- United Kingdom

- /

- Banks

- /

- LSE:BARC

Barclays (LSE:BARC) Valuation: Is the Market Underestimating Its True Potential?

Reviewed by Kshitija Bhandaru

If you’ve watched Barclays (LSE:BARC) stock lately, you might be wondering what’s behind its recent run and if now is the right time to act. There has been no single headline-grabbing event to spark this move, but sometimes, these kinds of quiet rallies can tell you just as much about how markets are sizing up future opportunities. Whether you’re an existing shareholder or weighing your first buy, steady upward motion without fanfare deserves a closer look.

Taking a step back, Barclays’ stock has built meaningful momentum this year. While the short-term climb over the past month sits around 3%, its performance over the past three months is even stronger, with a return of 13%. Zoom out a bit more, and you’ll find the stock has surged 71% in the past year, dramatically outpacing the broader market. Alongside this, annual revenue and profits have both grown moderately, and there hasn’t been any major corporate event or shock on the news front since the last quarter’s results.

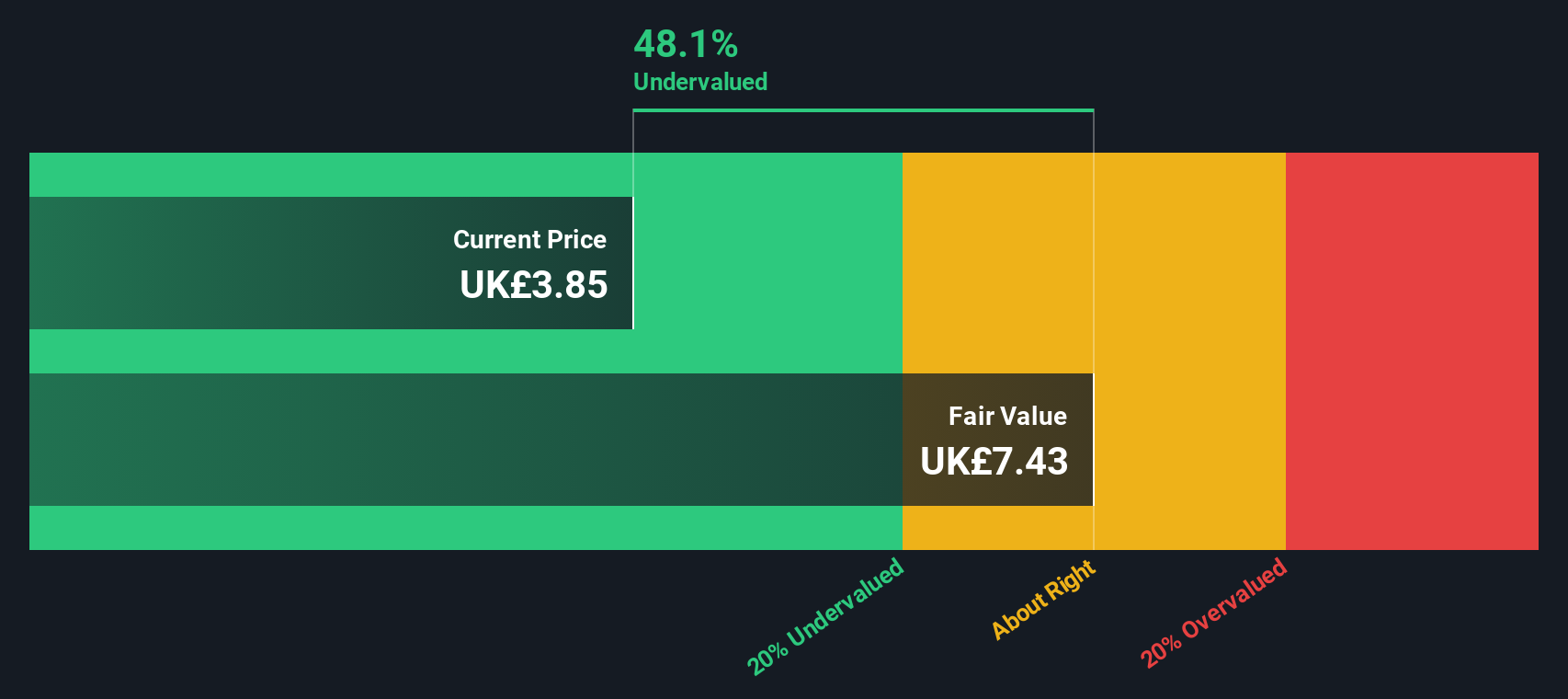

So, after such a stretch of strong gains, is Barclays undervalued and offering real upside, or is the market already factoring in all the future growth investors can hope for?

Most Popular Narrative: 7% Undervalued

Barclays is considered undervalued by the most widely followed narrative, with a fair value estimated to be noticeably higher than its current market price. Analysts, using their forward-looking assumptions about growth and profitability, see significant upside based on current forecasts.

Ongoing investments in digital banking and technology platforms, including integration of fintech partnerships and sustained client onboarding in corporate banking, are positioned to drive operational efficiency and expand Barclays' digital revenue streams. This supports stronger net margins and long-term earnings growth.

Want to know what’s fueling analyst confidence in Barclays’ upside? The secret lies in unusually ambitious earnings growth targets and margin forecasts brought to life by a bold digital transformation. Are you intrigued by the quantitative leaps that might justify a premium usually reserved for industry disruptors? Uncover the specific financial drivers and future expectations that underpin this potential re-rating.

Result: Fair Value of £4.11 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, the story is not without its risks. Tougher lending competition or surprise regulatory changes could weigh on Barclays’ growth ambitions down the line.

Find out about the key risks to this Barclays narrative.Another View: Discounted Cash Flow Model

Taking a fresh angle, our SWS DCF model also sees Barclays trading below its calculated fair value. This approach weighs future cash flows and provides a reality check compared to multiple-based optimism. Could this be a deeper sign that the market is overlooking something?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Barclays for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Barclays Narrative

If you’re the type to chart your own path or believe the story behind the numbers is yours to tell, you can even craft a unique take in just a few minutes: Do it your way.

A great starting point for your Barclays research is our analysis highlighting 3 key rewards and 5 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Why settle for just one opportunity when you can target the next big winners? Tap into fresh investing angles and seize trends before the crowd catches on.

- Capitalize on fast-growing tech with a focus on the AI revolution by tracking emerging leaders through AI penny stocks.

- Boost your search for hidden gems that offer strong financials and the potential for high long-term gains by uncovering value-packed opportunities via undervalued stocks based on cash flows.

- Unlock robust income streams with standout picks that deliver yields above 3%, all spotlighted in dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Barclays might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:BARC

Barclays

Provides various financial services in the United Kingdom, Europe, the Americas, Africa, the Middle East, and Asia.

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives