- United Kingdom

- /

- Banks

- /

- LSE:LLOY

What Does Lloyds' 47% Rally Mean for Its Valuation in 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with your Lloyds Banking Group shares right now? You’re not alone. In fact, Lloyds stock has become a bit of a talking point for anyone following UK financials. The company’s market moves recently have been intriguing, especially given the general optimism around bank stocks as interest rate expectations shift and investors look for relative value across the sector.

Over the past year, Lloyds’ share price has surged by 47.3%, with the gains climbing to an impressive 129.3% over three years and 288.8% across the last five. Even the year-to-date figure stands at a remarkable 52.0%. That said, recent action has been a touch quieter, with a decline of 0.8% in the past week and an increase of just 1.3% over the past month. What’s driving these moves? Some of it comes down to renewed market confidence as economic conditions in the UK show signs of stability. This has often led investors to rediscover the dividend appeal and balance sheet strength of established lenders like Lloyds.

But before jumping to conclusions about whether Lloyds stock is a bargain or fully priced, let’s consider the numbers. On a composite valuation score (where 1 is added for each of six factors if the company is undervalued), Lloyds scores a 2. Not exactly a slam dunk, but not a write-off either. In the next section, we’ll dig into what those valuation checks mean and how they stack up for Lloyds. In addition, we’ll touch on a smarter way to value shares that often gets overlooked by the market.

Lloyds Banking Group scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Lloyds Banking Group Excess Returns Analysis

The Excess Returns model is designed to assess how much value a company can create above its cost of equity. It focuses on returns generated by reinvesting profits beyond a basic required rate.

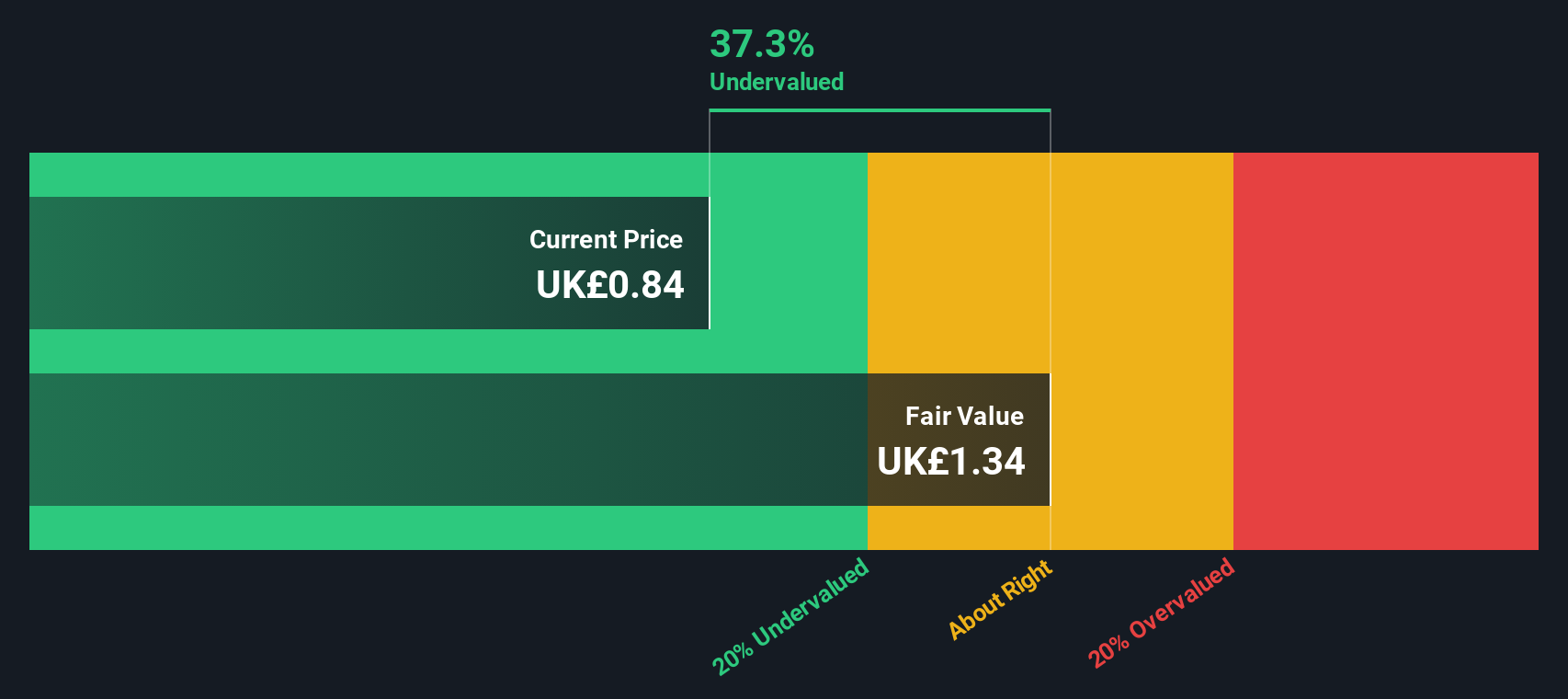

For Lloyds Banking Group, this model shows a Book Value of £0.67 per share and a Stable EPS of £0.10 per share, based on estimates from 13 analysts for future Return on Equity. The average Return on Equity stands at a healthy 12.67%, indicating that Lloyds is generating significant profit relative to its equity base. The Stable Book Value per share is projected at £0.77, and the cost of equity is £0.06 per share. After accounting for these factors, the resulting Excess Return per share is £0.03.

Taken together, the Excess Returns model implies an intrinsic value that is 37.8% higher than the current market price. This suggests Lloyds stock is trading at a considerable discount to what the underlying returns would justify. Investors are, in effect, paying less than what the company’s ongoing profitability would suggest is fair value.

Result: UNDERVALUED

Our Excess Returns analysis suggests Lloyds Banking Group is undervalued by 37.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Lloyds Banking Group Price vs Earnings

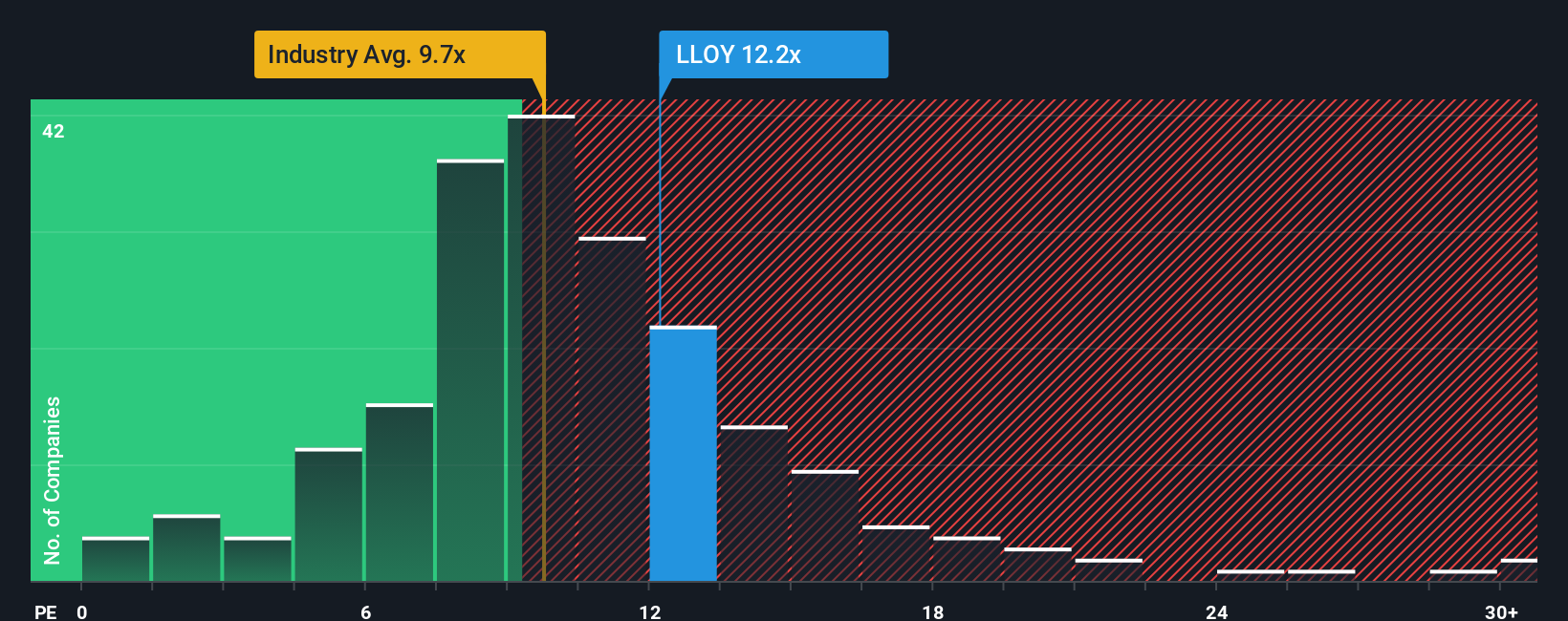

The Price-to-Earnings (PE) ratio is widely recognised as a practical metric for valuing profitable companies like Lloyds Banking Group. It offers a snapshot of how much investors are willing to pay per pound of earnings, helping to gauge whether a stock’s price is justified by its earnings power. Generally, higher expected growth and lower risk support a higher “normal” or “fair” PE ratio. Conversely, slower growth or higher risk may pull it lower.

Currently, Lloyds trades at a PE ratio of 12.13x. When comparing this to the Banks industry average PE of 10.24x, as well as the peer average of 10.06x, it appears Lloyds’ shares command a modest premium. However, these simple averages can overlook some crucial nuances specific to each company.

This is where the “Fair Ratio” comes in. Simply Wall St’s Fair Ratio for Lloyds is 8.95x, reflecting factors like earnings growth, sector outlook, market cap, profit margins, and unique company risks. Unlike raw industry or peer comparisons, the Fair Ratio seeks to answer what a fair market multiple should be after accounting for all these nuanced details. In this case, Lloyds’ actual PE ratio is noticeably higher than its Fair Ratio. This suggests the stock is a bit more expensive relative to its fundamental “fair value.”

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Lloyds Banking Group Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple but powerful concept: it is your story about a company, backed by your assumptions around future revenues, earnings, margins, and what you believe is a fair value for the stock.

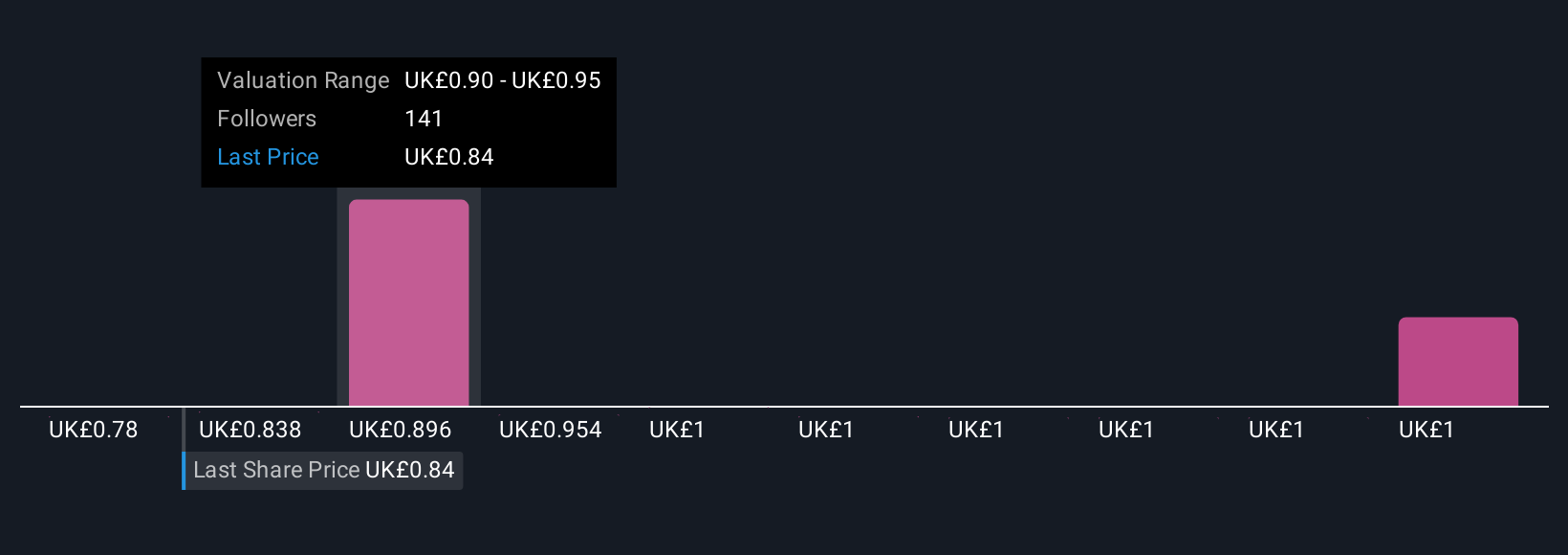

This approach goes beyond static ratios by connecting the company's past, present, and likely future. It links big picture developments to a specific financial forecast and, ultimately, a tailored fair value. Narratives are accessible to all Simply Wall St users on the Community page, where millions of investors share their perspectives and can track how their views compare to the crowd.

By building a Narrative, you get a living framework to decide exactly when to buy or sell, since you can continually compare your fair value to the live market price. As markets and companies change, so do Narratives. They update dynamically when new information like news, results, or major events comes in, meaning your analysis stays relevant.

For example, some investors in Lloyds Banking Group project robust growth in digital banking, expecting the share price to rise as high as £1.03. Others are more cautious about economic risks and see fair value at just £0.53. Narratives let you anchor those views with real numbers and update them as new facts emerge.

Do you think there's more to the story for Lloyds Banking Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:LLOY

Lloyds Banking Group

Provides a range of banking and financial products and services in the United Kingdom and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives