- United Kingdom

- /

- Healthtech

- /

- AIM:CRW

3 UK Growth Stocks Insiders Are Backing

Reviewed by Simply Wall St

As the UK market grapples with global economic uncertainties, particularly influenced by China's sluggish recovery, the FTSE 100 and FTSE 250 indices have recently experienced declines. In such a volatile environment, growth stocks with high insider ownership can be appealing as they often indicate confidence from those closest to the company’s operations and potential.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Filtronic (AIM:FTC) | 28.8% | 55.7% |

| Gulf Keystone Petroleum (LSE:GKP) | 12.2% | 93.9% |

| Foresight Group Holdings (LSE:FSG) | 34.2% | 23.5% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.6% | 21.5% |

| LSL Property Services (LSE:LSL) | 10.7% | 28.2% |

| Facilities by ADF (AIM:ADF) | 13.1% | 190% |

| Judges Scientific (AIM:JDG) | 10.6% | 29.4% |

| B90 Holdings (AIM:B90) | 24.4% | 166.8% |

| Mortgage Advice Bureau (Holdings) (AIM:MAB1) | 19.8% | 26.4% |

| Anglo Asian Mining (AIM:AAZ) | 40% | 189.1% |

Here's a peek at a few of the choices from the screener.

Craneware (AIM:CRW)

Simply Wall St Growth Rating: ★★★★☆☆

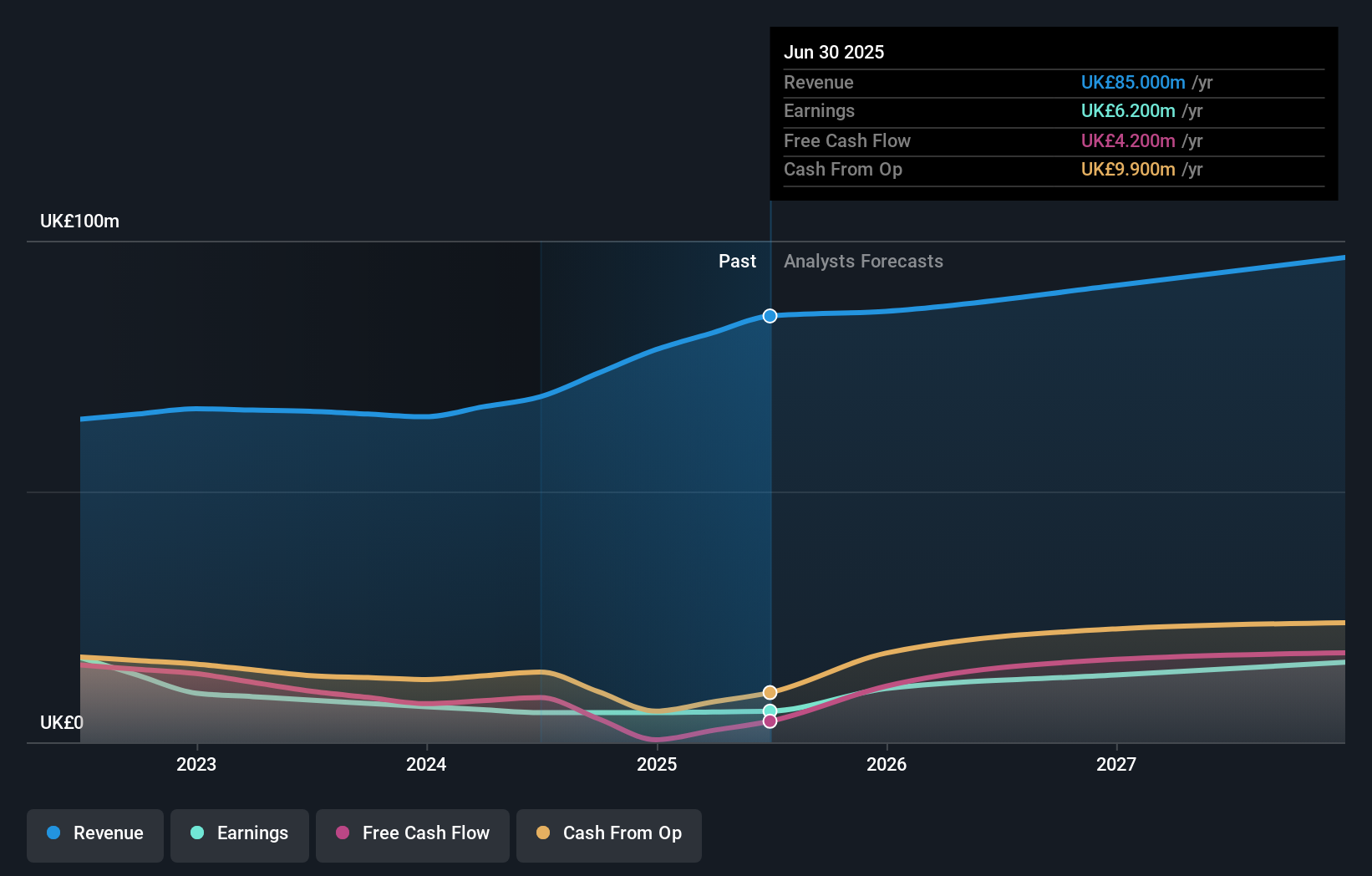

Overview: Craneware plc, along with its subsidiaries, develops, licenses, and supports computer software for the healthcare industry in the United States and has a market cap of £742.38 million.

Operations: The company's revenue primarily comes from its healthcare software segment, which generated $189.27 million.

Insider Ownership: 16.5%

Earnings Growth Forecast: 24.3% p.a.

Craneware has experienced a 26.8% earnings growth over the past year, with future earnings expected to grow significantly at 24.3% annually, outpacing the UK market's average. Despite high volatility in its share price recently, analysts anticipate a potential price increase of 38.4%. Recent board changes include appointing Tamra Minnier as Non-Executive Director, bringing extensive US healthcare experience. However, Craneware's revenue growth forecast is moderate at 8.1%, and its Return on Equity is projected to be relatively low at 12.2%.

- Click here to discover the nuances of Craneware with our detailed analytical future growth report.

- The valuation report we've compiled suggests that Craneware's current price could be inflated.

Fintel (AIM:FNTL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Fintel Plc provides intermediary services and distribution channels to the retail financial services sector in the United Kingdom, with a market cap of £270.89 million.

Operations: The company's revenue segments include £24.20 million from Research & Fintech, £21.40 million from Distribution Channels, and £23.30 million from Intermediary Services.

Insider Ownership: 29.9%

Earnings Growth Forecast: 34% p.a.

Fintel Plc is poised for substantial growth, with earnings forecast to increase by 34% annually, outpacing the UK market's average. Despite recent profit margin declines from 12.7% to 8.6%, its revenue is expected to grow at a steady rate of 7.6%. The company recently raised £51 million through a Follow-on Equity Offering, potentially bolstering its financial position and supporting future expansion efforts in the competitive UK market landscape.

- Get an in-depth perspective on Fintel's performance by reading our analyst estimates report here.

- In light of our recent valuation report, it seems possible that Fintel is trading beyond its estimated value.

LSL Property Services (LSE:LSL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: LSL Property Services plc, along with its subsidiaries, provides business-to-business services to mortgage intermediaries and estate agency franchisees, as well as valuation services to lenders in the United Kingdom, with a market cap of £291.07 million.

Operations: The company's revenue segments consist of £47.22 million from Financial Services, £79.49 million from Surveying and Valuation, and £30.61 million from Estate Agency (excluding Financial Services).

Insider Ownership: 10.7%

Earnings Growth Forecast: 28.2% p.a.

LSL Property Services is forecast to achieve significant earnings growth of 28.23% annually, surpassing the UK market's average of 14.4%. Although revenue growth at 12.1% per year is moderate, it still exceeds the broader market's rate of 3.5%. The company's return on equity is expected to reach a high of 27.6% in three years, though its dividend yield of 4.01% isn't well covered by earnings due to large one-off items affecting results.

- Delve into the full analysis future growth report here for a deeper understanding of LSL Property Services.

- According our valuation report, there's an indication that LSL Property Services' share price might be on the cheaper side.

Seize The Opportunity

- Click through to start exploring the rest of the 63 Fast Growing UK Companies With High Insider Ownership now.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:CRW

Craneware

Develops, licenses, and supports computer software for the healthcare industry in the United States.

Reasonable growth potential with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives