- United Kingdom

- /

- Retail Distributors

- /

- LSE:ULTP

UK Dividend Stocks To Watch In January 2025

Reviewed by Simply Wall St

The UK stock market has recently faced challenges, with the FTSE 100 index experiencing declines due to weak trade data from China, which has impacted companies heavily reliant on the Chinese economy. As global economic uncertainties persist, investors may find stability in dividend stocks that offer consistent income streams and potential resilience amid market fluctuations.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Pets at Home Group (LSE:PETS) | 6.18% | ★★★★★★ |

| Keller Group (LSE:KLR) | 3.49% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 3.30% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 8.38% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 8.06% | ★★★★★☆ |

| Man Group (LSE:EMG) | 6.14% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 4.85% | ★★★★★☆ |

| DCC (LSE:DCC) | 3.68% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 4.04% | ★★★★★☆ |

| James Latham (AIM:LTHM) | 6.72% | ★★★★★☆ |

Click here to see the full list of 61 stocks from our Top UK Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

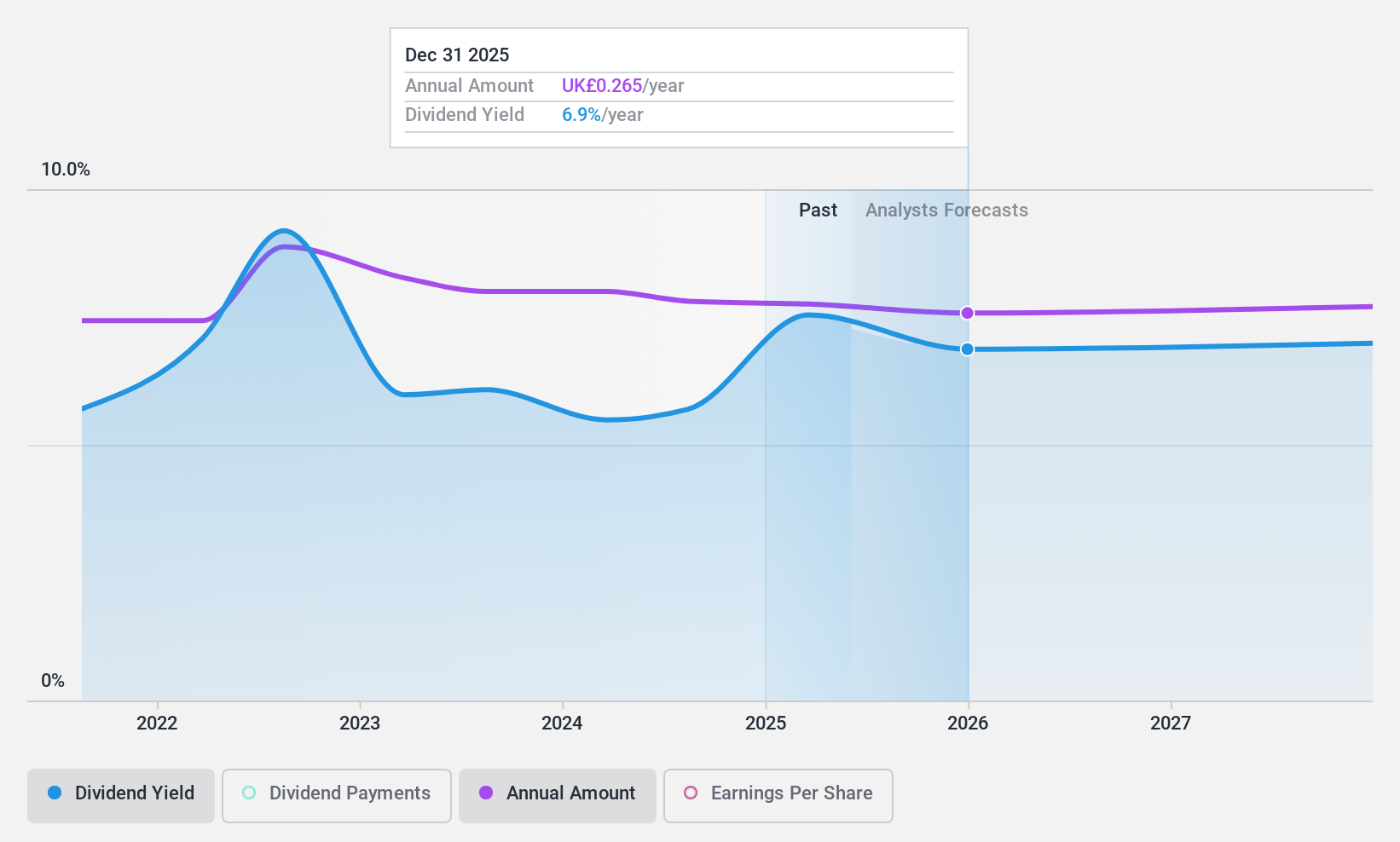

James Latham (AIM:LTHM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: James Latham plc, with a market cap of £234.54 million, imports and distributes timbers, panels, and decorative surfaces across the United Kingdom, the Republic of Ireland, Europe, and internationally.

Operations: James Latham plc generates revenue of £362.22 million from its timber importing and distribution segment.

Dividend Yield: 6.7%

James Latham offers a dividend yield of 6.72%, placing it in the top 25% of UK dividend payers. The company has a history of reliable and stable dividend payments over the past decade, with dividends growing consistently. However, its high cash payout ratio (107%) indicates that dividends are not well covered by free cash flows, raising concerns about sustainability. Recent earnings showed a decline in net income to £10.16 million for the half year ended September 2024, compared to £12.37 million previously.

- Click to explore a detailed breakdown of our findings in James Latham's dividend report.

- Insights from our recent valuation report point to the potential undervaluation of James Latham shares in the market.

Conduit Holdings (LSE:CRE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Conduit Holdings Limited, along with its subsidiaries, offers reinsurance products and services globally and has a market cap of £719.74 million.

Operations: Conduit Holdings Limited generates its revenue from three main segments: $174.60 million from Casualty, $320 million from Property, and $124.30 million from Specialty reinsurance products and services worldwide.

Dividend Yield: 6.5%

Conduit Holdings offers a dividend yield of 6.45%, ranking it among the top 25% of UK dividend payers. Despite its attractive yield, the company has an unstable and volatile dividend track record over the past three years. Dividends are well covered by earnings (27.2% payout ratio) and cash flows (15.9% cash payout ratio), suggesting sustainability in payments despite their unreliability. The stock trades at a favorable value with a low price-to-earnings ratio of 4.2x compared to the UK market average of 16x.

- Click here to discover the nuances of Conduit Holdings with our detailed analytical dividend report.

- According our valuation report, there's an indication that Conduit Holdings' share price might be on the cheaper side.

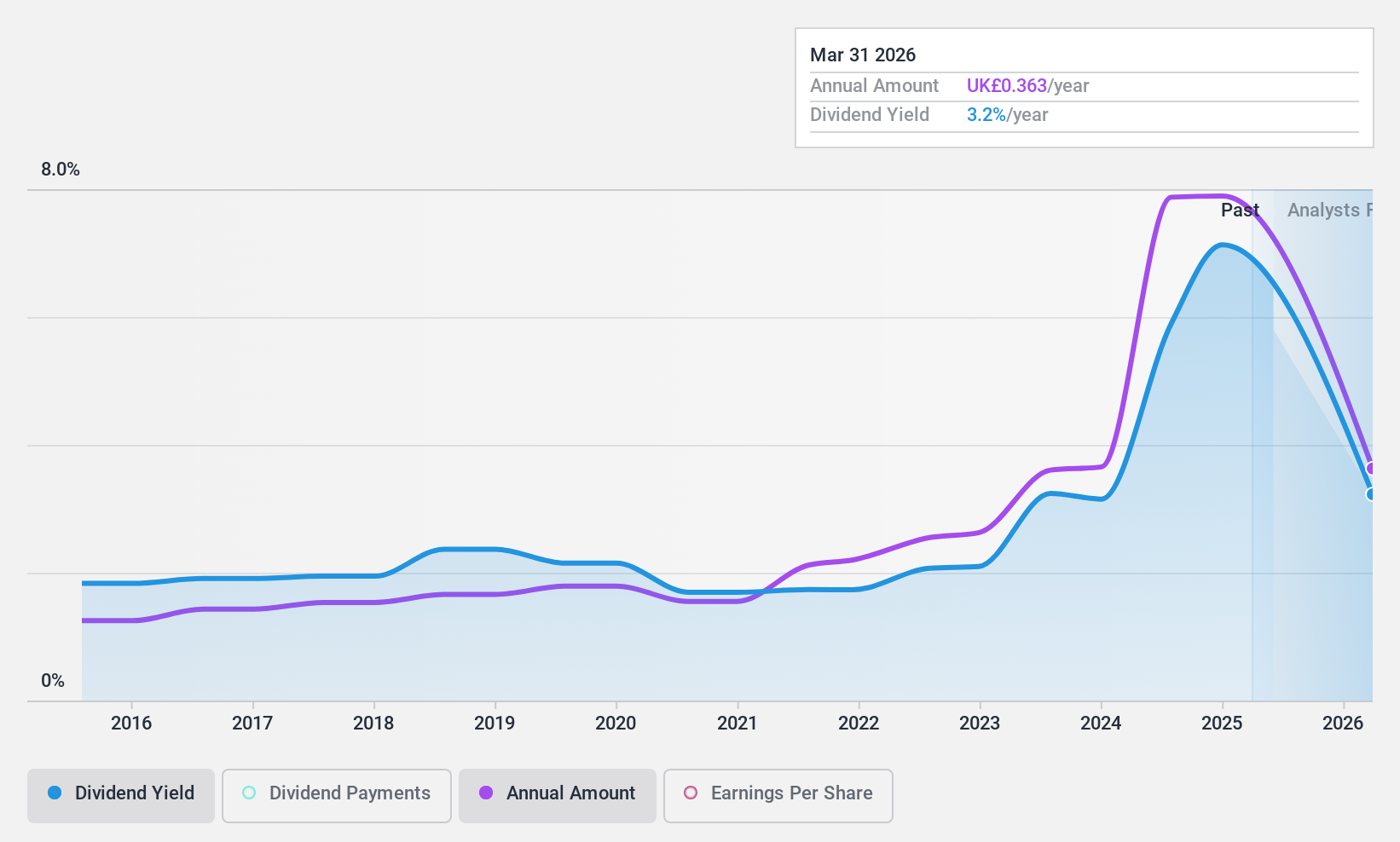

Ultimate Products (LSE:ULTP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ultimate Products Plc, with a market cap of £92.70 million, supplies branded household products in the United Kingdom, Germany, the rest of Europe, and internationally.

Operations: Ultimate Products Plc generates revenue primarily through its wholesale miscellaneous segment, which amounts to £155.50 million.

Dividend Yield: 6.8%

Ultimate Products offers a dividend yield of 6.8%, placing it in the top 25% of UK dividend payers. However, its dividend history is volatile, with payments over the past eight years being unreliable. The company maintains a reasonable payout ratio of 60.7%, indicating dividends are covered by earnings and cash flows (cash payout ratio: 44.8%). Despite recent declines in sales and net income, Ultimate Products trades below estimated fair value and analyst price targets, suggesting potential for capital appreciation.

- Take a closer look at Ultimate Products' potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that Ultimate Products is priced lower than what may be justified by its financials.

Turning Ideas Into Actions

- Unlock more gems! Our Top UK Dividend Stocks screener has unearthed 58 more companies for you to explore.Click here to unveil our expertly curated list of 61 Top UK Dividend Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:ULTP

Ultimate Products

Supplies branded household products in the United Kingdom, Germany, Rest of Europe, and internationally.

Very undervalued with excellent balance sheet.

Market Insights

Community Narratives