- United Kingdom

- /

- Trade Distributors

- /

- AIM:ASY

Undiscovered Gems In The UK Featuring 3 Promising Stocks

Reviewed by Simply Wall St

As the UK market grapples with the ripple effects of China's faltering economic recovery, reflected in the recent declines of both the FTSE 100 and FTSE 250 indices, investors are increasingly cautious about companies with significant exposure to global trade dynamics. In this environment, identifying promising stocks often involves seeking out those with strong fundamentals and resilience to broader economic fluctuations—qualities that can make them stand out as undiscovered gems in a challenging landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| B.P. Marsh & Partners | NA | 42.17% | 45.70% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.01% | 5.12% | ★★★★★★ |

| BioPharma Credit | NA | 7.73% | 7.94% | ★★★★★★ |

| Georgia Capital | NA | 2.23% | 16.34% | ★★★★★★ |

| Vectron Systems | NA | 2.48% | 28.82% | ★★★★★★ |

| Nationwide Building Society | 282.42% | 9.69% | 21.24% | ★★★★★☆ |

| Law Debenture | 15.39% | 21.17% | 19.12% | ★★★★★☆ |

| FW Thorpe | 2.12% | 10.94% | 13.25% | ★★★★★☆ |

| Distribution Finance Capital Holdings | 9.37% | 48.09% | 66.49% | ★★★★★☆ |

| Foresight Environmental Infrastructure | NA | -24.80% | -27.25% | ★★★★★☆ |

Underneath we present a selection of stocks filtered out by our screen.

Andrews Sykes Group (AIM:ASY)

Simply Wall St Value Rating: ★★★★★★

Overview: Andrews Sykes Group plc is an investment holding company that specializes in the hire, sale, and installation of environmental control equipment across various regions including the United Kingdom, Europe, the Middle East, and Africa, with a market capitalization of £209.29 million.

Operations: Andrews Sykes Group generates revenue primarily through the hire, sale, and installation of environmental control equipment across multiple regions. The company's operations span the United Kingdom, Europe, the Middle East, and Africa.

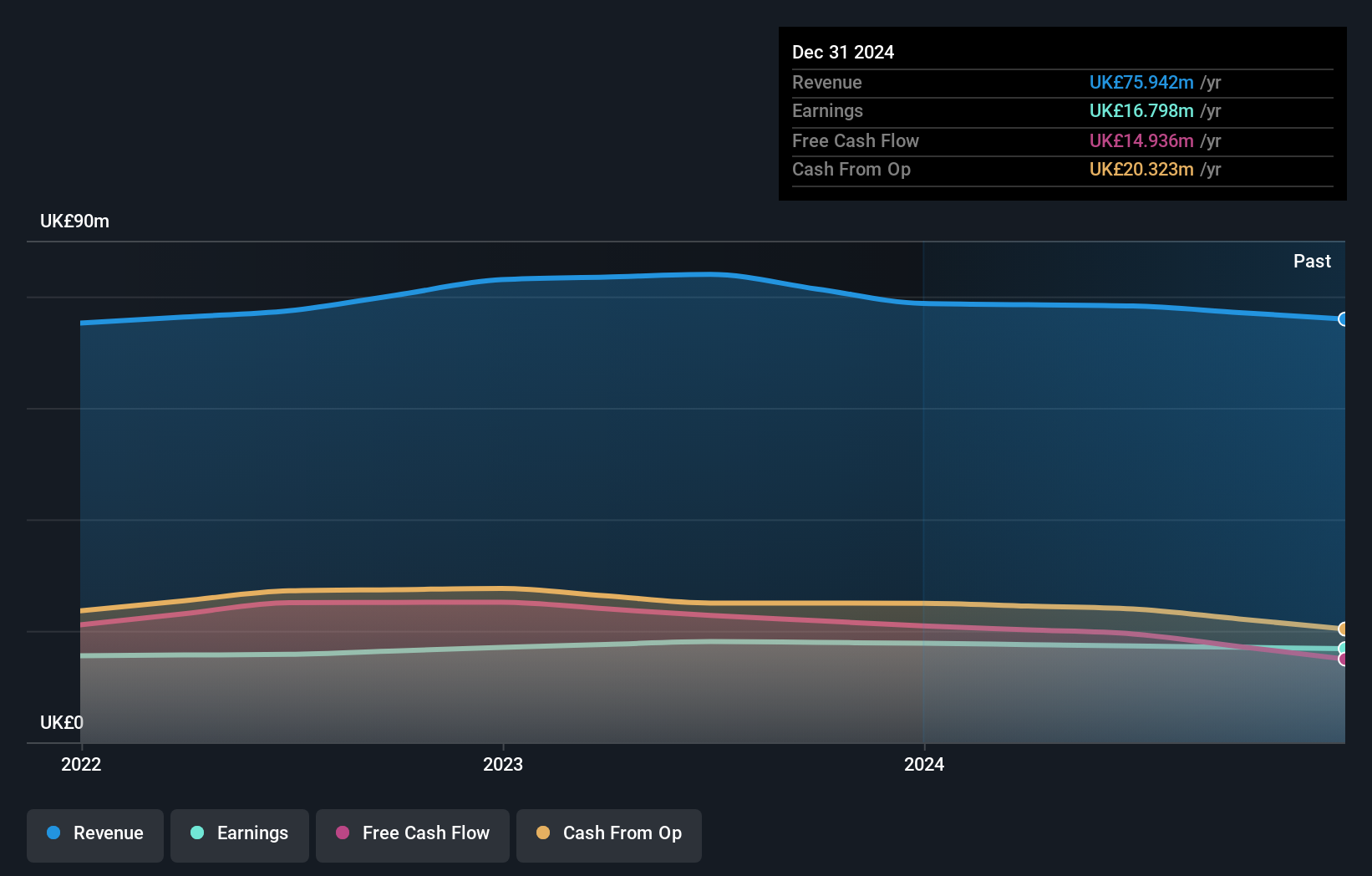

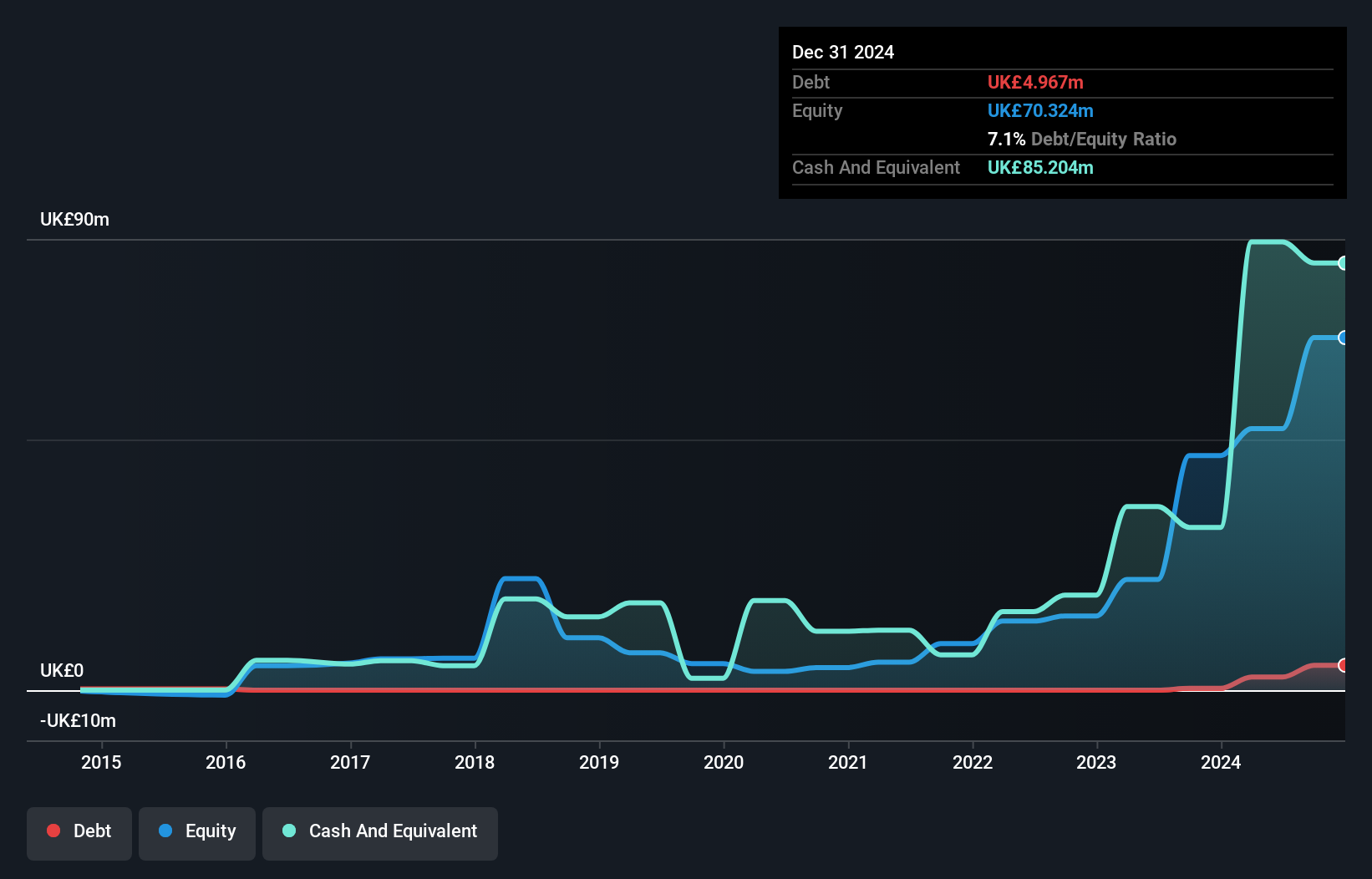

Andrews Sykes Group, a nimble player in the UK market, showcases a solid financial standing with no debt on its books, contrasting its past 5.4% debt-to-equity ratio from five years ago. Trading at 22.6% below estimated fair value suggests potential upside for investors seeking undervalued opportunities. Despite recent negative earnings growth of -0.8%, the company reported an increase in net income to £7.44 million for the half-year ending June 2025 compared to £7.08 million last year, indicating resilience amidst industry challenges. Additionally, it declared an interim dividend of 11.90 pence per share, maintaining shareholder returns steady at £5 million total payout.

- Navigate through the intricacies of Andrews Sykes Group with our comprehensive health report here.

Understand Andrews Sykes Group's track record by examining our Past report.

Yü Group (AIM:YU.)

Simply Wall St Value Rating: ★★★★★☆

Overview: Yü Group PLC, with a market cap of £258.64 million, operates through its subsidiaries to supply energy and utility solutions primarily in the United Kingdom.

Operations: Yü Group generates revenue primarily from supplying energy and utility solutions in the UK. The company's cost structure includes expenses related to procurement and distribution, impacting its overall profitability. It reported a net profit margin of 3.5%, reflecting its ability to convert revenue into profit after covering all costs.

Yü Group, a notable player in the UK energy sector, stands out with its robust financial health and strategic leadership changes. The company reported half-year sales of £341.04 million, up from £312.68 million the previous year, with net income rising to £16.52 million from £14.69 million. Trading at 65% below estimated fair value suggests potential upside for investors. Despite a debt-to-equity ratio increase to 10% over five years, Yü maintains more cash than total debt and positive free cash flow of £61.93 million as of September 2024 indicates strong liquidity management amidst industry challenges with earnings growth forecasted at 6%.

- Click here and access our complete health analysis report to understand the dynamics of Yü Group.

Explore historical data to track Yü Group's performance over time in our Past section.

Pinewood Technologies Group (LSE:PINE)

Simply Wall St Value Rating: ★★★★★★

Overview: Pinewood Technologies Group PLC is a cloud-based dealer management software provider with operations in the United Kingdom, Europe, Africa, Asia, the Middle East, and internationally, and has a market capitalization of £365.45 million.

Operations: Pinewood Technologies Group derives its revenue primarily from software subscriptions and support services, with a significant portion coming from the UK and European markets. The company has reported a net profit margin of 12% in recent periods, indicating efficient cost management relative to its revenue streams.

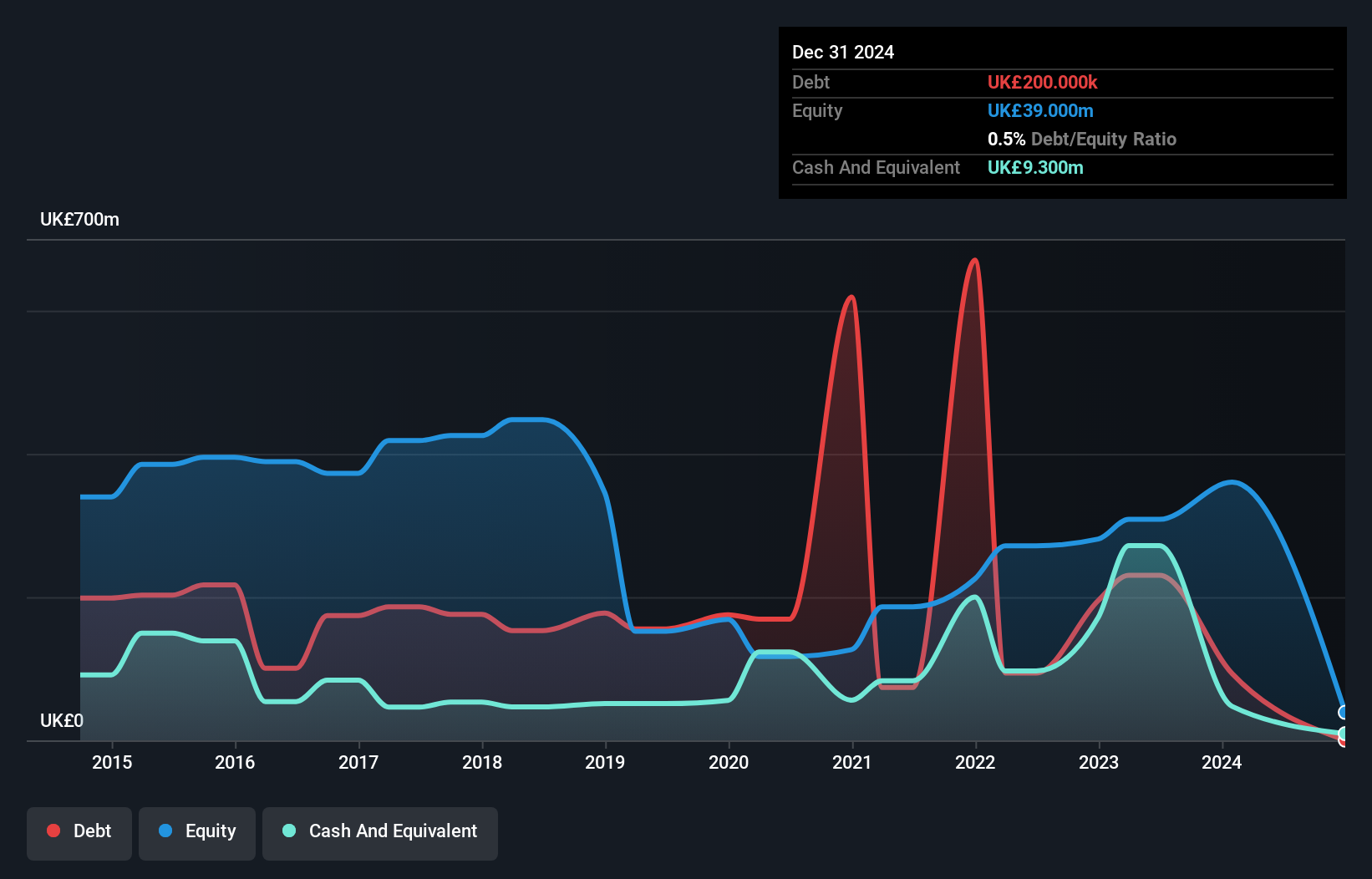

Pinewood Technologies Group, a player in the automotive software industry, has seen its debt to equity ratio plummet from 104% to just 0.5% over five years, reflecting robust financial management. Despite a one-off £2.4 million loss impacting recent results, earnings surged by 53% last year, outpacing the software sector's growth of 8%. The company trades at nearly half its estimated fair value and boasts more cash than total debt. While it faces challenges like shareholder dilution and integrating new tech post-Seez acquisition, Pinewood's strategic expansion into North America could enhance revenue streams significantly.

Next Steps

- Unlock our comprehensive list of 57 UK Undiscovered Gems With Strong Fundamentals by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:ASY

Andrews Sykes Group

An investment holding company, engages in the hire, sale, and installation of environmental control equipment in the United Kingdom, Rest of Europe, the Middle East, Africa, and internationally.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)