- United Kingdom

- /

- Aerospace & Defense

- /

- AIM:CHRT

Cohort And 2 Other Undiscovered Gems In The United Kingdom

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced headwinds, with the FTSE 100 and FTSE 250 indices slipping amid concerns over weak trade data from China, which has impacted companies closely tied to the Chinese economy. As global economic uncertainties continue to influence market sentiment, investors might find value in exploring lesser-known stocks that exhibit resilience and potential for growth despite broader challenges.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| BioPharma Credit | NA | 7.22% | 7.91% | ★★★★★★ |

| B.P. Marsh & Partners | NA | 29.42% | 31.34% | ★★★★★★ |

| Livermore Investments Group | NA | 9.92% | 13.65% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.15% | 4.93% | ★★★★★★ |

| London Security | 0.22% | 10.13% | 7.75% | ★★★★★★ |

| Rights and Issues Investment Trust | NA | -7.87% | -8.41% | ★★★★★★ |

| Goodwin | 37.02% | 9.75% | 15.68% | ★★★★★☆ |

| FW Thorpe | 2.95% | 11.79% | 13.49% | ★★★★★☆ |

| AltynGold | 77.07% | 28.64% | 38.10% | ★★★★☆☆ |

| Law Debenture | 17.80% | 11.81% | 7.59% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Cohort (AIM:CHRT)

Simply Wall St Value Rating: ★★★★★★

Overview: Cohort plc operates in the defense and security sectors, offering a range of products and services across multiple regions including the UK, Germany, and North America, with a market capitalization of approximately £529.76 million.

Operations: Cohort generates revenue from its Sensors and Effectors segment (£133.68 million) and Communications and Intelligence segment (£94.70 million).

Cohort, a nimble player in the aerospace and defense sector, has been making waves with a strategic acquisition of EM Solutions, enhancing its foothold in naval communications. This move aligns with rising global defense budgets and increased demand for maritime technologies, particularly benefiting from Australia’s strategic market position. The company boasts a robust 46% earnings growth over the past year, outpacing industry averages. Despite this momentum, profit margins are expected to dip from 8.6% to 5.1%, reflecting potential challenges ahead. With cash exceeding total debt and EBIT covering interest payments by 33 times, Cohort's financials appear solid yet warrant cautious optimism given geopolitical uncertainties impacting future performance projections.

Filtronic (AIM:FTC)

Simply Wall St Value Rating: ★★★★★★

Overview: Filtronic plc designs, develops, manufactures, and sells radio frequency (RF) technology across various regions including the United Kingdom, Europe, and the Americas with a market capitalization of £203.67 million.

Operations: Filtronic's revenue primarily stems from its wireless communications equipment segment, generating £42.55 million.

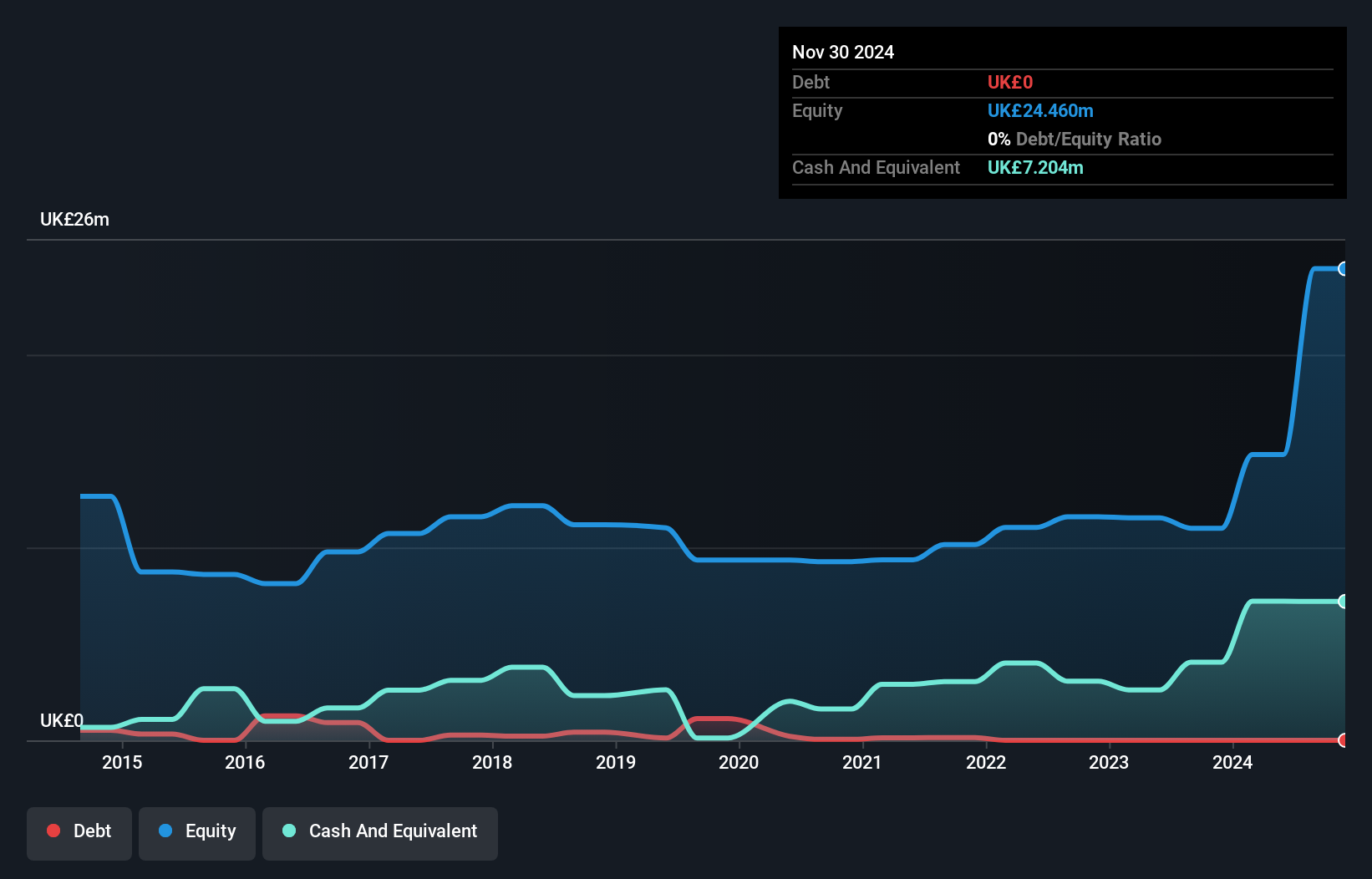

Filtronic, a nimble player in the communications sector, has made notable strides recently. The firm reported sales of £25.6 million for the half year ending November 2024, up from £8.48 million previously, and net income of £6.73 million compared to a loss last year. With a price-to-earnings ratio of 19.6x, it appears attractively valued against industry peers averaging 28.9x. Despite its debt-free status and positive free cash flow trajectory, significant insider selling and share price volatility pose concerns. Recent strategic expansions with SpaceX underscore its technological prowess but earnings are projected to decline significantly over the next three years.

- Navigate through the intricacies of Filtronic with our comprehensive health report here.

Understand Filtronic's track record by examining our Past report.

Yü Group (AIM:YU.)

Simply Wall St Value Rating: ★★★★★☆

Overview: Yü Group PLC, with a market cap of £235.90 million, operates through its subsidiaries to supply energy and utility solutions primarily in the United Kingdom.

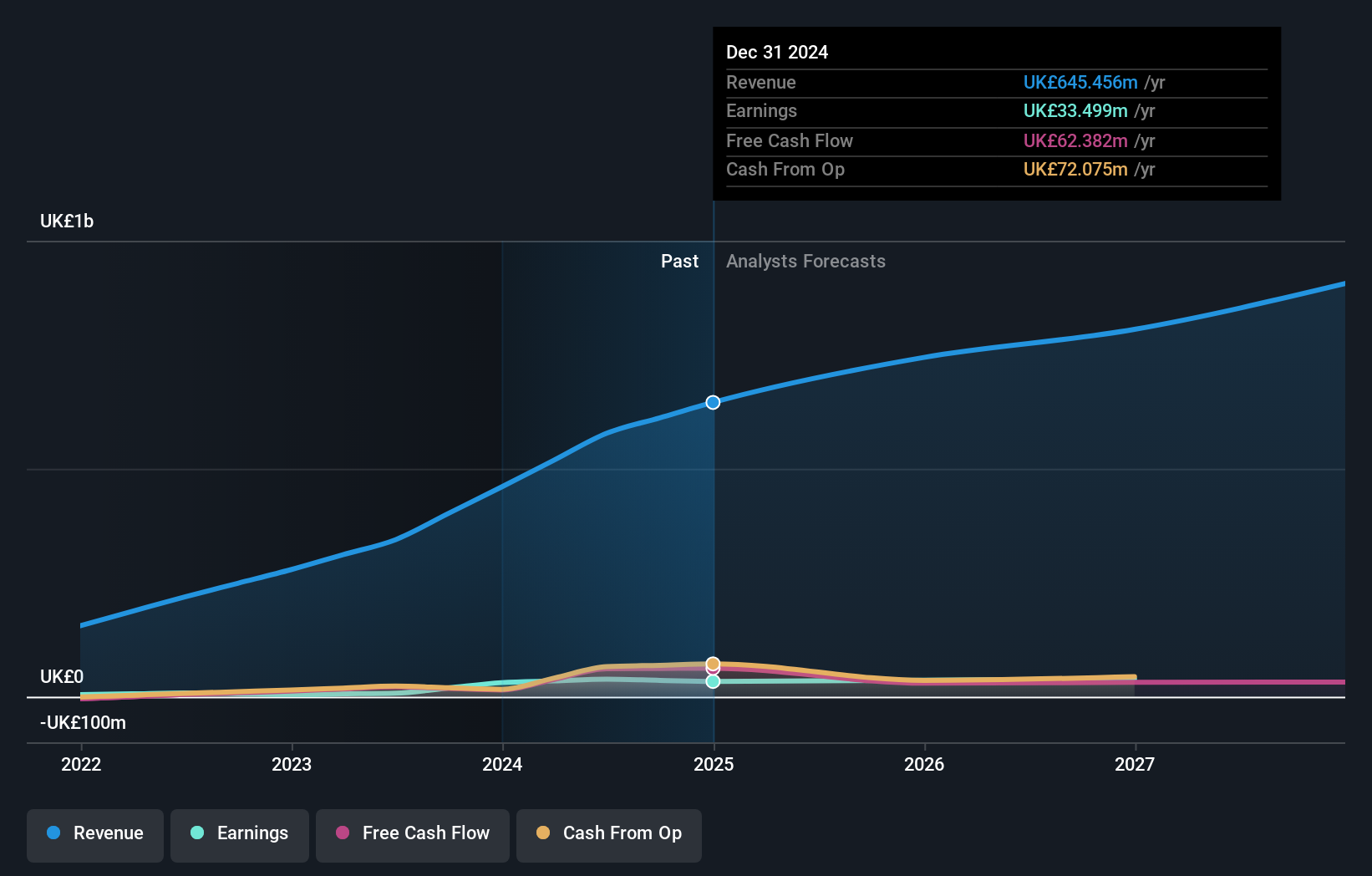

Operations: Yü Group PLC generates revenue primarily from its Retail segment, which accounts for £645.26 million, while the Smart and Metering Assets segments contribute £12.73 million and £0.66 million respectively. The company also engages in intra-segment trading, resulting in a deduction of £13.20 million from total revenue.

Yü Group, a promising player in the UK market, has demonstrated robust growth with earnings up 8.6% over the past year, outpacing the Renewable Energy industry's -11.8%. The company is trading at an attractive 48.3% below its estimated fair value and maintains more cash than total debt, suggesting financial stability. Recent results show sales climbing to £645 million from £460 million last year, while net income reached £33.5 million from £30.86 million previously. With a dividend increase of 50%, Yü Group seems committed to rewarding shareholders as it forecasts revenue between £730 and £760 million for 2025.

- Delve into the full analysis health report here for a deeper understanding of Yü Group.

Evaluate Yü Group's historical performance by accessing our past performance report.

Summing It All Up

- Discover the full array of 60 UK Undiscovered Gems With Strong Fundamentals right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:CHRT

Cohort

Provides various products and services in defense, security, and related markets in the United Kingdom, Germany, Portugal, Australia, North and South America, Asia Pacific, Africa, and other European countries.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)