- United Kingdom

- /

- Diversified Financial

- /

- AIM:FNX

Undiscovered Gems In The United Kingdom May 2025

Reviewed by Simply Wall St

The United Kingdom's equity market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, highlighting the interconnectedness of global economies and the impact on UK-based companies. In such a volatile environment, identifying undiscovered gems within the market requires an eye for stocks that demonstrate resilience and potential for growth despite broader economic pressures.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| BioPharma Credit | NA | 7.22% | 7.91% | ★★★★★★ |

| Livermore Investments Group | NA | 9.92% | 13.65% | ★★★★★★ |

| B.P. Marsh & Partners | NA | 29.42% | 31.34% | ★★★★★★ |

| MS INTERNATIONAL | NA | 13.42% | 56.55% | ★★★★★★ |

| Rights and Issues Investment Trust | NA | -7.87% | -8.41% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.08% | 5.03% | ★★★★★★ |

| FW Thorpe | 2.95% | 11.79% | 13.49% | ★★★★★☆ |

| Goodwin | 37.02% | 9.75% | 15.68% | ★★★★★☆ |

| AltynGold | 73.21% | 26.90% | 31.85% | ★★★★☆☆ |

| Law Debenture | 17.80% | 11.81% | 7.59% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Fonix (AIM:FNX)

Simply Wall St Value Rating: ★★★★★★

Overview: Fonix Plc specializes in mobile payments and messaging services, along with managed services for sectors such as media, charity, gaming, and e-mobility in the United Kingdom, with a market cap of £212.52 million.

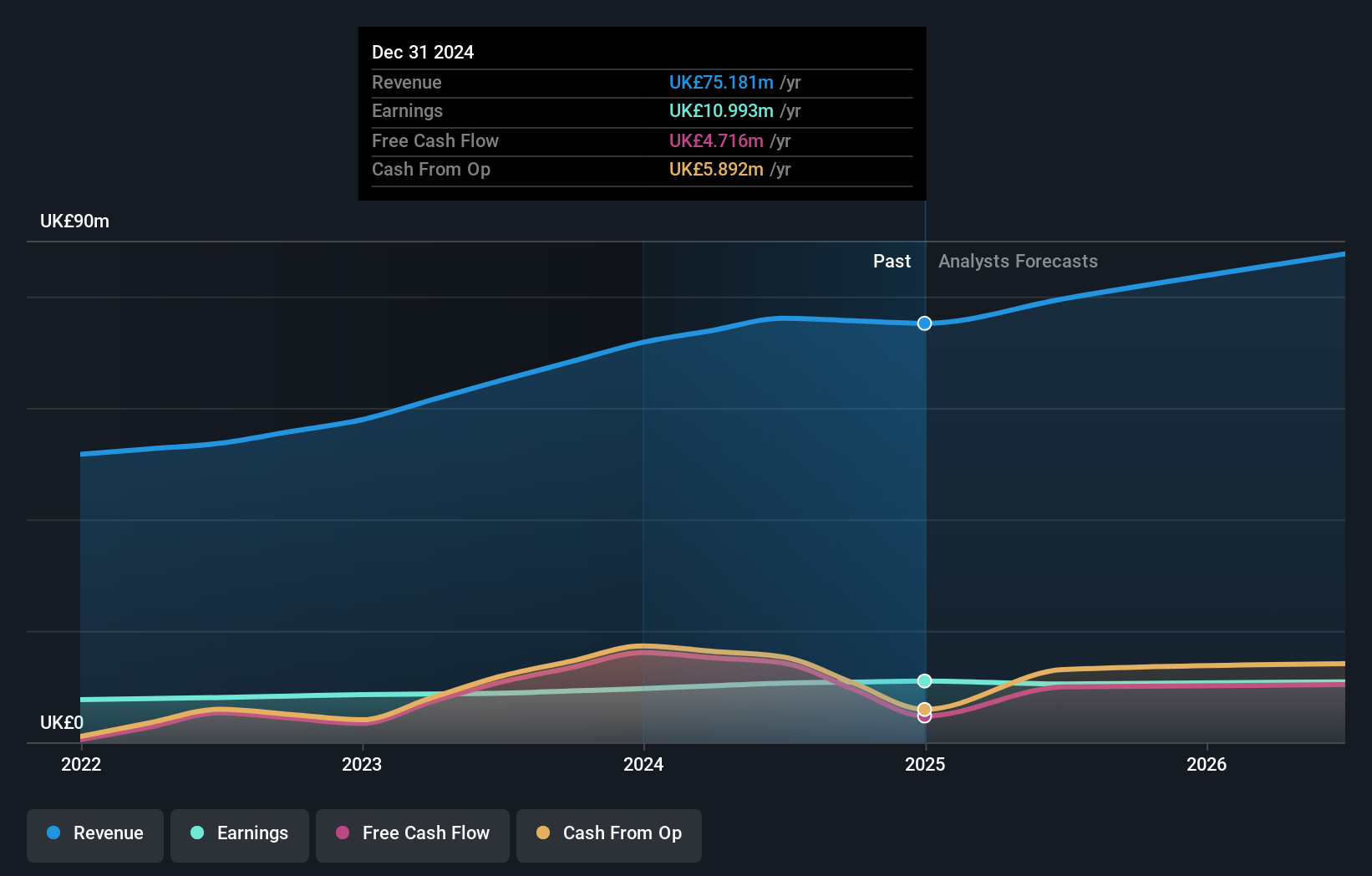

Operations: Revenue from facilitating mobile payments and messaging stands at £75.18 million.

Fonix, a nimble player in the UK market, showcases robust financial health with no debt over the past five years and high-quality earnings. Despite a slight dip in sales to £38.75 million for the half year ending December 2024, net income rose to £6.06 million from £5.69 million previously, reflecting strong operational efficiency. Earnings have grown at an impressive 14.8% annually over five years, although future earnings are expected to see a minor average decline of 0.2% per year over three years while revenue is anticipated to grow by 10%. The company also declared an increased interim dividend of 2.9p per share as part of its progressive policy.

- Click to explore a detailed breakdown of our findings in Fonix's health report.

Evaluate Fonix's historical performance by accessing our past performance report.

Goodwin (LSE:GDWN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Goodwin PLC, with a market cap of £509.15 million, operates in mechanical and refractory engineering solutions across the United Kingdom, Europe, the United States, the Pacific Basin, and other international markets.

Operations: Goodwin PLC generates revenue primarily from its mechanical segment (£168.02 million) and refractory segment (£75.58 million).

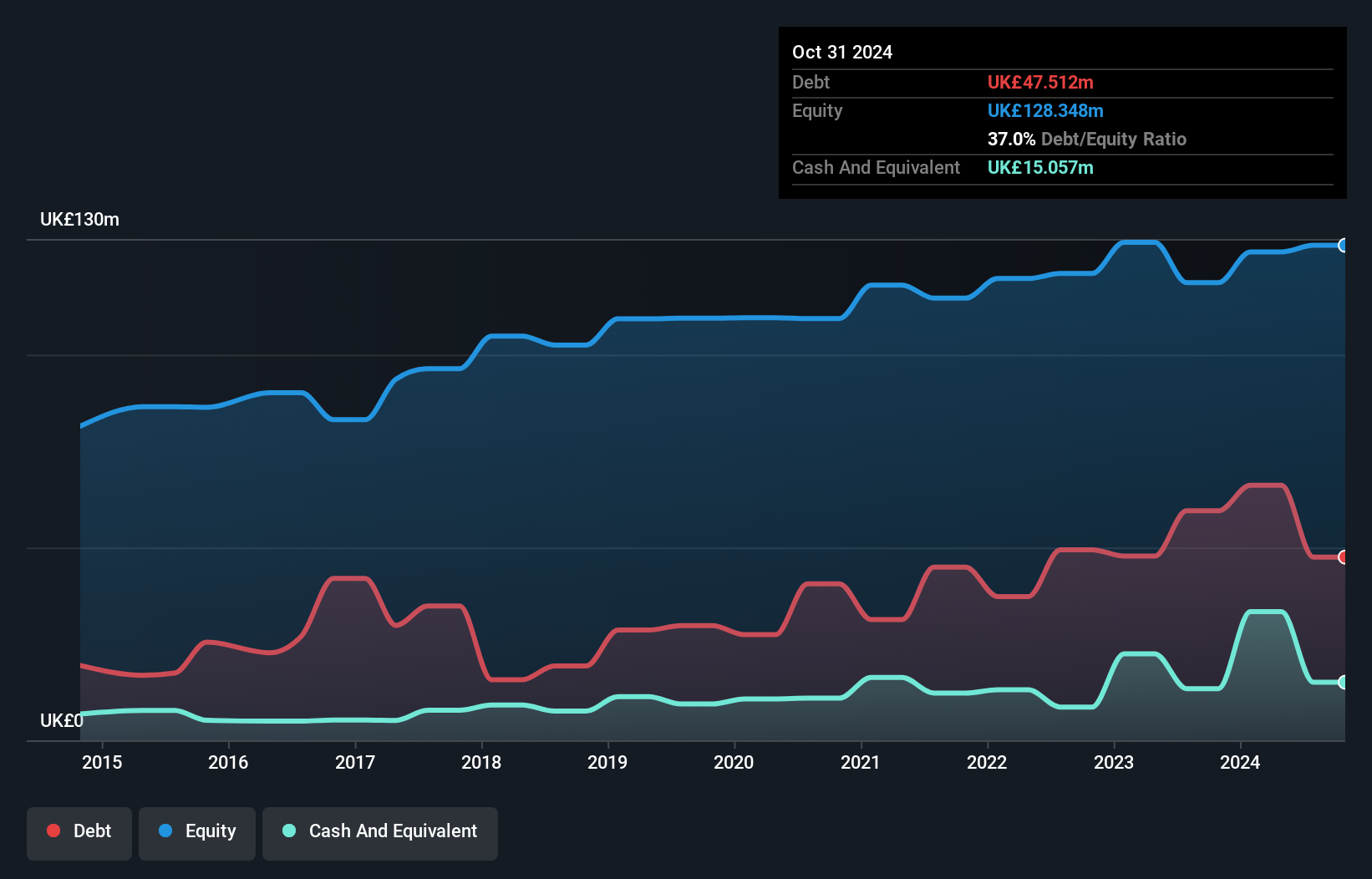

Goodwin's financial health reflects its potential, with earnings surging by 23% last year, outpacing the machinery industry's -7.7%. Its debt to equity ratio has climbed from 27.2% to 37% over five years, yet interest payments are comfortably covered at 8.4 times by EBIT. Trading at a significant discount of about 58% below estimated fair value suggests room for appreciation. The net debt to equity ratio stands at a satisfactory 25%, indicating prudent financial management. Recent events include a dividend payout and participation in industry conferences, reinforcing its commitment to shareholder value and industry engagement.

Pollen Street Group (LSE:POLN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Pollen Street Group, founded in 2015 and headquartered in London, is a financial services company with a market cap of £472.04 million.

Operations: Pollen Street Group generates revenue primarily from its Asset Manager segment (£66.80 million) and Investment Company segment (£60.38 million), while the Central segment incurs a negative contribution of £8.73 million.

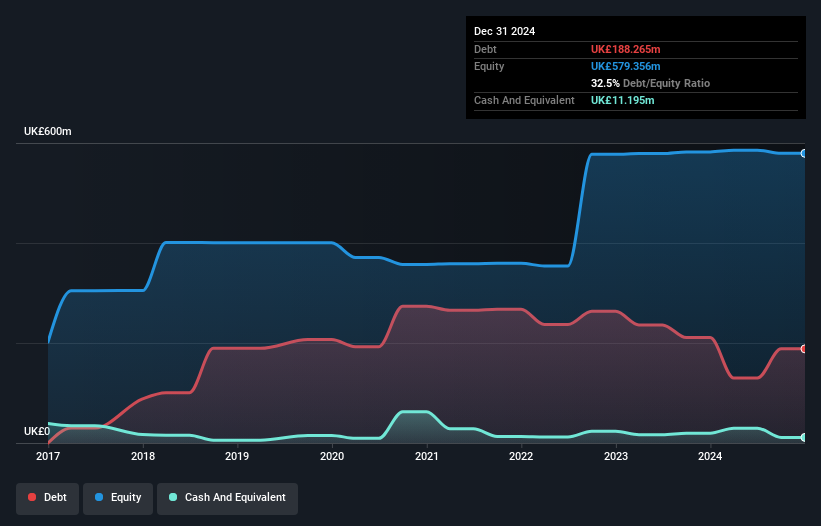

Pollen Street Group, a notable player in the UK financial sector, is seeing significant growth with earnings up 24.2% over the past year, outpacing industry averages. Their price-to-earnings ratio of 9.5x suggests good value compared to the broader UK market's 16.4x, while their debt-to-equity ratio has improved from 51.7% to 32.5% over five years, indicating prudent financial management. Recent strategic moves include ongoing discussions for acquiring Hipoges Iberia and a completed share buyback of £22.9 million (5.08%). With dividends set at no less than £0.55 per share in 2025, Pollen Street's robust performance and shareholder-friendly actions highlight its potential as an attractive investment opportunity within its sector.

Where To Now?

- Delve into our full catalog of 58 UK Undiscovered Gems With Strong Fundamentals here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Fonix, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:FNX

Fonix

Provides mobile payments and messaging, and managed services for media, charity, gaming, e-mobility, and other digital service businesses in the United Kingdom.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives