- United Kingdom

- /

- Professional Services

- /

- AIM:FNTL

3 UK Stocks Estimated To Be Up To 43.2% Below Intrinsic Value

Reviewed by Simply Wall St

The United Kingdom's stock market has been experiencing some turbulence, with the FTSE 100 index closing lower amid weak trade data from China, highlighting global economic challenges. In such a climate, identifying undervalued stocks can offer potential opportunities for investors seeking to capitalize on discrepancies between market prices and intrinsic values.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Gaming Realms (AIM:GMR) | £0.369 | £0.73 | 49.3% |

| Fevertree Drinks (AIM:FEVR) | £7.00 | £12.73 | 45% |

| TBC Bank Group (LSE:TBCG) | £32.20 | £62.39 | 48.4% |

| GlobalData (AIM:DATA) | £2.02 | £3.71 | 45.6% |

| On the Beach Group (LSE:OTB) | £1.658 | £3.00 | 44.7% |

| Informa (LSE:INF) | £8.55 | £15.41 | 44.5% |

| Nexxen International (AIM:NEXN) | £3.87 | £7.59 | 49% |

| Videndum (LSE:VID) | £2.50 | £4.59 | 45.5% |

| St. James's Place (LSE:STJ) | £8.96 | £16.40 | 45.4% |

| Genel Energy (LSE:GENL) | £0.85 | £1.56 | 45.4% |

We'll examine a selection from our screener results.

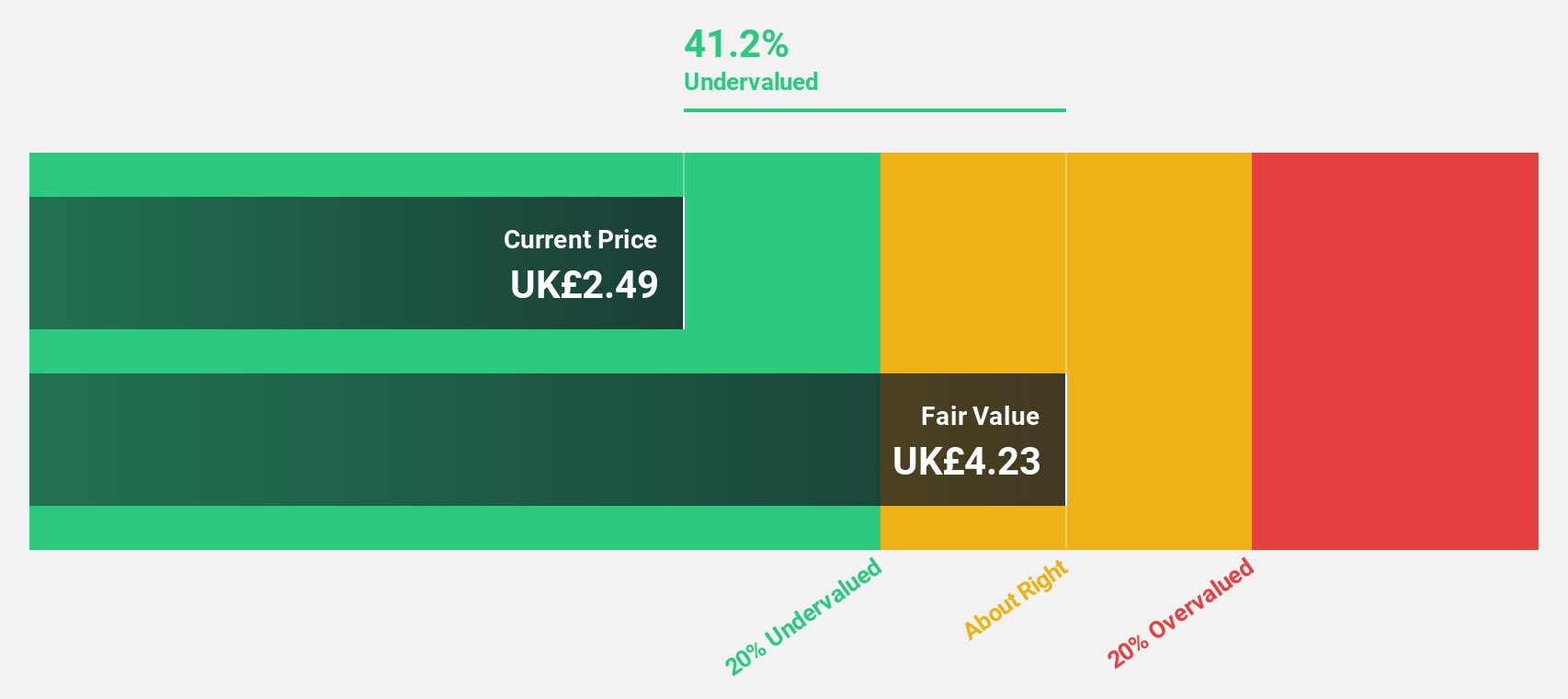

Fintel (AIM:FNTL)

Overview: Fintel Plc provides intermediary services and distribution channels to the retail financial services sector in the United Kingdom, with a market cap of £304.23 million.

Operations: The company's revenue is derived from three main segments: Research & Fintech (£24.20 million), Distribution Channels (£21.40 million), and Intermediary Services (£23.30 million).

Estimated Discount To Fair Value: 34.4%

Fintel is trading at £2.92, significantly below its estimated fair value of £4.45, suggesting it may be undervalued based on cash flows. Despite a decline in profit margins from 12.7% to 8.6%, earnings are forecasted to grow at 34% annually, outpacing the UK market's growth rate of 14.8%. Recent developments include a follow-on equity offering raising £51 million and an interim dividend increase by 9%, reflecting ongoing shareholder returns amidst strategic financial maneuvers.

- Our comprehensive growth report raises the possibility that Fintel is poised for substantial financial growth.

- Take a closer look at Fintel's balance sheet health here in our report.

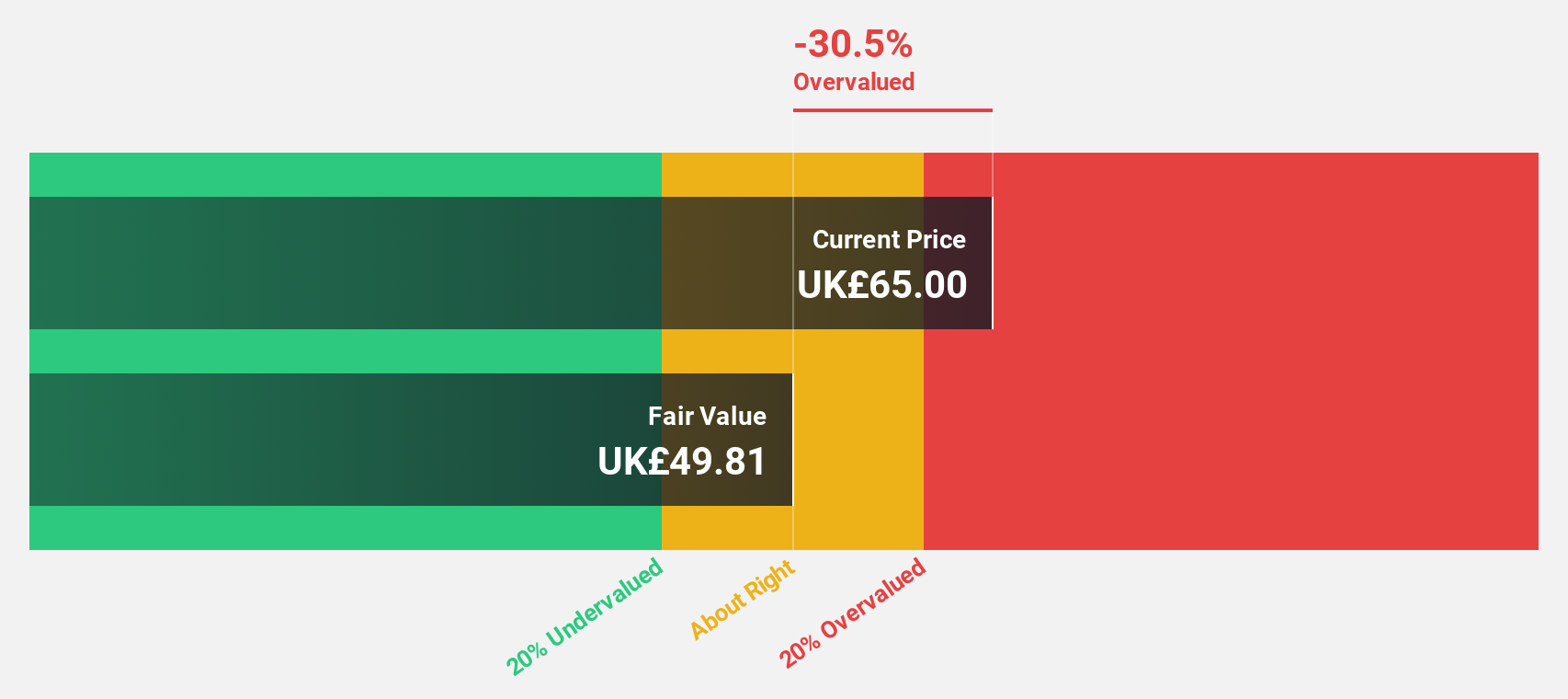

Judges Scientific (AIM:JDG)

Overview: Judges Scientific plc designs, manufactures, and sells scientific instruments and has a market cap of £557.95 million.

Operations: The company's revenue segments include £65.40 million from Vacuum and £70.20 million from Materials Sciences.

Estimated Discount To Fair Value: 27%

Judges Scientific, trading at £84, is currently valued 27% below its estimated fair value of £115.09. Despite facing high debt levels and recent significant insider selling, the company shows strong financial potential with earnings expected to grow significantly by 25.3% annually over the next three years—outpacing the UK market's growth rate. Recent half-year results revealed a net income increase from £1 million to £4.2 million, indicating robust profit growth despite stable sales figures.

- Our expertly prepared growth report on Judges Scientific implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in Judges Scientific's balance sheet health report.

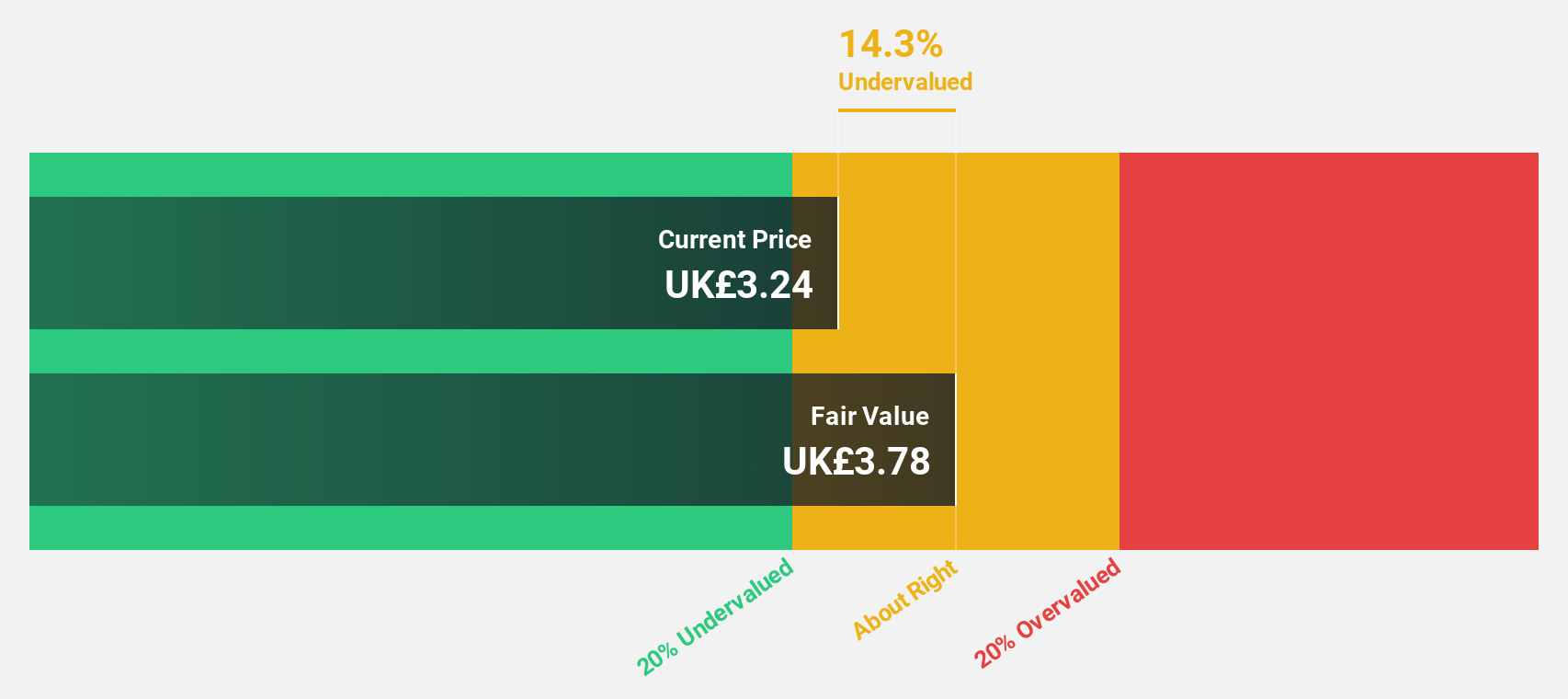

Loungers (AIM:LGRS)

Overview: Loungers plc operates cafés, bars, and restaurants under the Lounge and Cosy Club brand names in England and Wales, with a market cap of £316.02 million.

Operations: The company's revenue from operating café bars and café restaurants is £353.49 million.

Estimated Discount To Fair Value: 43.2%

Loungers is trading at £3.04, significantly below its estimated fair value of £5.35, highlighting its undervaluation based on discounted cash flows. The company reported strong earnings growth for the half year ending October 2024, with net income rising from £2.74 million to £4.28 million year-over-year and earnings per share increasing to £0.04. Additionally, CF EXEDRA BIDCO LIMITED has agreed to acquire Loungers for £3.1 per share in cash, subject to shareholder approval and expected completion in Q1 2025.

- According our earnings growth report, there's an indication that Loungers might be ready to expand.

- Unlock comprehensive insights into our analysis of Loungers stock in this financial health report.

Make It Happen

- Dive into all 53 of the Undervalued UK Stocks Based On Cash Flows we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:FNTL

Fintel

Engages in the provision of intermediary services and distribution channels to the retail financial services sector in the United Kingdom.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives