- United Kingdom

- /

- Banks

- /

- LSE:HSBA

HSBC (LSE:HSBA): Assessing Valuation After a Strong 54% One-Year Shareholder Return

Reviewed by Simply Wall St

Recent share performance and what it might signal

HSBC Holdings (LSE:HSBA) has been steadily grinding higher, with the share price up around 1% today, roughly 4% over the past week and about 14% in the past 3 months.

See our latest analysis for HSBC Holdings.

Zooming out, the share price return this year has been strong and that 1 year total shareholder return of 54.3% hints at investors steadily reassessing HSBC Holdings' earnings power and risk profile in its favour.

If HSBC Holdings' momentum has you rethinking your portfolio mix, this could be a good moment to explore fast growing stocks with high insider ownership as potential next wave candidates.

Yet with the shares sitting near analyst targets but still trading at a hefty intrinsic discount, the real question is whether HSBC Holdings remains undervalued or if the market is already pricing in its future growth.

Most Popular Narrative Narrative: 1% Overvalued

With HSBC Holdings last closing at £10.88 against a narrative fair value of £10.77, the story here hinges on modest upside already priced in.

The strategic shift away from underperforming and non-core businesses in Europe and the Americas, and redeployment of capital into high-return businesses in Asia and the Middle East, is expected to improve overall net interest margins and boost group return on equity through better allocation of resources.

Disproportionate investment in digital transformation, including AI-driven efficiency gains and digital onboarding, will generate structural cost reductions, directly improving the cost-to-income ratio and lifting long-term operating leverage and net margins.

Want to see why steady mid single digit revenue growth, expanding margins and a lower future earnings multiple still support this valuation call, and what numbers sit underneath those assumptions?

Result: Fair Value of $10.77 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained weakness in Hong Kong commercial real estate or prolonged interest rate volatility could pressure margins and undermine the current fair value narrative.

Find out about the key risks to this HSBC Holdings narrative.

Another View: Market Ratios Tell A Different Story

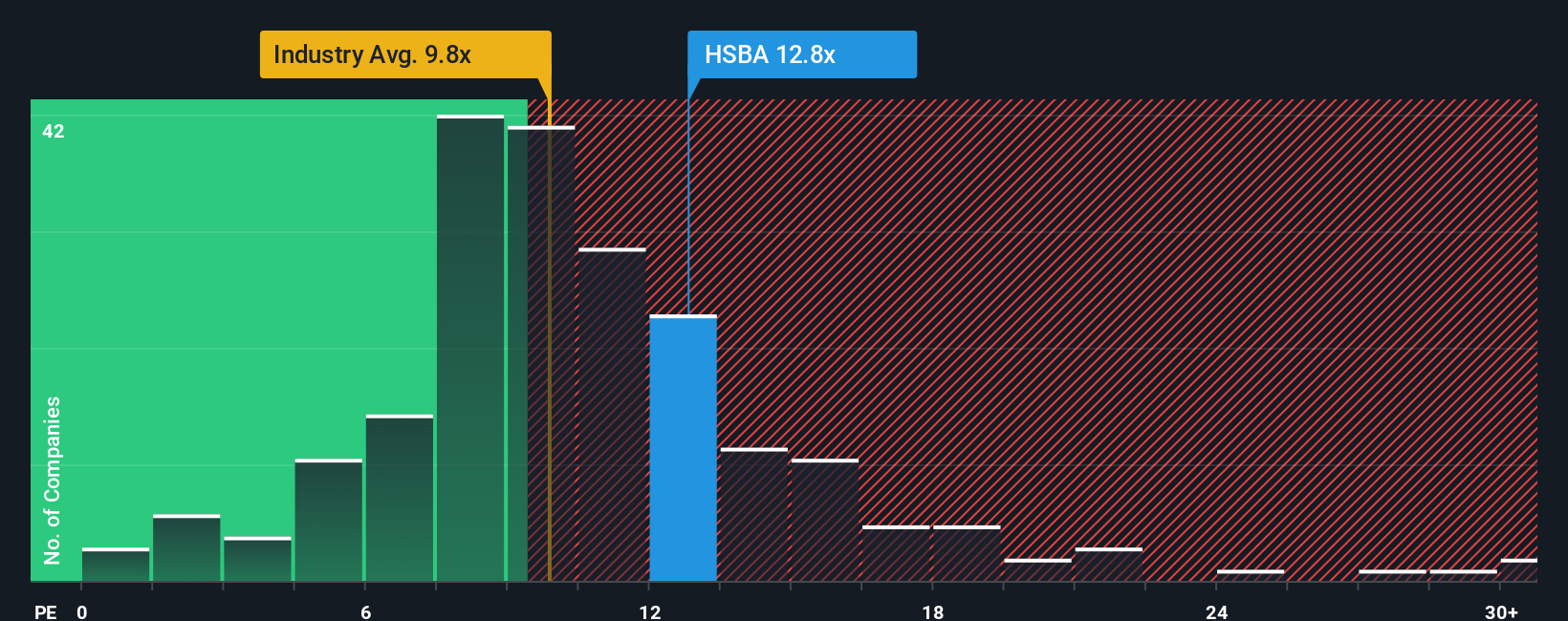

While the narrative fair value suggests HSBC Holdings is about right, the price to earnings ratio of 14.8 times compared with a fair ratio of 10.2 times and a European banks average of roughly 10 times points to a stock the market may be paying up for. This may leave less room for disappointment if earnings or margins wobble.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out HSBC Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 933 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own HSBC Holdings Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalised view in just minutes using Do it your way.

A great starting point for your HSBC Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next potential opportunity by using the Simply Wall Street Screener to uncover fresh ideas that could outperform HSBC Holdings.

- Capture income potential with these 14 dividend stocks with yields > 3% that aim to deliver reliable cash returns alongside solid fundamentals.

- Ride powerful innovation trends by targeting these 24 AI penny stocks positioned at the heart of the AI and automation boom.

- Strengthen your value hunting by scanning these 933 undervalued stocks based on cash flows where market prices may still lag underlying cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HSBC Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:HSBA

HSBC Holdings

Engages in the provision of banking and financial products and services worldwide.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026