- United Kingdom

- /

- Oil and Gas

- /

- LSE:GKP

Discover 3 UK Growth Stocks With Strong Insider Ownership

Reviewed by Simply Wall St

The United Kingdom's market landscape has recently been marked by challenges, with the FTSE 100 and FTSE 250 indices experiencing declines amid concerns over China's economic recovery and its impact on global trade. In such a volatile environment, identifying growth companies with substantial insider ownership can be particularly appealing as this often suggests confidence in the company's long-term prospects by those who know it best.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Filtronic (AIM:FTC) | 24.9% | 35.5% |

| Gulf Keystone Petroleum (LSE:GKP) | 12.2% | 96.2% |

| Foresight Group Holdings (LSE:FSG) | 34.3% | 23.5% |

| LSL Property Services (LSE:LSL) | 10.7% | 28.2% |

| Facilities by ADF (AIM:ADF) | 13.1% | 190% |

| RUA Life Sciences (AIM:RUA) | 13.3% | 61.7% |

| Getech Group (AIM:GTC) | 11.8% | 114.5% |

| Mortgage Advice Bureau (Holdings) (AIM:MAB1) | 19.8% | 26.4% |

| B90 Holdings (AIM:B90) | 24.4% | 166.8% |

| Anglo Asian Mining (AIM:AAZ) | 40% | 189.1% |

We'll examine a selection from our screener results.

Equals Group (AIM:EQLS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Equals Group plc operates in the United Kingdom, providing payment platforms for private clients and corporations through services such as prepaid currency cards, international money transfers, and current accounts, with a market cap of £258.45 million.

Operations: The company's revenue is derived from various segments, including Banking (£8.26 million), Solutions (£42.15 million), Travel Cash (£0.02 million), Currency Cards (£15.46 million), and International Payments excluding Solutions (£40.71 million).

Insider Ownership: 21.1%

Earnings Growth Forecast: 32% p.a.

Equals Group is set for an all-cash acquisition and delisting from AIM, transitioning to a private entity. Despite its forecasted earnings growth of 32% annually, surpassing the UK market average, insider activity shows more selling than buying recently. Revenue growth is expected at 18.8% per year, outpacing the broader market but below high-growth benchmarks. Historical earnings have grown significantly at 61.8% annually over five years, indicating robust past performance amidst current strategic changes.

- Click to explore a detailed breakdown of our findings in Equals Group's earnings growth report.

- Our valuation report unveils the possibility Equals Group's shares may be trading at a premium.

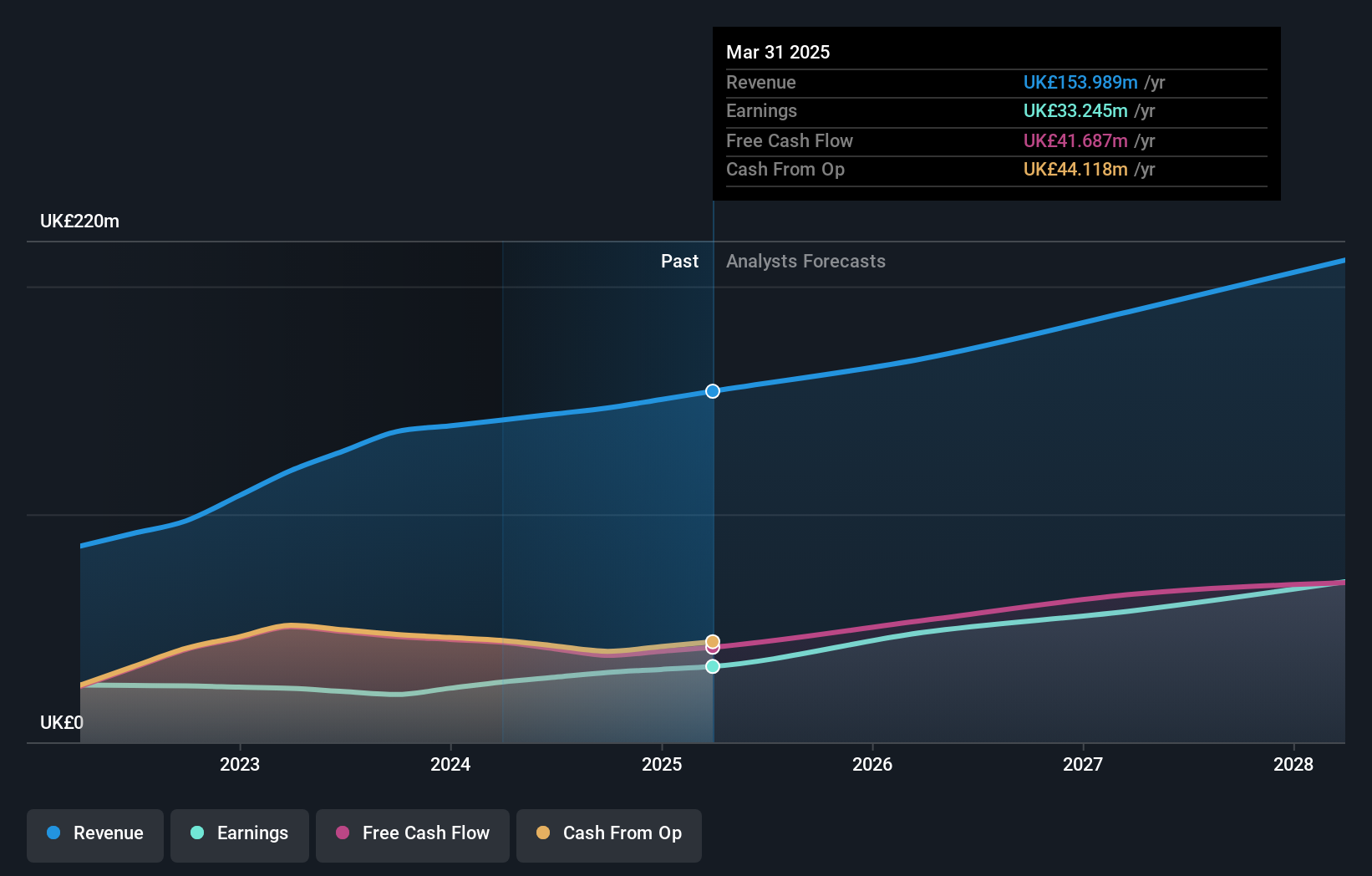

Foresight Group Holdings (LSE:FSG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Foresight Group Holdings Limited is an infrastructure and private equity manager operating in the United Kingdom, Italy, Luxembourg, Ireland, Spain, and Australia with a market cap of £426.51 million.

Operations: The company's revenue is derived from three main segments: Infrastructure (£87.79 million), Private Equity (£50.78 million), and Foresight Capital Management (£8.10 million).

Insider Ownership: 34.3%

Earnings Growth Forecast: 23.5% p.a.

Foresight Group Holdings has demonstrated strong financial performance, with recent half-year earnings rising to £12.65 million from £8.49 million the previous year, alongside sales of £73.19 million. Analysts expect its earnings to grow significantly at 23.5% annually over the next three years, outpacing the UK market average of 14.5%. The company recently increased its equity buyback plan by £5 million to a total of £15 million, reflecting confidence in its growth trajectory and value proposition.

- Click here to discover the nuances of Foresight Group Holdings with our detailed analytical future growth report.

- Our valuation report here indicates Foresight Group Holdings may be undervalued.

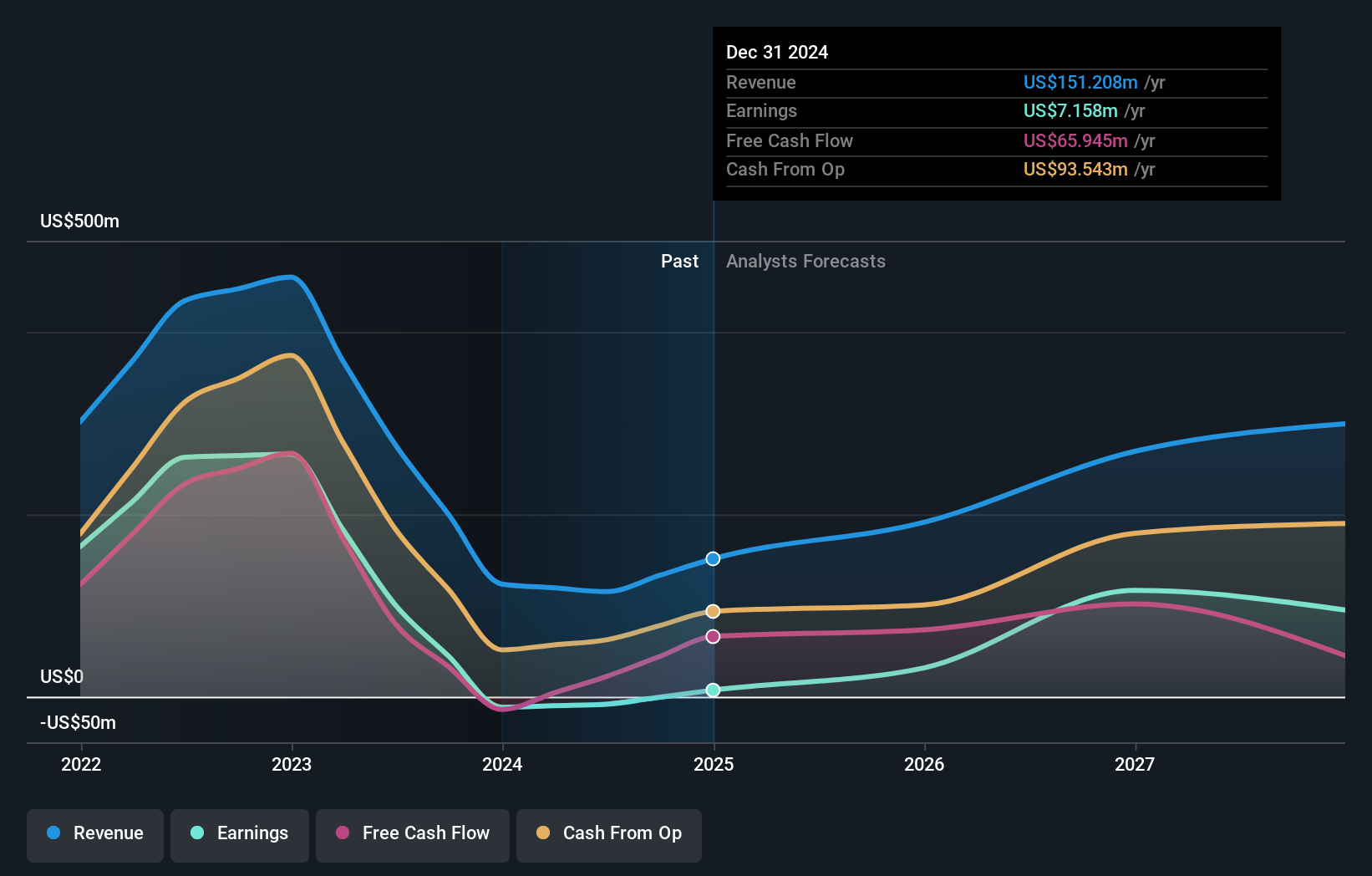

Gulf Keystone Petroleum (LSE:GKP)

Simply Wall St Growth Rating: ★★★★★★

Overview: Gulf Keystone Petroleum Limited is involved in the exploration, development, and production of oil and gas in the Kurdistan Region of Iraq, with a market cap of £358.60 million.

Operations: The company's revenue segment is primarily derived from the exploration and production of oil and gas, amounting to $115.15 million.

Insider Ownership: 12.2%

Earnings Growth Forecast: 96.2% p.a.

Gulf Keystone Petroleum is forecasted to achieve profitability within three years, with revenue expected to grow at 33.9% annually, significantly outpacing the UK market's 3.5%. Its Return on Equity is projected to reach a high of 21.8%, though the dividend yield of 9.04% lacks coverage by earnings or cash flows. The stock trades at a substantial discount, approximately 83.3% below its estimated fair value, with no significant insider trading activity reported recently.

- Unlock comprehensive insights into our analysis of Gulf Keystone Petroleum stock in this growth report.

- The valuation report we've compiled suggests that Gulf Keystone Petroleum's current price could be inflated.

Summing It All Up

- Click through to start exploring the rest of the 56 Fast Growing UK Companies With High Insider Ownership now.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:GKP

Gulf Keystone Petroleum

Engages in the exploration, development, and production of oil and gas in the Kurdistan Region of Iraq.

Exceptional growth potential with flawless balance sheet.