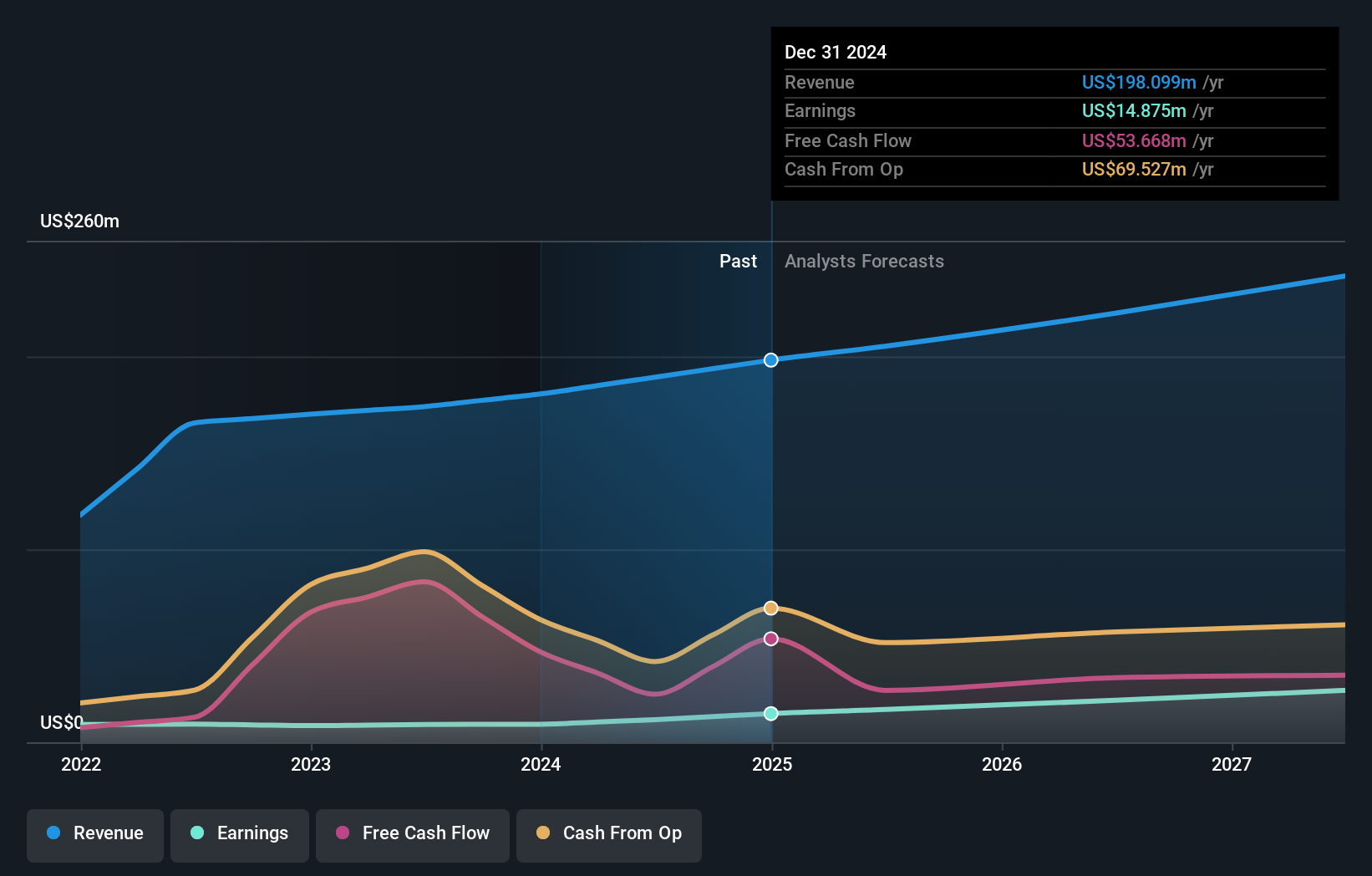

Overview: Craneware plc, with a market cap of £796.94 million, develops, licenses, and supports computer software for the healthcare industry in the United States.

Operations: Craneware generates revenue through the development, licensing, and support of computer software tailored for the U.S. healthcare sector.

Insider Ownership: 17%

Earnings Growth Forecast: 25.6% p.a.

Craneware, a UK-based growth company with high insider ownership, is poised for significant earnings growth at 25.6% annually over the next three years, outpacing the UK market's 14.3%. Recent full-year results show sales of US$189.27 million and net income of US$11.7 million, reflecting robust financial health. Strategic collaborations with Microsoft enhance Craneware’s Trisus Platform offerings and cloud capabilities, while potential acquisitions aim to bolster its market position further through targeted M&A activities.

- Take a closer look at Craneware's potential here in our earnings growth report.

- Our expertly prepared valuation report Craneware implies its share price may be too high.

Fintel (AIM:FNTL)

Simply Wall St Growth Rating: ★★★★☆☆

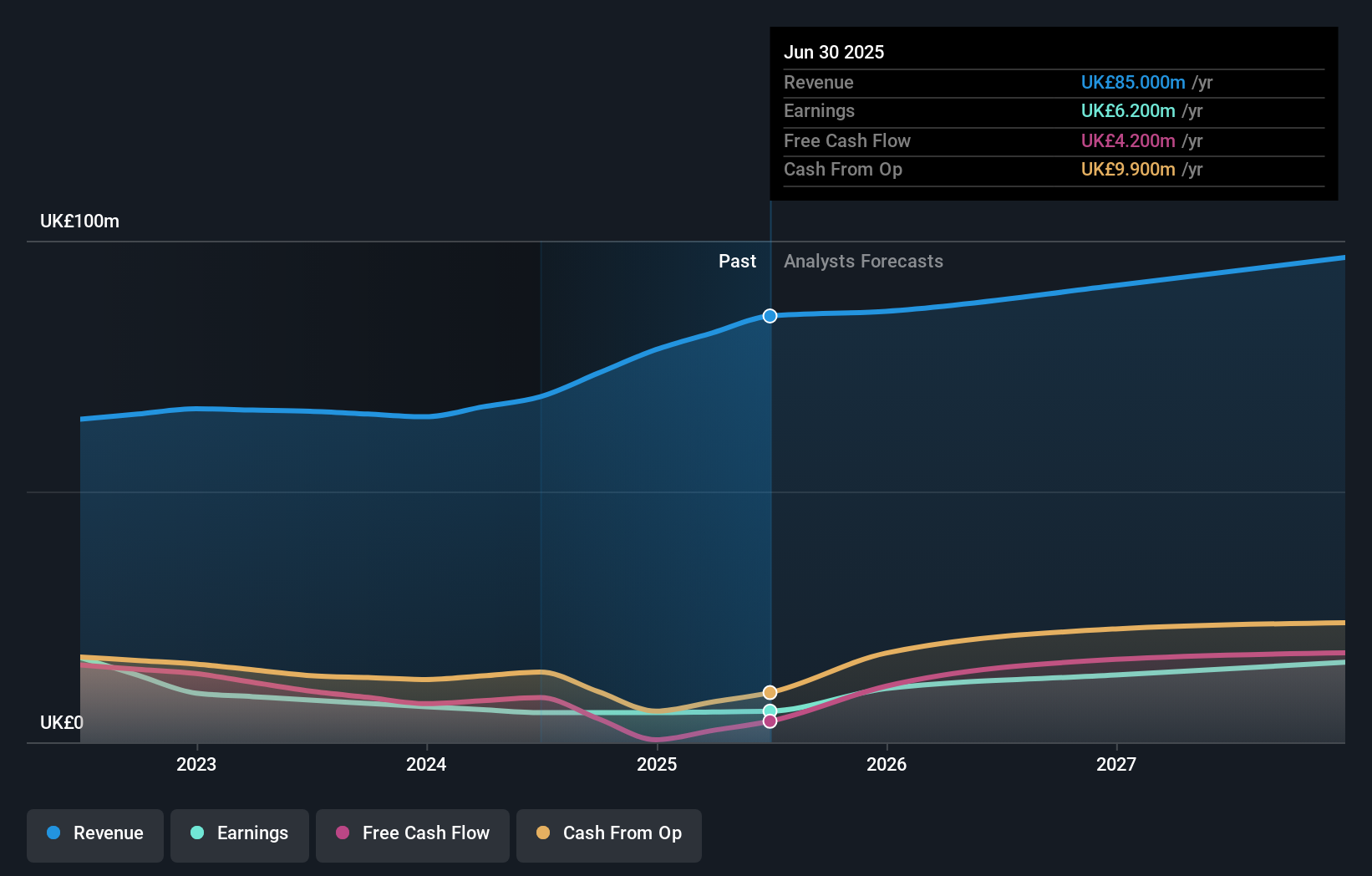

Overview: Fintel Plc provides intermediary services and distribution channels to the retail financial services sector in the United Kingdom, with a market cap of £322.97 million.

Operations: The company's revenue segments include Research & Fintech (£22.30 million), Distribution Channels (£20.20 million), and Intermediary Services (£22.40 million).

Insider Ownership: 29.1%

Earnings Growth Forecast: 23.9% p.a.

Fintel, a UK-based firm with high insider ownership, is expected to see significant annual earnings growth of 23.88% over the next three years, outpacing the UK market's 14.3%. Trading at 21.9% below its estimated fair value and with revenue forecasted to grow at 8.6% annually—faster than the UK's average of 3.8%—the company shows potential despite low projected Return on Equity (12.8%) and large one-off items impacting results.

- Get an in-depth perspective on Fintel's performance by reading our analyst estimates report here.

- The analysis detailed in our Fintel valuation report hints at an inflated share price compared to its estimated value.

Judges Scientific (AIM:JDG)

Simply Wall St Growth Rating: ★★★★★☆

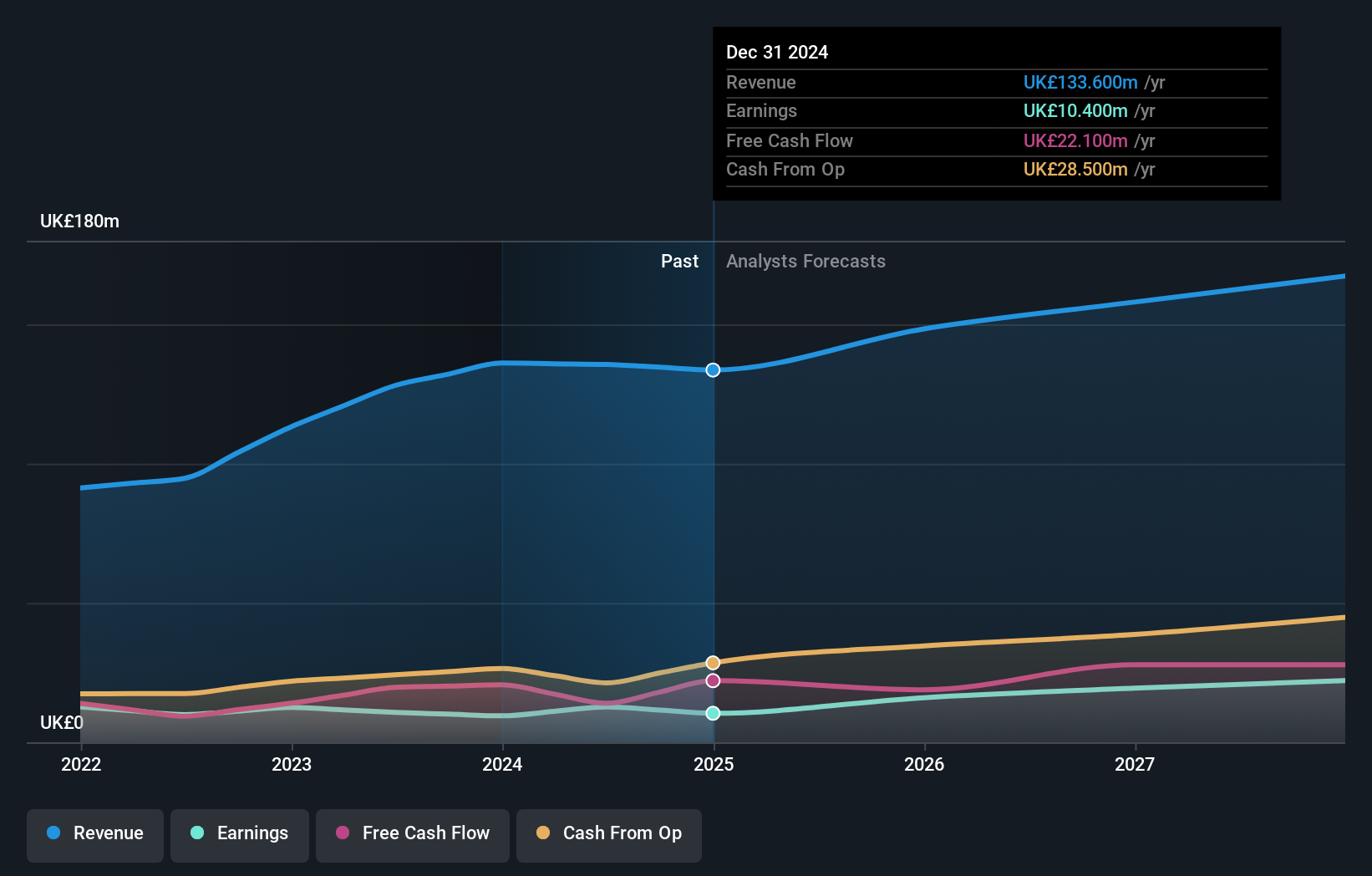

Overview: Judges Scientific plc designs, manufactures, and sells scientific instruments and has a market cap of £723.91 million.

Operations: Judges Scientific's revenue segments include Vacuum (£63.60 million) and Materials Sciences (£72.50 million).

Insider Ownership: 11.9%

Earnings Growth Forecast: 26.9% p.a.

Judges Scientific, a UK-based firm with substantial insider ownership, is expected to see annual earnings growth of 26.9%, outpacing the UK market's 14.3%. Despite high debt levels and recent significant insider selling, its revenue is forecasted to grow at 6.3% annually. The recent appointment of Dr. Ian Wilcock as Group Commercial Director brings extensive leadership and innovation experience, potentially bolstering future growth and development initiatives for the company.

- Click here and access our complete growth analysis report to understand the dynamics of Judges Scientific.

- Our valuation report here indicates Judges Scientific may be overvalued.

Make It Happen

- Embark on your investment journey to our 68 Fast Growing UK Companies With High Insider Ownership selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:CRW

Craneware

Develops, licenses, and supports computer software for the healthcare industry in the United States.

Reasonable growth potential with proven track record.