- Netherlands

- /

- Hospitality

- /

- ENXTAM:BFIT

3 Undervalued Small Caps In Global With Insider Action To Consider

Reviewed by Simply Wall St

In recent weeks, global markets have experienced a surge in optimism following the U.S.-China agreement to pause tariffs, leading to significant gains across major indices such as the S&P 500 and Nasdaq Composite. This positive momentum has been further supported by cooling inflation rates and strong performance from investment-grade bonds, creating a favorable environment for small-cap stocks that often thrive in risk-on scenarios. In this context, identifying promising small-cap stocks involves looking at companies with solid fundamentals that may be temporarily overlooked by the market. These stocks can present opportunities when insider activity suggests confidence in their future prospects amidst broader economic improvements.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| FRP Advisory Group | 11.8x | 2.1x | 20.01% | ★★★★★☆ |

| Tristel | 29.9x | 4.2x | 19.70% | ★★★★☆☆ |

| Cloetta | 15.3x | 1.1x | 47.07% | ★★★★☆☆ |

| SmartCraft | 40.8x | 7.3x | 35.82% | ★★★★☆☆ |

| Sing Investments & Finance | 7.3x | 3.7x | 41.18% | ★★★★☆☆ |

| Close Brothers Group | NA | 0.6x | 44.74% | ★★★★☆☆ |

| Absolent Air Care Group | 23.1x | 1.8x | 47.85% | ★★★☆☆☆ |

| Saturn Oil & Gas | 2.1x | 0.4x | -33.50% | ★★★☆☆☆ |

| Eastnine | 18.2x | 8.8x | 39.61% | ★★★☆☆☆ |

| Seeing Machines | NA | 2.4x | 45.39% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

Basic-Fit (ENXTAM:BFIT)

Simply Wall St Value Rating: ★★★☆☆☆

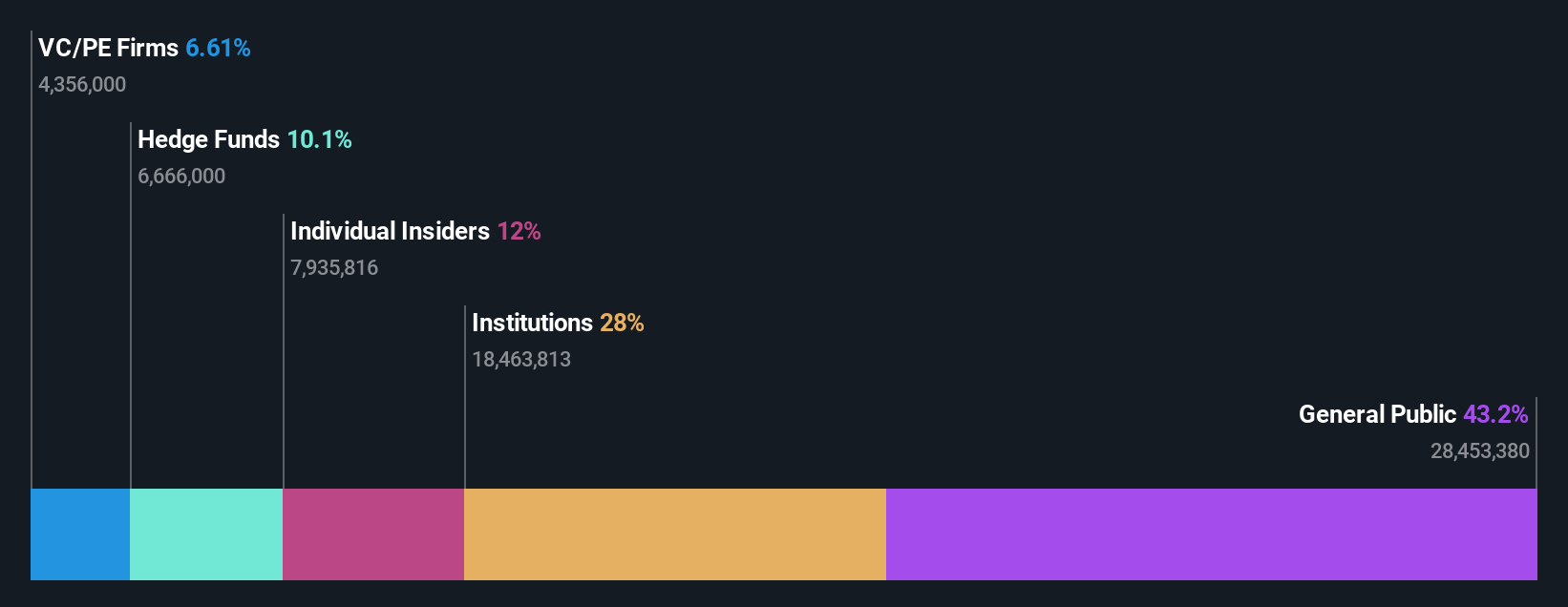

Overview: Basic-Fit operates a network of fitness clubs primarily in the Benelux region, France, Spain, and Germany, with a market capitalization of approximately €2.5 billion.

Operations: The company generates revenue primarily from its operations in Benelux and France, Spain & Germany, with recent figures showing €522.10 million and €693.10 million respectively. The gross profit margin has shown a trend of increasing over time, reaching 79.61% by the end of 2024. Operating expenses are significant, driven largely by depreciation and amortization costs, which were €440.40 million as of the latest data point in 2025-05-19.

PE: 178.9x

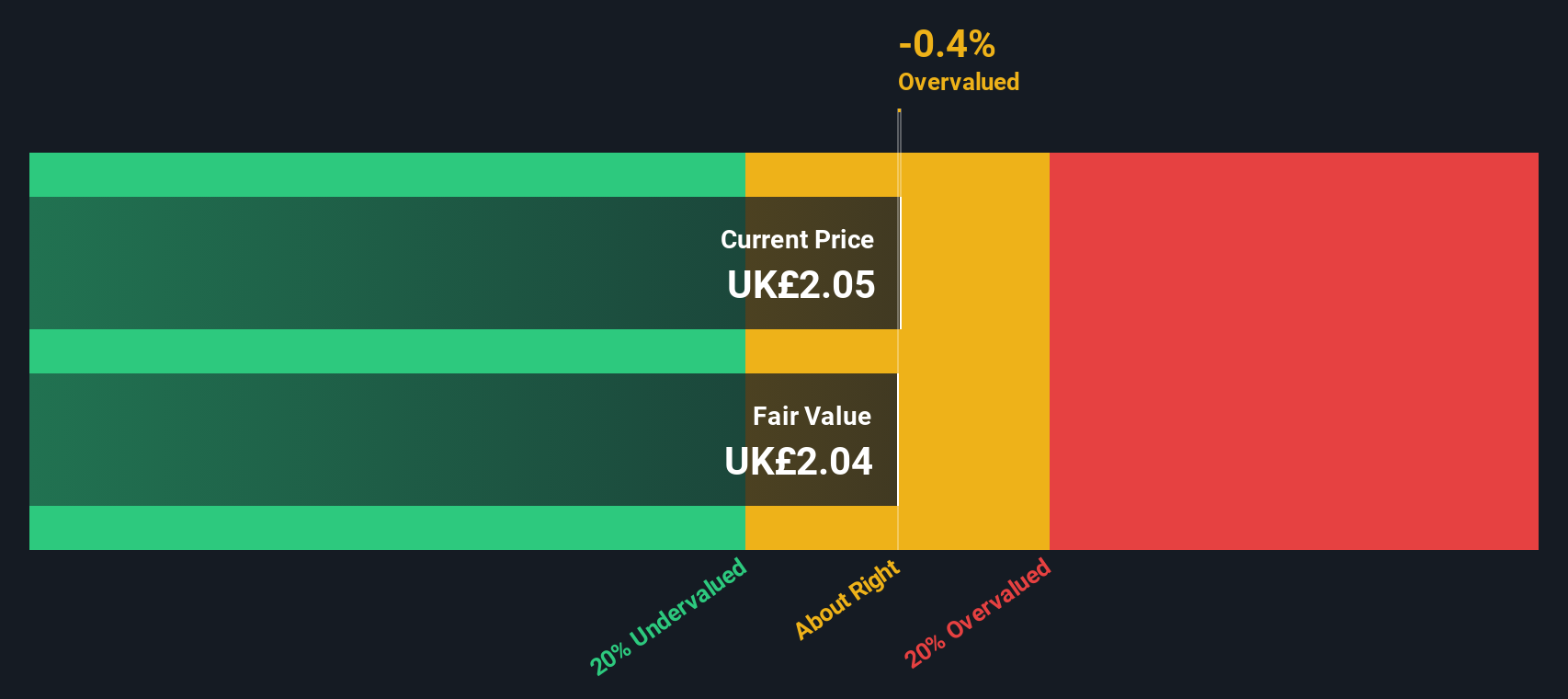

Basic-Fit, a fitness chain operating in the European market, reported sales of €1.22 billion for 2024, up from €1.05 billion the previous year, with net income reaching €8 million compared to a prior loss. Despite volatile share prices recently and reliance on external borrowing for funding, insider confidence is evident with recent purchases by executives. The company announced a share repurchase program worth up to €40 million valid until 2025, aiming to enhance shareholder value amidst forecasted earnings growth of over 61% annually.

- Click here to discover the nuances of Basic-Fit with our detailed analytical valuation report.

Evaluate Basic-Fit's historical performance by accessing our past performance report.

Kier Group (LSE:KIE)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Kier Group is a UK-based construction and infrastructure services company with operations spanning property development, corporate services, construction, and infrastructure services, and it has a market cap of £0.41 billion.

Operations: The company generates revenue primarily from its Construction (£1.92 billion) and Infrastructure Services (£2.08 billion) segments. Over recent periods, the gross profit margin has shown some fluctuation, reaching 9.06% by the end of September 2023 before decreasing to 8.03% by December 2024. Operating expenses have varied but were recorded at £219.5 million in December 2024, reflecting a decrease from previous periods.

PE: 14.0x

Kier Group, a smaller player in its industry, shows potential as an undervalued stock. Despite relying on riskier external borrowing for funding, insider confidence is evident with recent share purchases. For the half-year ending December 2024, sales increased to £1.97 billion from £1.86 billion previously, while net income rose slightly to £20.4 million. A dividend hike of 20% further indicates positive momentum and earnings are projected to grow by 17% annually, suggesting promising future prospects amidst current financial strategies and performance improvements.

- Dive into the specifics of Kier Group here with our thorough valuation report.

Gain insights into Kier Group's past trends and performance with our Past report.

Russel Metals (TSX:RUS)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Russel Metals is a leading North American metals distribution company with operations in metals service centers, energy field stores, and steel distribution, boasting a market cap of CA$2.96 billion.

Operations: The company's revenue primarily comes from Metals Service Centers, Energy Field Stores, and Steel Distributors. Over recent periods, the gross profit margin has shown variability, peaking at 28.46% in December 2021 before declining to around 20.11% by March 2025. Operating expenses have consistently been a significant portion of costs, with general and administrative expenses forming a notable component.

PE: 15.5x

Russel Metals, a company in the metals distribution sector, is navigating financial challenges with a focus on growth. Despite lower net profit margins of 3.5% compared to last year's 5.5%, earnings are projected to grow by 15.33% annually. Recent insider confidence is not evident through share purchases; however, the company has shown commitment to shareholder returns by increasing dividends for three consecutive years, with a recent hike of 2.4%. The extension and amendment of its credit facilities until April 2029 reflect strategic financial management amidst higher-risk external borrowing sources.

- Navigate through the intricacies of Russel Metals with our comprehensive valuation report here.

Explore historical data to track Russel Metals' performance over time in our Past section.

Seize The Opportunity

- Access the full spectrum of 168 Undervalued Global Small Caps With Insider Buying by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Basic-Fit might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:BFIT

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives