- United Kingdom

- /

- Retail Distributors

- /

- LSE:INCH

Associated British Foods And 2 Other Leading UK Dividend Stocks

Reviewed by Simply Wall St

As the FTSE 100 index faces challenges due to weak trade data from China and declining commodity prices, investors are increasingly focused on stability and income generation in their portfolios. In this environment, dividend stocks like Associated British Foods offer potential appeal by providing regular income streams amidst market volatility.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Pets at Home Group (LSE:PETS) | 6.23% | ★★★★★★ |

| Keller Group (LSE:KLR) | 3.34% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 3.50% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 8.26% | ★★★★★☆ |

| Man Group (LSE:EMG) | 5.90% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 4.77% | ★★★★★☆ |

| Plus500 (LSE:PLUS) | 5.95% | ★★★★★☆ |

| DCC (LSE:DCC) | 3.82% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.82% | ★★★★★☆ |

| James Latham (AIM:LTHM) | 6.84% | ★★★★★☆ |

Click here to see the full list of 61 stocks from our Top UK Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Associated British Foods (LSE:ABF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Associated British Foods plc is a diversified company operating in food, ingredients, and retail sectors globally, with a market cap of £14.96 billion.

Operations: Associated British Foods plc generates its revenue from several segments, including Retail (£9.45 billion), Grocery (£4.24 billion), Sugar (£2.53 billion), Ingredients (£2.13 billion), and Agriculture (£1.65 billion).

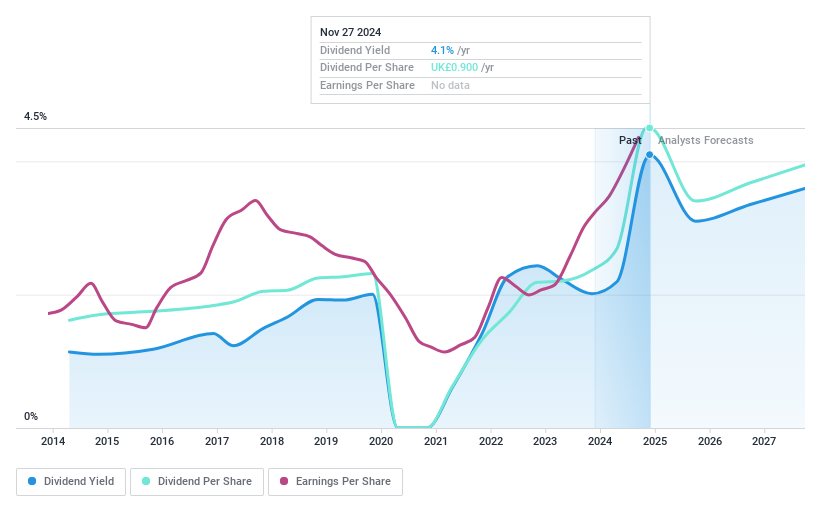

Dividend Yield: 4.4%

Associated British Foods offers a mixed outlook for dividend investors. The company recently announced a final dividend of 42.3 pence per share and a special dividend of 27 pence, payable in January 2025. Despite its dividends being well-covered by earnings and cash flows, ABF's historical dividend volatility raises concerns about reliability. Earnings grew significantly over the past year to £1.46 billion, supporting its payout capacity, but insider selling may indicate caution among executives.

- Take a closer look at Associated British Foods' potential here in our dividend report.

- The valuation report we've compiled suggests that Associated British Foods' current price could be quite moderate.

Inchcape (LSE:INCH)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Inchcape plc operates as an automotive distributor and retailer with a market cap of £3.02 billion.

Operations: Inchcape plc generates revenue through its automotive distribution operations, with £3.07 billion from the APAC region, £3.44 billion from the Americas, and £2.75 billion from Europe & Africa.

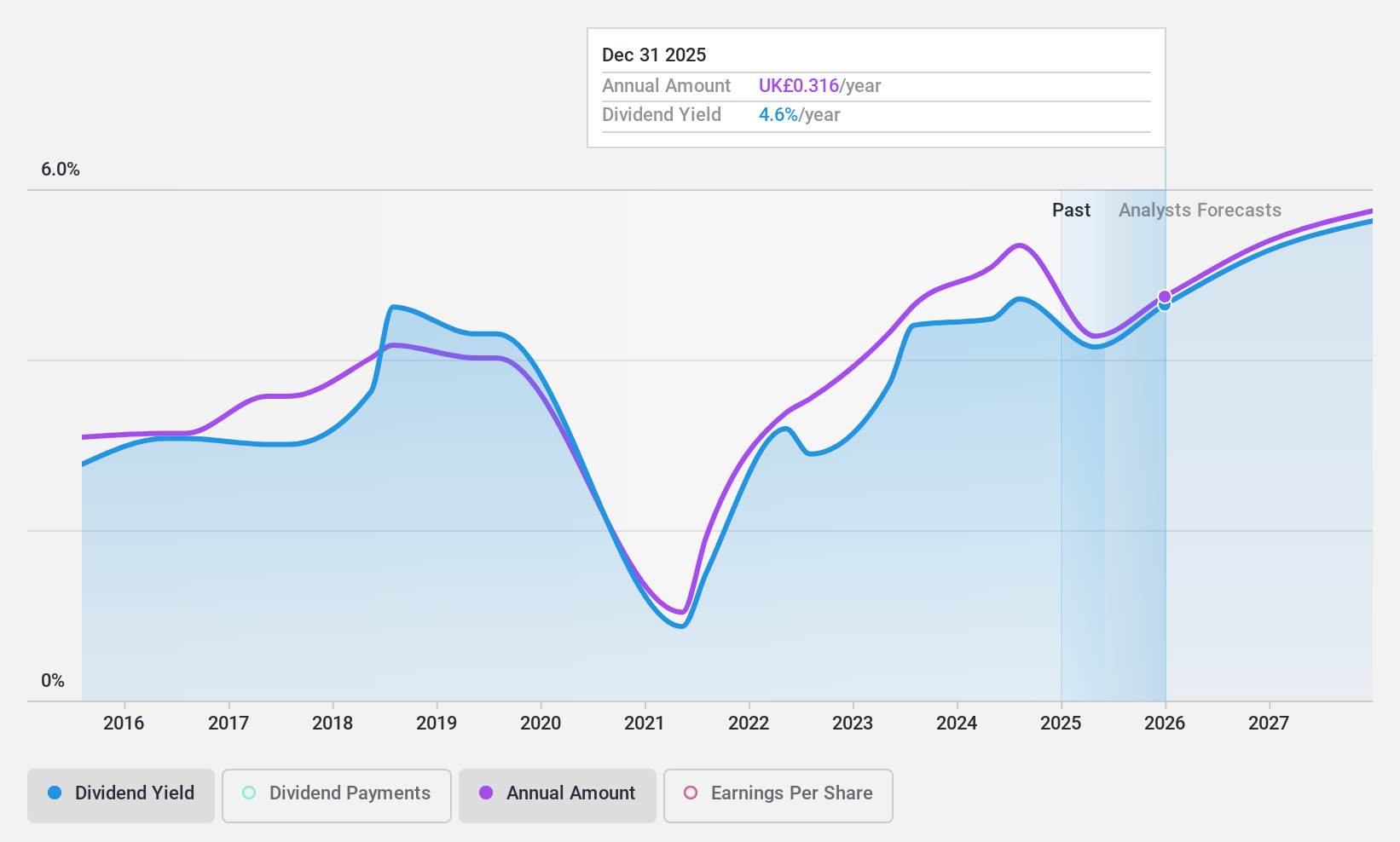

Dividend Yield: 4.7%

Inchcape's dividend payments are covered by earnings and cash flows, with a payout ratio of 52.5% and a cash payout ratio of 27.2%. However, its dividends have been volatile over the past decade, raising concerns about reliability. Trading at £2.2 billion in Q3 2024 revenue, Inchcape is exploring bolt-on acquisitions to enhance growth. Despite trading well below estimated fair value, its dividend yield remains lower than the UK's top tier payers.

- Click to explore a detailed breakdown of our findings in Inchcape's dividend report.

- The analysis detailed in our Inchcape valuation report hints at an deflated share price compared to its estimated value.

Morgan Advanced Materials (LSE:MGAM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Morgan Advanced Materials plc is a materials science and application engineering company based in the United Kingdom, with a market cap of £772.49 million.

Operations: Morgan Advanced Materials plc generates revenue from its Carbon & Technical Ceramics Division, specifically within the Technical Ceramics segment, amounting to £320.90 million.

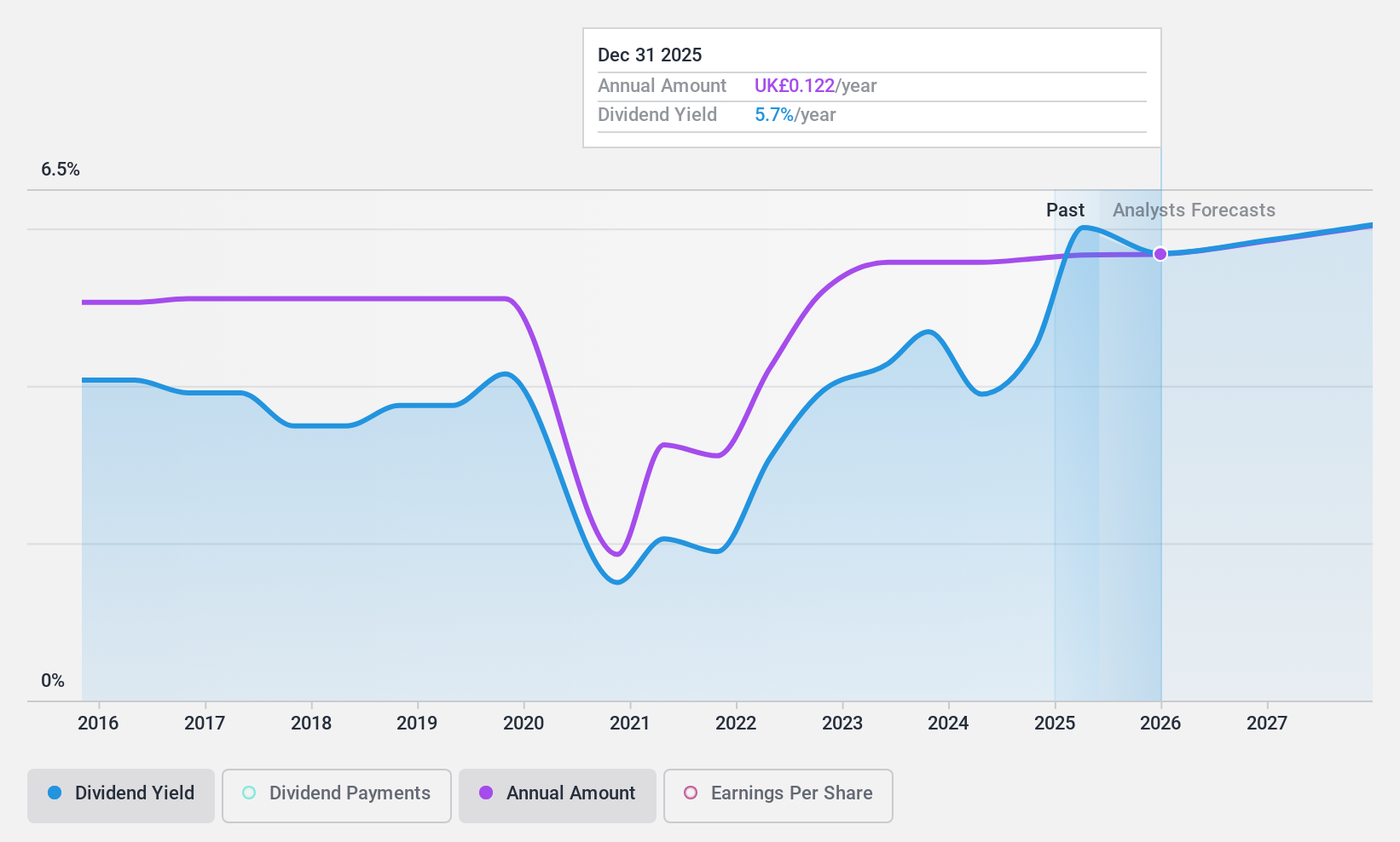

Dividend Yield: 4.4%

Morgan Advanced Materials' dividends are covered by earnings and cash flows, with payout ratios of 49.8% and 72.7%, respectively. Despite an unstable dividend history, recent growth in payments is notable. The company trades at a discount to its fair value, indicating potential undervaluation compared to peers. However, the dividend yield of 4.43% is below the top UK payers. A share buyback program initiated in November 2024 could influence future capital allocation strategies.

- Navigate through the intricacies of Morgan Advanced Materials with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Morgan Advanced Materials' share price might be too pessimistic.

Where To Now?

- Unlock more gems! Our Top UK Dividend Stocks screener has unearthed 58 more companies for you to explore.Click here to unveil our expertly curated list of 61 Top UK Dividend Stocks.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:INCH

Very undervalued with proven track record and pays a dividend.

Market Insights

Community Narratives