- United Kingdom

- /

- Professional Services

- /

- AIM:FNTL

3 UK Stocks Estimated To Be 10.9% To 45% Below Intrinsic Value

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices closing lower due to weak trade data from China, highlighting concerns about global economic recovery. In such a climate, identifying undervalued stocks—those trading below their intrinsic value—can present opportunities for investors seeking potential gains despite broader market uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Vistry Group (LSE:VTY) | £6.408 | £12.32 | 48% |

| Tortilla Mexican Grill (AIM:MEX) | £0.425 | £0.78 | 45.5% |

| Pinewood Technologies Group (LSE:PINE) | £3.665 | £7.13 | 48.6% |

| PageGroup (LSE:PAGE) | £2.308 | £4.53 | 49% |

| Nichols (AIM:NICL) | £9.52 | £18.53 | 48.6% |

| Motorpoint Group (LSE:MOTR) | £1.35 | £2.67 | 49.5% |

| Ibstock (LSE:IBST) | £1.39 | £2.68 | 48.1% |

| Gym Group (LSE:GYM) | £1.494 | £2.94 | 49.1% |

| Fevertree Drinks (AIM:FEVR) | £8.33 | £15.82 | 47.4% |

| Advanced Medical Solutions Group (AIM:AMS) | £2.215 | £4.20 | 47.3% |

Here we highlight a subset of our preferred stocks from the screener.

Fintel (AIM:FNTL)

Overview: Fintel Plc provides intermediary services and distribution channels to the retail financial services sector in the United Kingdom, with a market cap of £218.81 million.

Operations: Fintel Plc's revenue is derived from intermediary services and distribution channels within the UK's retail financial services sector.

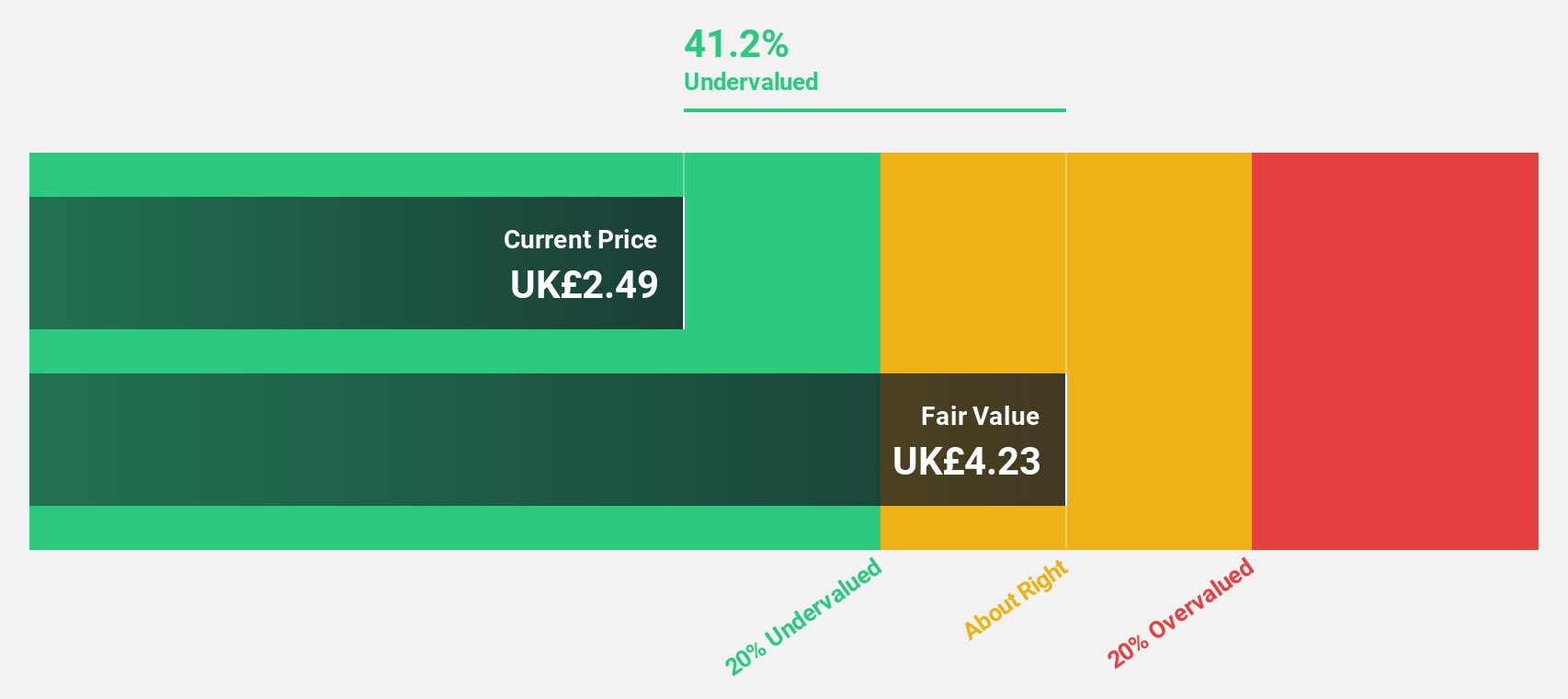

Estimated Discount To Fair Value: 45%

Fintel is trading at £2.1, significantly below its estimated fair value of £3.81, indicating it may be undervalued based on cash flows. Analysts expect a 61.9% price increase, with earnings projected to grow significantly over the next three years at 31.2% annually—outpacing the UK market's growth rate of 14.2%. Despite low forecasted return on equity and large one-off items affecting results, Fintel offers strong growth potential relative to its current valuation.

- Our comprehensive growth report raises the possibility that Fintel is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of Fintel.

Avon Technologies (LSE:AVON)

Overview: Avon Technologies Plc, with a market cap of £512.98 million, specializes in respiratory and head protection products for military and first responder markets in Europe and the United States.

Operations: The company's revenue is derived from two segments: Team Wendy, generating $145.10 million, and Avon Protection, contributing $168.80 million.

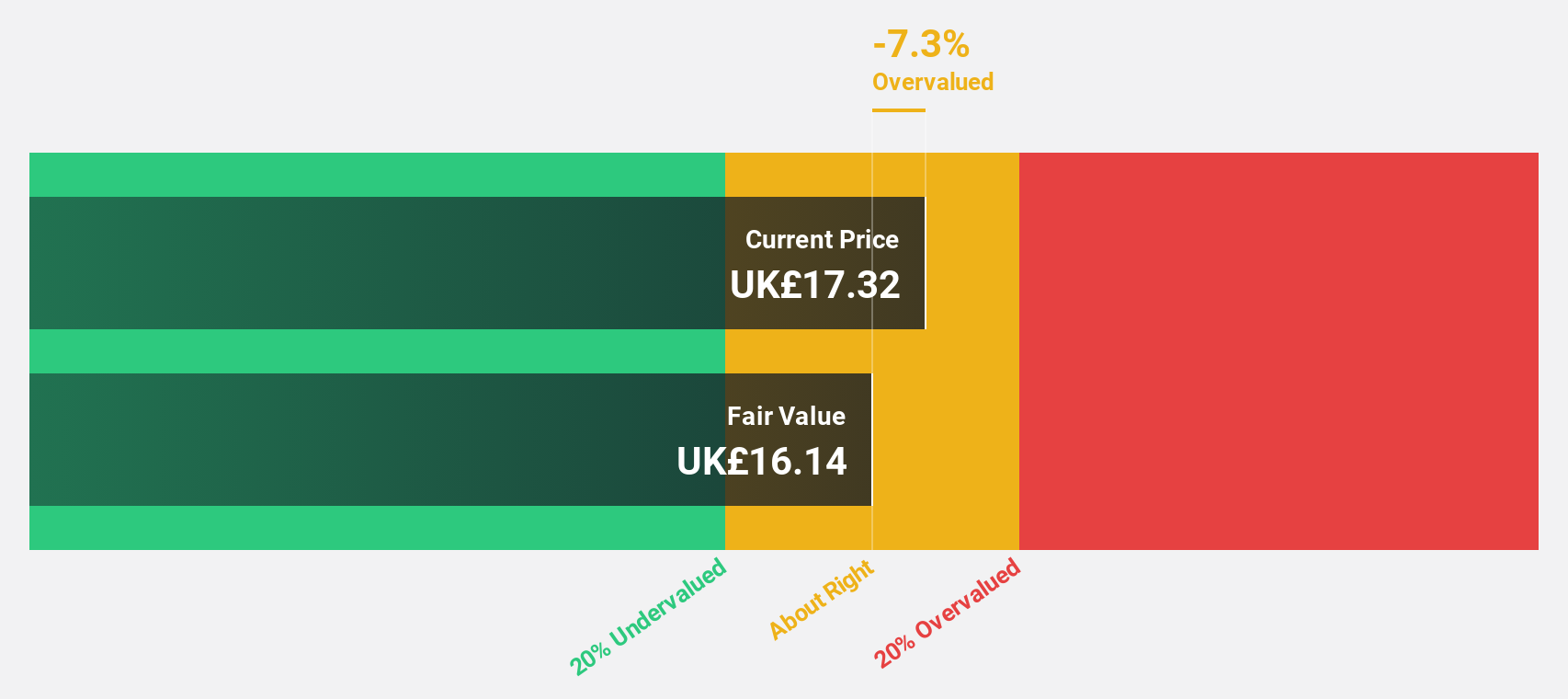

Estimated Discount To Fair Value: 29.1%

Avon Technologies, trading at £17.5, is priced below its estimated fair value of £24.68, reflecting a potential undervaluation based on cash flows. Analysts agree on a 22% price rise, with earnings expected to grow significantly at 33.3% annually—surpassing the UK market's growth rate of 14.2%. Recent $20.6 million NATO contract for respirators supports future revenue expectations despite slower forecasted revenue growth compared to earnings expansion and low return on equity projections.

- In light of our recent growth report, it seems possible that Avon Technologies' financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Avon Technologies' balance sheet health report.

XPS Pensions Group (LSE:XPS)

Overview: XPS Pensions Group plc, with a market cap of £692.11 million, offers employee benefit consultancy and related business services in the United Kingdom through its subsidiaries.

Operations: The company generates revenue of £246.90 million from its Pension and Employee Benefit Solutions segment in the United Kingdom.

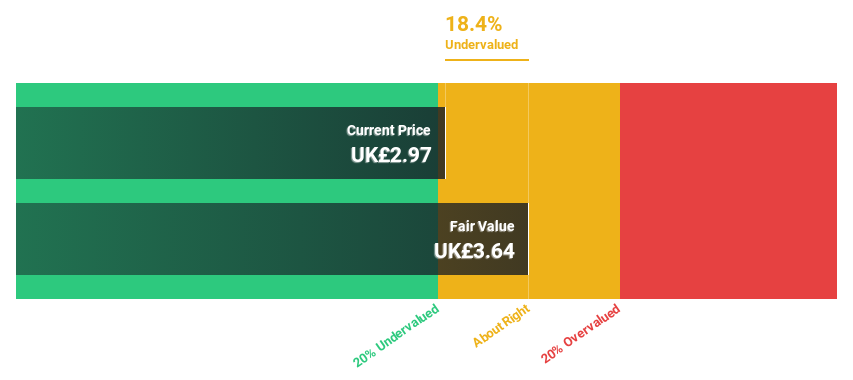

Estimated Discount To Fair Value: 10.9%

XPS Pensions Group, trading at £3.39, is priced below its estimated fair value of £3.8, indicating potential undervaluation based on cash flows. Despite a decline in net profit margins from 28.3% to 10.5%, earnings are forecast to grow faster than the UK market at 14.2% annually. Recent strategic moves include seeking M&A opportunities and securing a significant contract with the Metropolitan Police Service's Pension Scheme, enhancing long-term revenue prospects despite modest expected growth rates compared to historical performance.

- According our earnings growth report, there's an indication that XPS Pensions Group might be ready to expand.

- Dive into the specifics of XPS Pensions Group here with our thorough financial health report.

Summing It All Up

- Click this link to deep-dive into the 57 companies within our Undervalued UK Stocks Based On Cash Flows screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:FNTL

Fintel

Engages in the provision of intermediary services and distribution channels to the retail financial services sector in the United Kingdom.

Reasonable growth potential with adequate balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion