- France

- /

- Electric Utilities

- /

- ENXTPA:ELEC

Top Dividend Stocks To Consider In February 2025

Reviewed by Simply Wall St

As global markets navigate the complexities of tariff uncertainties and mixed economic signals, dividend stocks continue to attract investors seeking stability amid volatility. With U.S. job growth showing signs of cooling and manufacturing activity rebounding, selecting dividend stocks that offer reliable income streams can be a prudent strategy for those looking to weather market fluctuations while potentially benefiting from consistent payouts.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.83% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.54% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.33% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.04% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.84% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.41% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.12% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.90% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.35% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.28% | ★★★★★★ |

Click here to see the full list of 1971 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

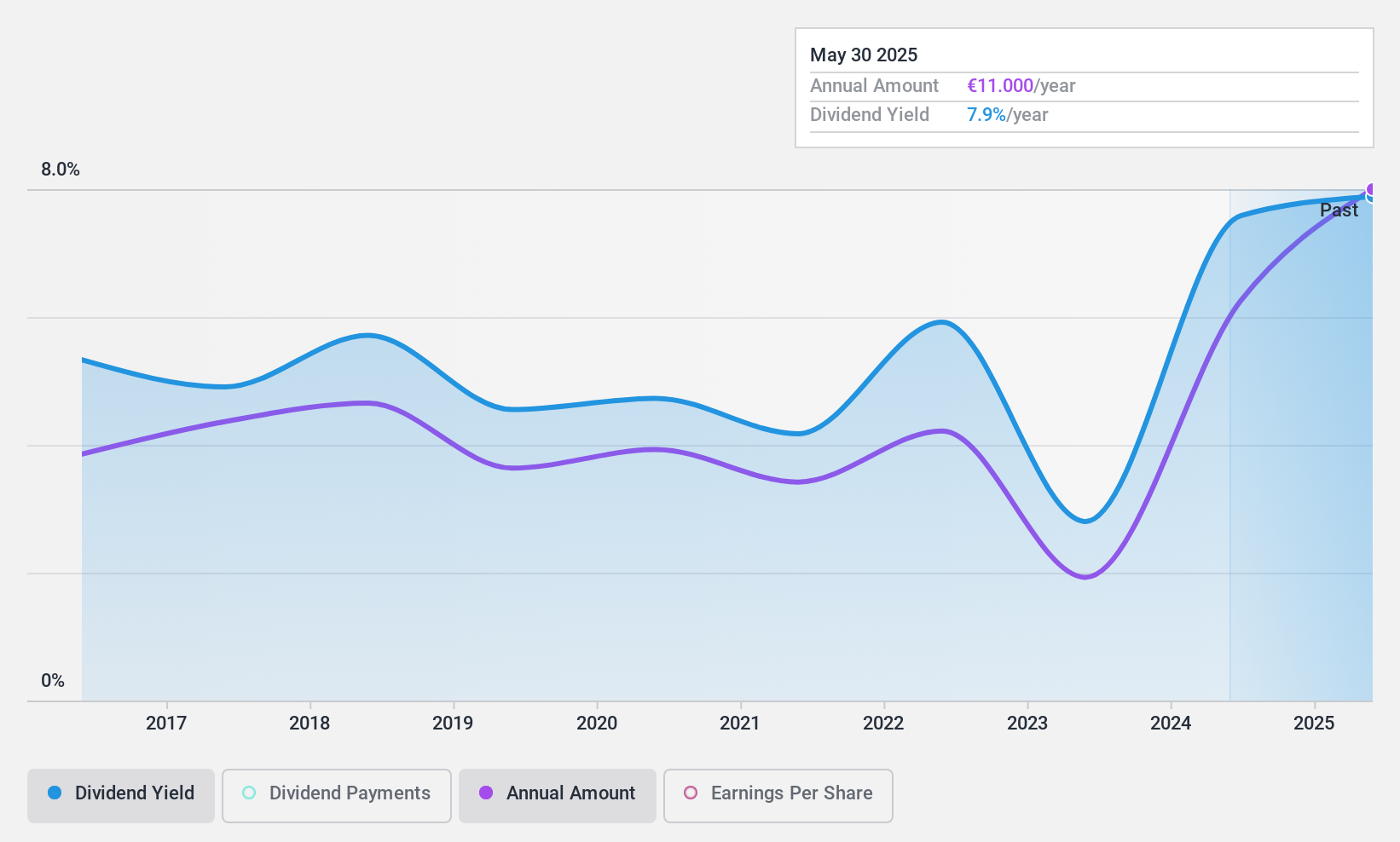

Électricite de Strasbourg Société Anonyme (ENXTPA:ELEC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Électricite de Strasbourg Société Anonyme supplies electricity and natural gas to individuals, businesses, and local authorities in France, with a market cap of €906.93 million.

Operations: Électricite de Strasbourg Société Anonyme generates revenue primarily from the production and distribution of electricity and gas (€1.24 billion) and its role as an electricity distributor (€302.94 million).

Dividend Yield: 6.5%

Électricite de Strasbourg Société Anonyme offers a compelling dividend yield at 6.49%, placing it in the top 25% among French dividend payers. Its dividends are well-covered by earnings and cash flows, with payout ratios of 43.8% and 38.6%, respectively, indicating sustainability. However, investors should note its volatile dividend history over the past decade despite recent growth in payments and earnings surging by 96.7% last year, suggesting potential for future stability improvements.

- Dive into the specifics of Électricite de Strasbourg Société Anonyme here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Électricite de Strasbourg Société Anonyme is trading behind its estimated value.

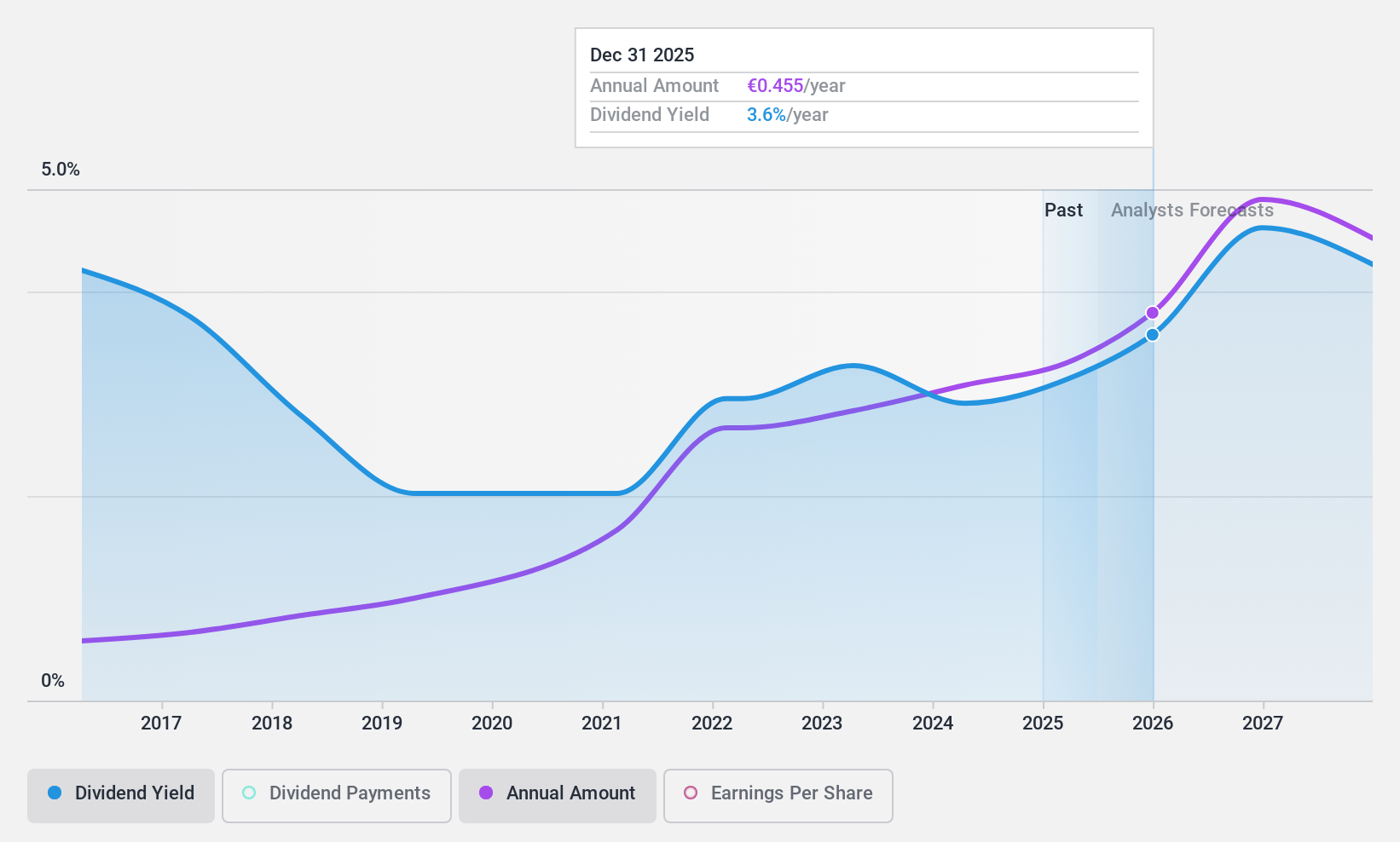

Marimekko Oyj (HLSE:MEKKO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Marimekko Oyj is a lifestyle design company that designs, manufactures, and sells clothing, bags and accessories, and interior decoration products globally with a market cap of €490.91 million.

Operations: Marimekko Oyj generates revenue primarily through its Marimekko Business segment, which contributed €179.21 million.

Dividend Yield: 3%

Marimekko Oyj's dividends have been stable and growing over the past decade, supported by a payout ratio of 64.9% and a cash payout ratio of 45.3%, indicating sustainability. Although its dividend yield of 2.97% is below the top tier in Finland, it remains reliable due to consistent earnings growth, recently at 7.5%. Trading at a discount to fair value enhances its attractiveness for dividend-focused investors seeking stability and potential appreciation.

- Click here to discover the nuances of Marimekko Oyj with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Marimekko Oyj shares in the market.

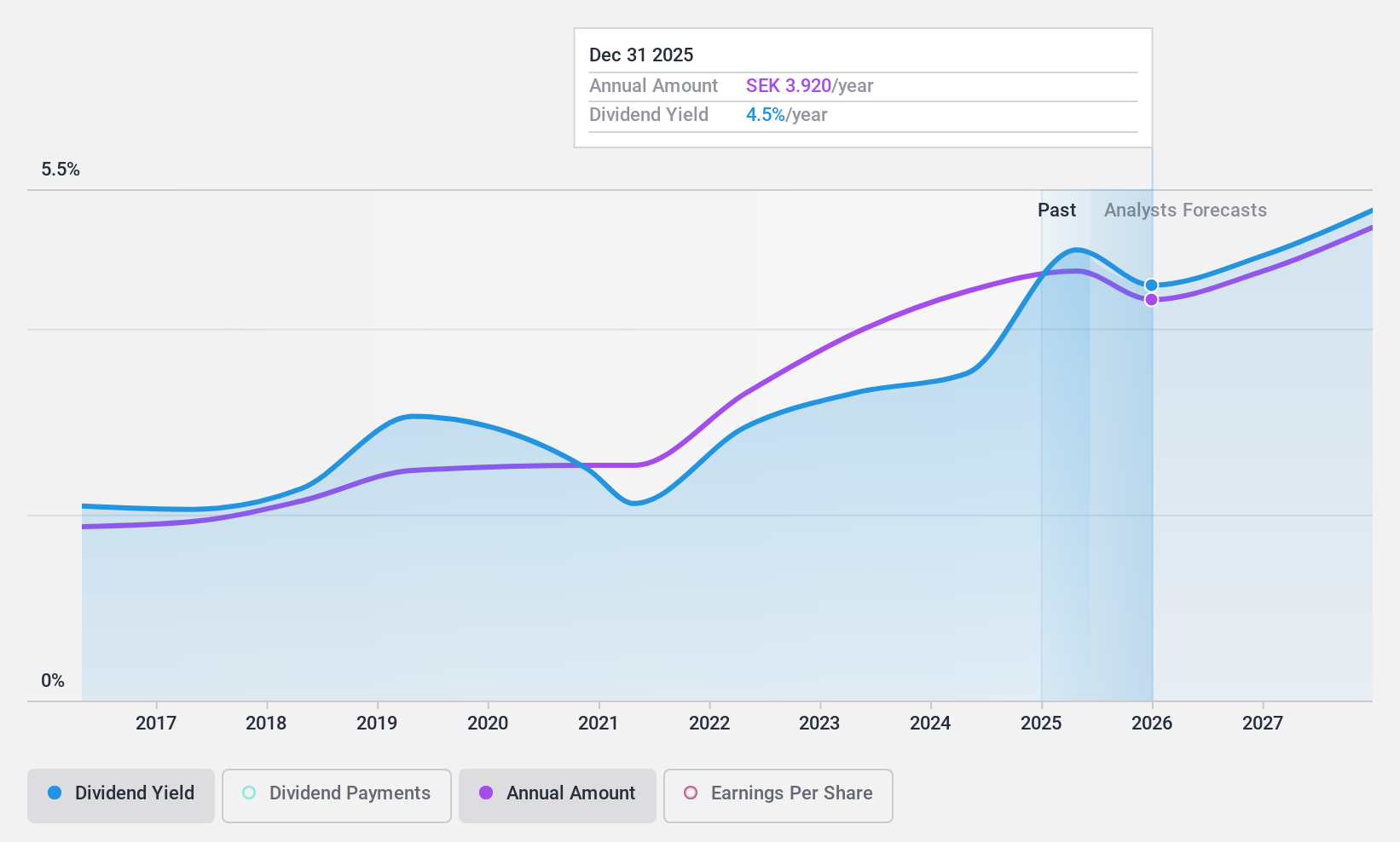

HEXPOL (OM:HPOL B)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: HEXPOL AB (publ) is involved in the development, manufacture, and sale of various polymer compounds and engineered products across Sweden, Europe, the Americas, and Asia with a market cap of SEK34.72 billion.

Operations: HEXPOL AB generates revenue primarily from its HEXPOL Compounding segment, which accounts for SEK18.92 billion, and its HEXPOL Engineered Products segment, contributing SEK1.52 billion.

Dividend Yield: 4%

HEXPOL's dividend payments have been stable and growing over the past decade, with a proposed increase to SEK 4.20 per share for 2024, supported by a payout ratio of 65.2% and cash payout ratio of 69.3%. Although its yield of 3.98% is below Sweden's top tier, it remains reliable due to consistent earnings coverage and trading at a significant discount to estimated fair value, despite recent earnings declines and strategic reorganizations aimed at improving efficiency.

- Click to explore a detailed breakdown of our findings in HEXPOL's dividend report.

- Our comprehensive valuation report raises the possibility that HEXPOL is priced lower than what may be justified by its financials.

Where To Now?

- Click here to access our complete index of 1971 Top Dividend Stocks.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Électricite de Strasbourg Société Anonyme might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ELEC

Électricite de Strasbourg Société Anonyme

Engages in the supply of electricity and natural gas to individuals, businesses, and local authorities in France.

Outstanding track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives