- United Kingdom

- /

- Building

- /

- AIM:JHD

Top UK Dividend Stocks James Halstead And 2 More Picks

Reviewed by Simply Wall St

As the FTSE 100 and FTSE 250 indices face downward pressure due to weak trade data from China, UK investors are increasingly seeking stability in dividend stocks. In such uncertain times, companies with a strong track record of consistent dividend payouts, like James Halstead and others, can offer some reassurance amidst market volatility.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Keller Group (LSE:KLR) | 3.11% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 3.23% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 7.72% | ★★★★★☆ |

| Man Group (LSE:EMG) | 6.02% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 4.39% | ★★★★★☆ |

| Plus500 (LSE:PLUS) | 5.78% | ★★★★★☆ |

| DCC (LSE:DCC) | 3.54% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 6.92% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.83% | ★★★★★☆ |

| James Latham (AIM:LTHM) | 6.32% | ★★★★★☆ |

Click here to see the full list of 60 stocks from our Top UK Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

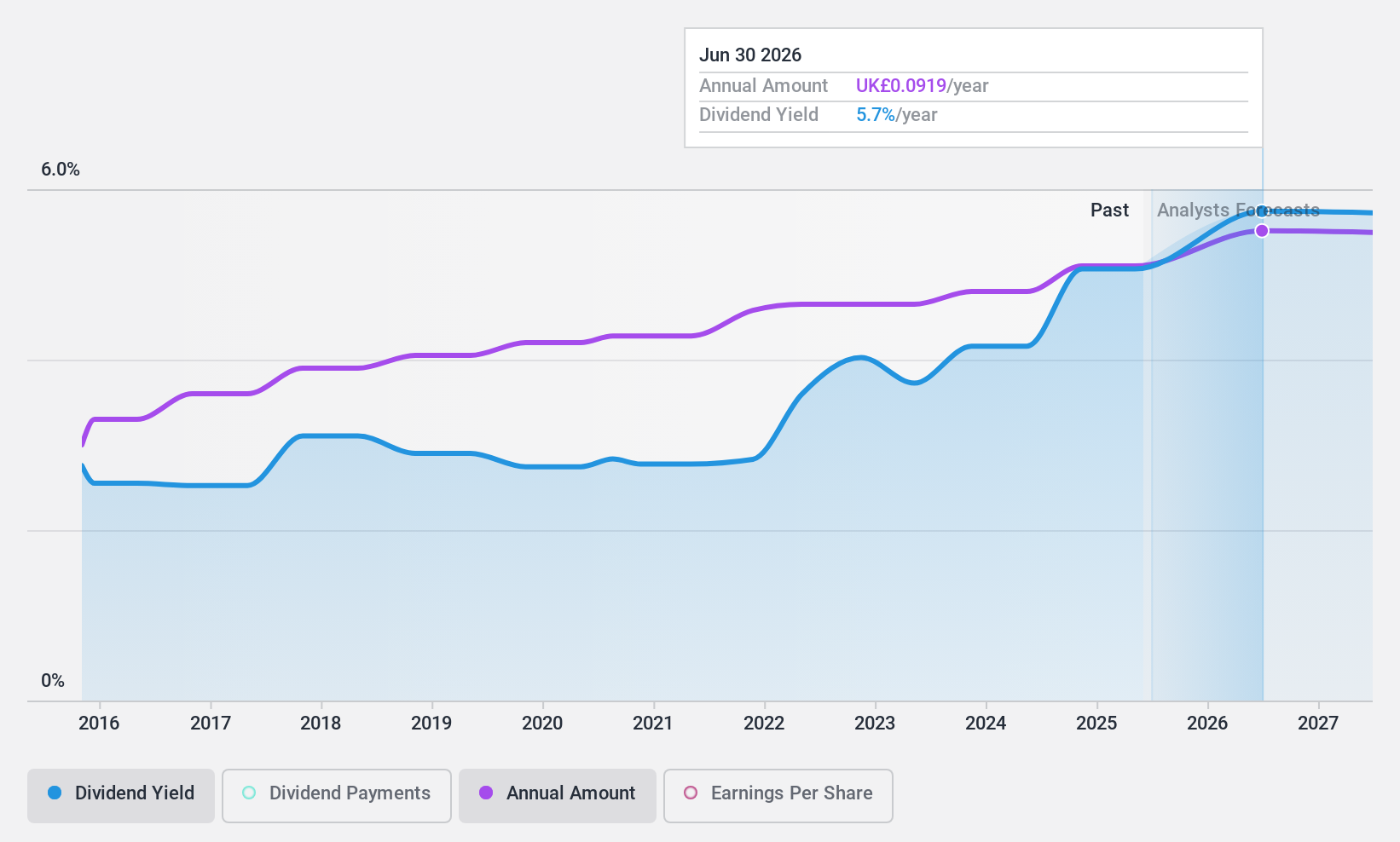

James Halstead (AIM:JHD)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: James Halstead plc manufactures and supplies flooring products for both commercial and domestic uses across the United Kingdom, Europe, Scandinavia, Australasia, Asia, and other international markets with a market cap of £773.14 million.

Operations: The company's revenue is primarily derived from the manufacture and distribution of flooring products, amounting to £274.88 million.

Dividend Yield: 4.6%

James Halstead has demonstrated a reliable dividend history over the past decade, with stable and growing payments. The proposed final dividend increase to 6.0 pence, totaling 8.5 pence for the year, marks its 49th consecutive annual rise. Despite a slight decline in sales to £274.88 million and net income to £41.52 million, dividends remain covered by earnings (payout ratio: 85.3%) and cash flows (cash payout ratio: 77%), supporting sustainability amidst leadership changes with Chairman Anthony Wild stepping down soon.

- Delve into the full analysis dividend report here for a deeper understanding of James Halstead.

- According our valuation report, there's an indication that James Halstead's share price might be on the cheaper side.

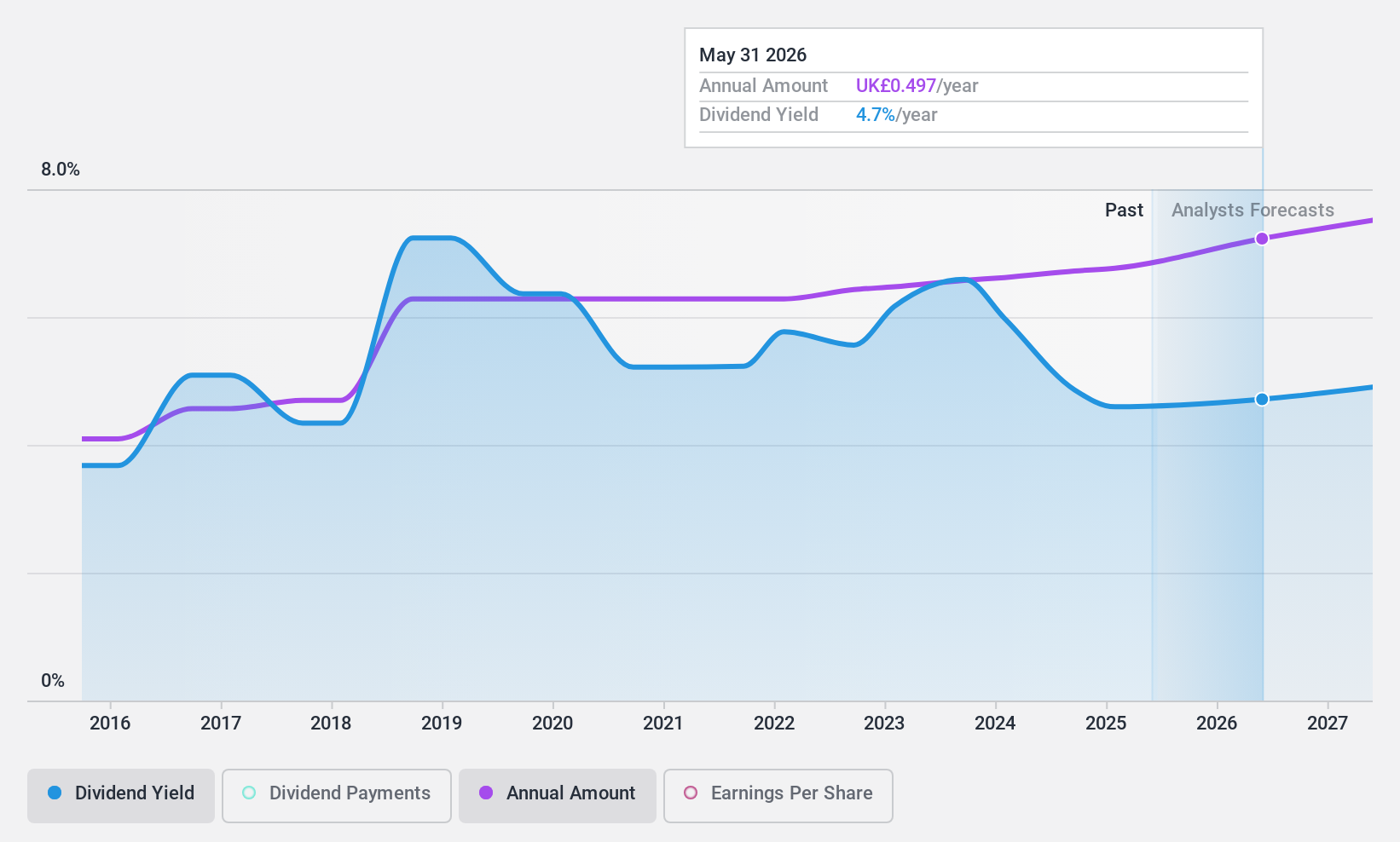

IG Group Holdings (LSE:IGG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: IG Group Holdings plc is a fintech company that operates in the online trading business globally, with a market cap of £3.45 billion.

Operations: IG Group Holdings plc generates revenue primarily from its brokerage segment, amounting to £954.50 million.

Dividend Yield: 4.8%

IG Group Holdings offers a reliable dividend yield of 4.76%, although it is lower than the top UK dividend payers. The company's dividends have been stable and growing over the past decade, supported by a payout ratio of 58.2% and cash payout ratio of 43.2%, indicating sustainability through earnings and cash flows. Recent executive changes, including Clifford Abrahams' appointment as CFO, may influence strategic financial management, potentially impacting future dividend policies amidst its undervalued trading position relative to peers.

- Get an in-depth perspective on IG Group Holdings' performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that IG Group Holdings is trading behind its estimated value.

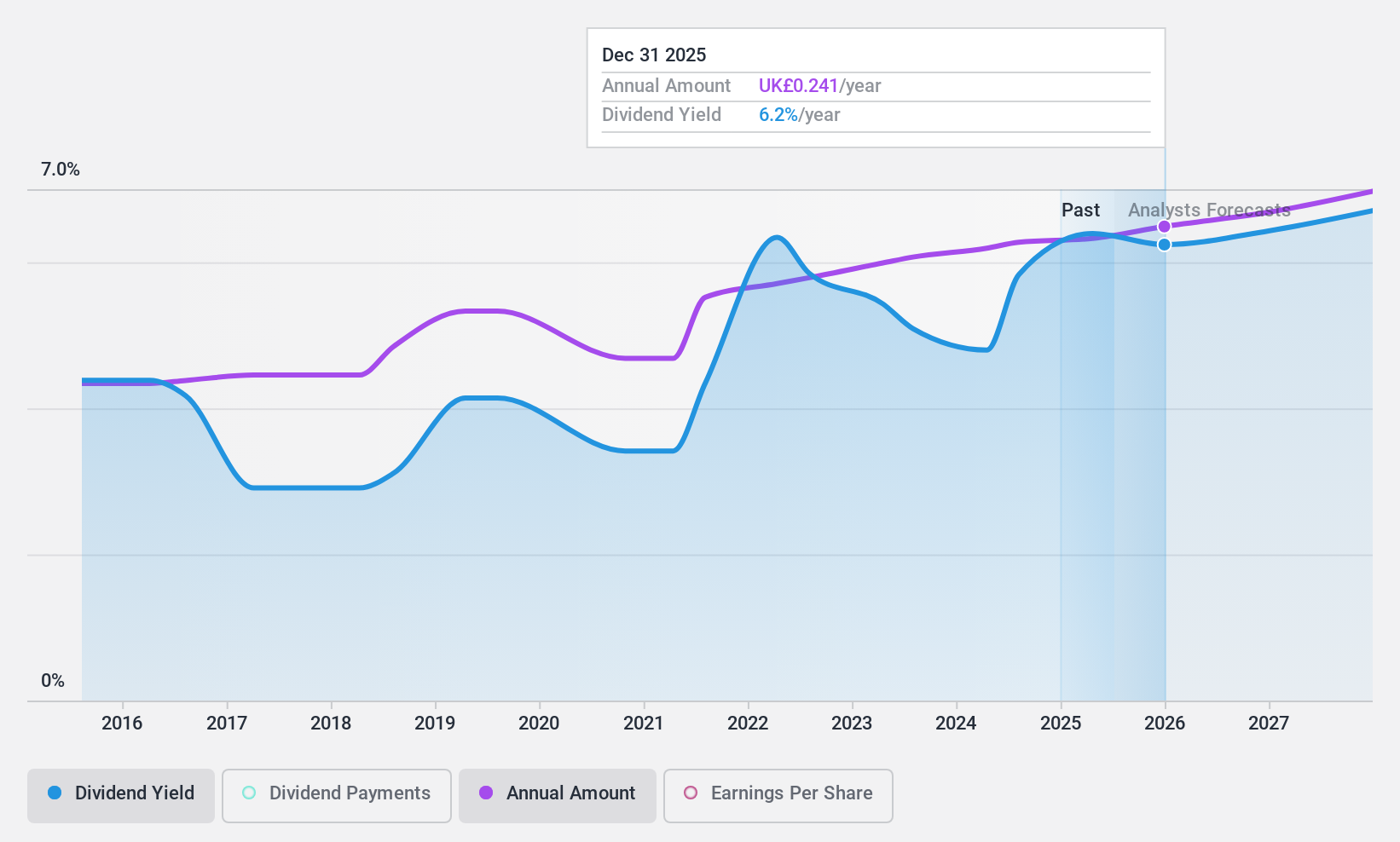

Vesuvius (LSE:VSVS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Vesuvius plc offers molten metal flow engineering and technology services to the steel and foundry casting industries globally, with a market cap of approximately £1.10 billion.

Operations: Vesuvius plc generates its revenue from several key segments, including £496.80 million from Foundry, £784.90 million from Steel - Flow Control, £40.70 million from Steel - Sensors & Probes, and £548.60 million from Steel - Advanced Refractories.

Dividend Yield: 5.5%

Vesuvius plc's dividend payments, while covered by earnings and cash flows with payout ratios of 59.8% and 58.2% respectively, have been volatile over the past decade. Trading at a significant discount to estimated fair value, the company's dividend yield of 5.47% is below top-tier UK payers. Recent initiatives include a £50 million share buyback program aimed at capital reduction and potential bolt-on acquisitions in North America, reflecting strategic financial maneuvers amidst fluctuating profit margins.

- Click here to discover the nuances of Vesuvius with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Vesuvius' current price could be quite moderate.

Next Steps

- Gain an insight into the universe of 60 Top UK Dividend Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:JHD

James Halstead

Manufactures and supplies flooring products for commercial and domestic uses in the United Kingdom, rest of Europe, Scandinavia, Australasia, Asia, and internationally.

Flawless balance sheet established dividend payer.