- United Kingdom

- /

- Aerospace & Defense

- /

- LSE:RR.

Rolls-Royce Holdings (LSE:RR.): Assessing Value After a 93% Share Price Surge in 2024

Reviewed by Kshitija Bhandaru

Rolls-Royce Holdings (LSE:RR.) shares have shown impressive momentum, with the company’s stock returning over 90% since the start of the year. Investors are paying close attention as fundamentals such as revenue growth continue to shape the outlook.

See our latest analysis for Rolls-Royce Holdings.

Rolls-Royce’s share price has surged nearly 93.5% so far in 2024, building on news of ongoing operational improvements and renewed global demand in aerospace. The one-year total shareholder return stands at an impressive 114.6%, highlighting robust momentum and renewed confidence in the company’s longer-term prospects.

If Rolls-Royce’s remarkable run has you rethinking what’s possible in the sector, why not expand your search and discover See the full list for free.

But with such rapid gains and only a minor discount to analyst price targets, the question now becomes: Is Rolls-Royce still undervalued, or has the market already priced in all the future growth?

Most Popular Narrative: Fairly Valued

With Rolls-Royce Holdings closing at £11.39 and the most widely followed narrative estimating a fair value of £11.36, there is only a slight difference between the recent market price and forecast value. This sets the backdrop for high expectations and intense scrutiny around the company's outlook.

The exceptionally strong financial performance and raised guidance appear to heavily reflect surging demand from the civil aviation aftermarket (especially higher shop visits, aftermarket profitability, and improved contract terms), as well as record aftermarket order intake in Defence. Both of these factors are influenced by a spike in global air traffic and backlogged demand post-pandemic. There is a risk this recovery pace will normalize, resulting in softer revenue and earnings growth than implied by current market optimism.

Curious why the narrative calls things “fairly valued” even after such rapid share price gains? The forecast rides on bold financial projections that defy typical industry expectations. Get the full picture on the growth drivers and margin outlook that push this valuation sky-high. One overlooked number could swing the whole story. Are you ready to see which?

Result: Fair Value of £11.36 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if data center growth cools or airlines shift quicker to new fleets, Rolls-Royce's current earnings momentum could come under real pressure.

Find out about the key risks to this Rolls-Royce Holdings narrative.

Another View: Is There More Room to Run?

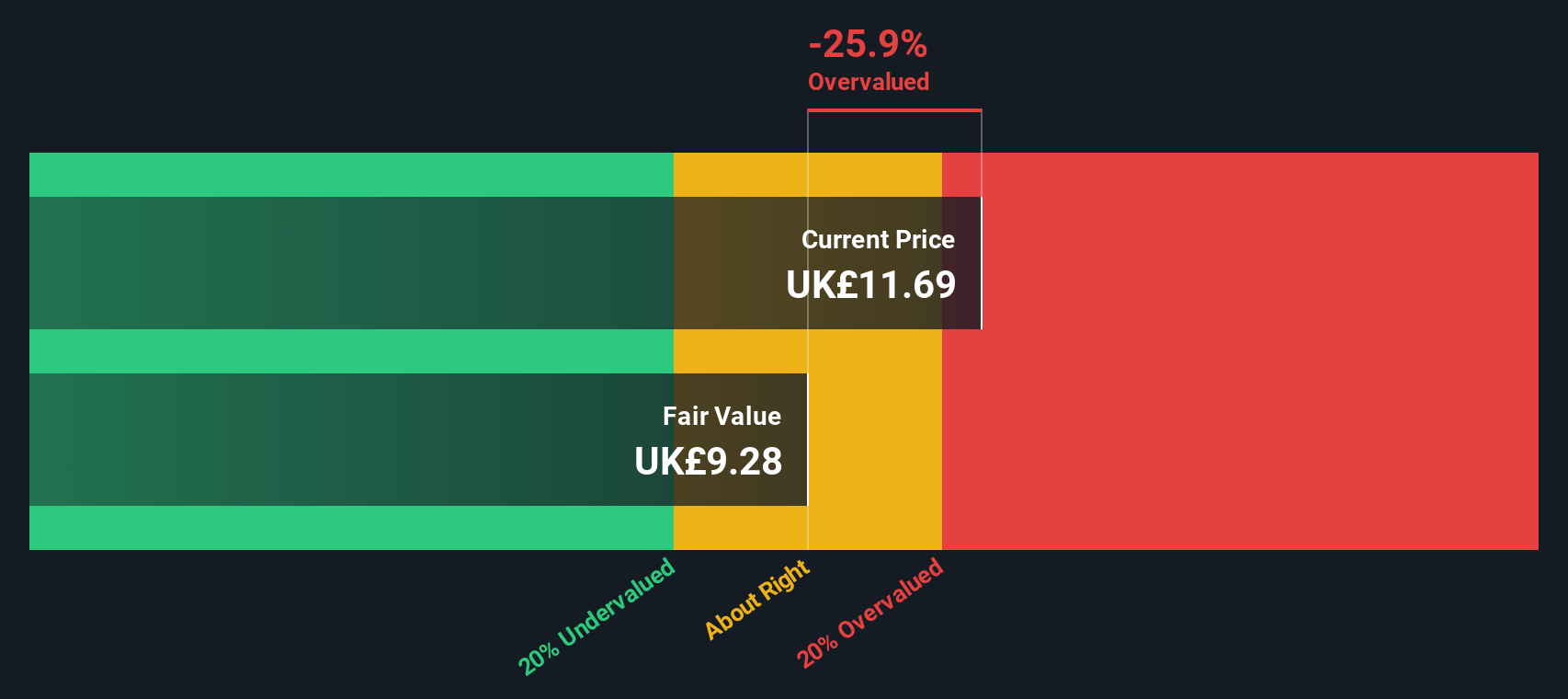

While the market sees Rolls-Royce as fairly valued based on forecasts, our DCF model tells a different story. It estimates the fair value at £9.19, which is below the current price of £11.39. This suggests the shares might now be trading at a premium to what is justified by future cash flows. Could earnings surprises or faster growth prove this estimate too conservative, or is the optimism already built into today’s price?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Rolls-Royce Holdings Narrative

Prefer your own perspective or want to dig deeper into the numbers? You can shape your own narrative using fresh data in just a few minutes, and Do it your way.

A great starting point for your Rolls-Royce Holdings research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t miss your chance to get ahead. Simply Wall Street’s screeners make it easy to pinpoint unique investment opportunities that could set your portfolio apart.

- Uncover value by tapping into these 898 undervalued stocks based on cash flows, where strong cash flow potential meets attractive entry points others might overlook.

- Boost your long-term returns with these 19 dividend stocks with yields > 3%, featuring companies offering healthy yields above 3% for steady passive income.

- Join the frontier of innovation with these 26 quantum computing stocks and see which businesses are powering advances in quantum computing and next-gen technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:RR.

Rolls-Royce Holdings

Develops and delivers mission-critical power systems in the United Kingdom and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives