Gérard Tremblay has been the CEO of Osmozis SA (EPA:ALOSM) since 2016, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Osmozis.

Check out our latest analysis for Osmozis

How Does Total Compensation For Gérard Tremblay Compare With Other Companies In The Industry?

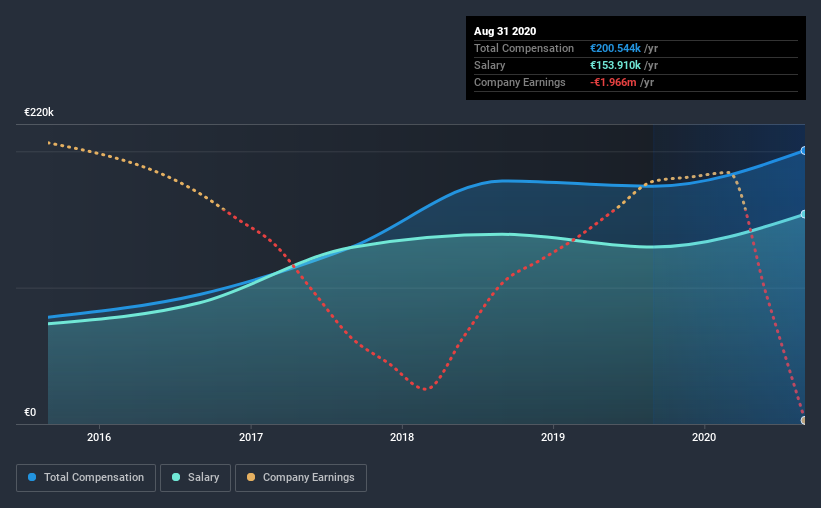

At the time of writing, our data shows that Osmozis SA has a market capitalization of €13m, and reported total annual CEO compensation of €201k for the year to August 2020. We note that's an increase of 15% above last year. We note that the salary portion, which stands at €153.9k constitutes the majority of total compensation received by the CEO.

On comparing similar-sized companies in the industry with market capitalizations below €165m, we found that the median total CEO compensation was €238k. This suggests that Osmozis remunerates its CEO largely in line with the industry average. What's more, Gérard Tremblay holds €2.7m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | €154k | €130k | 77% |

| Other | €47k | €45k | 23% |

| Total Compensation | €201k | €174k | 100% |

On an industry level, roughly 77% of total compensation represents salary and 23% is other remuneration. Our data reveals that Osmozis allocates salary more or less in line with the wider market. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Osmozis SA's Growth Numbers

Over the past three years, Osmozis SA has seen its earnings per share (EPS) grow by 36% per year. Its revenue is down 4.6% over the previous year.

Shareholders would be glad to know that the company has improved itself over the last few years. The lack of revenue growth isn't ideal, but it is the bottom line that counts most in business. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Osmozis SA Been A Good Investment?

With a three year total loss of 34% for the shareholders, Osmozis SA would certainly have some dissatisfied shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

As we touched on above, Osmozis SA is currently paying a compensation that's close to the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. Meanwhile, shareholder returns paint a sorry picture for the company, finishing in the red over the last three years. But EPS growth is moving in a favorable direction, certainly a positive sign. Considering positive EPS growth, we'd say compensation is fair, but shareholders may be wary of a bump in pay before the company logs positive returns.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. In our study, we found 2 warning signs for Osmozis you should be aware of, and 1 of them can't be ignored.

Important note: Osmozis is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you decide to trade Osmozis, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTPA:ALOSM

Osmozis

Provides broadband internet access for holidaymakers and professional connected services for owners in Europe.

Medium-low with mediocre balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)