- United Kingdom

- /

- Professional Services

- /

- AIM:FNTL

3 UK Growth Stocks With Up To 29% Insider Ownership

Reviewed by Simply Wall St

Over the past 7 days, the United Kingdom market has dropped 1.6%, but over the last year, it has risen by 9.0%, with earnings forecast to grow by 14% annually. In this environment, growth companies with high insider ownership can be particularly attractive as they often signal strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Filtronic (AIM:FTC) | 28.6% | 34% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.6% | 23.7% |

| Foresight Group Holdings (LSE:FSG) | 31.7% | 27.9% |

| Helios Underwriting (AIM:HUW) | 23.9% | 14.7% |

| LSL Property Services (LSE:LSL) | 10.8% | 33.3% |

| Belluscura (AIM:BELL) | 36.1% | 113.4% |

| B90 Holdings (AIM:B90) | 24.4% | 142.7% |

| Velocity Composites (AIM:VEL) | 27.6% | 188.7% |

| Judges Scientific (AIM:JDG) | 11.9% | 26.9% |

| Gulf Keystone Petroleum (LSE:GKP) | 12.1% | 80.6% |

Underneath we present a selection of stocks filtered out by our screen.

Craneware (AIM:CRW)

Simply Wall St Growth Rating: ★★★★☆☆

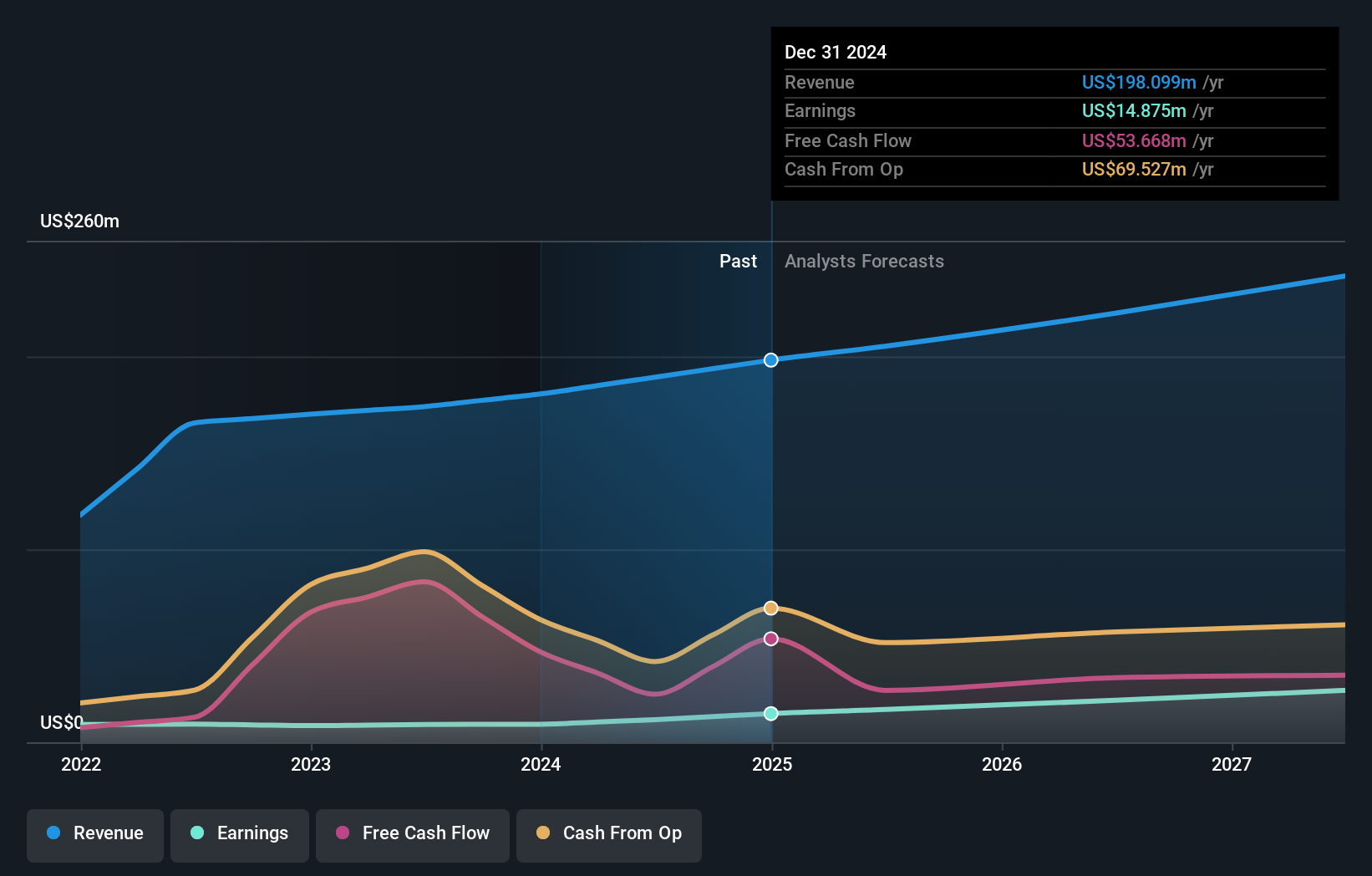

Overview: Craneware plc, with a market cap of £796.94 million, develops, licenses, and supports computer software for the healthcare industry in the United States.

Operations: Craneware's revenue segments include the development, licensing, and support of computer software for the healthcare industry in the United States.

Insider Ownership: 17%

Craneware, a UK-based healthcare software company with significant insider ownership, reported robust earnings for the year ending June 30, 2024. Sales increased to US$189.27 million from US$174.02 million, and net income rose to US$11.7 million from US$9.23 million. The company is actively seeking acquisitions to complement its organic growth strategy and has partnered with Microsoft Azure to enhance its cloud capabilities and AI applications in healthcare analytics, potentially driving future growth and market expansion.

- Unlock comprehensive insights into our analysis of Craneware stock in this growth report.

- The valuation report we've compiled suggests that Craneware's current price could be inflated.

Fintel (AIM:FNTL)

Simply Wall St Growth Rating: ★★★★☆☆

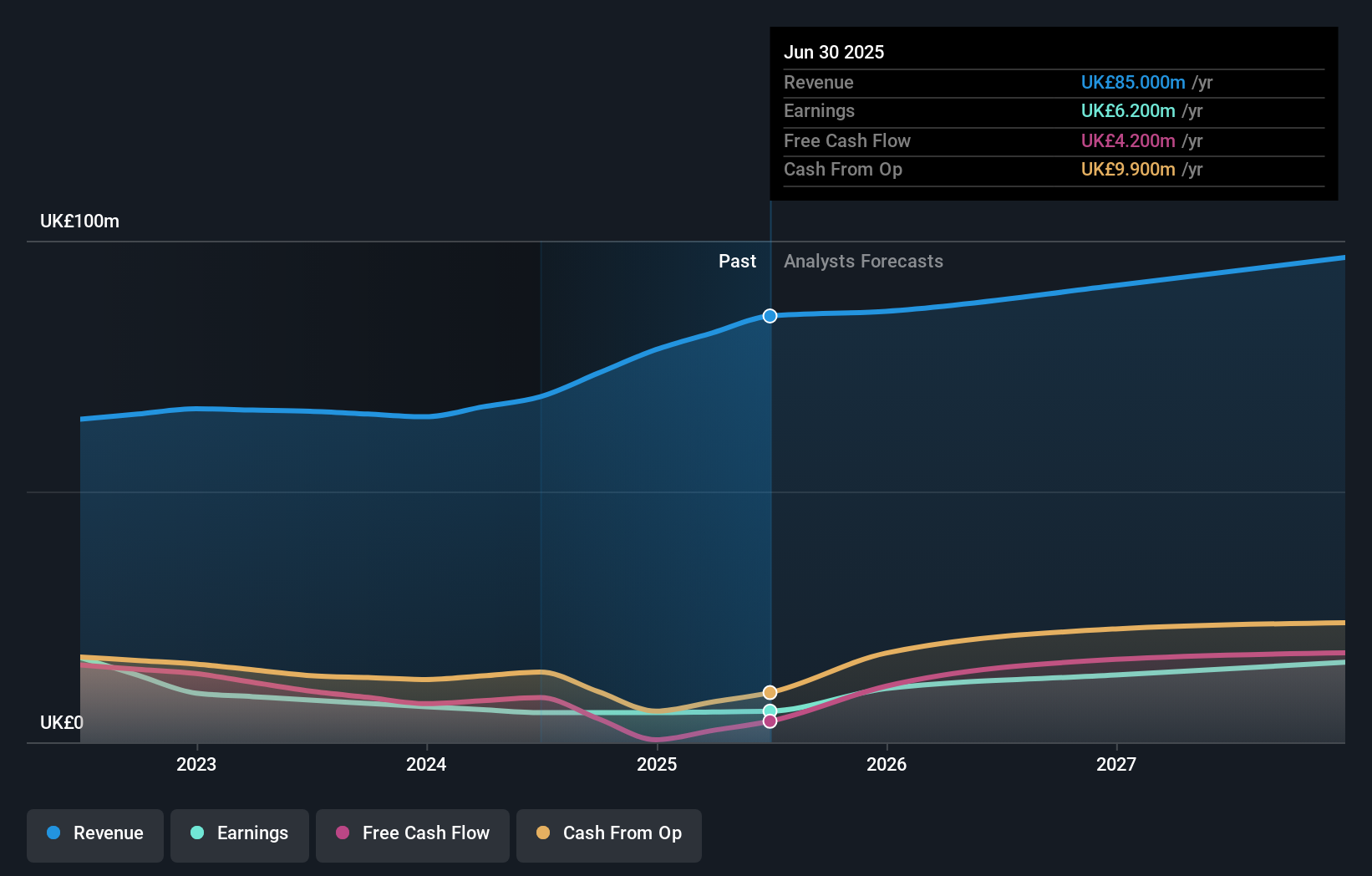

Overview: Fintel Plc provides intermediary services and distribution channels to the retail financial services sector in the United Kingdom, with a market cap of £322.97 million.

Operations: Revenue segments for Fintel Plc include Research & Fintech (£22.30 million), Distribution Channels (£20.20 million), and Intermediary Services (£22.40 million).

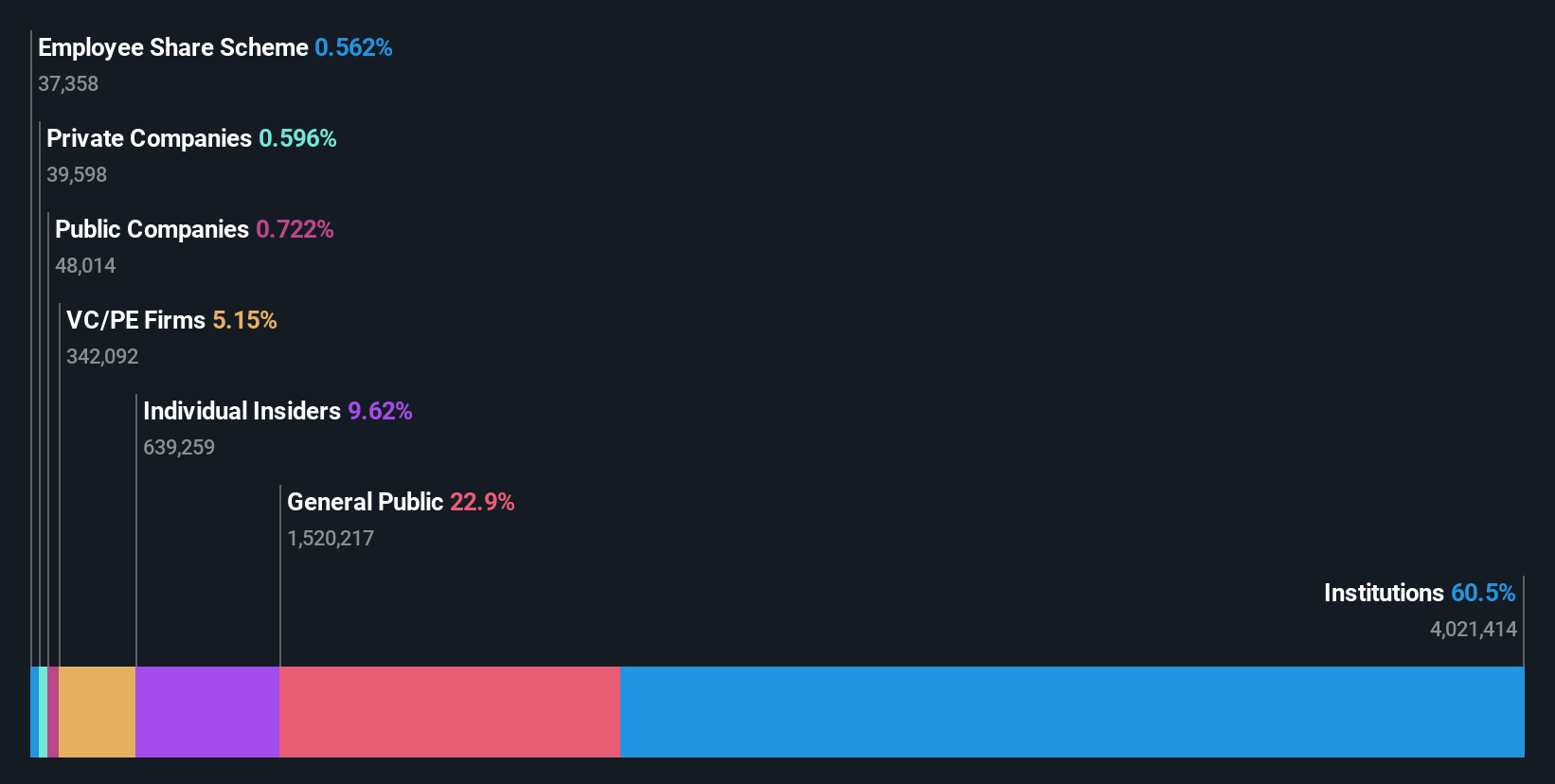

Insider Ownership: 29.1%

Fintel, a UK-based financial technology company with substantial insider ownership, is expected to see significant earnings growth of 23.88% annually over the next three years, outpacing the broader UK market's forecast. Despite trading at 21.9% below its estimated fair value and having revenue growth projections of 8.6% per year, its return on equity is anticipated to be low at 12.8%. Recent financial results have been impacted by large one-off items.

- Delve into the full analysis future growth report here for a deeper understanding of Fintel.

- The analysis detailed in our Fintel valuation report hints at an inflated share price compared to its estimated value.

Judges Scientific (AIM:JDG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Judges Scientific plc designs, manufactures, and sells scientific instruments with a market cap of £723.91 million.

Operations: Judges Scientific generates revenue from two primary segments: Vacuum (£63.60 million) and Materials Sciences (£72.50 million).

Insider Ownership: 11.9%

Judges Scientific, a UK-based company with high insider ownership, is forecasted to achieve significant annual earnings growth of 26.88% over the next three years, outpacing the broader UK market's 14.3%. Despite recent volatility in share price and lower profit margins (7%) compared to last year (11%), its return on equity is projected at 20.9%. Recent board appointment of Dr. Ian Wilcock aims to bolster growth and innovation, leveraging his extensive industry experience.

- Dive into the specifics of Judges Scientific here with our thorough growth forecast report.

- According our valuation report, there's an indication that Judges Scientific's share price might be on the expensive side.

Taking Advantage

- Gain an insight into the universe of 68 Fast Growing UK Companies With High Insider Ownership by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:FNTL

Fintel

Engages in the provision of intermediary services and distribution channels to the retail financial services sector in the United Kingdom.

Reasonable growth potential with adequate balance sheet.