- United Kingdom

- /

- Software

- /

- LSE:APTD

3 UK Penny Stocks With Market Caps Over £100M To Consider

Reviewed by Simply Wall St

The UK stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, highlighting the global interconnectedness of economies. Despite these broader market pressures, investors often seek opportunities in smaller or newer companies that might not be immediately apparent. Penny stocks, though an outdated term, still represent potential growth avenues for those willing to explore beyond the mainstream; when supported by strong financials and fundamentals, they can offer intriguing prospects amid current market conditions.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.115 | £796.86M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.926 | £146.07M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.52 | £67.13M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.16 | £99.11M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.31 | £202.04M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.35 | £171.93M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.85 | £382.91M | ★★★★☆☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.4395 | $255.49M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £4.12 | £472M | ★★★★★★ |

| Impax Asset Management Group (AIM:IPX) | £2.45 | £313.05M | ★★★★★★ |

Click here to see the full list of 472 stocks from our UK Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Aptitude Software Group (LSE:APTD)

Simply Wall St Financial Health Rating: ★★★★★☆

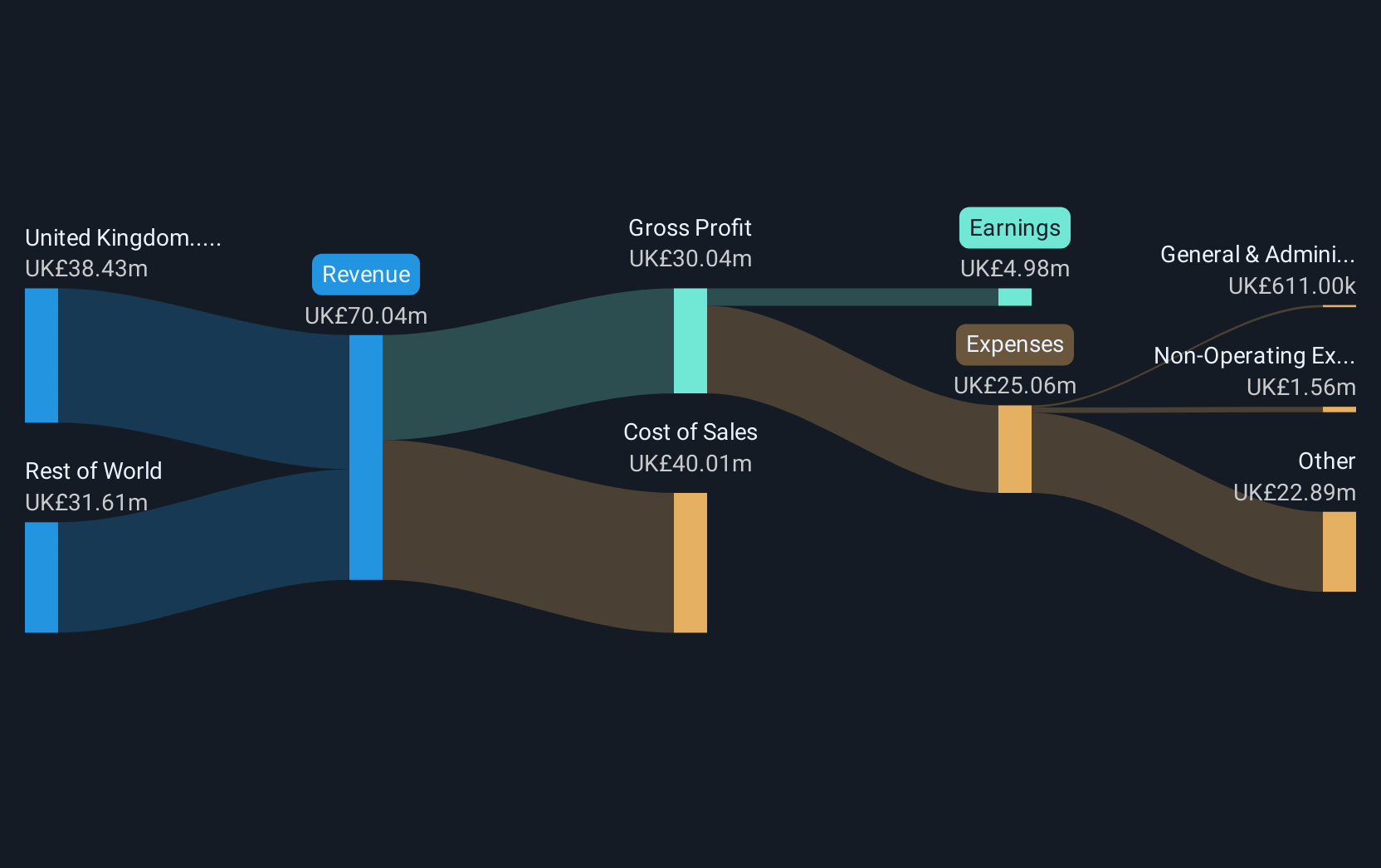

Overview: Aptitude Software Group plc, with a market cap of £187.36 million, provides financial management software both in the United Kingdom and internationally through its subsidiaries.

Operations: The company generates revenue of £72.41 million from its financial management software offerings in the United Kingdom and international markets.

Market Cap: £187.36M

Aptitude Software Group plc, with a market cap of £187.36 million and revenue of £72.41 million, has demonstrated strong earnings growth of 104.9% over the past year, surpassing the software industry's growth rate. Despite its low return on equity at 8.3%, the company maintains high-quality earnings and covers interest payments well with EBIT (73.2x). Its short-term assets exceed both long-term (£14M) and short-term liabilities (£39.4M), indicating solid financial health despite an increased debt to equity ratio to 13.3%. Recent board changes signal potential strategic shifts as leadership evolves in coming years.

- Get an in-depth perspective on Aptitude Software Group's performance by reading our balance sheet health report here.

- Assess Aptitude Software Group's future earnings estimates with our detailed growth reports.

Gulf Keystone Petroleum (LSE:GKP)

Simply Wall St Financial Health Rating: ★★★★★☆

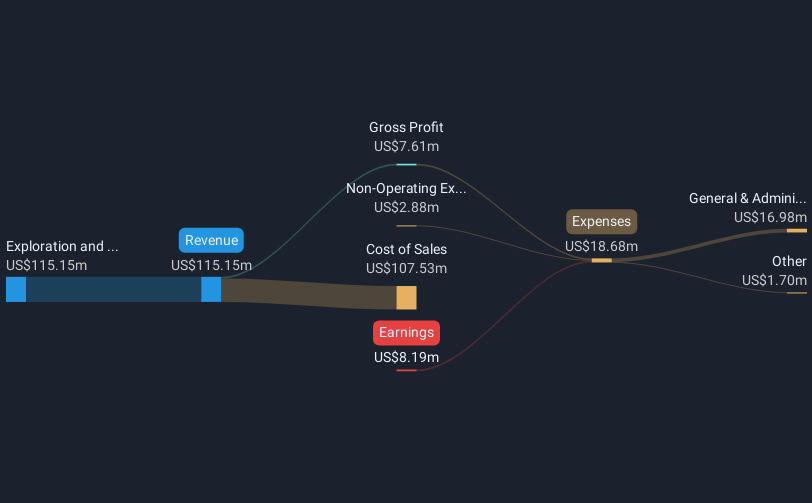

Overview: Gulf Keystone Petroleum Limited focuses on the exploration, development, and production of oil and gas in the Kurdistan Region of Iraq, with a market cap of £297.02 million.

Operations: The company's revenue is primarily derived from its exploration and production of oil and gas, amounting to $115.15 million.

Market Cap: £297.02M

Gulf Keystone Petroleum, with a market cap of £297.02 million and revenue of US$115.15 million, is currently unprofitable but has successfully reduced its losses by 14.4% annually over the past five years. The company remains debt-free, enhancing its financial flexibility despite short-term liabilities slightly exceeding assets by US$3.3 million. Recent dividend declarations highlight a commitment to shareholder returns, though the dividend sustainability is questionable due to insufficient earnings coverage. Board restructuring may influence future strategic direction as the management team demonstrates experience with an average tenure of 3.3 years amidst stable weekly volatility in stock performance.

- Click here to discover the nuances of Gulf Keystone Petroleum with our detailed analytical financial health report.

- Understand Gulf Keystone Petroleum's earnings outlook by examining our growth report.

Trifast (LSE:TRI)

Simply Wall St Financial Health Rating: ★★★★☆☆

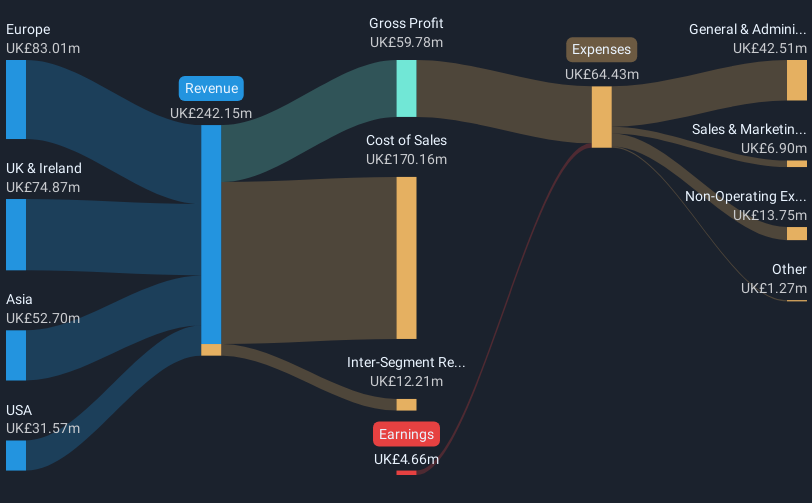

Overview: Trifast plc, with a market cap of £113.94 million, manufactures and distributes industrial fasteners and category C components across the United Kingdom, Ireland, Europe, North America, and Asia.

Operations: The company generates revenue of £229.94 million from its industrial fasteners and category C components segment.

Market Cap: £113.94M

Trifast plc, with a market cap of £113.94 million, reported half-year sales of £113.9 million and net income of £1.34 million, reflecting a slight decline from the previous year. Despite being unprofitable overall and experiencing increased losses over five years, its short-term assets comfortably cover both short-term and long-term liabilities. The company's debt is satisfactorily managed with operating cash flow covering 53.8% of it, though interest coverage remains weak at 1.9x EBIT. Recent changes include appointing RSM UK Audit LLP as their new auditor and maintaining an interim dividend payout despite earnings not fully covering it.

- Click to explore a detailed breakdown of our findings in Trifast's financial health report.

- Gain insights into Trifast's future direction by reviewing our growth report.

Summing It All Up

- Unlock our comprehensive list of 472 UK Penny Stocks by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:APTD

Aptitude Software Group

Provides financial management software in the United Kingdom and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives