Metro Bank PLC (LON:MTRO) is possibly approaching a major achievement in its business, so we would like to shine some light on the company. Metro Bank PLC, together with its subsidiaries, provides retail and commercial banking services in the United Kingdom. The UK£128m market-cap company’s loss lessened since it announced a UK£248m loss in the full financial year, compared to the latest trailing-twelve-month loss of UK£169m, as it approaches breakeven. Many investors are wondering about the rate at which Metro Bank will turn a profit, with the big question being “when will the company breakeven?” In this article, we will touch on the expectations for the company's growth and when analysts expect it to become profitable.

Check out the opportunities and risks within the GB Banks industry.

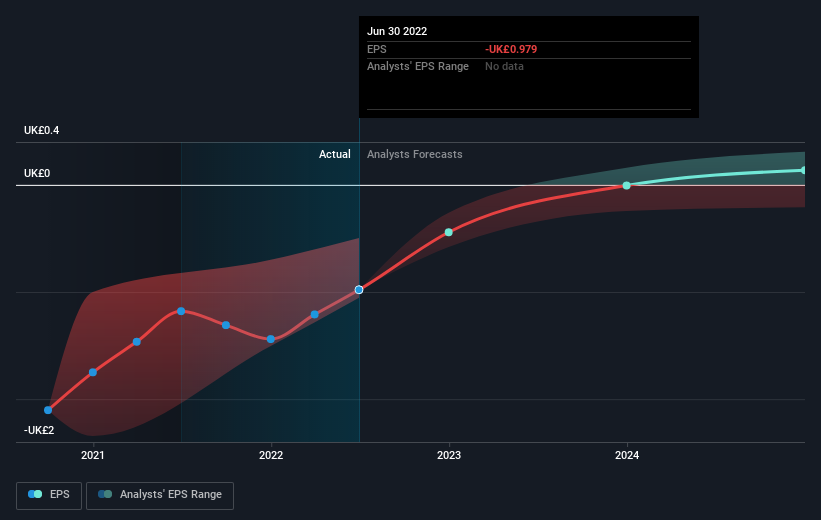

Consensus from 5 of the British Banks analysts is that Metro Bank is on the verge of breakeven. They expect the company to post a final loss in 2023, before turning a profit of UK£24m in 2024. The company is therefore projected to breakeven around 2 years from now. In order to meet this breakeven date, we calculated the rate at which the company must grow year-on-year. It turns out an average annual growth rate of 84% is expected, which is extremely buoyant. If this rate turns out to be too aggressive, the company may become profitable much later than analysts predict.

Given this is a high-level overview, we won’t go into details of Metro Bank's upcoming projects, however, take into account that generally a high forecast growth rate is not unusual for a company that is currently undergoing an investment period.

One thing we would like to bring into light with Metro Bank is its relatively high level of debt. Generally, the rule of thumb is debt shouldn’t exceed 40% of your equity, which in Metro Bank's case is 78%. Note that a higher debt obligation increases the risk in investing in the loss-making company.

Next Steps:

This article is not intended to be a comprehensive analysis on Metro Bank, so if you are interested in understanding the company at a deeper level, take a look at Metro Bank's company page on Simply Wall St. We've also put together a list of key factors you should further research:

- Historical Track Record: What has Metro Bank's performance been like over the past? Go into more detail in the past track record analysis and take a look at the free visual representations of our analysis for more clarity.

- Management Team: An experienced management team on the helm increases our confidence in the business – take a look at who sits on Metro Bank's board and the CEO’s background.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.