The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like Crestchic (LON:LOAD), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for Crestchic

How Quickly Is Crestchic Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. Over the last three years, Crestchic has grown EPS by 17% per year. That growth rate is fairly good, assuming the company can keep it up.

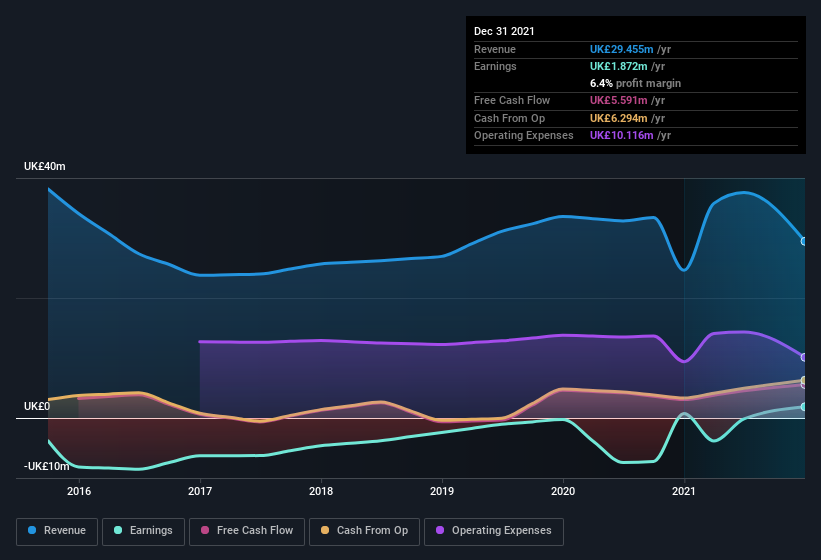

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Crestchic shareholders can take confidence from the fact that EBIT margins are up from 7.3% to 13%, and revenue is growing. Ticking those two boxes is a good sign of growth, in our book.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Crestchic.

Are Crestchic Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Not only did Crestchic insiders refrain from selling stock during the year, but they also spent UK£77k buying it. That paints the company in a nice light, as it signals that its leaders are feeling confident in where the company is heading. We also note that it was the Executive Chairman, Peter Harris, who made the biggest single acquisition, paying UK£34k for shares at about UK£1.69 each.

Is Crestchic Worth Keeping An Eye On?

As previously touched on, Crestchic is a growing business, which is encouraging. It's not easy for business to grow EPS, but Crestchic has shown the strengths to do just that. The real kicker is that insiders have been accumulating, suggesting that those who understand the company best see some potential. We should say that we've discovered 3 warning signs for Crestchic that you should be aware of before investing here.

The good news is that Crestchic is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:LOAD

Crestchic

Crestchic Plc, together with its subsidiaries, manufactures, hires, and sells specialist industrial equipment in the United Kingdom, Continental Europe, North America, South America, Australia, New Zealand, the Middle East, and Asia.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives