Dassault Systèmes (ENXTPA:DSY) Earnings Growth Slows, Challenging Bullish Margin Expansion Narratives

Reviewed by Simply Wall St

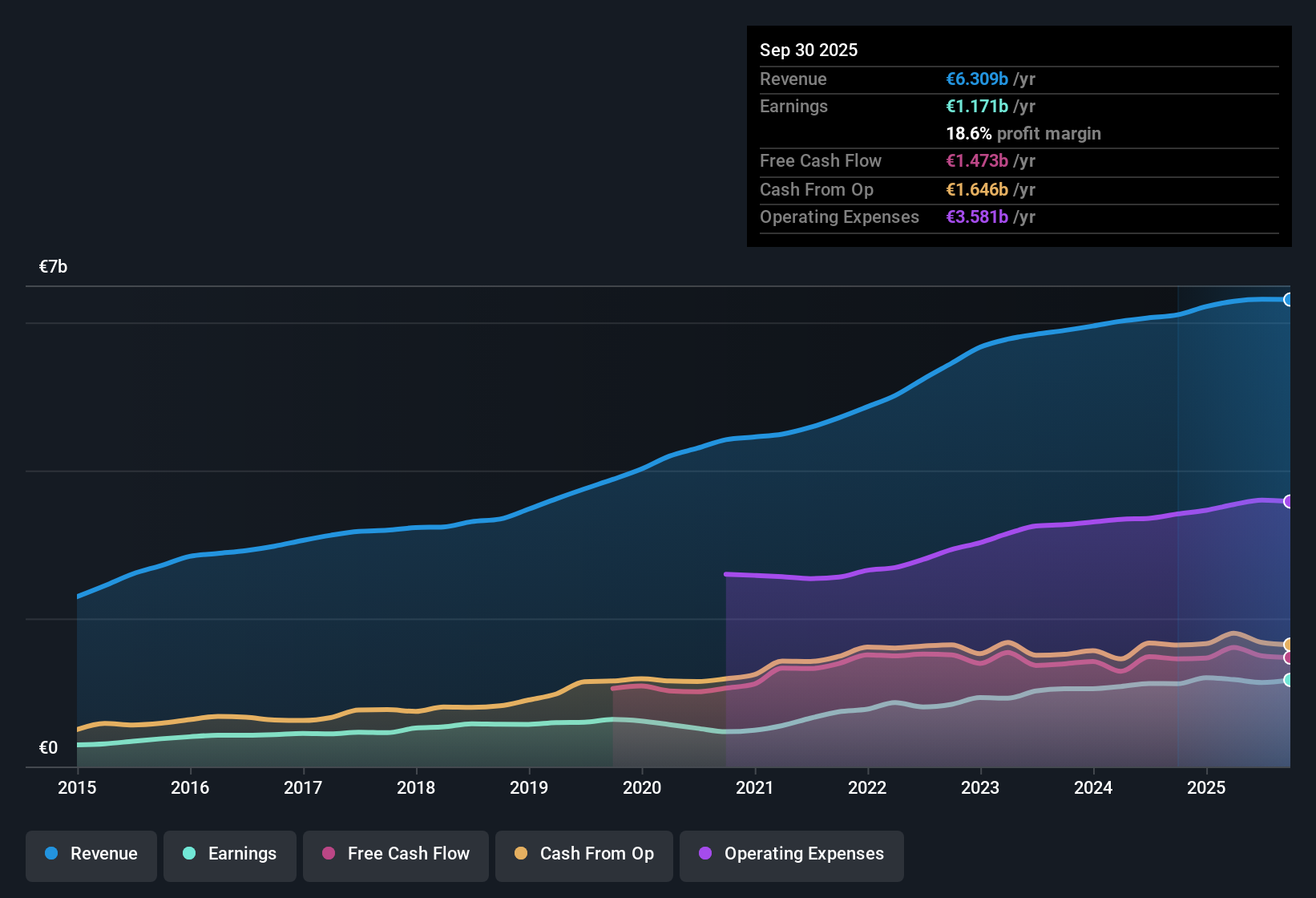

Dassault Systèmes (ENXTPA:DSY) delivered annual earnings growth of 1.2%, falling short of its robust five-year compound rate of 16.7%. Net profit margins edged down to 18% from last year’s 18.5%, and shares are trading at €25.69, just below the estimated fair value of €25.88. Looking ahead, analysts forecast earnings growth of 10.2% per year and revenue growth of 6.2% per year. This beats the French market’s sales outlook but trails its earnings momentum.

See our full analysis for Dassault Systèmes.Now that we have set the latest results, it is time to see how Dassault Systèmes stacks up against the dominant market narratives. Some perspectives might be confirmed, while others could be up for debate.

See what the community is saying about Dassault Systèmes

Margins Projected to Rebound by 4.3 Percentage Points

- Analysts expect Dassault Systèmes’ profit margin to rise from the current 18% to 22.3% over the next three years, marking a 4.3 percentage point expansion that would reverse this year’s slight compression.

- Analysts' consensus view heavily supports the idea that growing adoption of cloud-based, AI-driven solutions and the shift to recurring revenue streams will be central to this rebound.

- 83% of software revenues are now recurring, which consensus believes structurally lifts net profit margins, especially as recurring streams offset volatility seen in segments like Life Sciences.

- What’s surprising is that despite flat margins year-on-year, consensus still calls for sustained margin expansion even as cost pressures are rising. This places significant weight on growth from AI and cloud as protective levers.

- For a deeper dive into why analysts think these shifts matter, see the full consensus narrative. 📊 Read the full Dassault Systèmes Consensus Narrative.

P/E Ratio Sits Below Peer Average

- Dassault Systèmes currently trades at a price-to-earnings (P/E) ratio of 29.8x, slightly less than the peer group average of 31x, but above the European software industry average of 28.6x.

- Consensus narrative highlights that the company’s blend of high-quality past growth and ongoing innovation justifies this modest premium over the sector. Investors should recognize that the stock isn’t trading at a steep discount.

- Its fair value by DCF methods is €25.88, very close to the current share price of €25.69, suggesting most of the upside rests on achieving future growth forecasts.

- There is a risk that if margin expansion or top-line acceleration misses expectations, shares could re-rate closer to the wider sector average, trimming today’s modest valuation advantage.

Forecast Earnings Growth Trails the French Market

- Dassault Systèmes’ forecasted annual earnings growth of 10.2% is strong, but trails the French market’s 12.2% projection, even as its expected revenue growth (6.2%) outpaces the local market’s 5.4%.

- Consensus narrative observes that entering high-growth verticals like sustainable infrastructure and "lab-to-fab" transitions in life sciences should boost the company’s total addressable market,

- but uneven performance in key units, such as ongoing weakness in MEDIDATA and volatility in large deal closures particularly in North America, risk pulling overall growth below management’s targets.

- Currency fluctuations and higher operating costs further complicate Dassault Systèmes’ ability to consistently outgrow its domestic peers on the bottom line.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Dassault Systèmes on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot something others have missed? Share your unique take and shape a fresh narrative of your own in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Dassault Systèmes.

See What Else Is Out There

Dassault Systèmes’ forecasted earnings growth lags the local market and depends heavily on margin expansion and recurring revenues holding up despite rising costs.

If steady and reliable growth matters most to you, switch your focus to stable growth stocks screener (2098 results). These companies have proven they can consistently build revenue and earnings, even when others stall.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:DSY

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Cheap if able to sustain revenue, and a potential bargain if able to turn store openings into revenue growth

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)