- United Kingdom

- /

- Banks

- /

- LSE:LLOY

3 UK Dividend Stocks Yielding Up To 6%

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines amid weak trade data from China, highlighting concerns over global economic recovery. In such uncertain times, dividend stocks can offer investors a measure of stability and income potential, as they provide regular payouts that can help offset market volatility.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Treatt (LSE:TET) | 3.91% | ★★★★★☆ |

| Seplat Energy (LSE:SEPL) | 7.71% | ★★★★★☆ |

| RS Group (LSE:RS1) | 3.70% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 5.98% | ★★★★★☆ |

| MONY Group (LSE:MONY) | 6.92% | ★★★★★★ |

| Keller Group (LSE:KLR) | 3.19% | ★★★★★☆ |

| Impax Asset Management Group (AIM:IPX) | 8.26% | ★★★★★☆ |

| IG Group Holdings (LSE:IGG) | 4.12% | ★★★★★☆ |

| Halyk Bank of Kazakhstan (LSE:HSBK) | 6.10% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 4.67% | ★★★★★☆ |

Click here to see the full list of 48 stocks from our Top UK Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Arbuthnot Banking Group (AIM:ARBB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Arbuthnot Banking Group PLC, with a market cap of £147.12 million, offers private and commercial banking products and services in the United Kingdom through its subsidiaries.

Operations: Arbuthnot Banking Group PLC generates revenue through several key segments, including Wealth Management (£15.21 million), Asset Alliance Group (AAG) (£15.40 million), Renaissance Asset Finance (RAF) (£14.09 million), and Arbuthnot Commercial Asset Based Lending (ACABL) (£20.31 million).

Dividend Yield: 5.4%

Arbuthnot Banking Group offers a mixed dividend profile. While its payout ratio of 50.9% suggests dividends are well-covered by earnings, the bank's history of volatile payments over the past decade raises concerns about reliability. Profit margins have declined from 17.1% to 9.5%, and a high bad loans ratio (3.7%) could impact future stability. Despite trading at a significant discount to fair value, its dividend yield (5.43%) lags behind top UK payers (5.73%).

- Navigate through the intricacies of Arbuthnot Banking Group with our comprehensive dividend report here.

- The analysis detailed in our Arbuthnot Banking Group valuation report hints at an deflated share price compared to its estimated value.

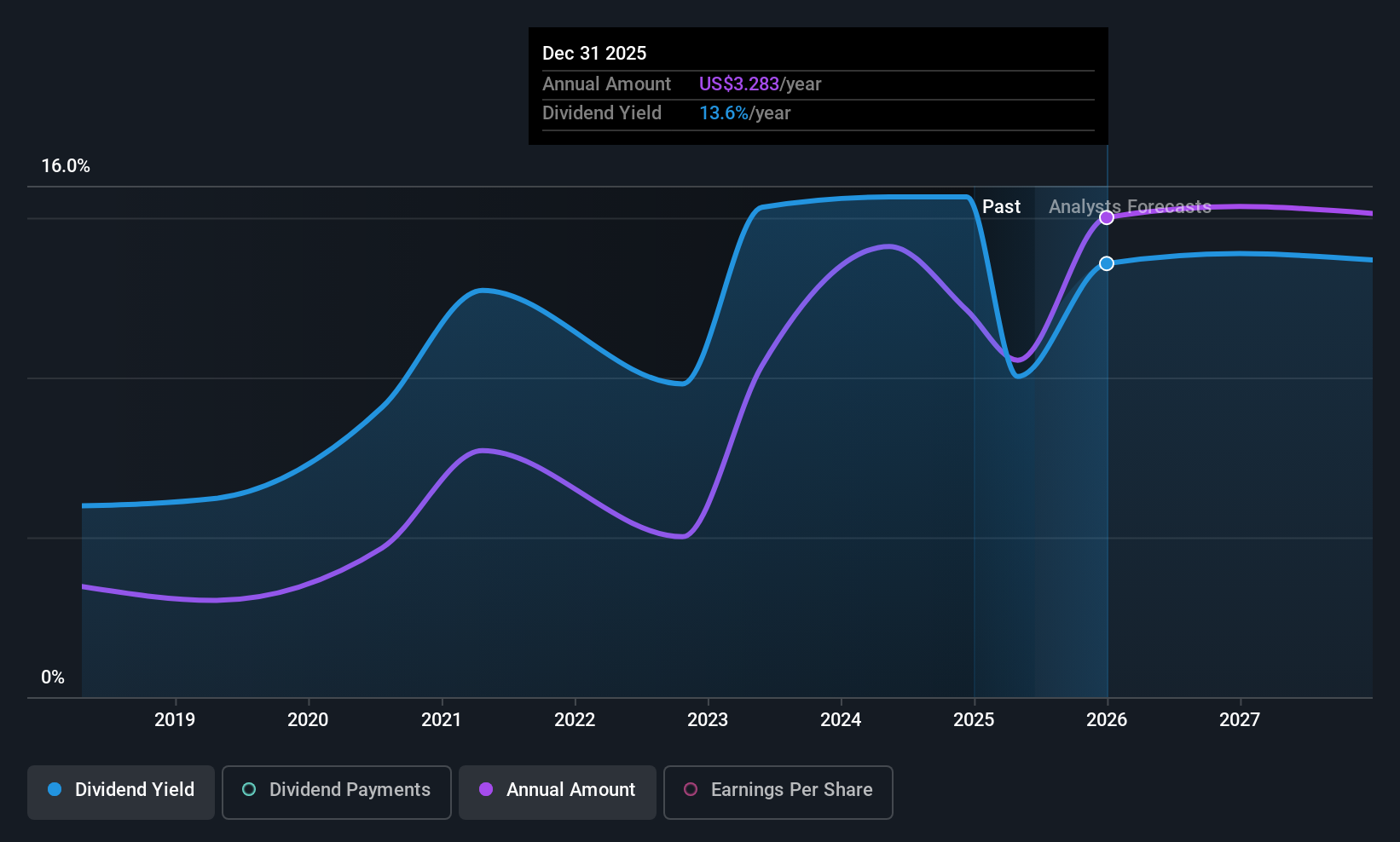

Halyk Bank of Kazakhstan (LSE:HSBK)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Halyk Bank of Kazakhstan Joint Stock Company, along with its subsidiaries, offers corporate and retail banking services mainly in Kazakhstan, Kyrgyzstan, Georgia, and Uzbekistan with a market cap of $7.25 billion.

Operations: Halyk Bank of Kazakhstan generates revenue primarily through its Corporate Banking segment, which accounts for KZT 865.95 billion, followed by Investment Banking at KZT 264.21 billion, Retail Banking at KZT 215.10 billion, and Small and Medium Enterprises (SME) Banking at KZT 202.26 billion.

Dividend Yield: 6.1%

Halyk Bank of Kazakhstan's dividend profile shows a low payout ratio of 29.6%, indicating strong coverage by earnings, yet its dividends have been volatile over the past decade. Despite trading at 57.6% below fair value, the bank faces challenges with a high bad loans ratio of 6.7%. Recent executive changes and a KZT 143 billion equity offering could impact future stability, though its dividend yield remains in the top UK quartile at 6.1%.

- Get an in-depth perspective on Halyk Bank of Kazakhstan's performance by reading our dividend report here.

- According our valuation report, there's an indication that Halyk Bank of Kazakhstan's share price might be on the cheaper side.

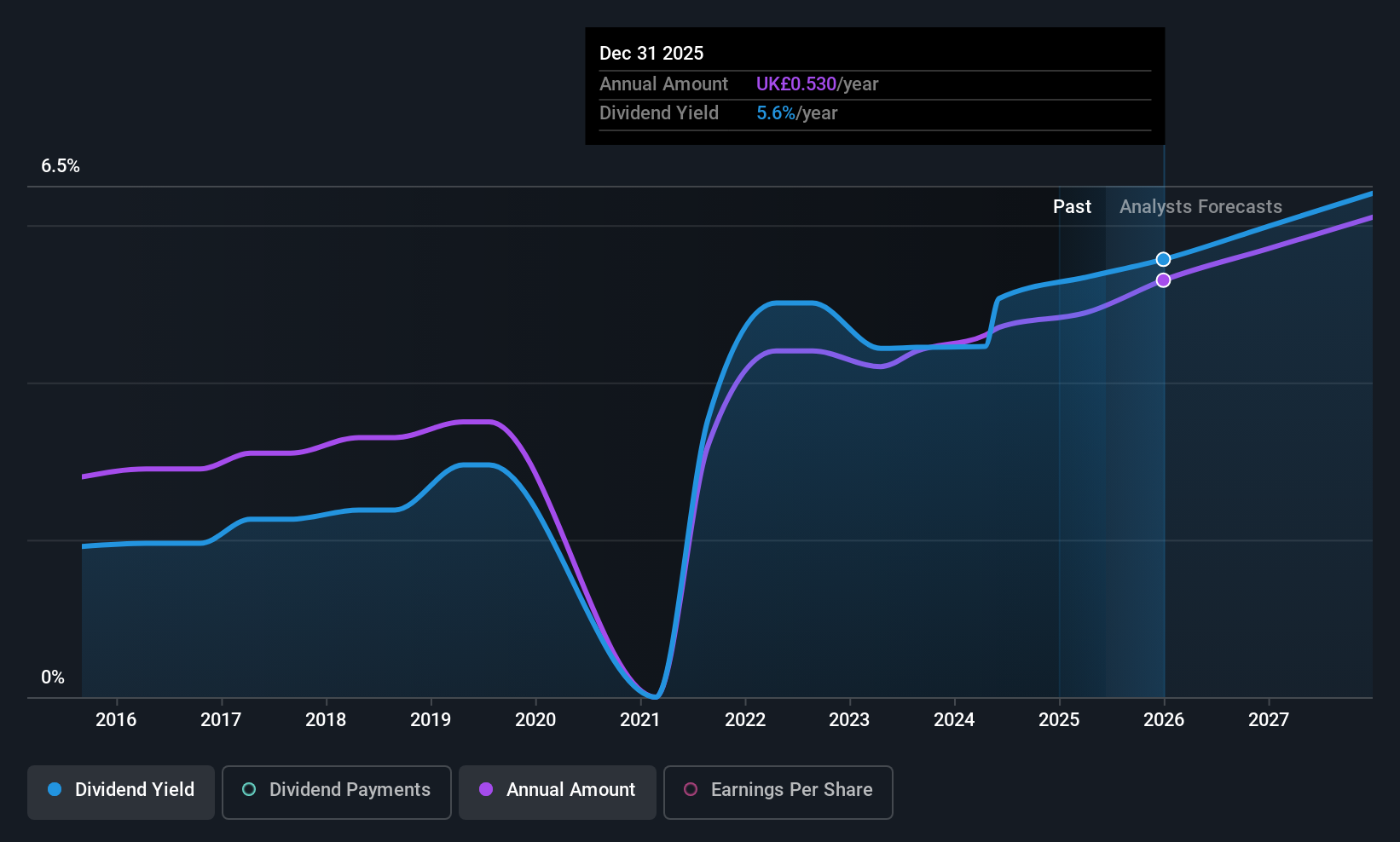

Lloyds Banking Group (LSE:LLOY)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Lloyds Banking Group plc, along with its subsidiaries, offers a variety of banking and financial products and services both in the United Kingdom and internationally, with a market capitalization of approximately £55.75 billion.

Operations: Lloyds Banking Group generates revenue through diverse banking and financial services offered within the UK and globally.

Dividend Yield: 3.5%

Lloyds Banking Group's dividend payments have been inconsistent over the past decade, with a history of volatility. Despite this, dividends are currently covered by earnings with a 58% payout ratio and are forecast to improve to 37.5% coverage in three years. The bank's net interest income guidance for 2025 is £13.6 billion, slightly above expectations, but its dividend yield of 3.51% remains below the top UK payers' average of 5.65%.

- Click to explore a detailed breakdown of our findings in Lloyds Banking Group's dividend report.

- The valuation report we've compiled suggests that Lloyds Banking Group's current price could be inflated.

Turning Ideas Into Actions

- Delve into our full catalog of 48 Top UK Dividend Stocks here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:LLOY

Lloyds Banking Group

Provides a range of banking and financial products and services in the United Kingdom and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Waiting for the Inevitable

Near zero debt, Japan centric focus provides future growth

Corning's Revenue Will Climb by 12.73% in Just Five Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026