- United Kingdom

- /

- Trade Distributors

- /

- LSE:RS1

Top UK Dividend Stocks To Consider In December 2025

Reviewed by Simply Wall St

As the UK market grapples with global economic uncertainties, particularly influenced by weak trade data from China, investors are closely monitoring the performance of the FTSE 100 and FTSE 250 indices. In such volatile times, dividend stocks can offer a measure of stability and income potential, making them an attractive consideration for those looking to navigate these challenging conditions.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Treatt (LSE:TET) | 3.88% | ★★★★★☆ |

| Seplat Energy (LSE:SEPL) | 7.73% | ★★★★★☆ |

| RS Group (LSE:RS1) | 3.73% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 6.00% | ★★★★★☆ |

| MONY Group (LSE:MONY) | 6.55% | ★★★★★★ |

| Keller Group (LSE:KLR) | 3.15% | ★★★★★☆ |

| IG Group Holdings (LSE:IGG) | 4.10% | ★★★★★☆ |

| Hargreaves Services (AIM:HSP) | 5.73% | ★★★★★☆ |

| Halyk Bank of Kazakhstan (LSE:HSBK) | 6.55% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 4.62% | ★★★★★☆ |

Click here to see the full list of 48 stocks from our Top UK Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

James Halstead (AIM:JHD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: James Halstead plc manufactures and supplies flooring products for commercial and domestic uses across the United Kingdom, Europe, Scandinavia, Australasia, Asia, and internationally with a market cap of £579.33 million.

Operations: The company's revenue is primarily derived from the manufacture and distribution of flooring products, totaling £261.97 million.

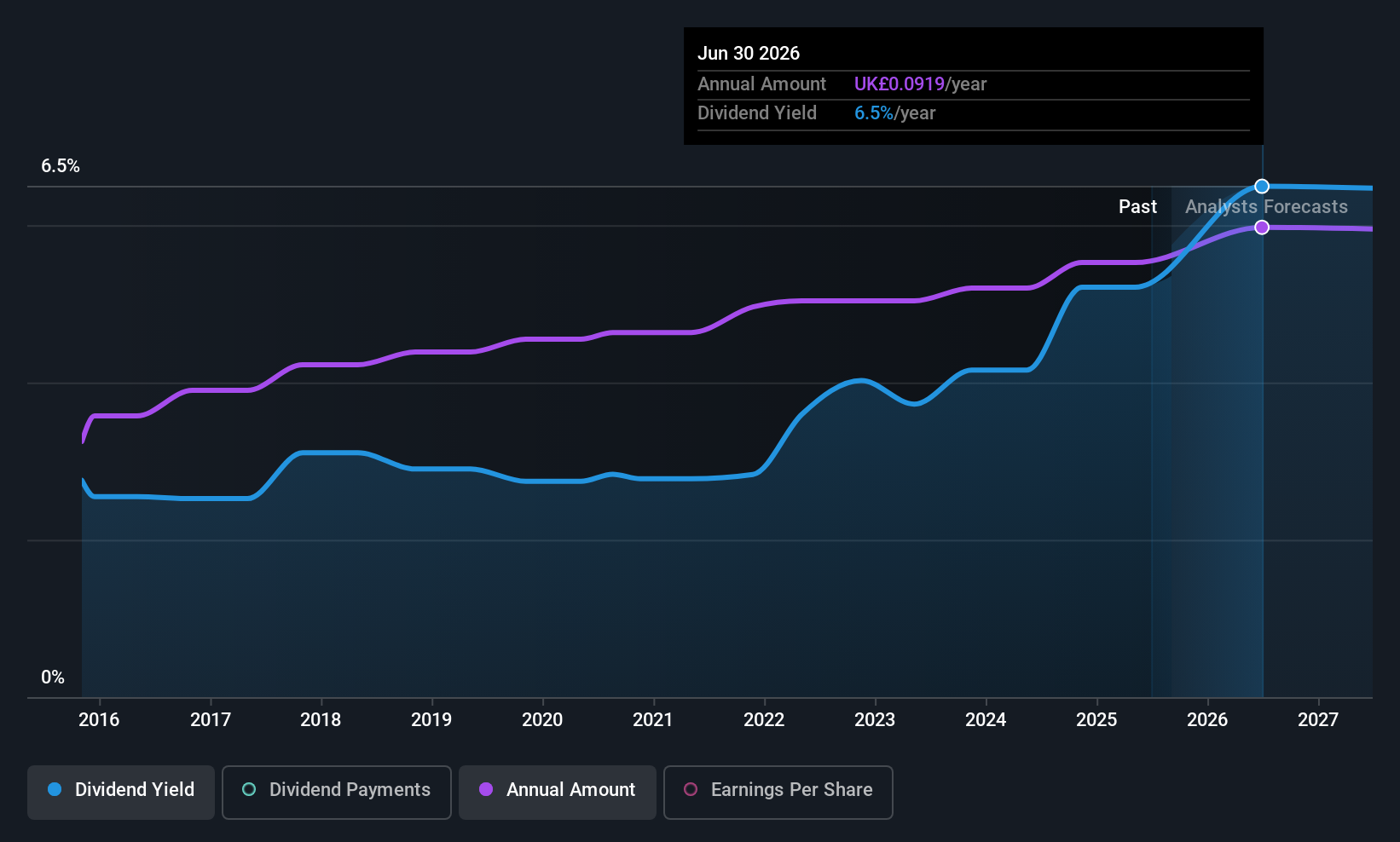

Dividend Yield: 6.3%

James Halstead's dividend yield of 6.33% ranks in the top 25% of UK dividend payers, but its high payout ratio (90.3%) and cash payout ratio (115.2%) indicate dividends are not well covered by earnings or cash flows. Despite this, the company has maintained a stable and growing dividend for 49 consecutive years, recently increasing it to a record total of 8.80 pence for the year ended June 2025 amidst slightly declining sales and net income figures.

- Get an in-depth perspective on James Halstead's performance by reading our dividend report here.

- Our valuation report unveils the possibility James Halstead's shares may be trading at a discount.

Drax Group (LSE:DRX)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Drax Group plc, with a market cap of £2.60 billion, operates in the United Kingdom focusing on renewable power generation through its subsidiaries.

Operations: Drax Group's revenue is primarily derived from Biomass Generation (£4.58 billion), Energy Solutions (£3.14 billion), Pellet Production (£948.80 million), and Flexible Generation (£191.10 million).

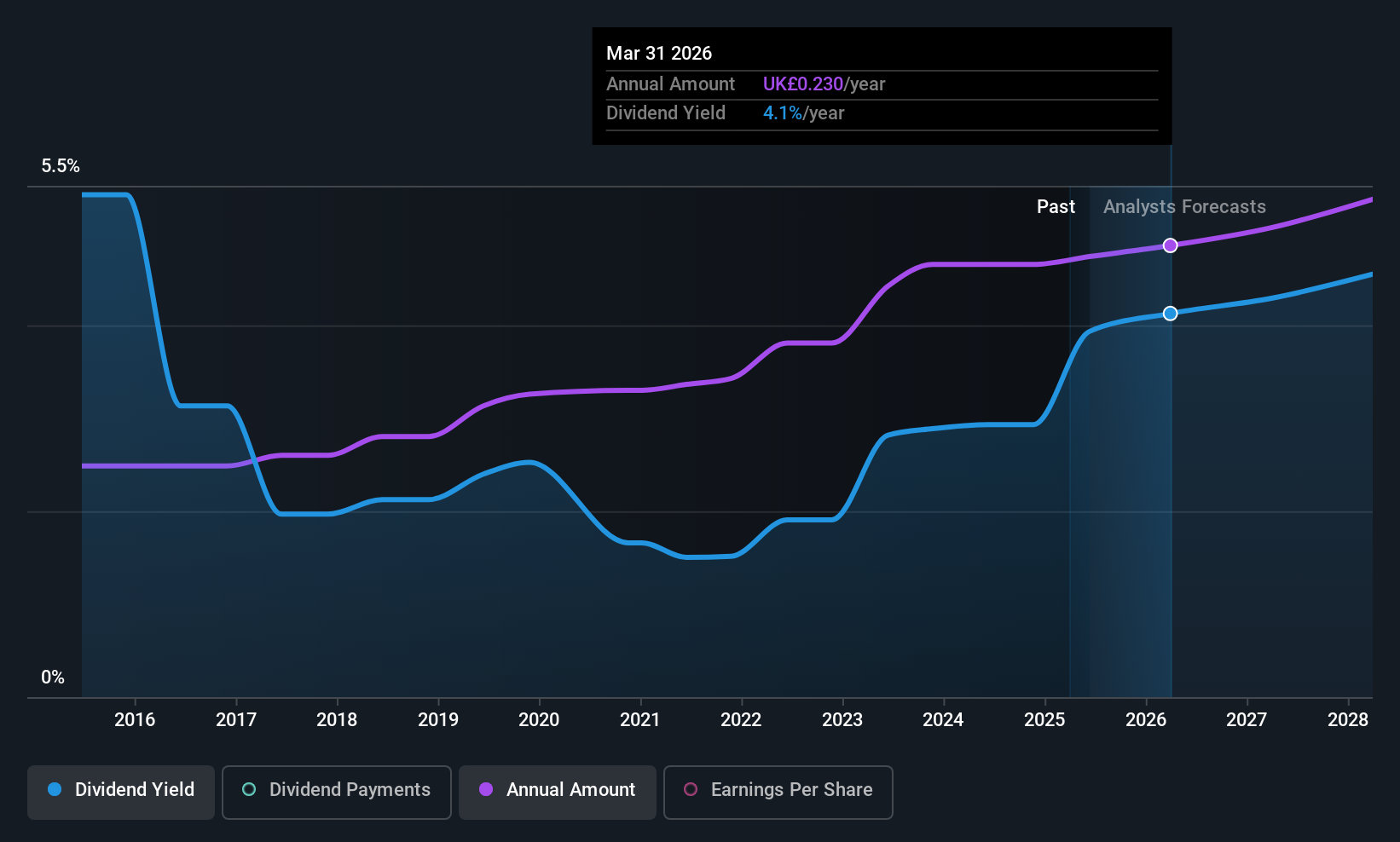

Dividend Yield: 3.6%

Drax Group's dividends are well covered by earnings and cash flows, with payout ratios of 24.7% and 18.2%, respectively. However, the dividend yield of 3.58% is below the UK market's top tier, and past payments have been volatile despite recent growth. Drax's financial position includes high debt levels, but it trades at a good value relative to peers. A new CfD agreement for biomass units supports energy security while enhancing sustainability practices without impacting EBITDA expectations significantly.

- Navigate through the intricacies of Drax Group with our comprehensive dividend report here.

- According our valuation report, there's an indication that Drax Group's share price might be on the cheaper side.

RS Group (LSE:RS1)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: RS Group plc, along with its subsidiaries, distributes maintenance, repair, and operations products and service solutions across the UK, US, France, Mexico, Germany, Italy, Switzerland and internationally; it has a market cap of approximately £2.82 billion.

Operations: RS Group plc generates revenue primarily through its Other Product and Service Solutions segment, which accounts for £2.46 billion, and its Own-Brand Product and Service Solutions segment, contributing £403.50 million.

Dividend Yield: 3.7%

RS Group's dividend is covered by earnings and cash flows, with payout ratios of 66.9% and 48.3%, respectively. The dividend yield of 3.73% is stable yet lower than the top UK payers, but it has grown over the past decade. Recent interim dividend growth aligns with its progressive policy, while strategic partnerships enhance market reach and operational efficiency. Despite a slight drop in sales, net income rose to £83 million for H1 2025, indicating resilience amidst market challenges.

- Click here and access our complete dividend analysis report to understand the dynamics of RS Group.

- Our valuation report here indicates RS Group may be undervalued.

Turning Ideas Into Actions

- Access the full spectrum of 48 Top UK Dividend Stocks by clicking on this link.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:RS1

RS Group

Engages in the distribution of maintenance, repair, and operations products and service solutions in the United Kingdom, the United States, France, Mexico, Germany, Italy, Switzerland, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026