- United Kingdom

- /

- Specialized REITs

- /

- LSE:BYG

3 UK Dividend Stocks Offering Yields Up To 6%

Reviewed by Simply Wall St

In recent times, the UK market has faced challenges, with the FTSE 100 index experiencing declines due to weak trade data from China and global economic uncertainties. Amid these fluctuations, dividend stocks can offer a measure of stability, providing investors with regular income even when market conditions are volatile.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| WPP (LSE:WPP) | 7.02% | ★★★★★★ |

| Man Group (LSE:EMG) | 7.78% | ★★★★★☆ |

| Keller Group (LSE:KLR) | 3.50% | ★★★★★☆ |

| Treatt (LSE:TET) | 3.20% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 5.19% | ★★★★★☆ |

| DCC (LSE:DCC) | 4.15% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 4.64% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 7.16% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.64% | ★★★★★☆ |

| James Latham (AIM:LTHM) | 7.48% | ★★★★★☆ |

Click here to see the full list of 61 stocks from our Top UK Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

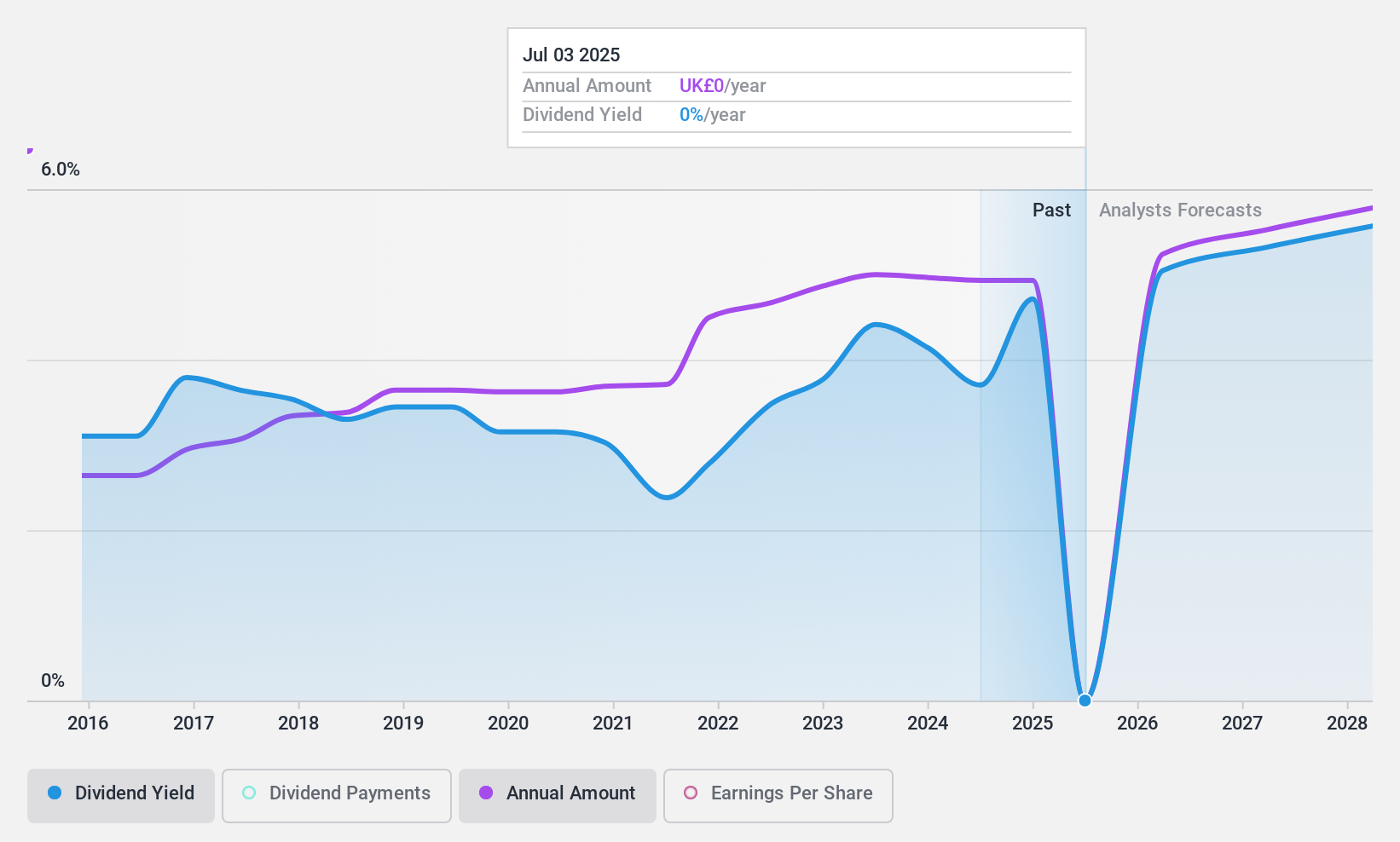

Big Yellow Group (LSE:BYG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Big Yellow Group is the UK's leading brand in self storage, with a market cap of £1.91 billion.

Operations: Big Yellow Group generates its revenue primarily from the provision of self storage and related services, amounting to £203.01 million.

Dividend Yield: 4.6%

Big Yellow Group offers a reliable dividend yield of 4.64%, though it falls short compared to the top UK payers. Its dividends have grown steadily over the past decade, with stable payments covered by both earnings and cash flows at payout ratios of 76.8% and 77.5%, respectively. Despite recent earnings volatility due to large one-off items, BYG trades at a favorable price-to-earnings ratio of 7.2x, suggesting good relative value in its sector.

- Navigate through the intricacies of Big Yellow Group with our comprehensive dividend report here.

- The analysis detailed in our Big Yellow Group valuation report hints at an deflated share price compared to its estimated value.

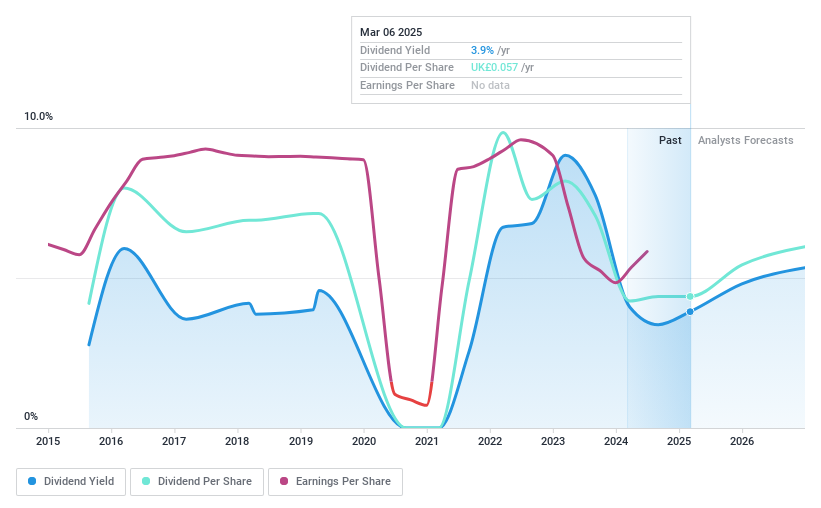

Eurocell (LSE:ECEL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Eurocell plc manufactures, distributes, and recycles PVC building products such as windows, doors, and roofline components in the United Kingdom and the Republic of Ireland, with a market cap of £156 million.

Operations: Eurocell plc's revenue is primarily derived from its Profiles segment, contributing £209.80 million, and its Building Plastics segment, adding £212.30 million.

Dividend Yield: 4%

Eurocell's dividend payments, though historically volatile, are currently well-covered by earnings and cash flows with payout ratios of 61.8% and 18.3%, respectively. Recent earnings growth of £10.5 million supports a proposed final dividend increase to 6.1 pence per share for the year. The company has also initiated a £5 million share buyback program aimed at enhancing shareholder value through reduced capital and improved earnings per share, despite trading below estimated fair value by 60.5%.

- Click to explore a detailed breakdown of our findings in Eurocell's dividend report.

- Our valuation report here indicates Eurocell may be undervalued.

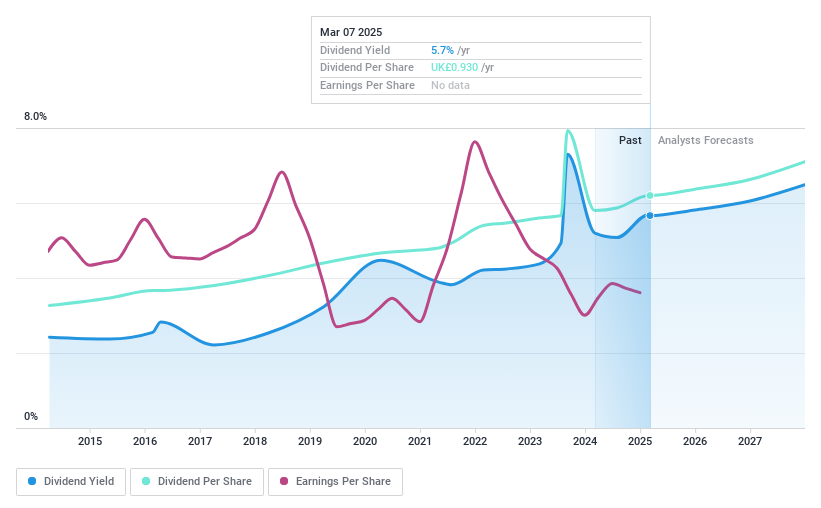

Rathbones Group (LSE:RAT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Rathbones Group Plc, with a market cap of £1.60 billion, offers wealth and asset management services in the United Kingdom and Channel Islands through its subsidiaries.

Operations: Rathbones Group Plc generates its revenue from two primary segments: Wealth Management, contributing £814.20 million, and Asset Management, adding £81.70 million.

Dividend Yield: 6%

Rathbones Group's dividend, though historically volatile and currently not well-covered by earnings due to a high payout ratio of 147.3%, is supported by a reasonable cash payout ratio of 40.6%. The company announced an interim dividend increase to 93 pence for the year, reflecting confidence in its financial position. Recent executive changes, including the upcoming CEO transition to Jonathan Sorrell, aim to bolster strategic growth initiatives following successful integration with Investec Wealth & Investment (UK).

- Delve into the full analysis dividend report here for a deeper understanding of Rathbones Group.

- Our expertly prepared valuation report Rathbones Group implies its share price may be too high.

Summing It All Up

- Delve into our full catalog of 61 Top UK Dividend Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Big Yellow Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:BYG

Very undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives