- United Kingdom

- /

- Electrical

- /

- AIM:CKT

3 Promising UK Penny Stocks With Under £100M Market Cap

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines influenced by weak trade data from China. Despite these broader market pressures, certain investment opportunities remain attractive, particularly in the realm of penny stocks. Although the term "penny stocks" might seem outdated, these smaller or newer companies can offer significant growth potential when they possess strong financial foundations and solid fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Begbies Traynor Group (AIM:BEG) | £0.926 | £147.58M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.065 | £778.12M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.71 | £422.96M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.415 | £180.2M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £4.60 | £87.73M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.43 | £341.13M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.065 | £90.69M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.95 | £188.38M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.08 | £148.39M | ★★★★★☆ |

| QinetiQ Group (LSE:QQ.) | £3.818 | £2.13B | ★★★★★☆ |

Click here to see the full list of 445 stocks from our UK Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Checkit (AIM:CKT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Checkit plc, with a market cap of £19.98 million, provides intelligent operations management platforms for deskless workforces in the United Kingdom and the Americas.

Operations: The company's revenue is derived from its Electronic Components & Parts segment, totaling £13 million.

Market Cap: £19.98M

Checkit plc, with a market cap of £19.98 million, operates in the intelligent operations management space. The company is currently unprofitable and its revenue from the Electronic Components & Parts segment stands at £13 million. Checkit has no debt, and its short-term assets (£14.8M) exceed both long-term (£400K) and short-term liabilities (£8.6M), providing some financial stability despite ongoing losses which have slightly increased over five years. Revenue is forecast to grow by 15% annually; however, profitability isn't expected within three years. Recent board changes include the resignation of non-executive director Simon Greenman after three years of service.

- Unlock comprehensive insights into our analysis of Checkit stock in this financial health report.

- Review our growth performance report to gain insights into Checkit's future.

Naked Wines (AIM:WINE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Naked Wines plc operates in the direct-to-consumer wine retail sector across Australia, the United Kingdom, and the United States, with a market capitalization of £35.52 million.

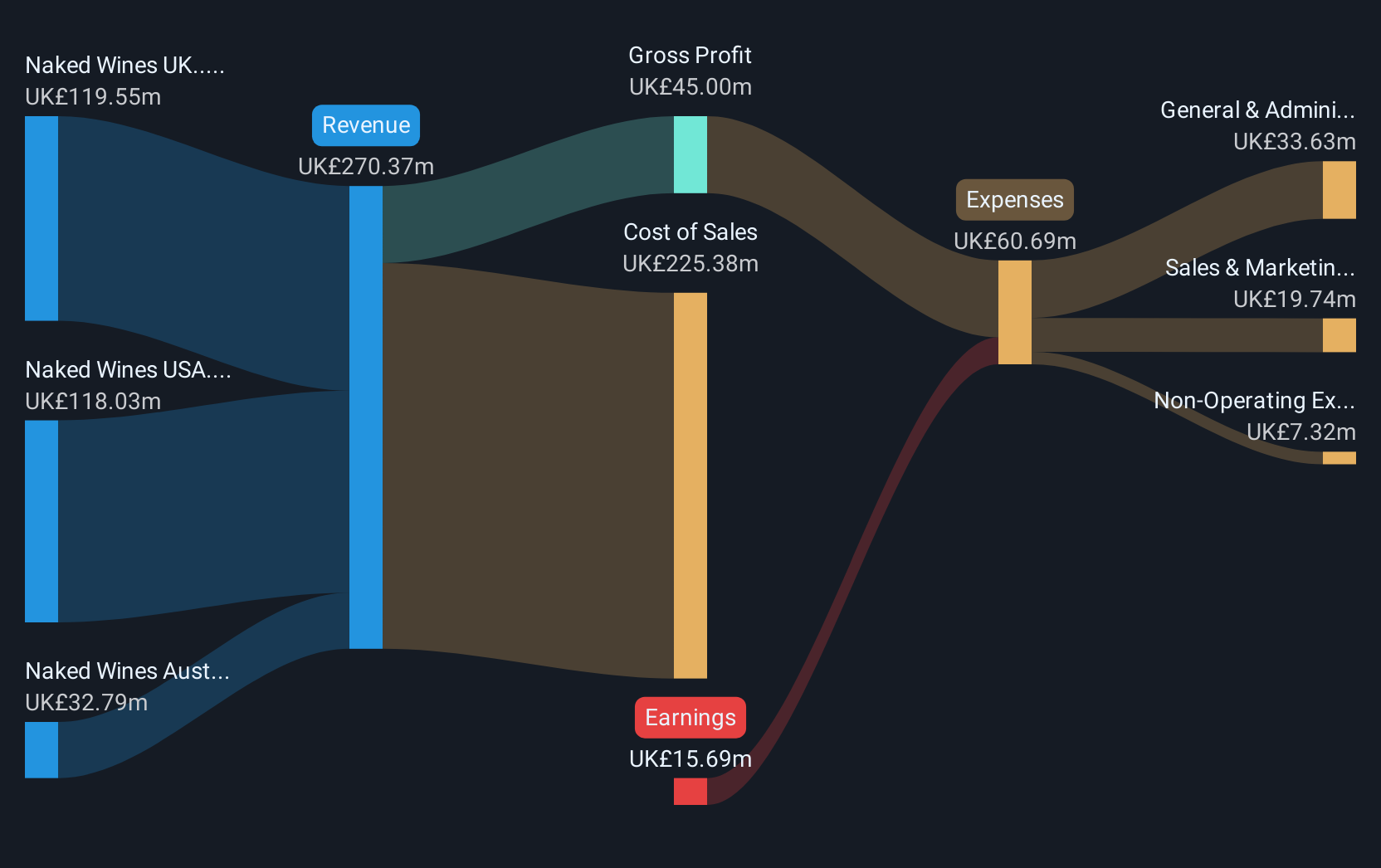

Operations: The company's revenue is derived from three key regions: £119.55 million from the UK, £118.03 million from the USA, and £32.79 million from Australia.

Market Cap: £35.52M

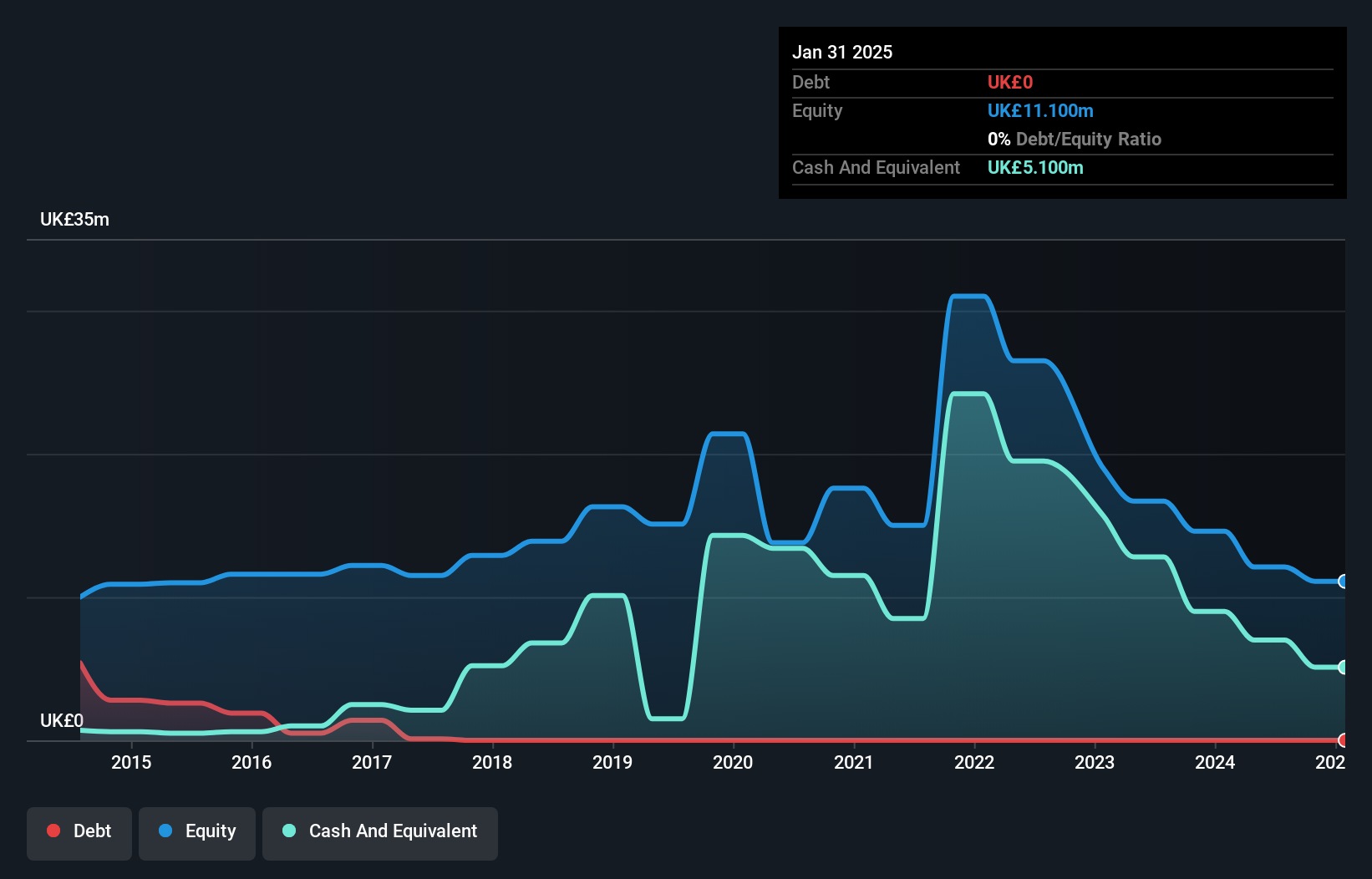

Naked Wines plc, with a market cap of £35.52 million, operates in the direct-to-consumer wine sector across key markets including the UK (£119.55M), USA (£118.03M), and Australia (£32.79M). Despite being unprofitable, it maintains financial stability with short-term assets (£178.8M) exceeding both long-term (£7.8M) and short-term liabilities (£116.1M). The company has reduced its debt to equity ratio significantly over five years and holds more cash than total debt, ensuring a cash runway for over three years even as free cash flow shrinks annually by 28.5%. Recent earnings show improved losses from £11.67 million to £6.53 million year-over-year for H1 2024-2025 but declining sales from £132.34 million to £112.3 million in the same period.

- Jump into the full analysis health report here for a deeper understanding of Naked Wines.

- Learn about Naked Wines' future growth trajectory here.

Record (LSE:REC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Record plc, with a market cap of £91.37 million, offers currency and derivative management services across the United Kingdom, North America, Continental Europe, Australia, and other international markets.

Operations: The company generates £45.02 million in revenue from its currency and derivatives management services.

Market Cap: £91.37M

Record plc, with a market cap of £91.37 million, provides currency and derivative management services. The company has shown consistent earnings growth over the past five years at 13.2% annually but faced negative earnings growth of -3.5% last year. Despite this, Record's return on equity is high at 31.7%, and it operates debt-free with short-term assets exceeding both short-term and long-term liabilities significantly (£28.2M vs £5M and £446K respectively). Recently, Record raised its earnings guidance for the fiscal year ending March 2025, indicating potential revenue slightly ahead of previous expectations amidst stable weekly volatility at 4%.

- Click here to discover the nuances of Record with our detailed analytical financial health report.

- Examine Record's earnings growth report to understand how analysts expect it to perform.

Next Steps

- Click through to start exploring the rest of the 442 UK Penny Stocks now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:CKT

Checkit

Provides intelligent operations management platforms for deskless workforces in the United Kingdom and the Americas.

Excellent balance sheet and fair value.