- United Kingdom

- /

- Specialty Stores

- /

- LSE:KGF

3 UK Dividend Stocks Offering Yields Up To 4.9%

Reviewed by Simply Wall St

Amidst the backdrop of faltering trade data from China and its impact on the UK market, the FTSE 100 has recently experienced a downturn, reflecting broader global economic challenges. In such uncertain times, dividend stocks can offer a measure of stability and income potential for investors seeking to navigate these turbulent waters.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Pets at Home Group (LSE:PETS) | 6.08% | ★★★★★★ |

| Keller Group (LSE:KLR) | 3.47% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 8.20% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 8.06% | ★★★★★☆ |

| Man Group (LSE:EMG) | 5.98% | ★★★★★☆ |

| DCC (LSE:DCC) | 3.66% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 4.82% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 4.04% | ★★★★★☆ |

| RS Group (LSE:RS1) | 3.27% | ★★★★★☆ |

| James Latham (AIM:LTHM) | 6.78% | ★★★★★☆ |

Click here to see the full list of 63 stocks from our Top UK Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Croda International (LSE:CRDA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Croda International Plc operates in the consumer care, life science, and industrial specialty sectors across Europe, the Middle East, Africa, North America, Asia, and Latin America with a market cap of approximately £4.69 billion.

Operations: Croda International Plc's revenue is primarily derived from its Consumer Care segment (£898.90 million), followed by Life Sciences (£545.30 million) and Industrial Specialties (£185.30 million).

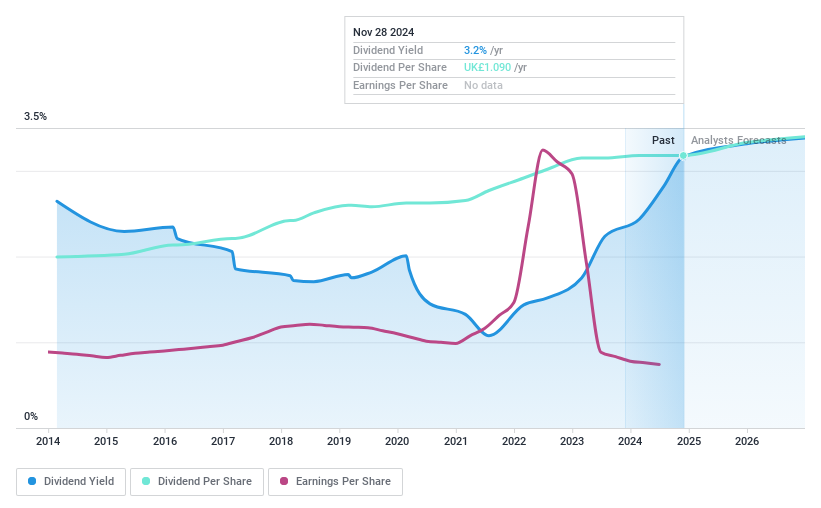

Dividend Yield: 3.2%

Croda International has a history of stable and growing dividends over the past decade, though its current dividend yield of 3.25% is lower than the top UK payers. The company's high payout ratio suggests dividends are not well covered by earnings, yet they are supported by cash flows with an 80.4% cash payout ratio. Recent sales growth to £407 million in Q3 2024 indicates positive momentum, despite upcoming board changes affecting audit oversight.

- Get an in-depth perspective on Croda International's performance by reading our dividend report here.

- Our expertly prepared valuation report Croda International implies its share price may be too high.

Games Workshop Group (LSE:GAW)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Games Workshop Group PLC designs, manufactures, distributes, and sells fantasy miniature figures and games globally, with a market cap of £4.61 billion.

Operations: Games Workshop Group PLC generates revenue primarily from its Core segment, amounting to £528.50 million, and Licensing, which contributes £49 million.

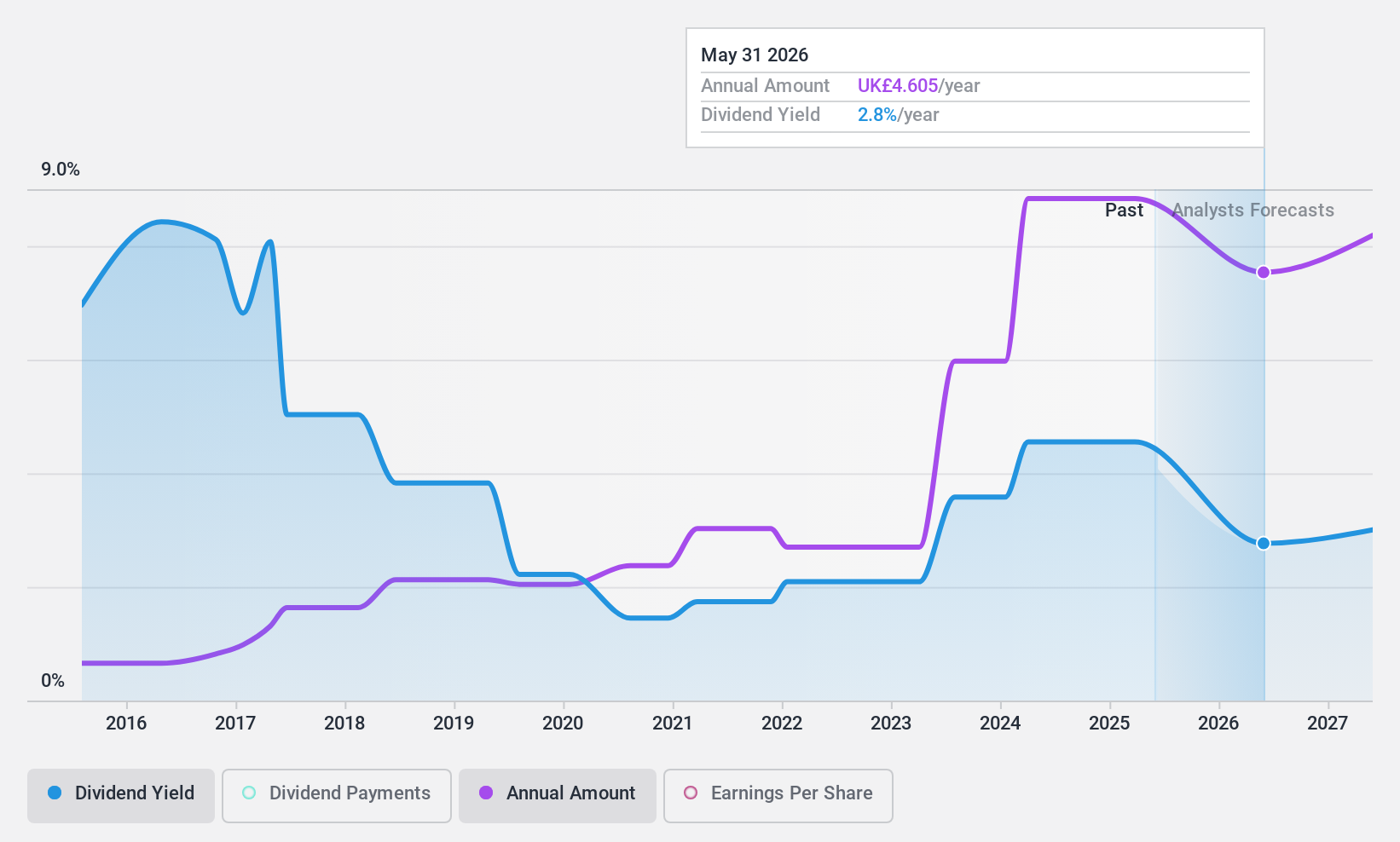

Dividend Yield: 3.9%

Games Workshop Group has consistently increased its dividends over the past decade, with recent announcements raising total dividends for 2024/25 to £4.20 per share. Despite a dividend yield of 3.86%, lower than top UK payers, dividends are not well covered by cash flows due to a high payout ratio of 111.6%. However, earnings growth and stable dividend history support its reliability as a dividend stock amidst strong financial performance and strategic media partnerships.

- Delve into the full analysis dividend report here for a deeper understanding of Games Workshop Group.

- Our valuation report here indicates Games Workshop Group may be overvalued.

Kingfisher (LSE:KGF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kingfisher plc, with a market cap of £4.50 billion, supplies home improvement products and services primarily in the United Kingdom, Ireland, France, and internationally.

Operations: Kingfisher plc generates £12.86 billion from its supply of home improvement products and services across its key markets.

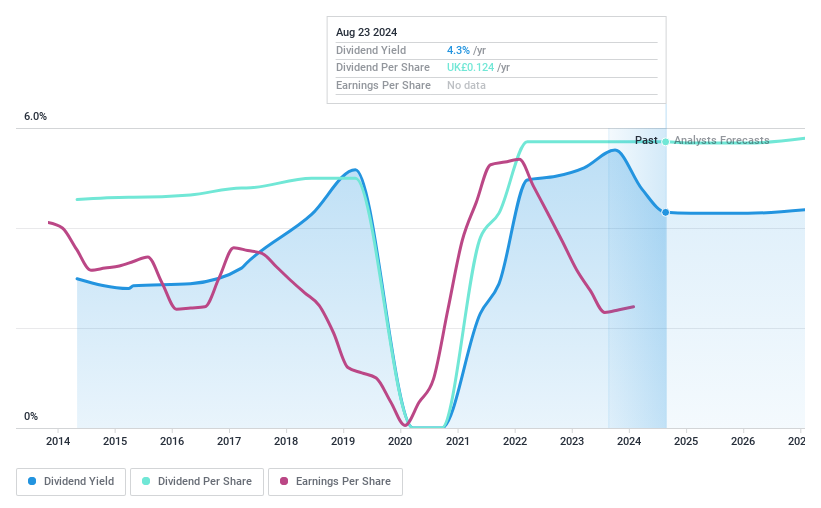

Dividend Yield: 5%

Kingfisher's dividend payments have been unreliable and volatile over the past decade, despite a reasonable payout ratio of 67% and strong cash flow coverage at 21.2%. The dividend yield of 4.96% is below the top UK payers, but the stock offers value with a price-to-earnings ratio of 13x against the market average of 16x. Recent board changes include Ian McLeod's appointment as Non-Executive Director, which may influence future strategic decisions.

- Unlock comprehensive insights into our analysis of Kingfisher stock in this dividend report.

- In light of our recent valuation report, it seems possible that Kingfisher is trading beyond its estimated value.

Next Steps

- Click this link to deep-dive into the 63 companies within our Top UK Dividend Stocks screener.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kingfisher might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:KGF

Kingfisher

Supplies home improvement products and services primarily in the United Kingdom, Ireland, France, and internationally.

Flawless balance sheet with proven track record and pays a dividend.