- France

- /

- Tech Hardware

- /

- ENXTPA:ALLOG

Investors Aren't Entirely Convinced By Logic Instrument S.A.'s (EPA:ALLOG) Revenues

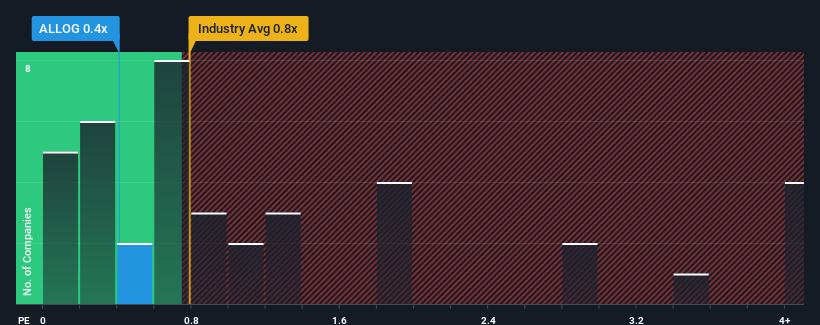

There wouldn't be many who think Logic Instrument S.A.'s (EPA:ALLOG) price-to-sales (or "P/S") ratio of 0.4x is worth a mention when the median P/S for the Tech industry in France is similar at about 0.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Logic Instrument

What Does Logic Instrument's Recent Performance Look Like?

Recent times have been quite advantageous for Logic Instrument as its revenue has been rising very briskly. It might be that many expect the strong revenue performance to wane, which has kept the share price, and thus the P/S ratio, from rising. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Logic Instrument will help you shine a light on its historical performance.How Is Logic Instrument's Revenue Growth Trending?

In order to justify its P/S ratio, Logic Instrument would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 49%. As a result, it also grew revenue by 13% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

When compared to the industry's one-year growth forecast of 2.1%, the most recent medium-term revenue trajectory is noticeably more alluring

With this information, we find it interesting that Logic Instrument is trading at a fairly similar P/S compared to the industry. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We didn't quite envision Logic Instrument's P/S sitting in line with the wider industry, considering the revenue growth over the last three-year is higher than the current industry outlook. When we see strong revenue with faster-than-industry growth, we can only assume potential risks are what might be placing pressure on the P/S ratio. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to see the likelihood of revenue fluctuations in the future.

Having said that, be aware Logic Instrument is showing 6 warning signs in our investment analysis, and 4 of those are concerning.

If you're unsure about the strength of Logic Instrument's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALLOG

Logic Instrument

Manufactures, distributes, and sells mobile computers for professional applications.

Undervalued with high growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)