- France

- /

- Entertainment

- /

- ENXTPA:BLV

Believe And Two More Euronext Paris Growth Stocks With Major Insider Ownership

Reviewed by Simply Wall St

As the French CAC 40 Index experiences a downturn, reflecting broader European market sensitivities to inflationary pressures and monetary policy expectations, investors are increasingly scrutinizing company fundamentals. In this context, stocks with significant insider ownership can be compelling, as high insider stakes often align management’s interests with those of shareholders, potentially leading to more prudent corporate governance and strategic decision-making during uncertain times.

Top 10 Growth Companies With High Insider Ownership In France

| Name | Insider Ownership | Earnings Growth |

| VusionGroup (ENXTPA:VU) | 13.5% | 25% |

| Groupe OKwind Société anonyme (ENXTPA:ALOKW) | 24.8% | 30.6% |

| WALLIX GROUP (ENXTPA:ALLIX) | 19.8% | 101.4% |

| La Française de l'Energie (ENXTPA:FDE) | 20.1% | 37.7% |

| Adocia (ENXTPA:ADOC) | 12.4% | 104.5% |

| OSE Immunotherapeutics (ENXTPA:OSE) | 24.9% | 92.9% |

| Icape Holding (ENXTPA:ALICA) | 30.2% | 26.1% |

| Arcure (ENXTPA:ALCUR) | 21.4% | 41.7% |

| Munic (ENXTPA:ALMUN) | 29.4% | 150% |

| MedinCell (ENXTPA:MEDCL) | 16.4% | 68.8% |

Let's uncover some gems from our specialized screener.

Believe (ENXTPA:BLV)

Simply Wall St Growth Rating: ★★★★☆☆

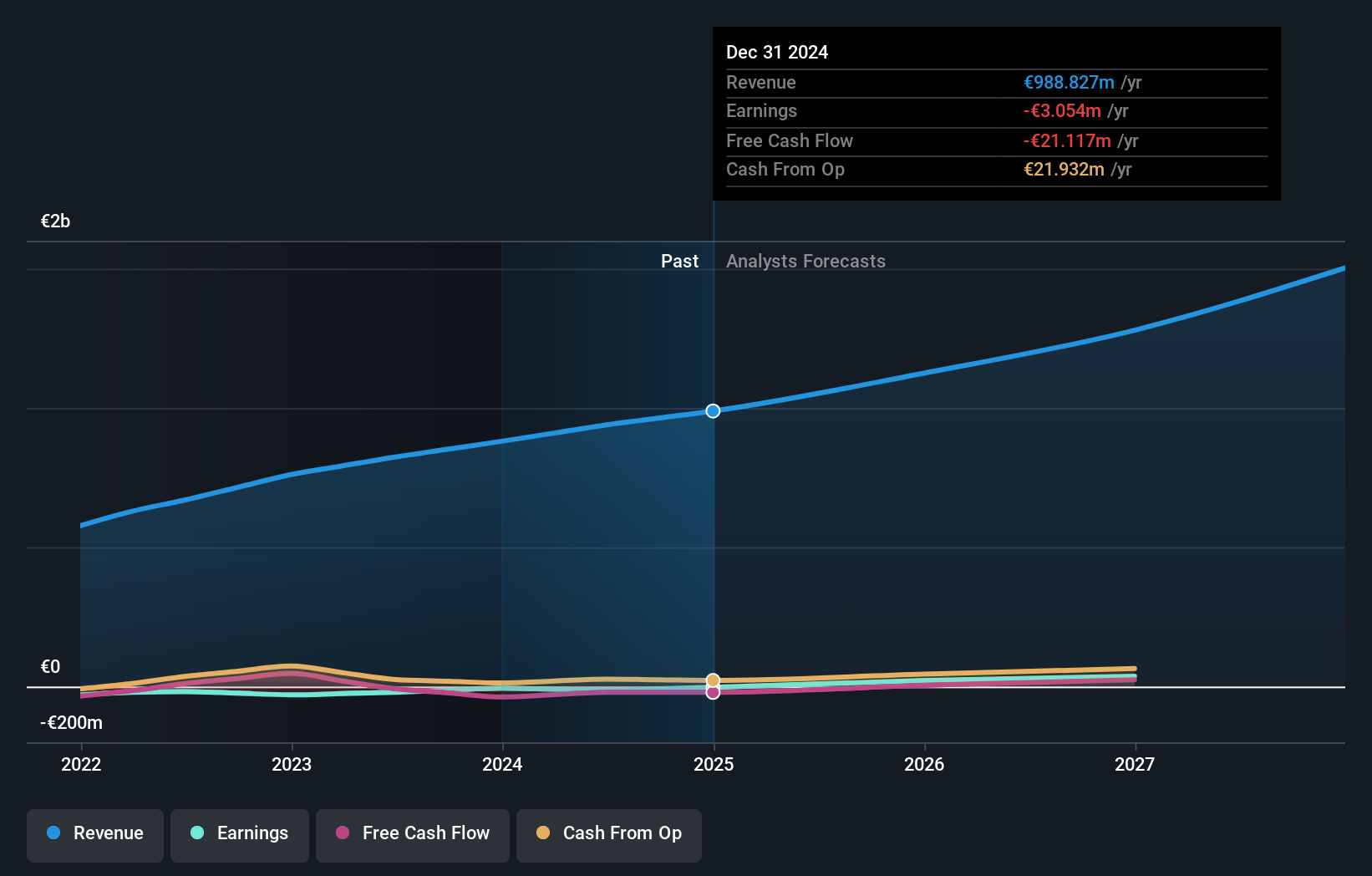

Overview: Believe S.A. operates as a digital music service provider for independent labels and artists across regions including France, Germany, Europe, the Americas, Asia, Oceania, and the Pacific, with a market cap of approximately €1.47 billion.

Operations: Believe S.A. generates revenue primarily through two segments: Premium Solutions at €825.12 million and Automated Solutions at €55.19 million.

Insider Ownership: 10.3%

Believe S.A., a French digital music company, is currently trading at 57.8% below its estimated fair value, indicating potential undervaluation. Despite recent takeover interest from Warner Music and a consortium led by insiders, the company remains independent. Believe reported significant improvement in its financials for 2023 with sales increasing to €880.31 million and reducing net loss to €5.48 million from the previous year's larger losses. With earnings expected to grow by 74.2% annually, Believe is on track to become profitable within three years, outpacing average market growth forecasts in France.

- Delve into the full analysis future growth report here for a deeper understanding of Believe.

- The analysis detailed in our Believe valuation report hints at an deflated share price compared to its estimated value.

MedinCell (ENXTPA:MEDCL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MedinCell S.A. is a French pharmaceutical company specializing in the development of long-acting injectable treatments across multiple therapeutic areas, with a market capitalization of approximately €454.51 million.

Operations: The company generates its revenue primarily from the pharmaceuticals segment, totaling €14.13 million.

Insider Ownership: 16.4%

MedinCell, a French biotech firm, is anticipated to reach profitability within the next three years with earnings growth forecasted at 68.85% annually and revenue growth projected at 40.1% per year, significantly outpacing the French market average of 5.8%. Despite recent setbacks in clinical trials, such as the Phase 3 trial for F14 not meeting its primary endpoint, MedinCell continues to show potential through other successful trials and strategic partnerships like the one with AbbVie potentially worth up to US$1.9 billion in milestones plus royalties. However, investors should note that shareholder dilution occurred over the past year and share price has been highly volatile recently.

- Click here and access our complete growth analysis report to understand the dynamics of MedinCell.

- Upon reviewing our latest valuation report, MedinCell's share price might be too optimistic.

VusionGroup (ENXTPA:VU)

Simply Wall St Growth Rating: ★★★★★★

Overview: VusionGroup S.A. is a company that offers digitalization solutions for commerce across Europe, Asia, and North America, with a market capitalization of approximately €2.32 billion.

Operations: The company generates revenue primarily through the installation and maintenance of electronic shelf labels, contributing approximately €801.96 million.

Insider Ownership: 13.5%

VusionGroup S.A. demonstrated robust growth with earnings surging by 320.8% last year, reaching EUR 79.77 million in net income from EUR 18.95 million the previous year, on revenues of EUR 801.96 million up from EUR 620.86 million. Analysts predict a significant earnings growth of about 25% annually over the next three years and a high return on equity forecast at 29.3%. Despite these strong financials, the company's share price has been highly volatile recently, which may concern some investors.

- Navigate through the intricacies of VusionGroup with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that VusionGroup is priced higher than what may be justified by its financials.

Turning Ideas Into Actions

- Discover the full array of 23 Fast Growing Euronext Paris Companies With High Insider Ownership right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Believe might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:BLV

Believe

Provides digital music services for independent labels and local artists in France, Germany, rest of Europe, the Americas, Asia, Oceania, and Pacific.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)