We'd be surprised if Virgin Money UK PLC (LON:VMUK) shareholders haven't noticed that an insider, Gavin Rodney Opperman, recently sold UK£193k worth of stock at UK£1.93 per share. That sale was 42% of their holding, so it does make us raise an eyebrow.

See our latest analysis for Virgin Money UK

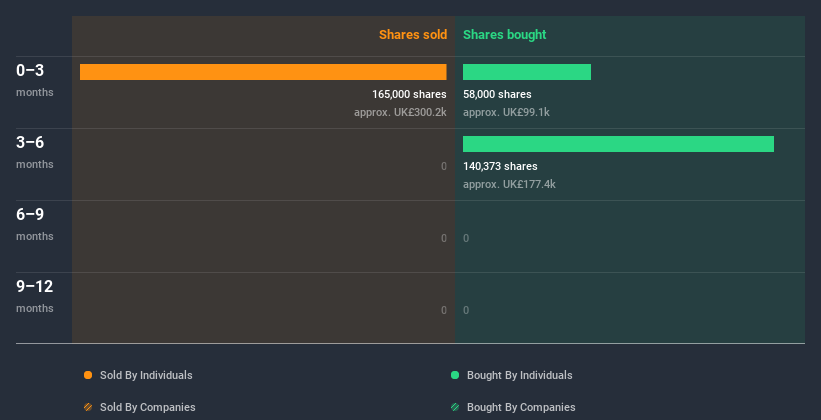

Virgin Money UK Insider Transactions Over The Last Year

In fact, the recent sale by Gavin Rodney Opperman was the biggest sale of Virgin Money UK shares made by an insider individual in the last twelve months, according to our records. That means that even when the share price was below the current price of UK£2.00, an insider wanted to cash in some shares. As a general rule we consider it to be discouraging when insiders are selling below the current price, because it suggests they were happy with a lower valuation. Please do note, however, that sellers may have a variety of reasons for selling, so we don't know for sure what they think of the stock price. This single sale was just 42% of Gavin Rodney Opperman's stake.

In the last twelve months insiders purchased 198.37k shares for UK£276k. On the other hand they divested 165.00k shares, for UK£304k. All up, insiders sold more shares in Virgin Money UK than they bought, over the last year. They sold for an average price of about UK£1.84. We don't gain confidence from insider selling below the recent share price. Of course, the sales could be motivated for a multitude of reasons, so we shouldn't jump to conclusions. The chart below shows insider transactions (by companies and individuals) over the last year. By clicking on the graph below, you can see the precise details of each insider transaction!

I will like Virgin Money UK better if I see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Insider Ownership

Another way to test the alignment between the leaders of a company and other shareholders is to look at how many shares they own. We usually like to see fairly high levels of insider ownership. Our data indicates that Virgin Money UK insiders own about UK£5.6m worth of shares (which is 0.2% of the company). But they may have an indirect interest through a corporate structure that we haven't picked up on. Overall, this level of ownership isn't that impressive, but it's certainly better than nothing!

What Might The Insider Transactions At Virgin Money UK Tell Us?

Unfortunately, there has been more insider selling of Virgin Money UK stock, than buying, in the last three months. And our longer term analysis of insider transactions didn't bring confidence, either. When you consider that most companies have higher levels of insider ownership, we're a little wary. So we're not rushing to buy, to say the least. While we like knowing what's going on with the insider's ownership and transactions, we make sure to also consider what risks are facing a stock before making any investment decision. While conducting our analysis, we found that Virgin Money UK has 2 warning signs and it would be unwise to ignore them.

Of course Virgin Money UK may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you’re looking to trade Virgin Money UK, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:VMUK

Virgin Money UK

Provides banking products and services for consumers, and small and medium sized businesses under the Clydesdale Bank, Yorkshire Bank, and Virgin Money brands in the United Kingdom.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives