Analysts Have Been Trimming Their OVH Groupe S.A. (EPA:OVH) Price Target After Its Latest Report

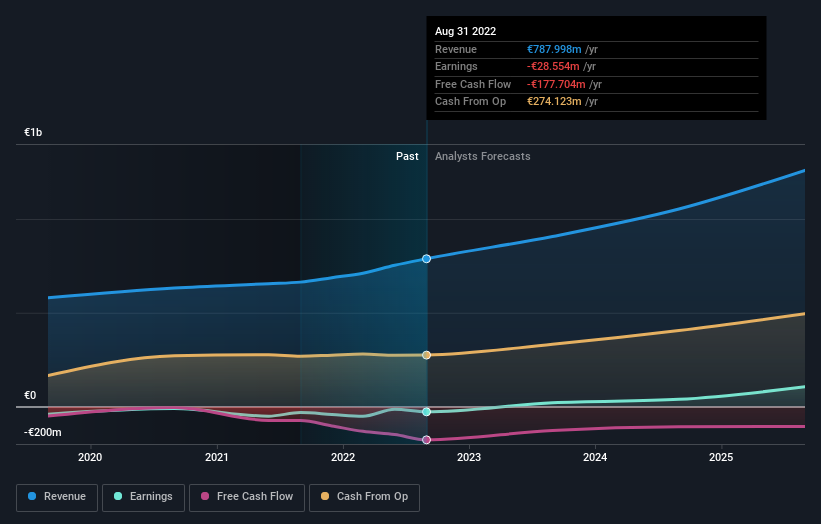

It's been a pretty great week for OVH Groupe S.A. (EPA:OVH) shareholders, with its shares surging 13% to €12.82 in the week since its latest annual results. It was an okay report, and revenues came in at €788m, approximately in line with analyst estimates leading up to the results announcement. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. We thought readers would find it interesting to see the analysts latest (statutory) post-earnings forecasts for next year.

Check out the opportunities and risks within the FR IT industry.

After the latest results, the seven analysts covering OVH Groupe are now predicting revenues of €906.8m in 2023. If met, this would reflect a notable 15% improvement in sales compared to the last 12 months. Earnings are expected to improve, with OVH Groupe forecast to report a statutory profit of €0.062 per share. Yet prior to the latest earnings, the analysts had been anticipated revenues of €883.6m and earnings per share (EPS) of €0.095 in 2023. So it's pretty clear the analysts have mixed opinions on OVH Groupe after the latest results; even though they upped their revenue numbers, it came at the cost of a pretty serious reduction to per-share earnings expectations.

The analysts also cut OVH Groupe's price target 7.3% to €16.32, implying that lower forecast earnings are expected to have a more negative impact than can be offset by the increase in sales. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. The most optimistic OVH Groupe analyst has a price target of €23.00 per share, while the most pessimistic values it at €9.50. Note the wide gap in analyst price targets? This implies to us that there is a fairly broad range of possible scenarios for the underlying business.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the OVH Groupe's past performance and to peers in the same industry. The analysts are definitely expecting OVH Groupe's growth to accelerate, with the forecast 15% annualised growth to the end of 2023 ranking favourably alongside historical growth of 9.3% per annum over the past three years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 7.8% per year. It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect OVH Groupe to grow faster than the wider industry.

The Bottom Line

The biggest concern is that the analysts reduced their earnings per share estimates, suggesting business headwinds could lay ahead for OVH Groupe. Happily, they also upgraded their revenue estimates, and are forecasting revenues to grow faster than the wider industry. Furthermore, the analysts also cut their price targets, suggesting that the latest news has led to greater pessimism about the intrinsic value of the business.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have forecasts for OVH Groupe going out to 2025, and you can see them free on our platform here.

You still need to take note of risks, for example - OVH Groupe has 2 warning signs (and 1 which shouldn't be ignored) we think you should know about.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:OVH

OVH Groupe

Provides public and private cloud, shared hosting, and dedicated server products and solutions worldwide.

High growth potential with low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)