- United Kingdom

- /

- Machinery

- /

- AIM:RNO

UK Penny Stocks To Watch In March 2025

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index recently faced downward pressure due to weak trade data from China, highlighting ongoing global economic challenges. Amid such fluctuations in major indices, investors often turn their attention to smaller-cap stocks for potential opportunities. Although the term "penny stocks" might seem outdated, these shares in smaller or newer companies can still offer significant growth potential when backed by strong financial fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Warpaint London (AIM:W7L) | £3.60 | £290.83M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.72 | £423.13M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £2.85 | £283.45M | ★★★★☆☆ |

| Begbies Traynor Group (AIM:BEG) | £0.916 | £145.98M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.285 | £413.06M | ★★★★★★ |

| Van Elle Holdings (AIM:VANL) | £0.375 | £40.58M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £0.805 | £68.24M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.06 | £146.97M | ★★★★★☆ |

| Luceco (LSE:LUCE) | £1.342 | £206.98M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.29 | £164.28M | ★★★★★☆ |

Click here to see the full list of 443 stocks from our UK Penny Stocks screener.

We'll examine a selection from our screener results.

Avingtrans (AIM:AVG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Avingtrans plc, with a market cap of £116.78 million, operates through its subsidiaries to deliver engineered components, systems, and services across the energy, medical, and infrastructure sectors in various regions including the UK, Europe, USA, Africa, Middle East, Americas, Caribbean, China and Asia Pacific.

Operations: The company's revenue is primarily derived from its Energy Advanced Engineering Systems segment, which accounts for £146.03 million, and the Medical and Industrial Imaging segment, contributing £4.41 million.

Market Cap: £116.78M

Avingtrans plc, with a market cap of £116.78 million, has demonstrated stable financial health and growth potential within the penny stock segment. The company reported half-year sales of £79.02 million, an increase from the previous year's £65.19 million, alongside a net income rise to £3.29 million from £2.84 million. Despite low return on equity at 3.8%, Avingtrans maintains satisfactory debt levels and high-quality earnings, with short-term assets exceeding liabilities significantly. Recent contracts like Booth Industries' new £4.5 million HS2 project further bolster its revenue prospects while continuing gradual dividend increases reflect shareholder confidence.

- Dive into the specifics of Avingtrans here with our thorough balance sheet health report.

- Examine Avingtrans' earnings growth report to understand how analysts expect it to perform.

Renold (AIM:RNO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Renold plc manufactures and sells high precision engineered products and solutions across various international markets, with a market cap of £77.79 million.

Operations: The company generates revenue from its Chain segment, which accounts for £191 million, and its Torque Transmission segment, contributing £53.9 million.

Market Cap: £77.79M

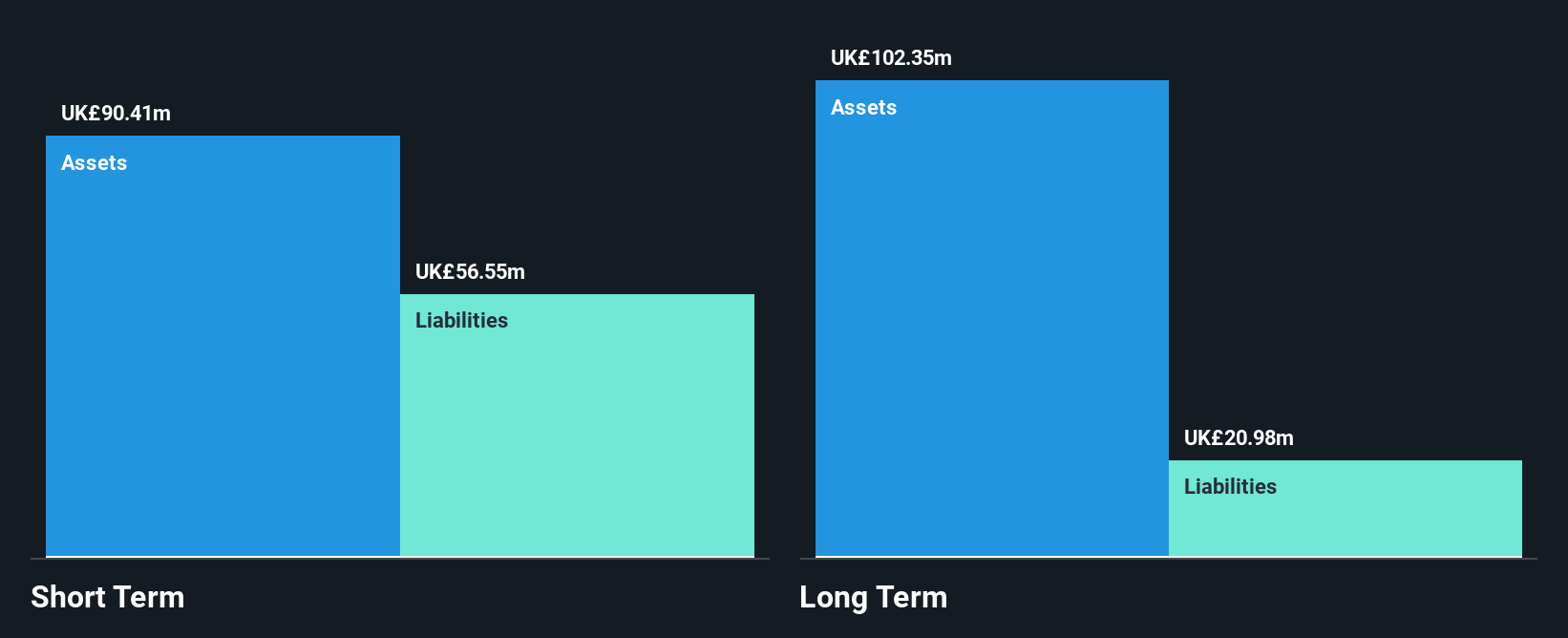

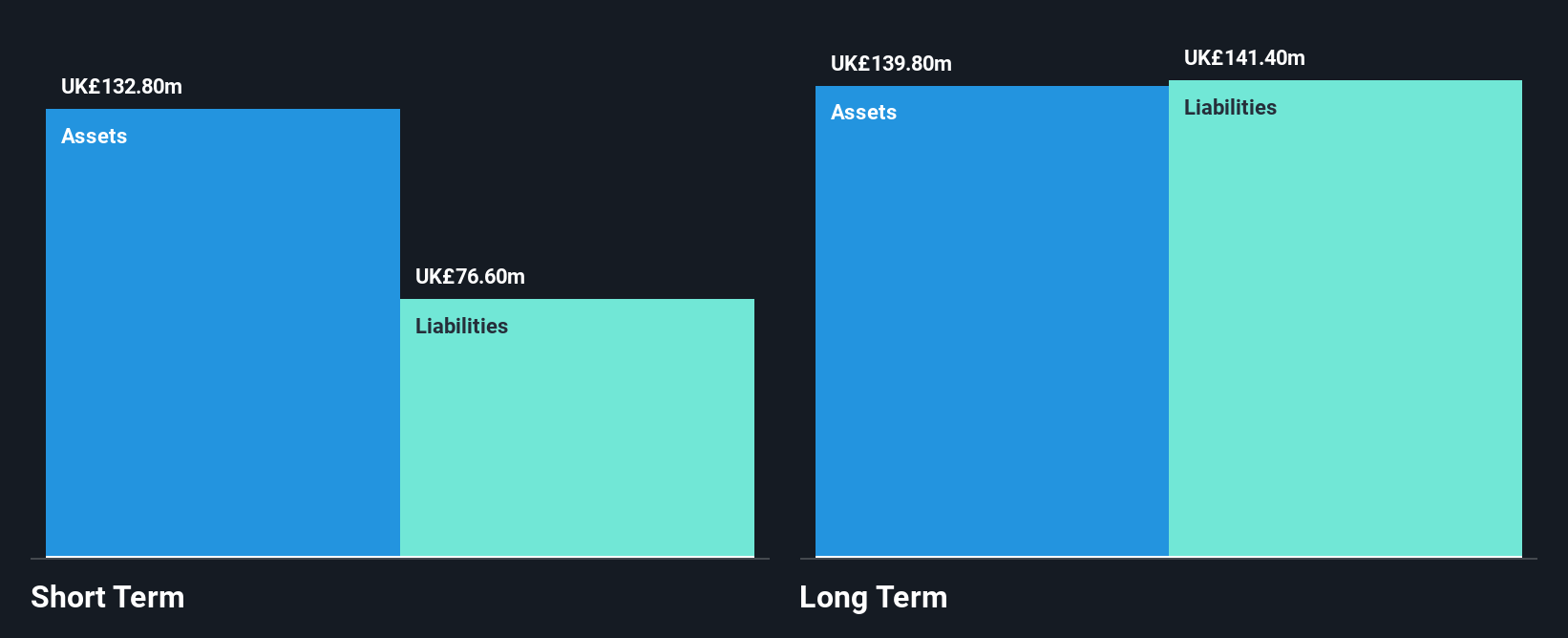

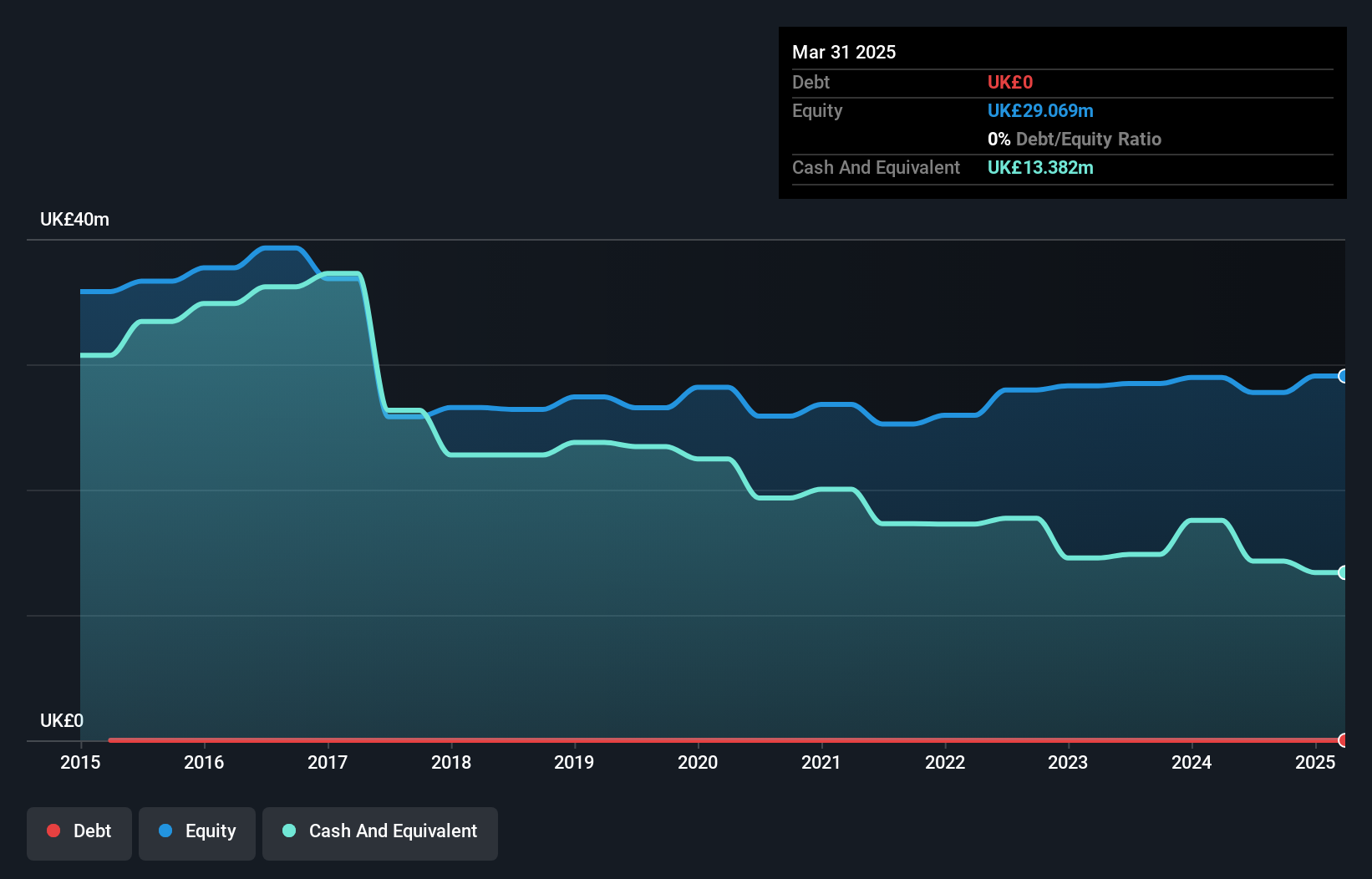

Renold plc, with a market cap of £77.79 million, shows promise within the penny stock segment due to its stable financial position and growth potential. The company has improved from negative shareholder equity five years ago to positive levels, indicating financial recovery. Its short-term assets (£132.8M) cover short-term liabilities (£76.6M), though long-term liabilities remain uncovered by these assets (£141.4M). Despite high debt levels (net debt to equity ratio of 77.3%), interest payments are well covered by EBIT (5.2x). While recent earnings growth was negative, analysts forecast a 23% annual increase in earnings moving forward, suggesting future potential for investors seeking value opportunities in this category.

- Click here to discover the nuances of Renold with our detailed analytical financial health report.

- Explore Renold's analyst forecasts in our growth report.

Record (LSE:REC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Record plc, with a market cap of approximately £1 billion, offers currency and derivative management services across the United Kingdom, North America, Continental Europe, Australia, and other international markets.

Operations: The company's revenue is derived from £45.02 million in currency and derivatives management services.

Market Cap: £100.02M

Record plc, with a market cap of approximately £1 billion, presents a mixed picture within the penny stock landscape. The company has demonstrated consistent earnings growth over the past five years at 13.2% per annum, although recent negative earnings growth challenges its industry comparison. Record's high return on equity of 31.7% and debt-free status highlight financial strength, while short-term assets comfortably cover both short- and long-term liabilities. However, its dividend yield of 8.85% is not well supported by earnings or free cash flows, and the board's inexperience may pose governance risks despite stable weekly volatility and high-quality past earnings.

- Get an in-depth perspective on Record's performance by reading our balance sheet health report here.

- Evaluate Record's prospects by accessing our earnings growth report.

Taking Advantage

- Get an in-depth perspective on all 443 UK Penny Stocks by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:RNO

Renold

Engages in the manufacture and sale of high precision engineered products and solutions in the United Kingdom, rest of Europe, the United States, Canada, Australasia, China, India, and internationally.

Very undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives