Undiscovered Gems With Strong Fundamentals To Explore December 2024

Reviewed by Simply Wall St

As 2024 draws to a close, global markets have experienced a mix of gains and setbacks, with major U.S. stock indexes posting moderate increases despite declining consumer confidence and manufacturing activity. Amidst this backdrop, the search for small-cap stocks with strong fundamentals becomes increasingly vital, as these companies often offer unique opportunities for growth even when broader market sentiments are mixed. Identifying such stocks involves looking beyond short-term fluctuations to assess long-term potential based on solid financial health and strategic positioning within their respective industries.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Tokyo Tekko | 9.82% | 7.91% | 12.42% | ★★★★★★ |

| Nihon Parkerizing | 0.31% | 2.12% | 6.94% | ★★★★★★ |

| Padma Oil | 0.76% | 4.42% | 9.81% | ★★★★★★ |

| QuickLtd | 0.62% | 9.82% | 15.64% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| AJIS | 0.79% | 1.12% | -12.92% | ★★★★★☆ |

| Ogaki Kyoritsu Bank | 136.00% | 2.73% | 2.17% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Al Ansari Financial Services PJSC (DFM:ALANSARI)

Simply Wall St Value Rating: ★★★★☆☆

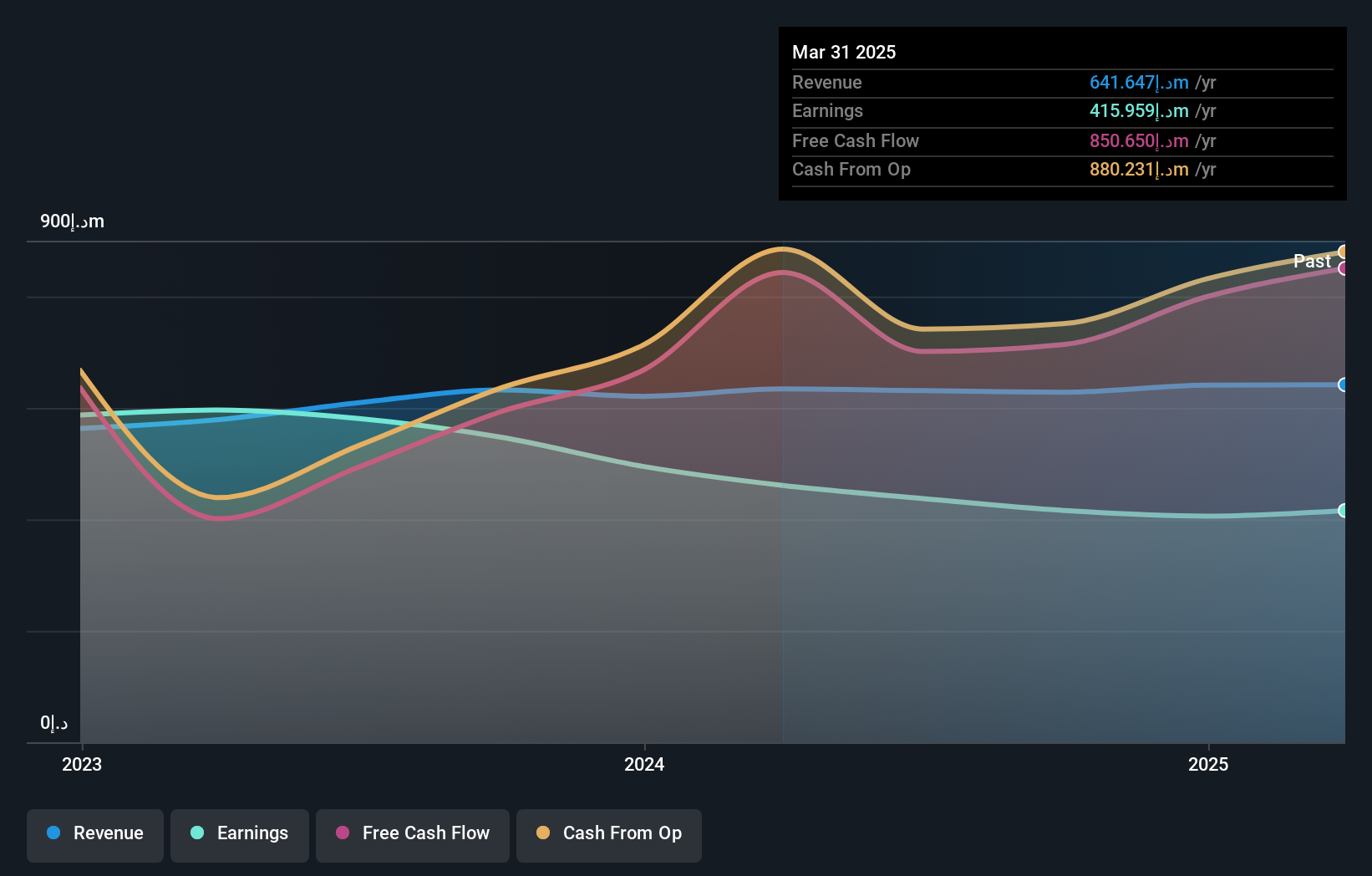

Overview: Al Ansari Financial Services PJSC offers a variety of integrated financial services both within the United Arab Emirates and internationally, with a market capitalization of AED7.46 billion.

Operations: The primary revenue stream for Al Ansari Financial Services PJSC comes from its Money Exchange and Remittances segment, generating AED1.14 billion.

Al Ansari Financial Services PJSC, a financial player with a Price-To-Earnings ratio of 17.9x, stands below the industry average of 20.7x, suggesting potential value. Despite its profitability, the company saw earnings drop by 24% over the past year against an industry growth average of 18.1%. Recent reports show third-quarter revenue at AED 297 million and net income at AED 103 million, down from AED 125 million last year. The forecasted annual earnings growth is pegged at over 20%, indicating room for future improvement despite current challenges in earnings momentum.

Linedata Services (ENXTPA:LIN)

Simply Wall St Value Rating: ★★★★☆☆

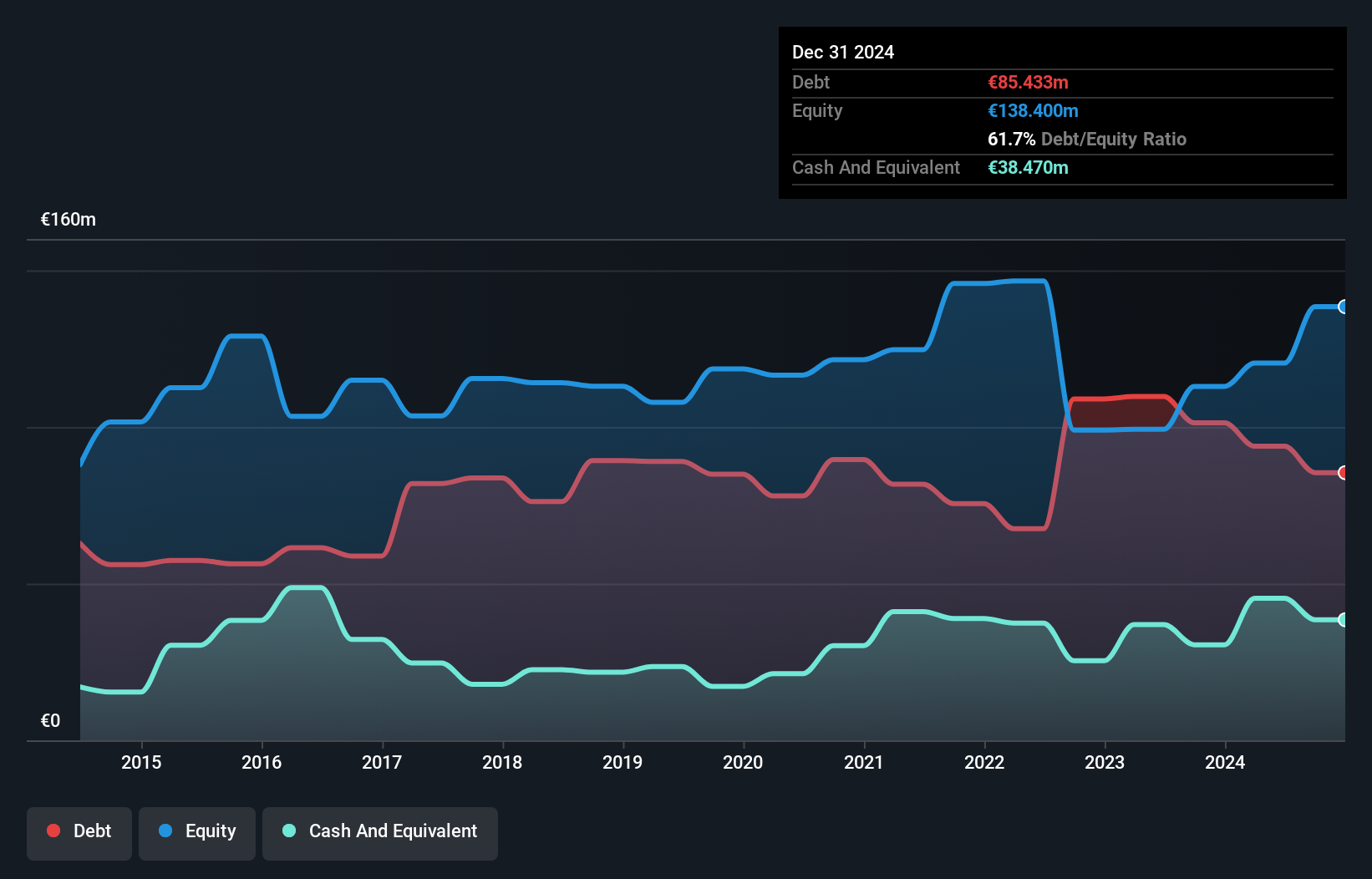

Overview: Linedata Services S.A. is a company that develops, publishes, and distributes financial software across Southern Europe, Northern Europe, North America, and Asia with a market capitalization of €424.55 million.

Operations: Linedata generates revenue primarily from its Asset Management segment, contributing €122.12 million, and its Lending & Leasing segment, which brings in €63.39 million.

Linedata Services, a nimble player in the software industry, has shown impressive earnings growth of 22% over the past year, outpacing the industry's 11.8%. Despite a high net debt to equity ratio at 40.3%, its interest payments are comfortably covered by EBIT at 9.7 times coverage. Trading at about 17.8% below its estimated fair value suggests potential upside for investors seeking value in smaller companies. Recent success with implementing their Global Hedge solution for Bank of Shanghai highlights Linedata's capability to enhance efficiency and integration for large financial institutions, reinforcing their reputation for delivering high-quality solutions in complex environments.

- Navigate through the intricacies of Linedata Services with our comprehensive health report here.

Gain insights into Linedata Services' past trends and performance with our Past report.

Aksigorta (IBSE:AKGRT)

Simply Wall St Value Rating: ★★★★★★

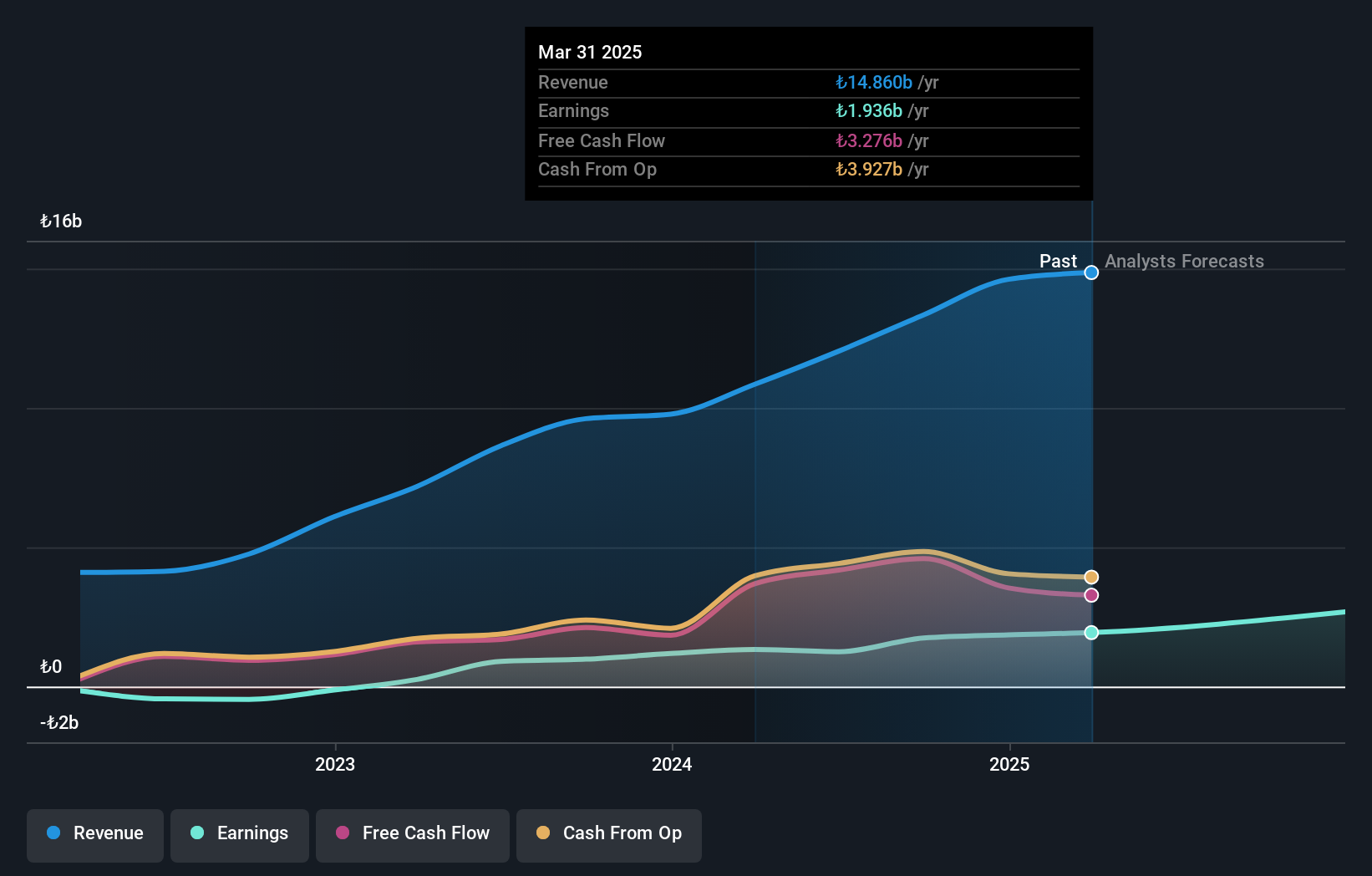

Overview: Aksigorta A.S. is a Turkish company offering a range of life and non-life insurance products and services to both retail and business clients, with a market capitalization of TRY11.64 billion.

Operations: Aksigorta generates significant revenue from Motor Vehicles (TRY5.81 billion) and Motor Vehicles Liability (TRY3.38 billion) insurance segments, with additional contributions from Fire and Other Accident insurance. The company's cost structure includes a segment adjustment of TRY-5.47 billion, impacting overall financial performance.

Aksigorta, a notable player in the insurance sector, has demonstrated robust financial health with no debt over the past five years. Its earnings have surged by 29.7% annually during this period, although recent growth of 70.2% trailed behind the industry's 79.1%. The company's price-to-earnings ratio at 7.4x is attractively lower than the TR market's average of 15.9x, suggesting potential undervaluation. Recent results highlight a significant rise in net income to TRY 625 million for Q3 compared to TRY 132 million last year, reflecting strong operational performance and high-quality earnings that bolster its investment appeal.

- Click to explore a detailed breakdown of our findings in Aksigorta's health report.

Evaluate Aksigorta's historical performance by accessing our past performance report.

Seize The Opportunity

- Gain an insight into the universe of 4629 Undiscovered Gems With Strong Fundamentals by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:AKGRT

Aksigorta

Provides various life and non-life insurance products and services to retail and corporate customers in Turkey.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)