- United Kingdom

- /

- Aerospace & Defense

- /

- LSE:RR.

Rolls-Royce Holdings (LSE:RR.) Eyes Stake Sale in SMR Venture Amid Revised Earnings Guidance for 2024

Reviewed by Simply Wall St

Rolls-Royce Holdings (LSE:RR.) is navigating a dynamic environment marked by both opportunities and challenges. Recent highlights include a significant 74% increase in operating profit and strategic investments in engine efficiency, juxtaposed against ongoing supply chain issues and financial provisions. In the discussion that follows, we will explore Rolls-Royce's financial health, operational inefficiencies, strategic growth initiatives, and external threats to provide a comprehensive overview of the company's current business situation.

Take a closer look at Rolls-Royce Holdings's potential here.

Strengths: Core Advantages Driving Sustained Success For Rolls-Royce Holdings

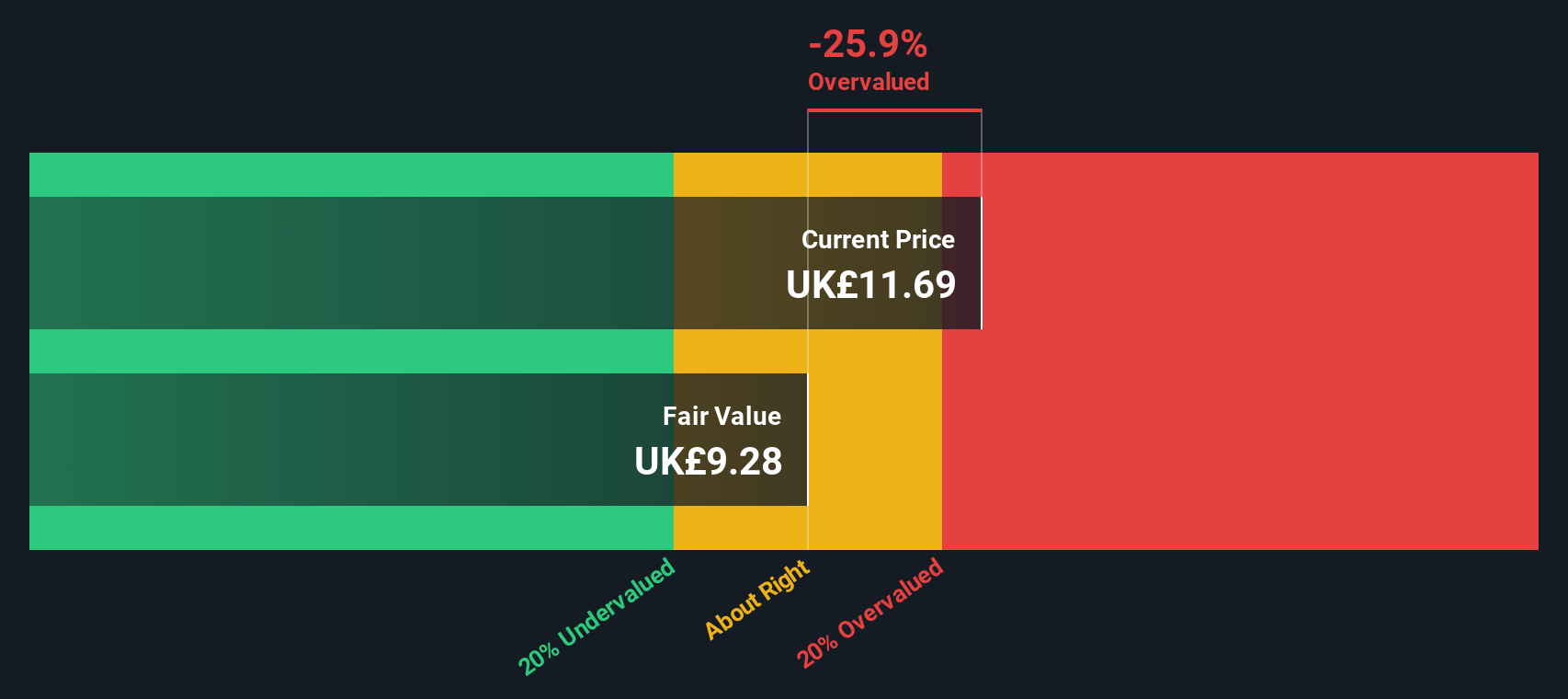

Rolls-Royce Holdings has demonstrated strong financial performance, with an operating profit of £1.1 billion, representing a 74% increase from the previous year. This profitability is further underscored by an improved operating margin of 14%, up by 4.4 percentage points. The company's solid cash flow, with free cash flow reaching £1.2 billion, highlights its financial health and operational efficiency. Additionally, Rolls-Royce's strategic initiatives, such as investing £1 billion to enhance the time-on-wing of its modern engines by 40%, position it well for future growth. The company is currently trading at £5.27, significantly below its estimated fair value of £11.55, indicating it is undervalued based on discounted cash flow analysis. This undervaluation, coupled with the company's strong financial metrics, suggests a solid market positioning.

Weaknesses: Critical Issues Affecting Rolls-Royce Holdings's Performance and Areas For Growth

Rolls-Royce faces several challenges. The company is grappling with supply chain issues, which are impacting product costs and parts availability, leading to customer disruptions. These challenges are industry-wide but require proactive management to mitigate their effects. Additionally, the company took a £410 million onerous contract provision last year, indicating potential financial strain. Rolls-Royce's earnings growth of 41.3% over the past year, while impressive, is below its five-year average of 54.1% per year. Furthermore, the management team and board of directors are relatively new, with average tenures suggesting a lack of extensive experience. These factors could hinder the company's ability to navigate complex industry dynamics effectively.

Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

Rolls-Royce has several opportunities to enhance its market position. The company is poised to sell a stake in its mini-nuclear power stations venture, potentially raising hundreds of millions of pounds. This strategic move could provide the necessary funding to advance its small modular reactor (SMR) business. Moreover, The expected doubling of passenger numbers, particularly driven by India and China, presents a significant growth avenue. Regulatory support, such as partial funding from the German government to develop hydrogen reciprocal engine technology, further strengthens Rolls-Royce's growth prospects.

Finally, the company's collaboration with Tata Consultancy Services to research hydrogen fuel systems underscores its commitment to innovation and sustainability. These initiatives can significantly bolster Rolls-Royce's competitive advantage and market share.

Threats: Key Risks and Challenges That Could Impact Rolls-Royce Holdings's Success

Rolls-Royce faces several external threats that could impact its success. The competitive environment in the aerospace and defense industry is intense, with strategic delivery pressures. Economic factors, including supply chain challenges expected to persist for another 18 to 24 months, pose significant risks. Regulatory issues, such as navigating the final phase of the Generic Design Assessment process, add to the operational complexities. Additionally, the company's high level of debt and negative shareholders' equity are financial risks that could affect its long-term stability. These challenges require strategic management to ensure sustained growth and market presence.

Conclusion

Rolls-Royce Holdings has shown impressive financial performance with a significant increase in operating profit and improved margins, highlighting its operational efficiency and strong cash flow. However, the company must address supply chain issues and the financial strain from onerous contract provisions to maintain this momentum. The strategic initiatives in sustainable aviation technology and partnerships for hydrogen fuel systems present substantial growth opportunities, especially with the expected rise in passenger numbers from emerging markets like India and China. Despite the external risks and internal challenges, the company's current trading price of £5.27, well below its estimated fair value of £11.55, suggests a strong potential for future appreciation, making it an attractive investment opportunity.

Summing It All Up

- Got skin in the game with Rolls-Royce Holdings? Elevate how you manage them by using Simply Wall St's portfolio , where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management .

- Find companies with promising cash flow potential yet trading below their fair value .

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About LSE:RR.

Rolls-Royce Holdings

Develops and delivers mission-critical power systems in the United Kingdom and internationally.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives