- United Kingdom

- /

- Software

- /

- LSE:ALFA

Discovering Undiscovered Gems in United Kingdom Stocks September 2024

Reviewed by Simply Wall St

The United Kingdom market has recently faced challenges, with the FTSE 100 index closing lower due to weak trade data from China and broader global economic concerns. Despite these headwinds, there are still opportunities to be found in lesser-known stocks that demonstrate resilience and potential for growth. In this article, we will explore three such undiscovered gems in the UK stock market that could offer promising prospects amidst current market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Andrews Sykes Group | NA | 1.69% | 3.16% | ★★★★★★ |

| Globaltrans Investment | 15.40% | 2.68% | 16.51% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| London Security | 0.31% | 9.47% | 7.41% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | -0.35% | 1.18% | ★★★★★★ |

| Rights and Issues Investment Trust | NA | -3.68% | -4.07% | ★★★★★★ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| FW Thorpe | 3.34% | 11.37% | 9.41% | ★★★★★☆ |

| Goodwin | 52.21% | 9.26% | 13.12% | ★★★★★☆ |

| Mountview Estates | 16.64% | 4.50% | -0.59% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Warpaint London (AIM:W7L)

Simply Wall St Value Rating: ★★★★★★

Overview: Warpaint London PLC, with a market cap of £445.61 million, produces and sells cosmetics through its subsidiaries.

Operations: The company generates revenue primarily from its Own Brand segment (£87.07 million) and a smaller portion from Close-Out sales (£2.52 million).

Warpaint London, with no debt and a significant earnings growth of 122.4% over the past year, stands out in the Personal Products industry. The company’s profitability ensures its cash runway is not a concern. Forecasted earnings growth of 14.71% per year adds to its appeal, while recent insider selling might raise some eyebrows. The firm declared a final dividend of 6 pence per share in June 2024, showcasing confidence in its financial health and future prospects.

- Delve into the full analysis health report here for a deeper understanding of Warpaint London.

Understand Warpaint London's track record by examining our Past report.

Alfa Financial Software Holdings (LSE:ALFA)

Simply Wall St Value Rating: ★★★★★★

Overview: Alfa Financial Software Holdings PLC, with a market cap of £652.21 million, provides software and consultancy services to the auto and equipment finance industry across various regions including the United Kingdom, the United States, Europe, the Middle East, Africa, and internationally.

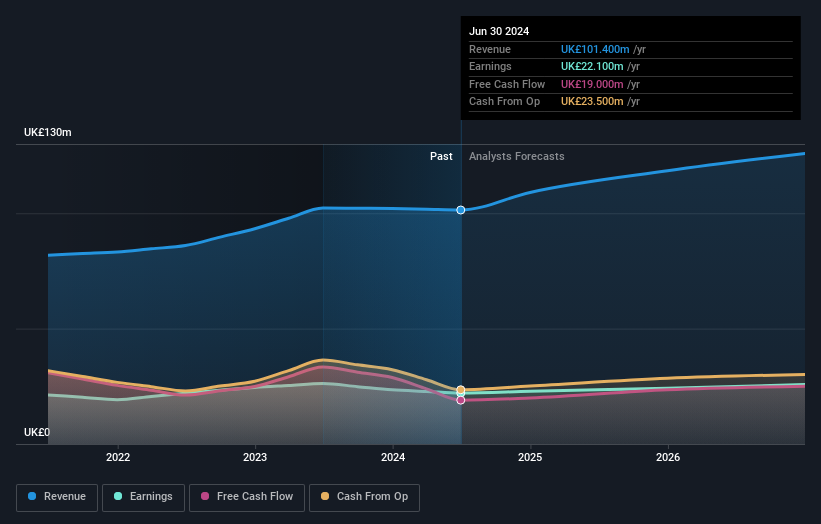

Operations: Alfa Financial Software Holdings PLC generates revenue primarily from the sale of software and related services, totaling £101.40 million. The company has a market cap of £652.21 million.

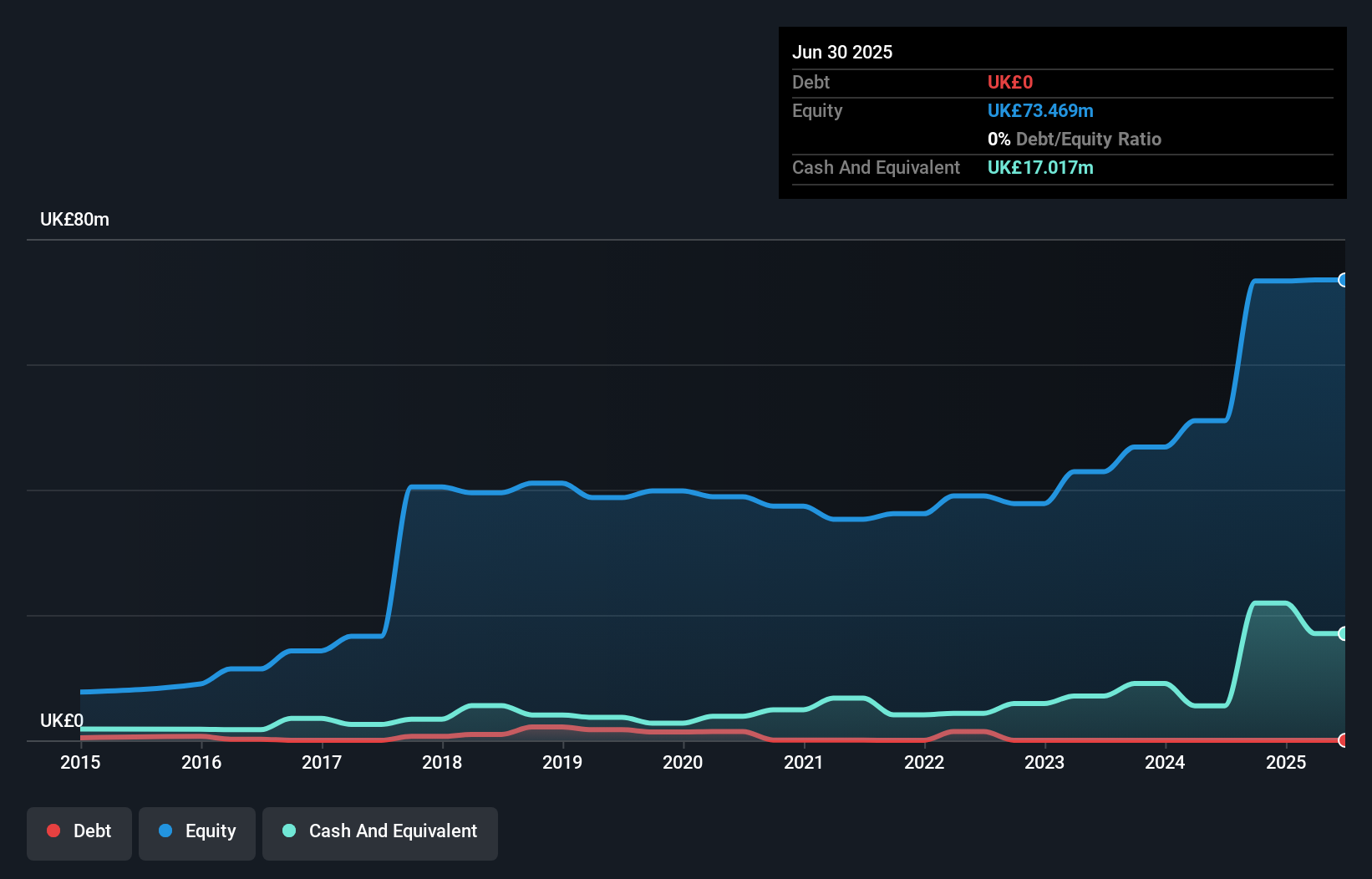

Alfa Financial Software Holdings, a notable player in the UK software sector, has shown mixed performance recently. The company reported H1 2024 sales of £52.3M and net income of £11.9M, down from £52.9M and £13.3M respectively last year. Despite a price-to-earnings ratio of 29.5x below the industry average of 36.8x, Alfa's earnings growth lagged at -15.6%. However, it remains debt-free with robust free cash flow at £33.4M as of June 2023.

Goodwin (LSE:GDWN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Goodwin PLC, with a market cap of £557.21 million, provides mechanical and refractory engineering solutions primarily in the United Kingdom, rest of Europe, the United States, the Pacific Basin, and internationally.

Operations: Goodwin PLC generates revenue primarily from its Mechanical Engineering (£156.94 million) and Refractory Engineering (£75.86 million) segments.

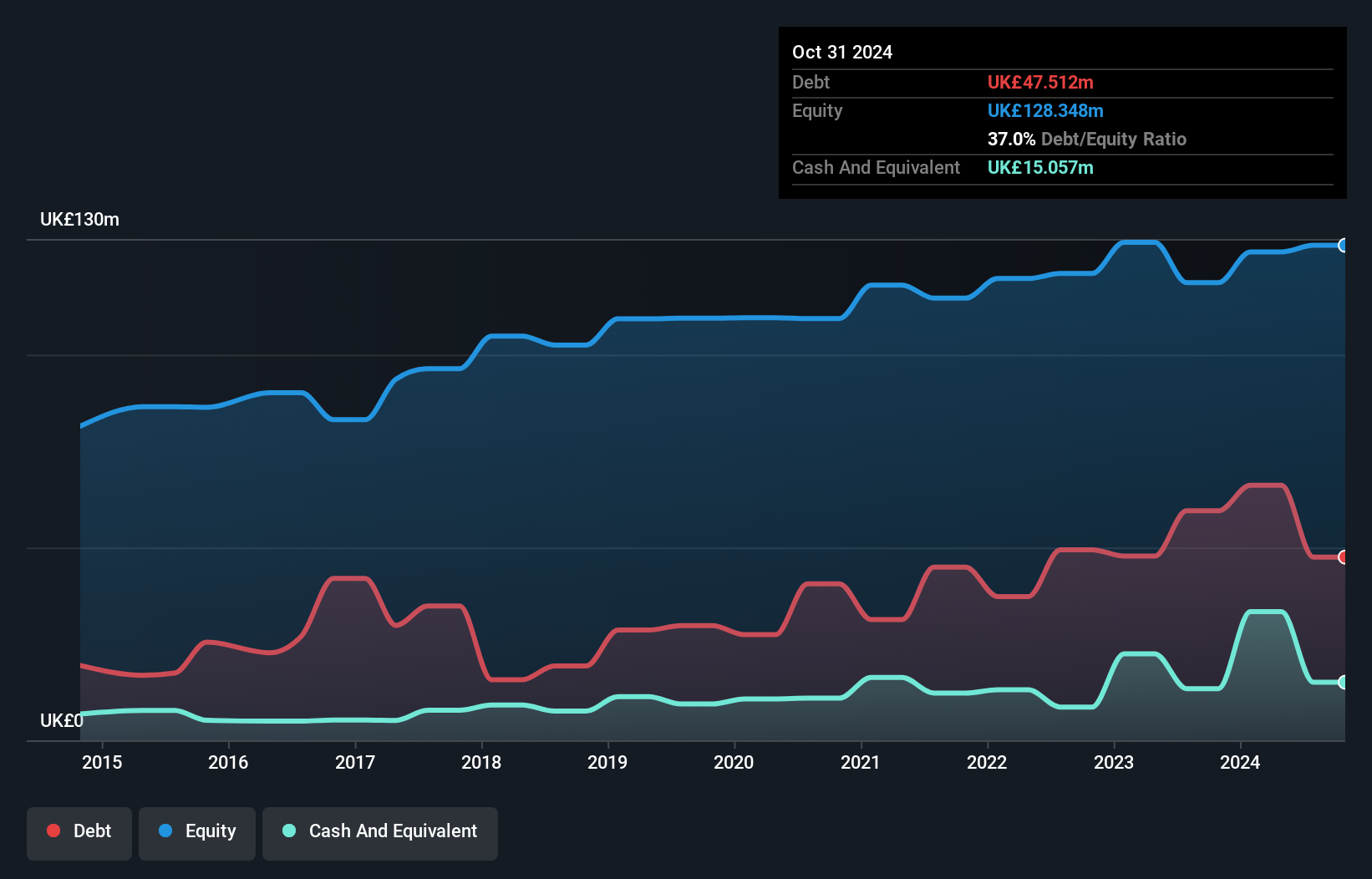

Goodwin PLC, a small yet promising player in the UK market, has demonstrated solid performance with sales reaching £191.26 million for the year ending April 2024, up from £185.74 million previously. Net income also rose to £16.9 million from £15.9 million last year, reflecting its robust earnings growth of 6.3%, outpacing the Machinery industry’s -4.7%. With a net debt to equity ratio at a satisfactory 25.9% and interest payments well covered by EBIT (9.8x), Goodwin remains financially sound despite increased debt levels over five years (52% from 26%).

- Click here and access our complete health analysis report to understand the dynamics of Goodwin.

Gain insights into Goodwin's historical performance by reviewing our past performance report.

Summing It All Up

- Investigate our full lineup of 82 UK Undiscovered Gems With Strong Fundamentals right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:ALFA

Alfa Financial Software Holdings

Through its subsidiaries, provides software and consultancy services to the auto and equipment finance industry in the United Kingdom, the United States, rest of Europe, the Middle East, Africa, and internationally.

Flawless balance sheet and good value.