- United Kingdom

- /

- Food

- /

- AIM:MPE

UK Dividend Stocks To Watch In November 2024

Reviewed by Simply Wall St

The United Kingdom market has remained flat over the last week but is up 6.1% over the past year, with earnings forecast to grow by 15% annually. In this context, identifying strong dividend stocks can be a strategic approach for investors seeking reliable income and potential growth in a stable market environment.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| James Latham (AIM:LTHM) | 5.99% | ★★★★★★ |

| Keller Group (LSE:KLR) | 3.21% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 3.33% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 8.50% | ★★★★★☆ |

| Man Group (LSE:EMG) | 6.19% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 4.26% | ★★★★★☆ |

| Plus500 (LSE:PLUS) | 6.15% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.83% | ★★★★★☆ |

| DCC (LSE:DCC) | 3.55% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 6.97% | ★★★★★☆ |

Click here to see the full list of 65 stocks from our Top UK Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

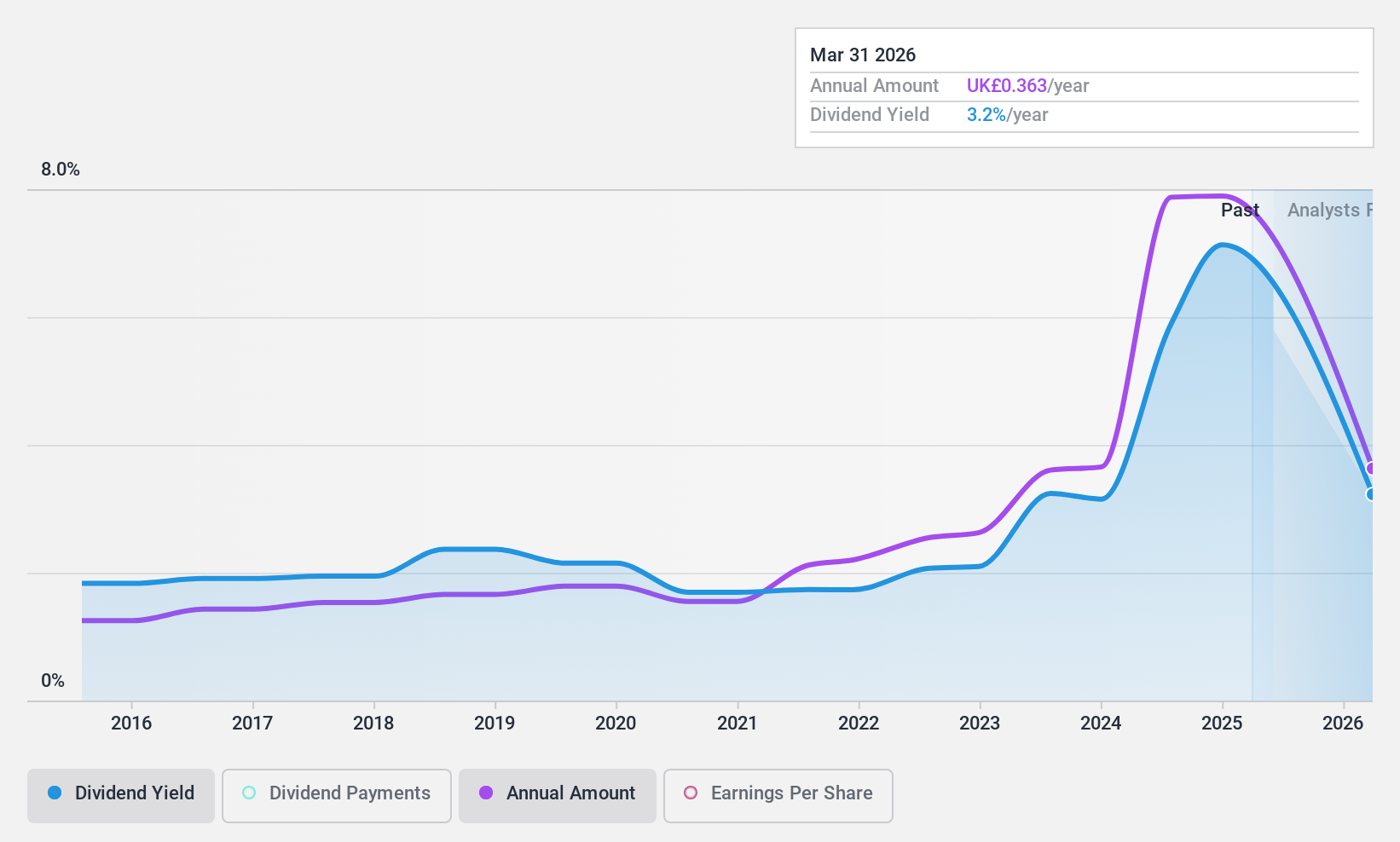

James Latham (AIM:LTHM)

Simply Wall St Dividend Rating: ★★★★★★

Overview: James Latham plc, with a market cap of £262.49 million, imports and distributes timbers, panels, and decorative surfaces across the United Kingdom, Republic of Ireland, Europe, and internationally.

Operations: James Latham plc generates revenue of £366.51 million from its timber importing and distribution segment.

Dividend Yield: 6%

James Latham offers a compelling dividend profile with stable and reliable payouts over the past decade. Its dividends are well-covered by earnings, with a payout ratio of 30%, and adequately supported by cash flows at an 87.4% cash payout ratio. Despite forecasts indicating a decline in earnings, its price-to-earnings ratio of 11.6x suggests good value relative to the UK market average of 16.3x, while maintaining an attractive dividend yield in the top quartile at 5.99%.

- Get an in-depth perspective on James Latham's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential overvaluation of James Latham shares in the market.

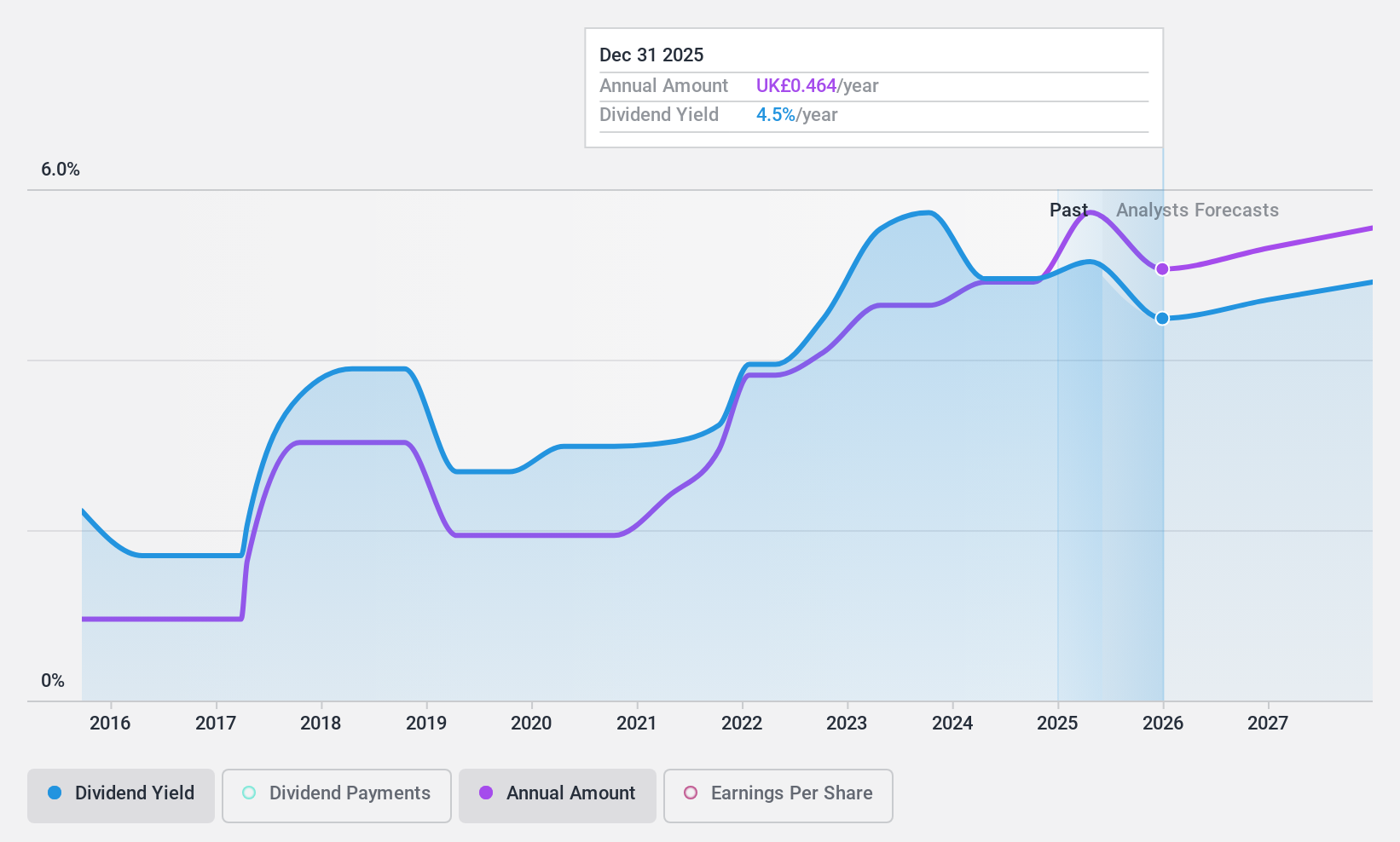

M.P. Evans Group (AIM:MPE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: M.P. Evans Group PLC, with a market cap of £507.68 million, is involved in the ownership and development of oil palm plantations in Indonesia and Malaysia through its subsidiaries.

Operations: M.P. Evans Group PLC generates revenue primarily from its plantation operations in Indonesia, amounting to $336.59 million.

Dividend Yield: 4.5%

M.P. Evans Group has shown strong earnings growth, with net income rising to US$30.08 million for H1 2024, supporting a 20% increase in interim dividends to 15 pence per share. Despite a relatively low dividend yield of 4.54%, the dividends are well-covered by earnings and cash flows, with payout ratios of 48.9% and 33.3%, respectively. However, its dividend history is marked by volatility and unreliability over the past decade, posing a risk for consistent income seekers.

- Click to explore a detailed breakdown of our findings in M.P. Evans Group's dividend report.

- Upon reviewing our latest valuation report, M.P. Evans Group's share price might be too pessimistic.

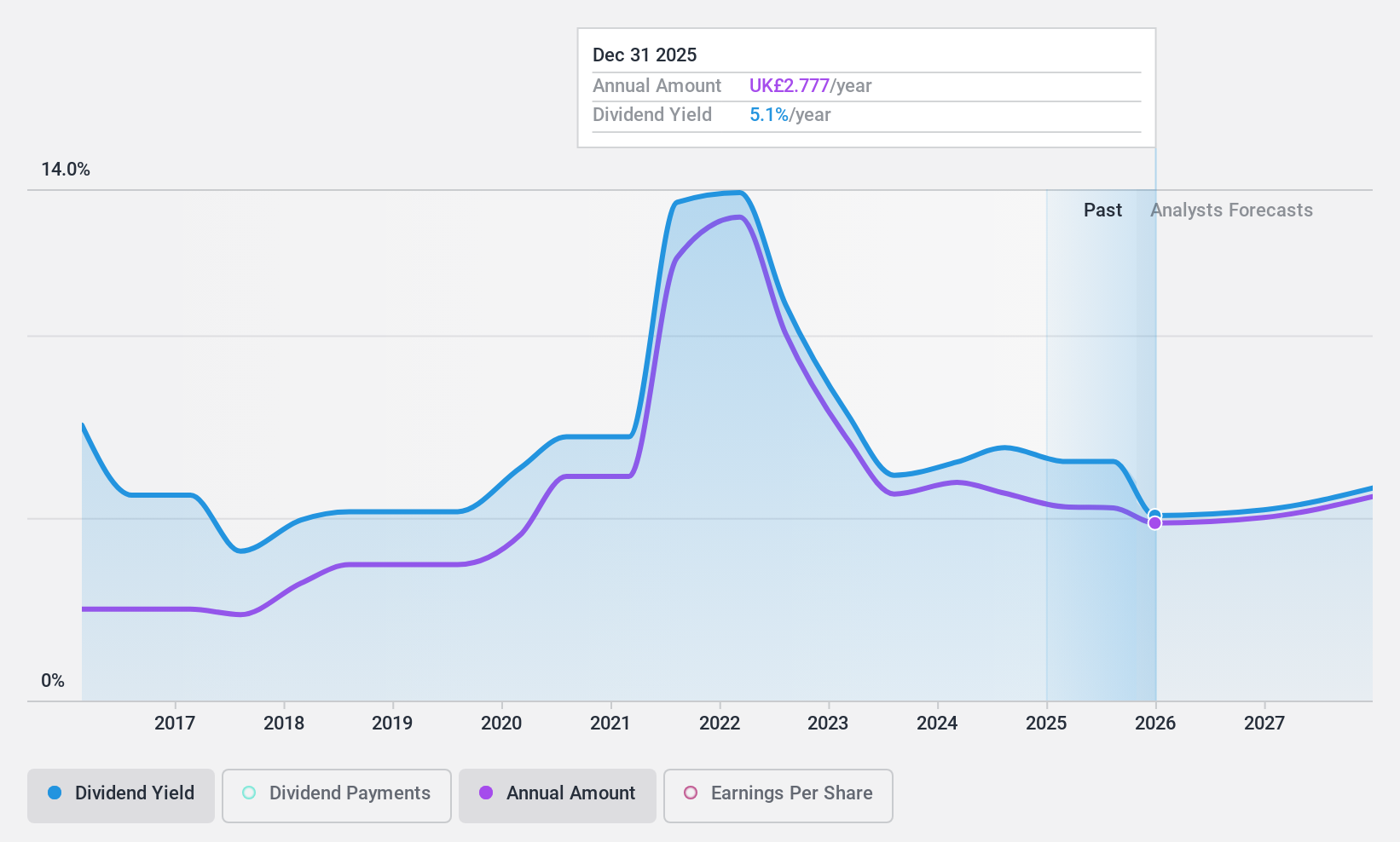

Rio Tinto Group (LSE:RIO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Rio Tinto Group is involved in the exploration, mining, and processing of mineral resources globally, with a market cap of £83.69 billion.

Operations: Rio Tinto Group's revenue segments include Copper at $7.60 billion, Iron Ore at $31.86 billion, Minerals at $5.78 billion, and Aluminium at $12.51 billion.

Dividend Yield: 7.0%

Rio Tinto's dividend yield of 6.99% ranks among the top 25% in the UK market, yet its sustainability is questionable due to a high cash payout ratio of 98.9%. Recent strategic alliances, such as with GravitHy for steel decarbonisation and SPIC for battery swap technology, highlight Rio Tinto's commitment to innovation and emissions reduction. However, its dividend history has been volatile over the past decade, raising concerns about reliability for income-focused investors.

- Dive into the specifics of Rio Tinto Group here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Rio Tinto Group is trading behind its estimated value.

Next Steps

- Reveal the 65 hidden gems among our Top UK Dividend Stocks screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:MPE

M.P. Evans Group

Through its subsidiaries, engages in the ownership and development of oil palm plantations in Indonesia and Malaysia.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives