- United Kingdom

- /

- Healthtech

- /

- AIM:CRW

High Growth Tech Stocks In The UK For January 2025

Reviewed by Simply Wall St

As the UK market navigates a period of uncertainty, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, investors are closely monitoring sectors that offer potential for resilience and growth. In this context, high-growth tech stocks in the UK present intriguing opportunities as they often exhibit innovative capabilities and adaptability that can thrive even amidst broader economic challenges.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Gaming Realms | 11.57% | 22.07% | ★★★★★☆ |

| Filtronic | 21.68% | 55.69% | ★★★★★★ |

| STV Group | 13.15% | 46.78% | ★★★★★☆ |

| Facilities by ADF | 48.47% | 189.97% | ★★★★★☆ |

| Redcentric | 5.32% | 67.90% | ★★★★★☆ |

| Pinewood Technologies Group | 20.07% | 25.09% | ★★★★★☆ |

| YouGov | 8.52% | 55.02% | ★★★★★☆ |

| Windar Photonics | 36.65% | 46.33% | ★★★★★☆ |

| Oxford Biomedica | 21.20% | 92.53% | ★★★★★☆ |

| Beeks Financial Cloud Group | 22.12% | 36.94% | ★★★★★☆ |

Click here to see the full list of 49 stocks from our UK High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Craneware (AIM:CRW)

Simply Wall St Growth Rating: ★★★★☆☆

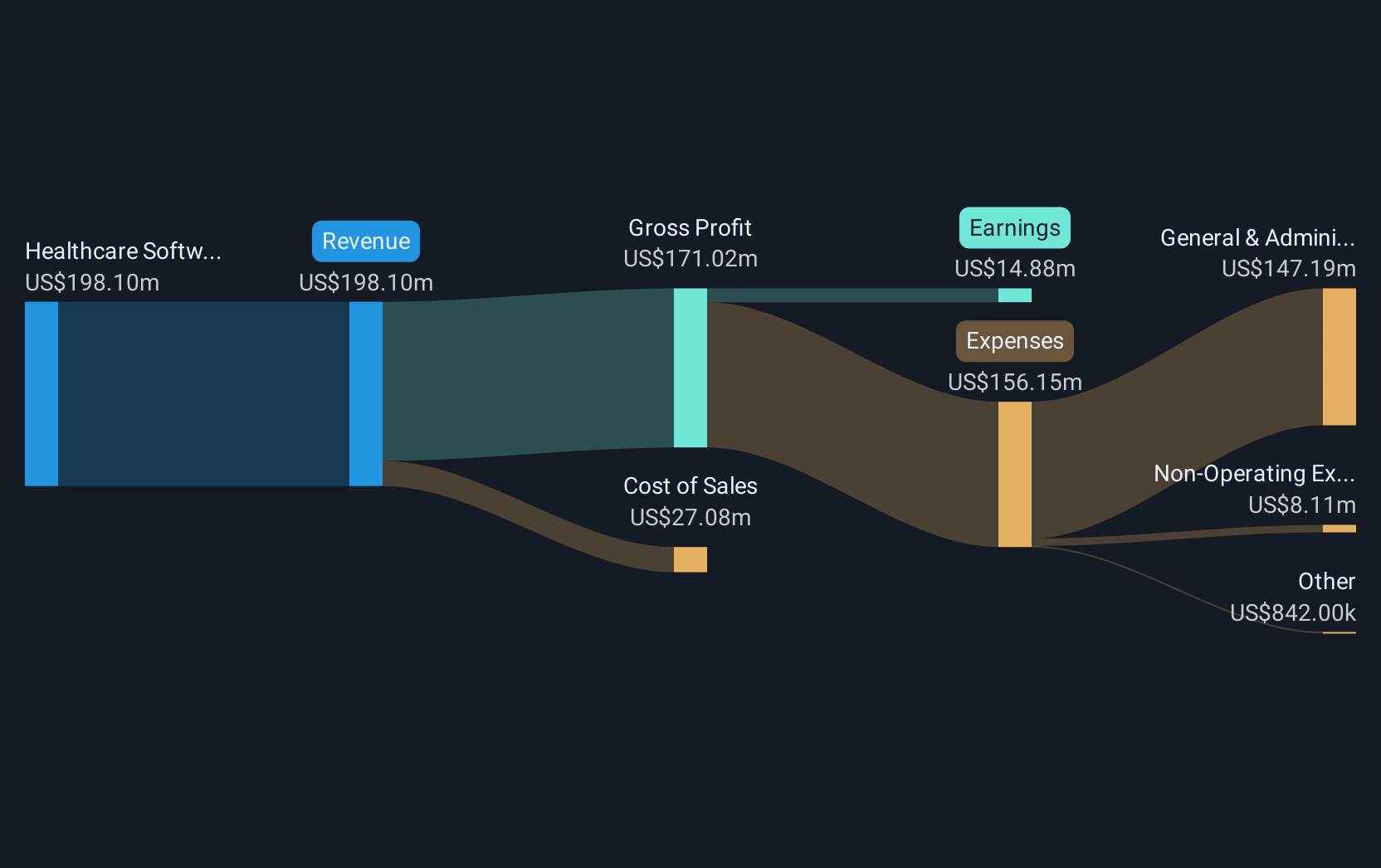

Overview: Craneware plc, along with its subsidiaries, focuses on developing, licensing, and supporting computer software for the healthcare industry in the United States, with a market capitalization of £738.88 million.

Operations: Craneware generates revenue primarily through its healthcare software segment, which accounts for $189.27 million. The company's operations are centered on providing specialized computer software solutions to the U.S. healthcare sector.

Craneware, a notable entity in the UK's tech landscape, demonstrates robust financial health with an annual earnings growth of 24.3% and revenue acceleration at 8.1%. This growth trajectory surpasses the broader UK market averages of 14.4% for earnings and 3.5% for revenue, underscoring its competitive edge in the healthcare software sector. The firm's commitment to innovation is evident from its R&D investments, crucial for sustaining long-term growth amidst evolving healthcare demands. Recent executive board changes signal a strategic realignment, potentially enhancing governance as it scales operations.

- Delve into the full analysis health report here for a deeper understanding of Craneware.

Gain insights into Craneware's historical performance by reviewing our past performance report.

Redcentric (AIM:RCN)

Simply Wall St Growth Rating: ★★★★★☆

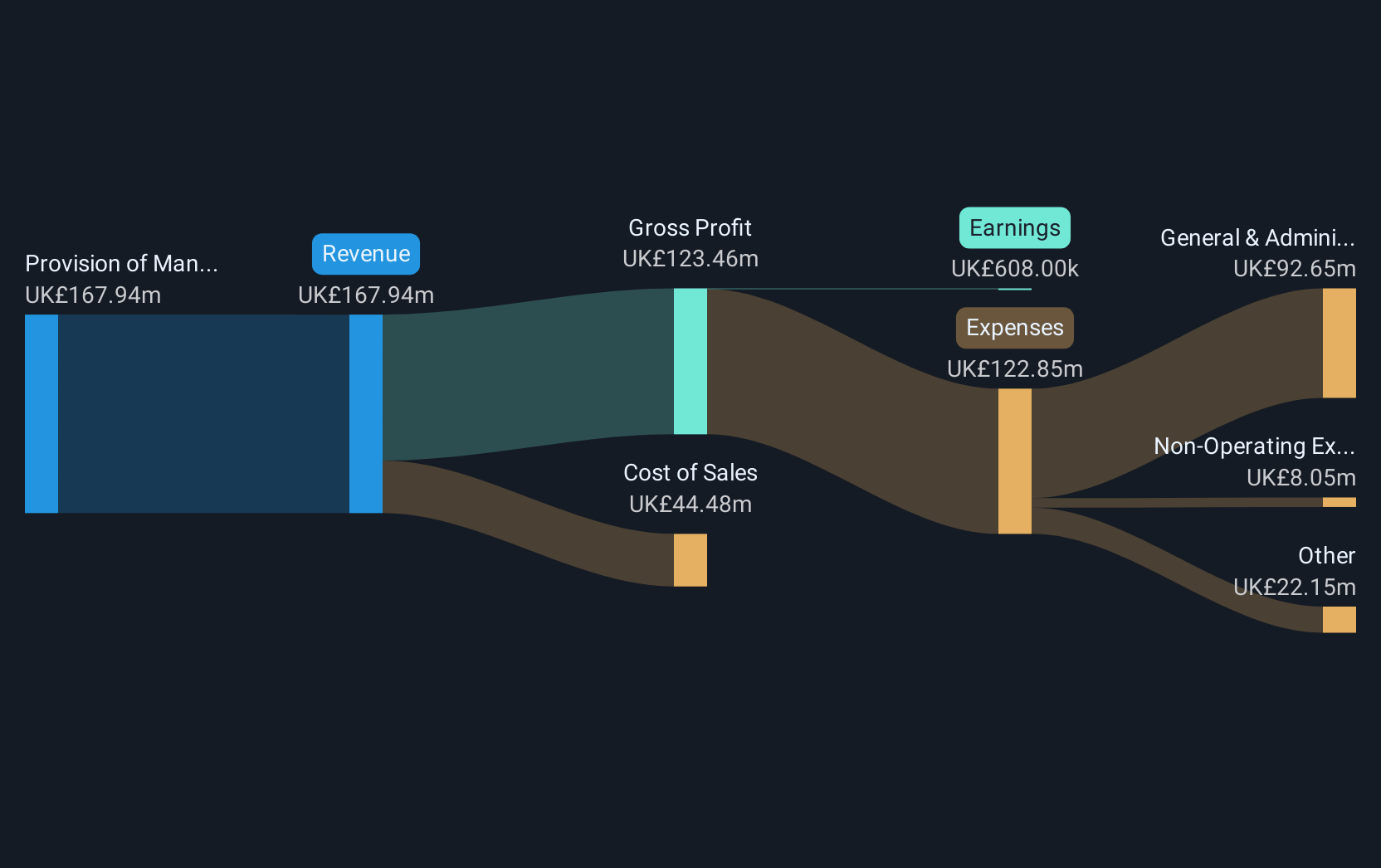

Overview: Redcentric plc offers IT managed services to both public and private sectors in the United Kingdom, with a market capitalization of £202.98 million.

Operations: With a revenue of £167.94 million from managed services, Redcentric focuses on delivering IT solutions to the UK public and private sectors.

Redcentric's recent financial performance illustrates a significant turnaround, with half-year sales rising to GBP 86.79 million from GBP 82 million and net income shifting from a loss to GBP 3.84 million. This recovery is underscored by an impressive forecast of annual earnings growth at 67.9%, far outpacing the UK market average of 14.4%. Strategic cost savings of approximately £0.9 million are expected to bolster profit margins further, despite projections of stable revenue in the upcoming half-year period. The company's commitment to returning value to shareholders is evident from its planned interim dividend payment, enhancing investor confidence amidst operational improvements.

Genus (LSE:GNS)

Simply Wall St Growth Rating: ★★★★☆☆

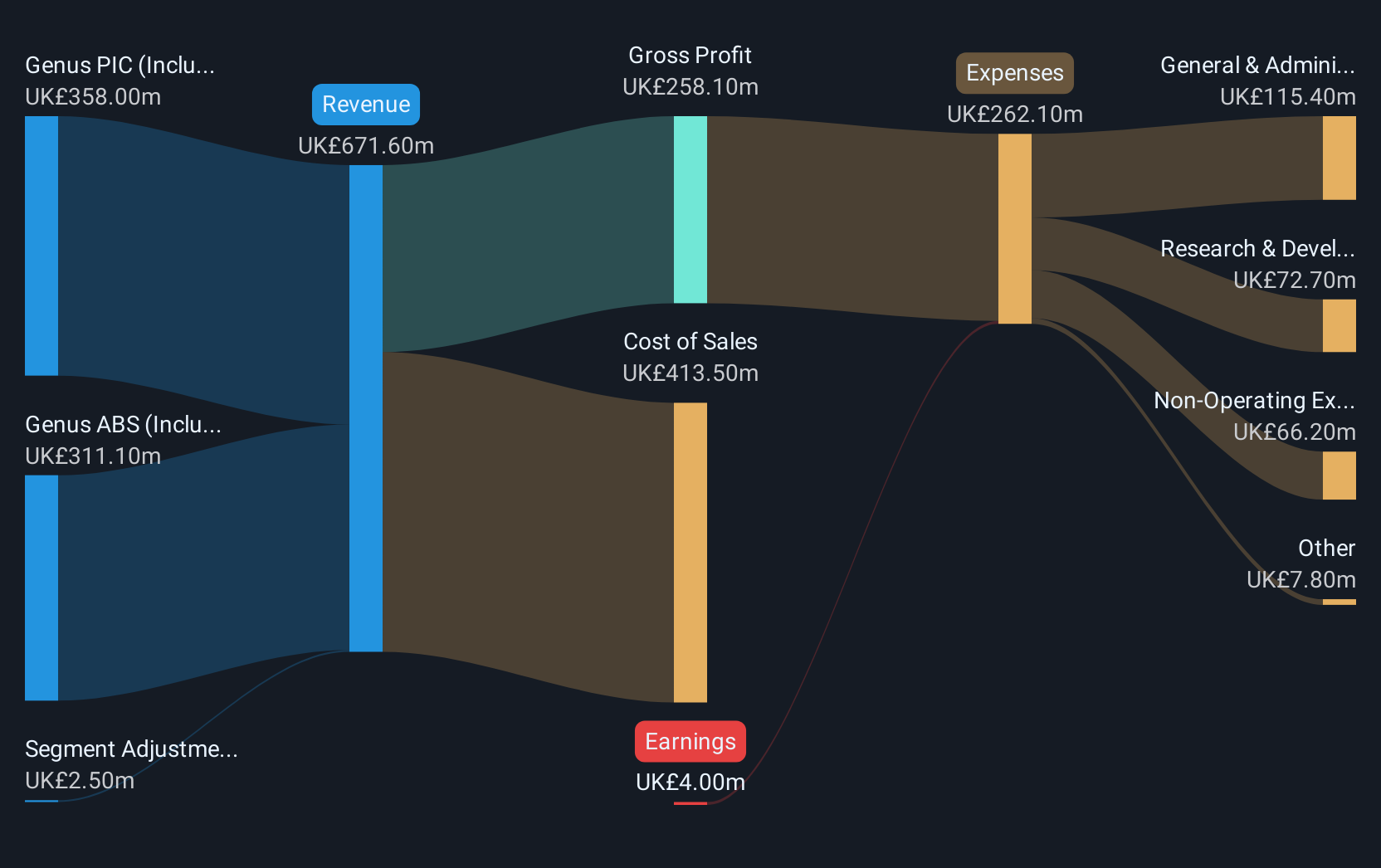

Overview: Genus plc is an animal genetics company with operations spanning North America, Latin America, the United Kingdom, Europe, the Middle East, Russia, Africa, and Asia; it has a market capitalization of approximately £1.01 billion.

Operations: Genus plc generates revenue primarily through its Genus ABS and Genus PIC segments, contributing £314.90 million and £352.50 million, respectively. The company's operations are focused on animal genetics across multiple regions worldwide.

Despite a challenging year with a significant one-off loss of £47.8 million, Genus demonstrates resilience and potential for robust growth. With an annual revenue increase projected at 3.7%, slightly above the UK market average of 3.5%, and an impressive earnings growth forecast at 31.5% per year, the company is poised for recovery and expansion in its sector. Recent strategic moves, including executive changes and new auditor appointments, signal a fresh approach to governance and financial management that could further enhance its market position. These developments, combined with Genus's commitment to shareholder value as evidenced by its recent dividend declaration, suggest that while past performance has seen volatility, future prospects appear promising in the high-growth tech landscape of the United Kingdom.

- Get an in-depth perspective on Genus' performance by reading our health report here.

Gain insights into Genus' past trends and performance with our Past report.

Taking Advantage

- Embark on your investment journey to our 49 UK High Growth Tech and AI Stocks selection here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:CRW

Craneware

Develops, licenses, and supports computer software for the healthcare industry in the United States.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives