- United Kingdom

- /

- Consumer Durables

- /

- AIM:IGR

Begbies Traynor Group And 2 Other Promising UK Penny Stocks

Reviewed by Simply Wall St

The UK market has been facing challenges, with the FTSE 100 and FTSE 250 indices recently closing lower amid weak trade data from China, highlighting concerns over global economic recovery. Despite these broader market pressures, smaller or newer companies often referred to as penny stocks continue to offer intriguing opportunities for investors. While the term 'penny stock' might seem outdated, these investments can combine financial strength and growth potential, providing a chance to uncover hidden value in quality companies.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Begbies Traynor Group (AIM:BEG) | £0.948 | £149.54M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.05 | £772.37M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.355 | £172.56M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.62 | £69.04M | ★★★★☆☆ |

| Luceco (LSE:LUCE) | £1.284 | £198.03M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.935 | £391.36M | ★★★★☆☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.437 | $254.04M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £4.11 | £470.86M | ★★★★★★ |

| Impax Asset Management Group (AIM:IPX) | £2.47 | £315.6M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.21 | £103.38M | ★★★★★★ |

Click here to see the full list of 469 stocks from our UK Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Begbies Traynor Group (AIM:BEG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Begbies Traynor Group plc offers professional services to businesses, advisors, large corporations, and financial institutions in the UK, with a market cap of £149.54 million.

Operations: The company generates revenue through its Business Recovery and Advisory segment, which accounts for £102.18 million, and its Property Advisory segment, contributing £44.96 million.

Market Cap: £149.54M

Begbies Traynor Group plc, with a market cap of £149.54 million, has shown robust financial growth, reporting earnings up by 528.7% over the past year and sales of £76.3 million for the half-year ending October 31, 2024. The company's short-term assets exceed both its short- and long-term liabilities, indicating solid financial health. Despite insider selling in recent months and a low return on equity of 3.2%, Begbies Traynor's debt is well covered by operating cash flow (133.2%), and it trades below its estimated fair value by 40.2%. Recent strategic moves include share repurchases and the appointment of insolvency specialist Kevin Mapstone to strengthen their presence in Scotland.

- Jump into the full analysis health report here for a deeper understanding of Begbies Traynor Group.

- Understand Begbies Traynor Group's earnings outlook by examining our growth report.

Intercede Group (AIM:IGP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Intercede Group plc is a cybersecurity company that develops and supplies identity and credential management software for digital trust across the UK, Europe, the US, and internationally, with a market cap of £103.55 million.

Operations: The company generates revenue of £21.51 million from its Software & Programming segment.

Market Cap: £103.55M

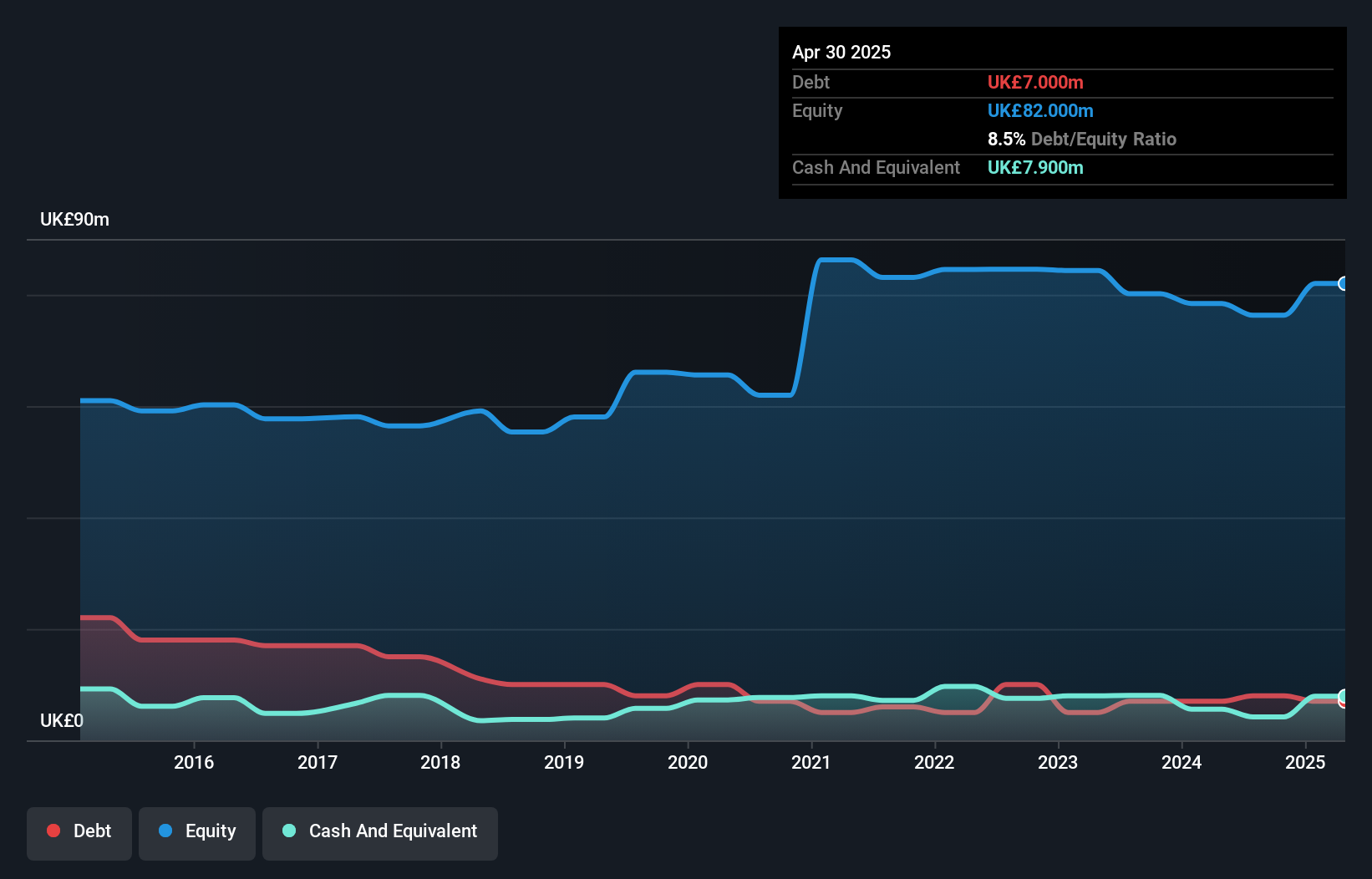

Intercede Group plc, with a market cap of £103.55 million, has demonstrated strong financial performance, reporting half-year sales of £8.54 million and net income growth to £1.67 million. The company benefits from a strategic partnership with Infinigate NL, enhancing its market reach for digital identity solutions. Despite high volatility in its share price recently, Intercede's debt-free status and robust short-term asset coverage position it well financially. Its earnings have grown significantly over the past year by 271.1%, surpassing industry averages, although future earnings are forecasted to decline significantly over the next three years.

- Dive into the specifics of Intercede Group here with our thorough balance sheet health report.

- Gain insights into Intercede Group's future direction by reviewing our growth report.

IG Design Group (AIM:IGR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: IG Design Group plc designs, produces, and distributes celebrations, craft and creative play, stationery, gifting, and not-for-resale consumable products across the Americas, the United Kingdom, Netherlands, and internationally with a market cap of £145.30 million.

Operations: The company's revenue is comprised of $459.68 million from the Americas and $289.39 million from international markets.

Market Cap: £145.3M

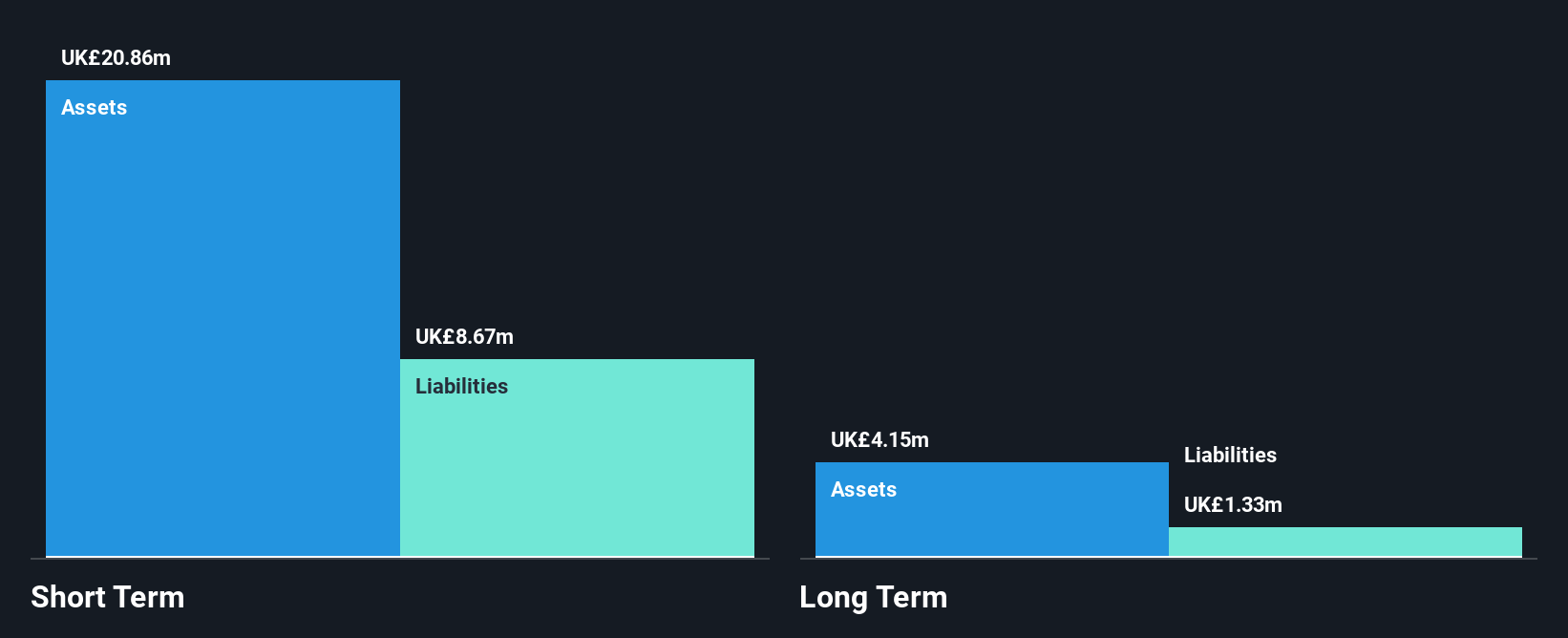

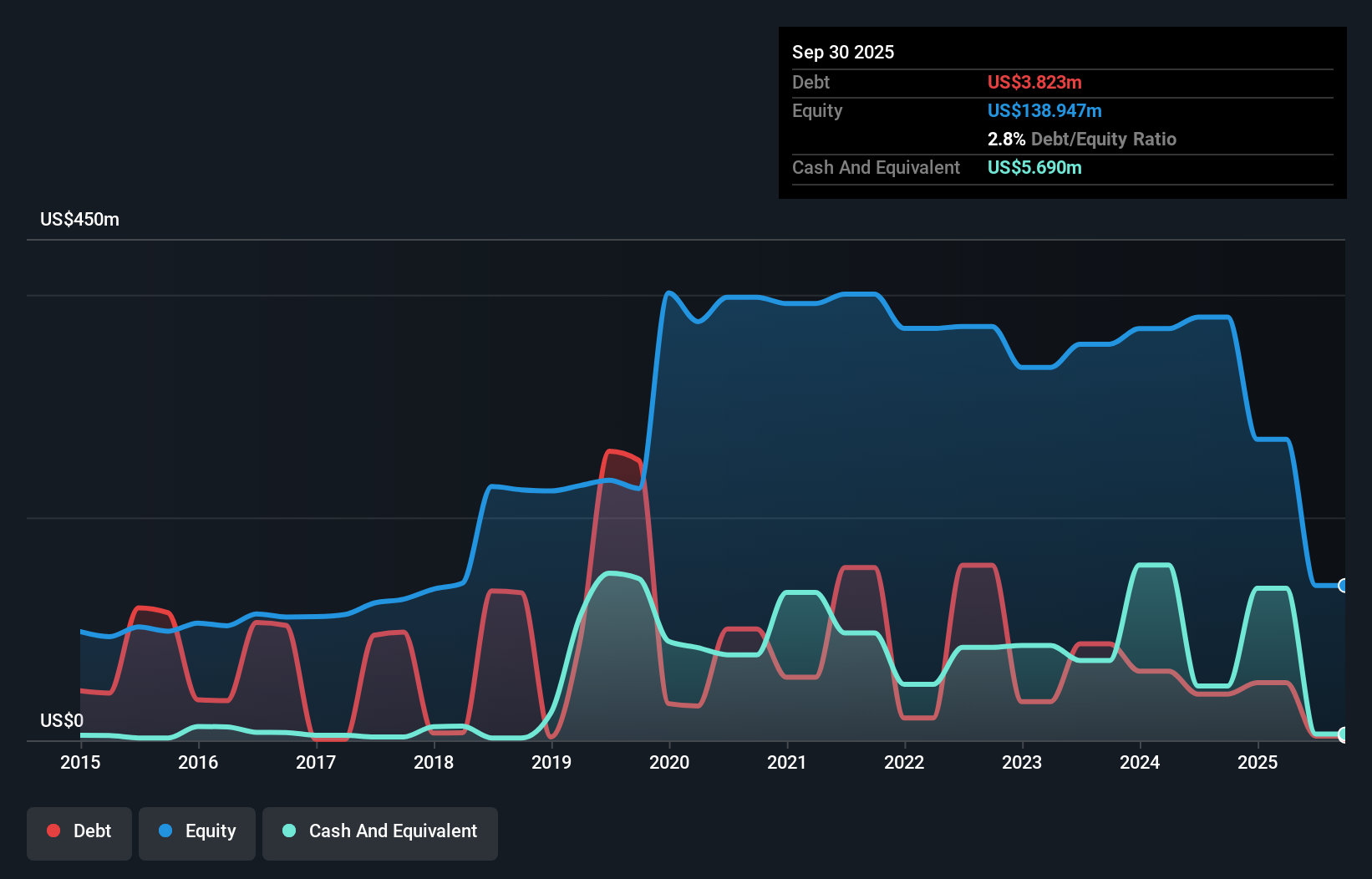

IG Design Group plc, with a market cap of £145.30 million, has seen recent challenges as its earnings for the half year ended September 2024 declined to US$3.97 million from US$23.91 million a year earlier, impacted by large one-off losses of US$7.4 million. Despite this, the company has become profitable over the past year and maintains strong financial health with short-term assets exceeding both short- and long-term liabilities significantly. While its debt-to-equity ratio has improved drastically over five years to 10.9%, interest coverage remains weak at 0.9x EBIT, indicating potential risk if earnings do not stabilize or grow further.

- Get an in-depth perspective on IG Design Group's performance by reading our balance sheet health report here.

- Explore IG Design Group's analyst forecasts in our growth report.

Where To Now?

- Jump into our full catalog of 469 UK Penny Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:IGR

IG Design Group

Engages in the design, production, and distribution of celebrations, craft and creative play, stationery, gifting, and not for re-sale consumable products in the Americas, the United Kingdom, Netherlands, and internationally.

Excellent balance sheet slight.

Market Insights

Community Narratives