- United Kingdom

- /

- Banks

- /

- LSE:HSBA

HSBC Holdings (LSE:HSBA) Reports Strong Dividend Performance and Strategic Alliances Despite Growth Challenges

Reviewed by Simply Wall St

HSBC Holdings (LSE:HSBA) is navigating a dynamic environment marked by both opportunities and challenges. Recent highlights include a record profit last year and strong first-half performance this year, juxtaposed against forecasted earnings declines and economic uncertainties. In the discussion that follows, we will explore HSBC's financial health, operational inefficiencies, strategic growth initiatives, and external threats to provide a comprehensive overview of the company's current business situation.

Click here to discover the nuances of HSBC Holdings with our detailed analytical report.

Strengths: Core Advantages Driving Sustained Success For HSBC Holdings

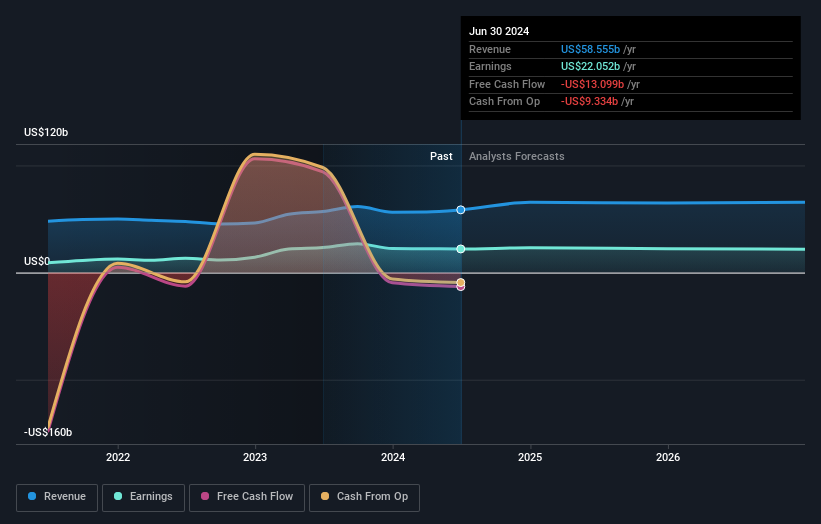

HSBC Holdings has demonstrated strong financial performance, evidenced by its record profit last year and solid first-half performance this year. Revenue reached $37.3 billion, marking a 1% increase, while profit before tax remained stable at $21.6 billion. This performance has enabled continued strong capital generation, with a return on tangible equity at 17%, excluding notable items, as highlighted by Group Chief Executive Noel Quinn. Additionally, HSBC's dividend yield of 6.7% places it in the top 25% of dividend payers in the UK market, reflecting its commitment to shareholder returns. The company is also trading at £6.81, significantly below the estimated fair value of £15.96, indicating it is undervalued based on discounted cash flow analysis. This undervaluation, combined with its diversified revenue growth, particularly in wealth management, underscores its strong market positioning.

Weaknesses: Critical Issues Affecting HSBC Holdings's Performance and Areas For Growth

The company's earnings are forecast to decline by an average of 0.7% per year over the next three years, and its revenue growth of 3.1% per year is expected to be slower than the UK market's 3.7%. Furthermore, HSBC's return on equity, forecasted at 12.4% in three years, is considered low compared to industry benchmarks. The bank also has a high level of bad loans at 2.2%, and its allowance for bad loans is insufficient at 46%. Additionally, the Hong Kong corporate loan market remains subdued, impacting overall growth. Despite trading at a low price-to-earnings ratio of 7.4x, compared to the European Banks industry average of 7.5x, the target price is less than 20% higher than the current share price, indicating limited short-term upside potential.

Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

HSBC has several opportunities to enhance its market position. The bank continues to grow multi-jurisdictional client revenue in both wholesale and retail sectors, capitalizing on significant inflows into Hong Kong. Investment in differentiated international propositions, particularly in wealth management, remains a strategic focus, with wealth revenue up 12% in the first half to $4.3 billion. Additionally, around $55 billion of assets are due to mature in the second half of 2024, with an average yield of 2.8%, providing structural hedge benefits. The long-term growth potential in Asia, with markets expected to grow at high-single to double-digit percentages over the next five years, offers substantial expansion opportunities for HSBC.

Threats: Key Risks and Challenges That Could Impact HSBC Holdings's Success

Economic uncertainty remains a significant threat, as noted by Noel Quinn, with ongoing volatility and regulatory risks such as the upcoming Basel 3.1 model update. Competitive pressure from other international franchises also poses a challenge. Additionally, HSBC's dividend payments have been unreliable over the past nine years, with volatility in payments, which could impact investor confidence. Market volatility, particularly in foreign exchange, which was down 8% compared to a strong performance last year, further adds to the risks. The company's sensitivity to interest rates, despite being reduced, still poses a financial risk, with banking net interest income sensitivity now at approximately $2.7 billion for a 100 basis points down shock in interest rates.

Conclusion

HSBC Holdings' strong financial performance, evidenced by its record profit and stable revenue growth, underscores its solid market positioning and ability to generate capital effectively. However, the company faces challenges such as forecasted earnings decline, high levels of bad loans, and slower revenue growth compared to the UK market, which could impact its future performance. Nonetheless, HSBC's strategic focus on wealth management and growth potential in Asia presents significant opportunities for expansion. Trading at £6.81, significantly below its estimated fair value of £15.96, HSBC appears to offer substantial long-term investment potential, provided it can navigate economic uncertainties and competitive pressures.

Seize The Opportunity

- Already own HSBC Holdings? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management .

- Find companies with promising cash flow potential yet trading below their fair value .

Valuation is complex, but we're here to simplify it.

Discover if HSBC Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About LSE:HSBA

Good value with adequate balance sheet and pays a dividend.