- United Kingdom

- /

- Electrical

- /

- LSE:LUCE

January 2025's Promising Penny Stocks On UK Exchange

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 index experiencing declines influenced by weak trade data from China. In such a climate, identifying stocks that can withstand broader economic pressures becomes crucial. Penny stocks, though often overlooked due to their smaller size and niche appeal, can still present compelling opportunities when backed by strong financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.015 | £759.28M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.984 | £156.82M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.67 | £418.56M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.405 | £178.93M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.50 | £66.75M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.60 | £358.04M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.085 | £92.7M | ★★★★★★ |

| Tristel (AIM:TSTL) | £4.05 | £193.15M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.224 | £188.78M | ★★★★★☆ |

| Helios Underwriting (AIM:HUW) | £2.18 | £155.53M | ★★★★★☆ |

Click here to see the full list of 441 stocks from our UK Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Eagle Eye Solutions Group (AIM:EYE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Eagle Eye Solutions Group plc offers marketing technology software as a service solutions across various regions including the United Kingdom, France, the United States, and others, with a market capitalization of £112.53 million.

Operations: The company's revenue is derived from two segments: Eagleai, contributing £4.42 million, and Organic, generating £43.31 million.

Market Cap: £112.53M

Eagle Eye Solutions Group has recently secured a significant five-year OEM agreement with a major enterprise software vendor, marking an important step in its global expansion strategy. The integration of its AIR platform into the vendor's cloud-based loyalty solution is expected to enhance recurring revenue streams over time. Despite impressive earnings growth of 382.7% last year and improved profit margins, Eagle Eye's share price remains volatile and trades below estimated fair value. The company's debt is well-managed, supported by strong cash flow, though future earnings are forecasted to decline slightly over the next three years.

- Dive into the specifics of Eagle Eye Solutions Group here with our thorough balance sheet health report.

- Evaluate Eagle Eye Solutions Group's prospects by accessing our earnings growth report.

Foresight Group Holdings (LSE:FSG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Foresight Group Holdings Limited is an infrastructure and private equity manager operating in the United Kingdom, Italy, Luxembourg, Ireland, Spain, and Australia with a market cap of £418.56 million.

Operations: The company generates revenue through its segments, with £87.79 million from Infrastructure, £50.78 million from Private Equity, and £8.10 million from Foresight Capital Management.

Market Cap: £418.56M

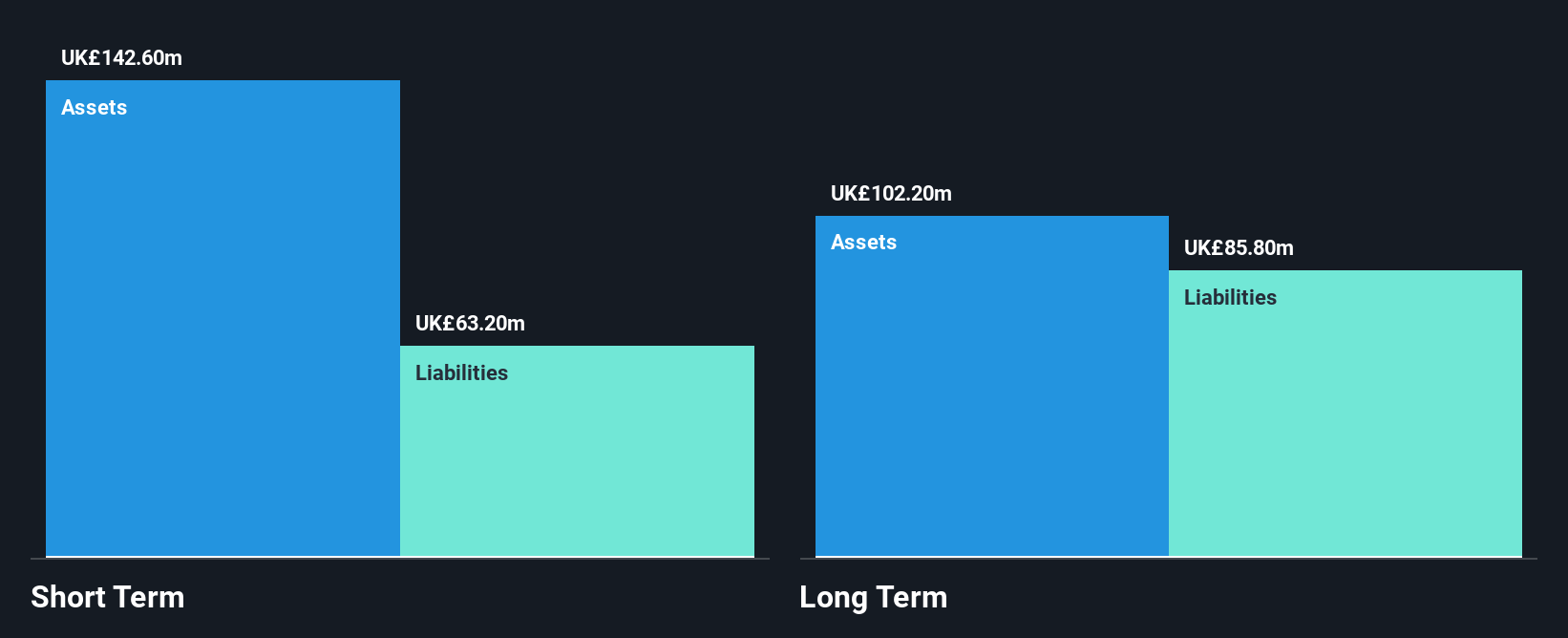

Foresight Group Holdings has demonstrated robust earnings growth, with a 45.9% increase over the past year, surpassing its five-year average of 27.6%. The company's financial health is strong, with more cash than total debt and short-term assets covering both short and long-term liabilities. Its Return on Equity stands high at 37.5%, indicating efficient profit generation from equity capital. Recent developments include an expanded £15 million equity buyback plan and improved net profit margins to 20.9%. Despite a one-off loss impacting recent results, Foresight's stock trades slightly below estimated fair value, suggesting potential undervaluation opportunities for investors.

- Get an in-depth perspective on Foresight Group Holdings' performance by reading our balance sheet health report here.

- Explore Foresight Group Holdings' analyst forecasts in our growth report.

Luceco (LSE:LUCE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Luceco plc manufactures and distributes wiring accessories, LED lighting, and portable power products across multiple regions including the United Kingdom, Europe, the Middle East, the Americas, the Asia Pacific, and Africa with a market cap of £188.78 million.

Operations: The company's revenue is derived from three main segments: Wiring Accessories (£90.40 million), LED Lighting (£77.50 million), and Portable Power (£49.60 million).

Market Cap: £188.78M

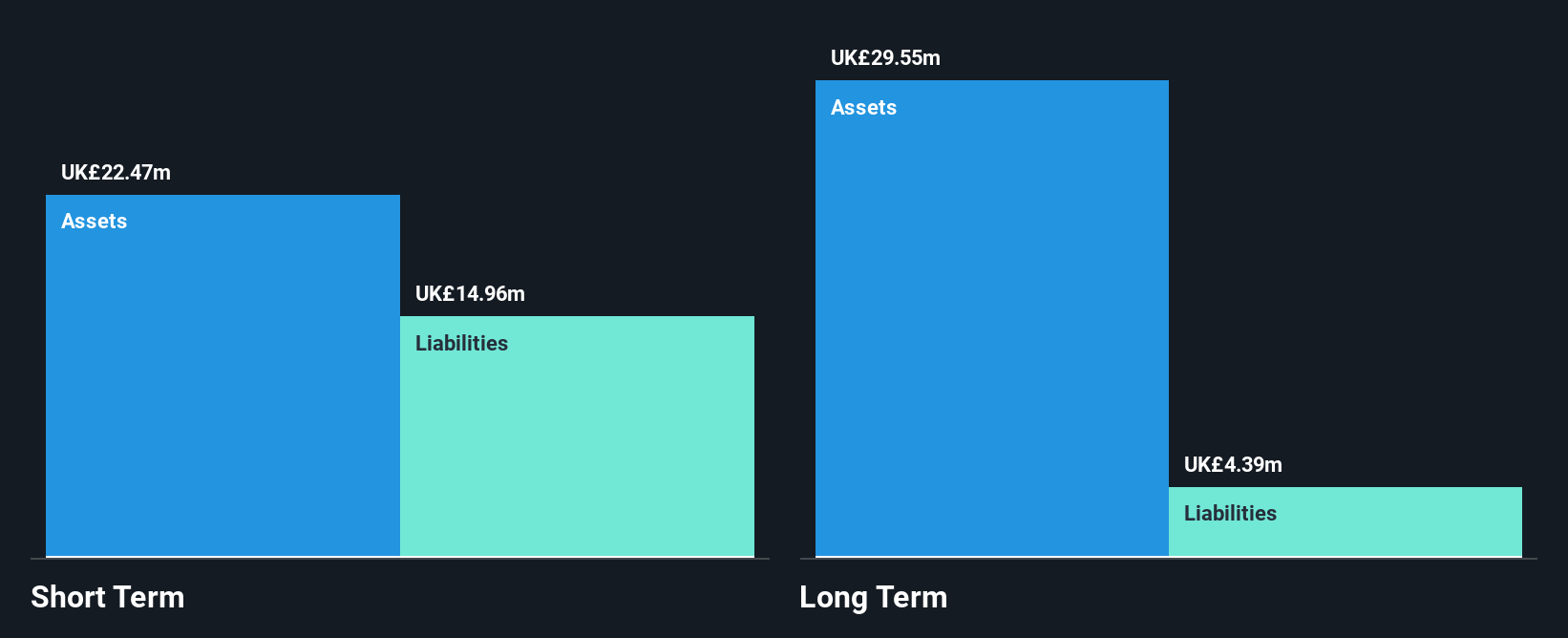

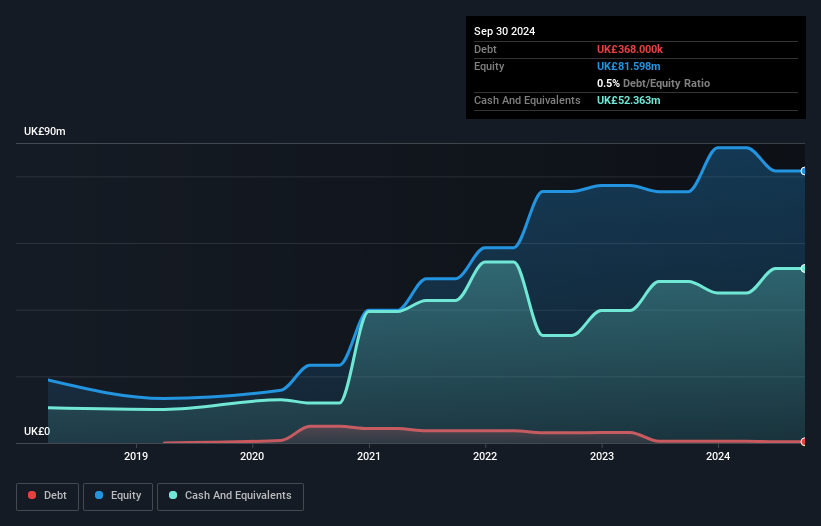

Luceco plc has shown significant earnings growth of 51.2% over the past year, outpacing its five-year average decline. The company's financial position is solid, with short-term assets exceeding both short and long-term liabilities, and debt well covered by operating cash flow. Despite a high net debt to equity ratio of 42.7%, Luceco's interest payments are comfortably covered by EBIT at 7.5 times. The stock trades significantly below its estimated fair value, presenting potential value opportunities for investors. Recent updates reveal a focus on mergers and acquisitions supported by strong cash flow generation and balance sheet strength.

- Take a closer look at Luceco's potential here in our financial health report.

- Gain insights into Luceco's future direction by reviewing our growth report.

Make It Happen

- Jump into our full catalog of 441 UK Penny Stocks here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:LUCE

Luceco

Manufactures and distributes wiring accessories and LED lighting and portable power products in the United Kingdom, Europe, the Middle East, the Americas, the Asia Pacific, and Africa.

Very undervalued with solid track record.